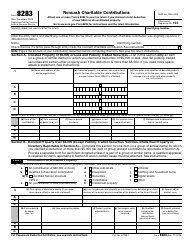

This version of the form is not currently in use and is provided for reference only. Download this version of

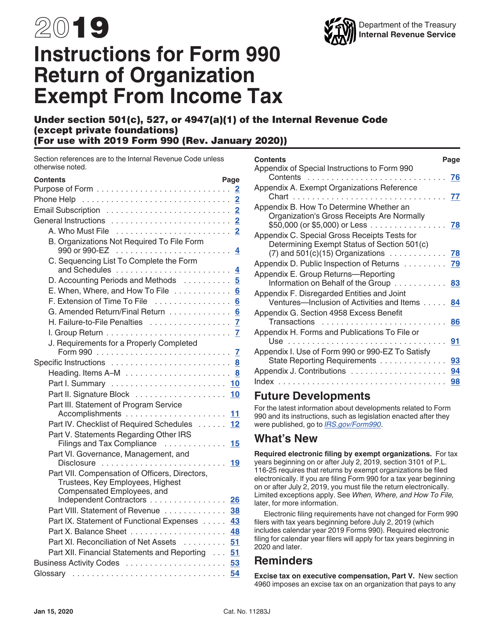

Instructions for IRS Form 990

for the current year.

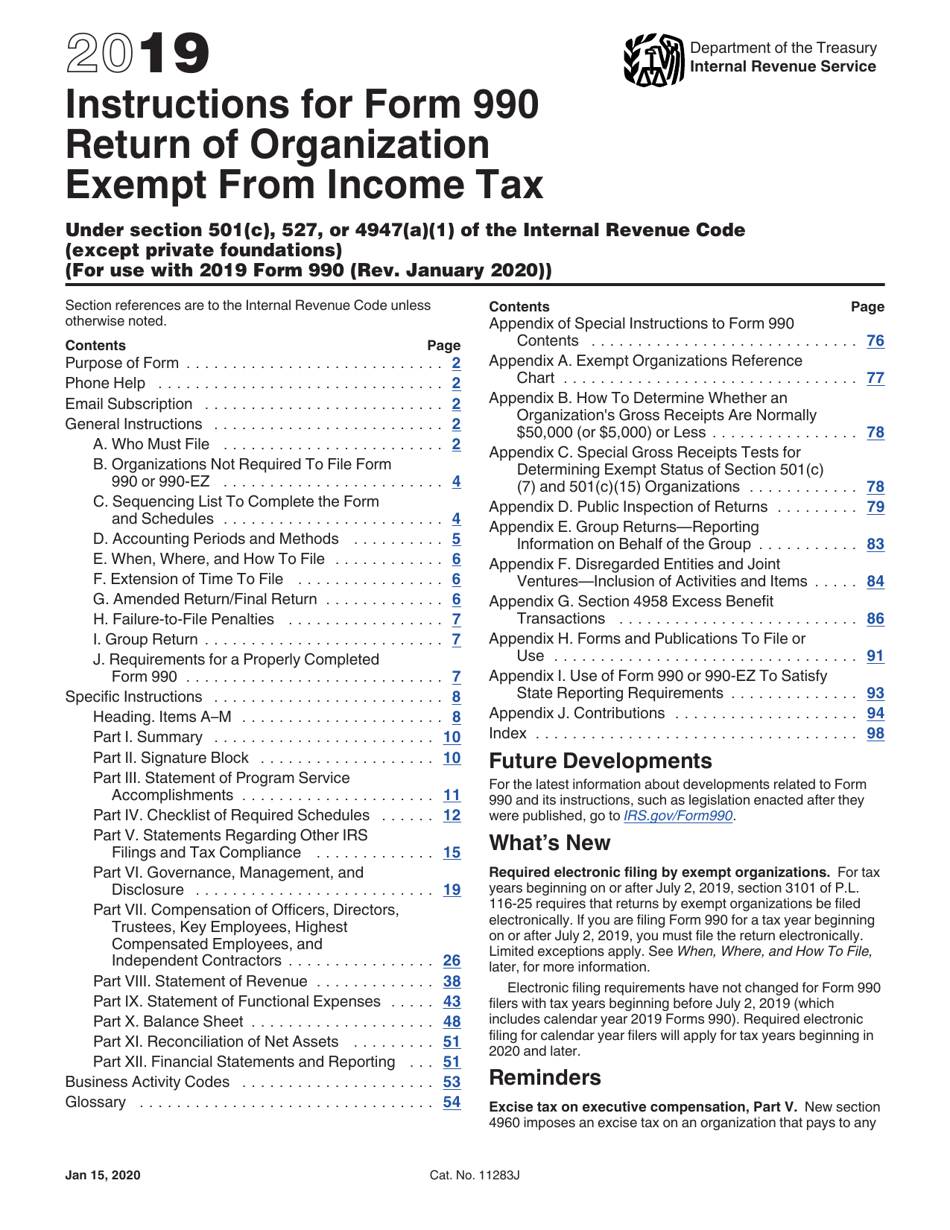

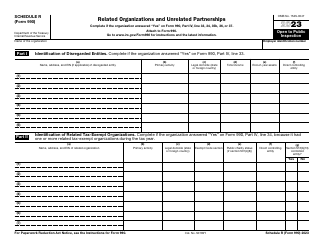

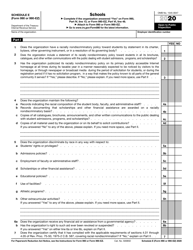

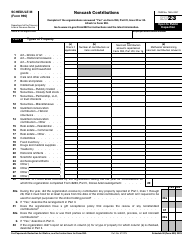

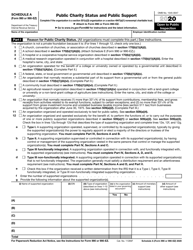

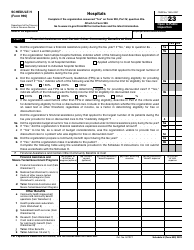

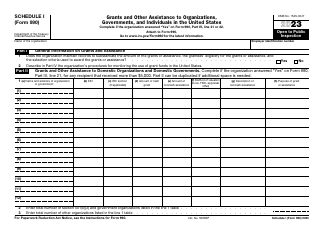

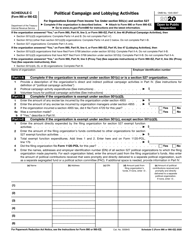

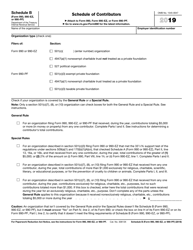

Instructions for IRS Form 990 Return of Organization Exempt From Income Tax

This document contains official instructions for IRS Form 990 , Return of Organization Exempt From Income Tax - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 (990-EZ) Schedule O is available for download through this link.

FAQ

Q: What is IRS Form 990?

A: IRS Form 990 is a tax return form for organizations that are exempt from income tax.

Q: Who needs to file IRS Form 990?

A: Nonprofit organizations that are tax-exempt under section 501(c)(3) of the Internal Revenue Code need to file IRS Form 990.

Q: What information is required on IRS Form 990?

A: IRS Form 990 requires organizations to provide information about their finances, activities, governance, and other details.

Q: When is IRS Form 990 due?

A: IRS Form 990 is due on the 15th day of the 5th month after the end of the organization's fiscal year.

Q: Are there any penalties for not filing IRS Form 990?

A: Yes, there are penalties for not filing IRS Form 990 or filing it late. The penalties can vary depending on the size of the organization's revenue.

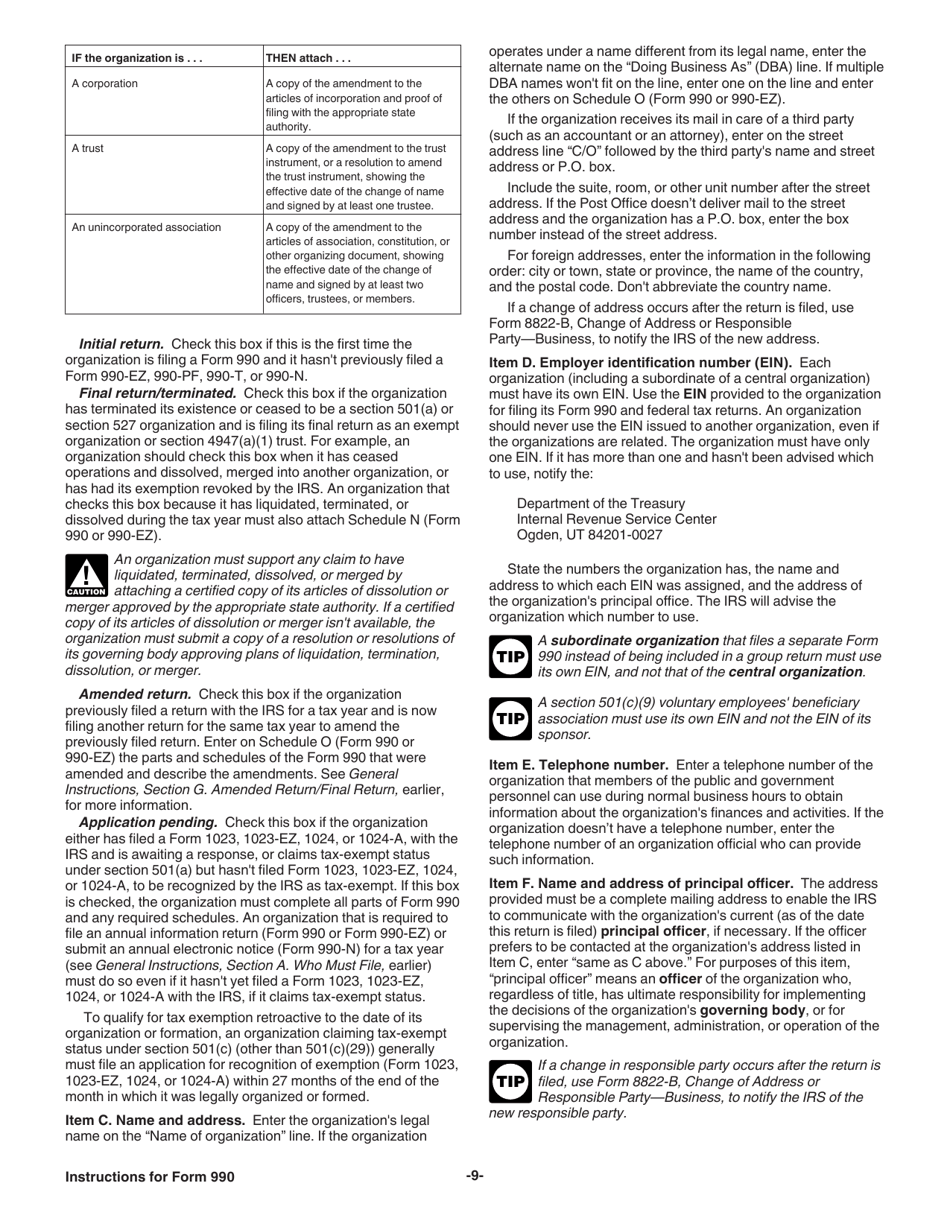

Q: Do I need to attach any additional documents with IRS Form 990?

A: Depending on the organization's specific situation, additional schedules and attachments may need to be included with IRS Form 990.

Instruction Details:

- This 103-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.