This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5500-SF

for the current year.

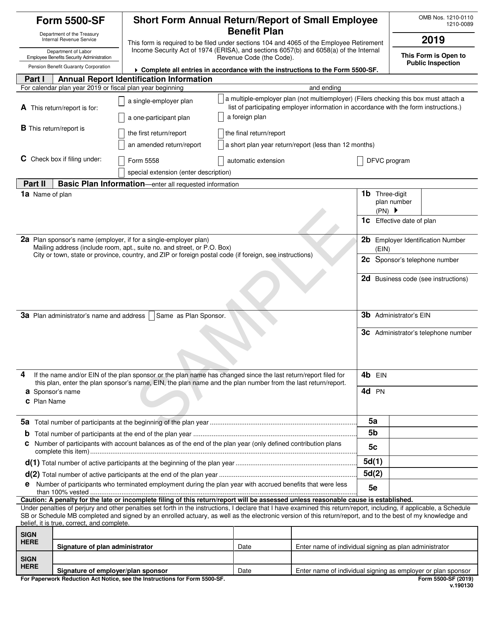

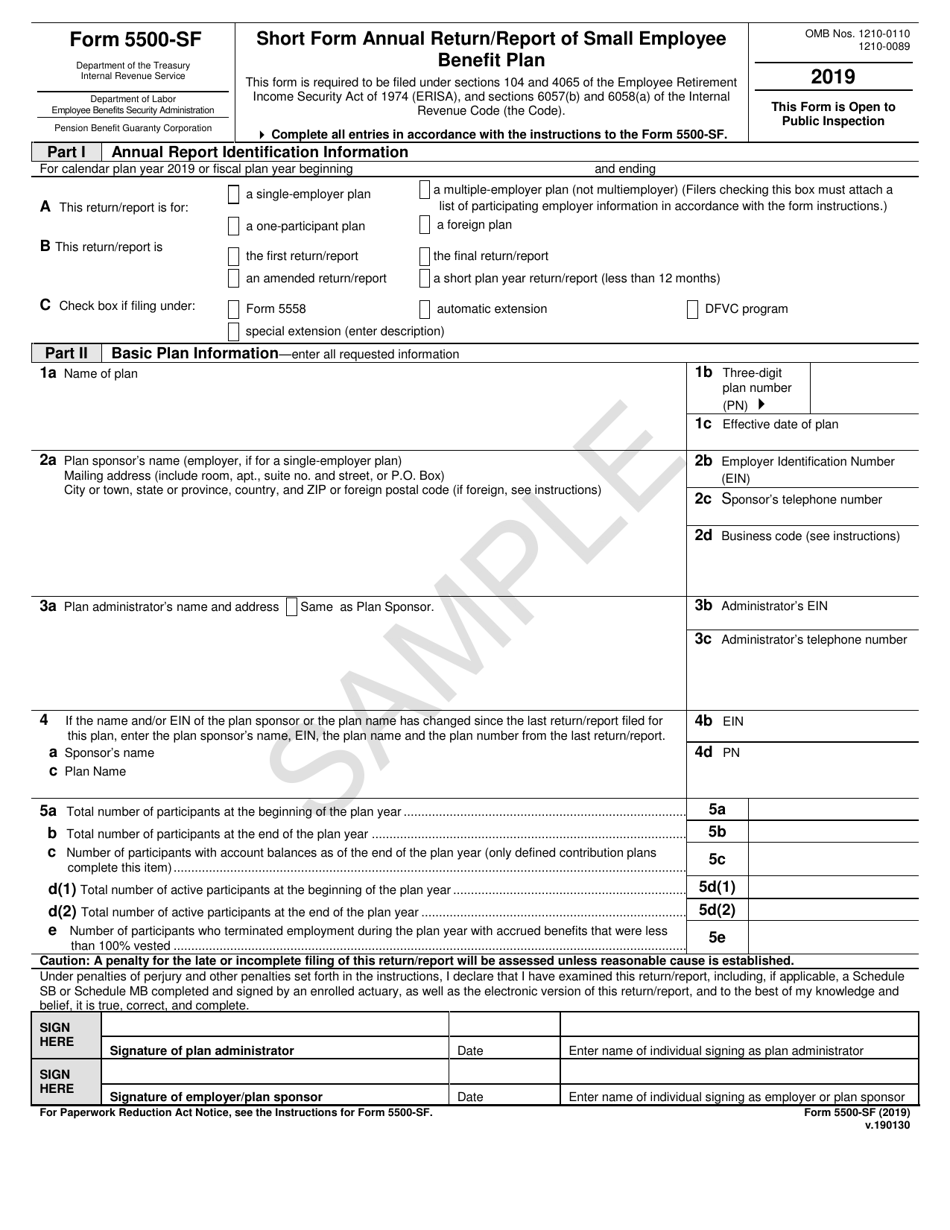

Form 5500-SF Short Form Annual Return / Report of Small Employee Benefit Plan

What Is Form 5500-SF?

IRS Form 5500-SF, Short Form Annual Return/Report of Small Employee Benefit Plan , is a simplified form used by certain welfare and pension benefit plans. There are several requirements for the plan to be eligible to use this form:

- Be a small plan (fewer than 100 participants at the beginning of the year);

- Not hold employer securities;

- Not be a multiemployer plan;

- Not be required to file a Form M-1, Report for Multiple Employer Welfare Arrangements (MEWAs) and Certain Entities Claiming Exception (ECEs);

- Be exempt from the audit by an independent qualified public accountant.

This form is the outcome of cooperation between the Internal Revenue Service (IRS) , the Department of Labor (DOL) , and the Pension Benefit Guaranty Corporation (PBGC) . These agencies consolidated several report forms and returns to reduce the burden of filing for employers and plan administrators.

The latest version of the form was jointly released by the IRS, the DOL, and the PBGC in 2019 with all previous editions obsolete. A fillable Form 5500-SF is available for download below. It must be filed electronically and signed.

IRS Form 5500-SF Instructions

To comply with the IRS 5500-SF Form filing requirements, you must file it with a schedule:

- Schedule MB (Multiemployer Defined Benefit Plan and Certain Money Purchase Plan Actuarial Information) - for most multiemployer defined benefit plans and for the defined contribution pension plans;

- Schedule SB (Single-Employer Defined Benefit Plan Actuarial Information) - for most single-employer defined benefit plans.

The filing instructions are as follows:

- Describe the plan and indicate if you are filing under extension.

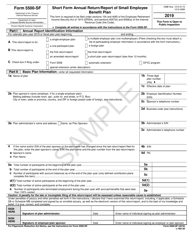

- Provide basic plan information - sponsor's and administrator's names, addresses, identification numbers. State the number of participants throughout the plan year.

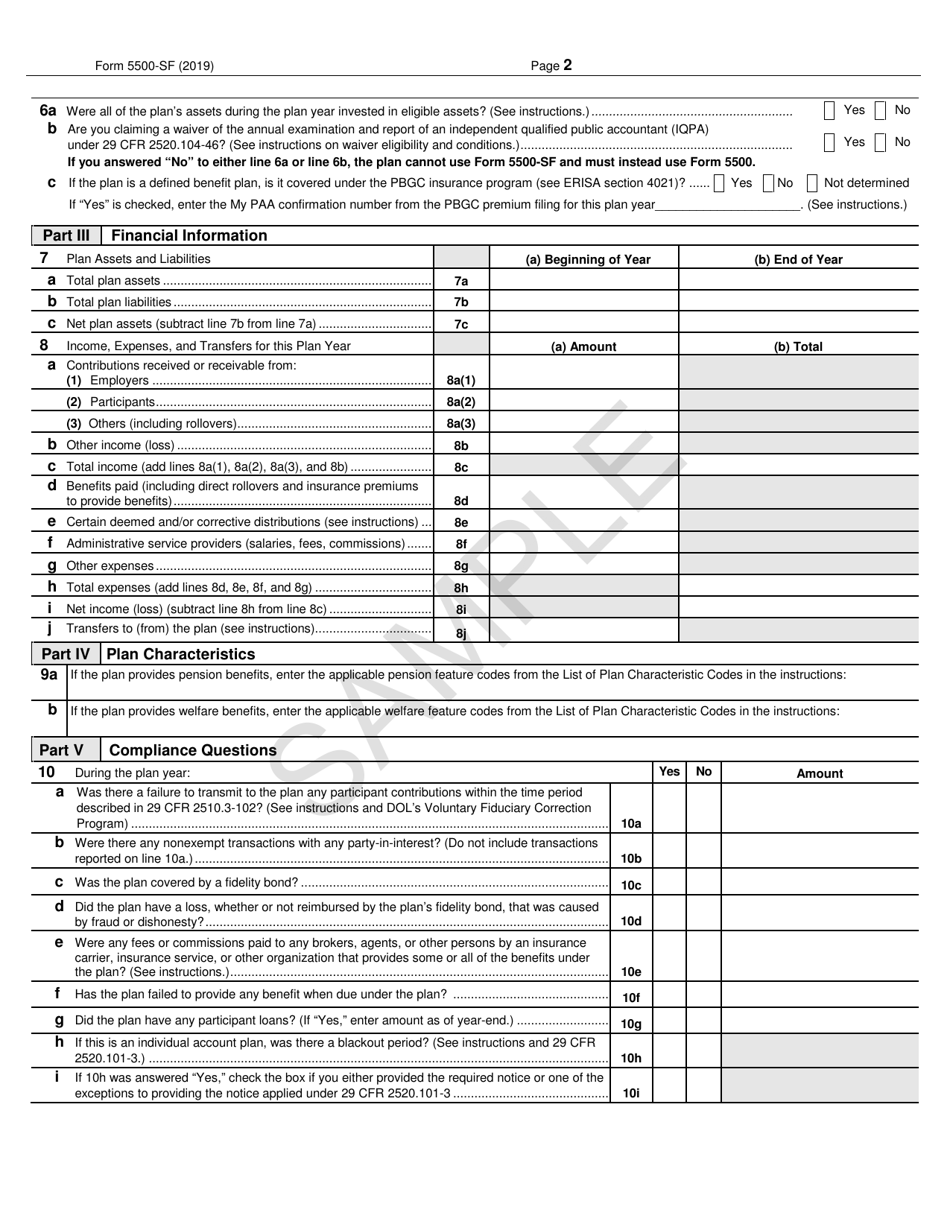

- Write down the financial information - assets, liabilities, income, expenses at the beginning and at the end of the year.

- Enter the applicable pension/welfare feature codes if the plan provides pension/welfare benefits.

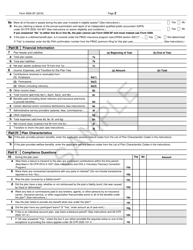

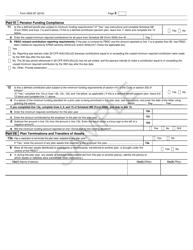

- State if the plan failed to provide benefits, had participant loans, was covered by a fidelity bond. Indicate if there was a blackout period and if there was a failure to transmit to the plan any participant contributions. Answer all compliance questions with either "yes" or "no."

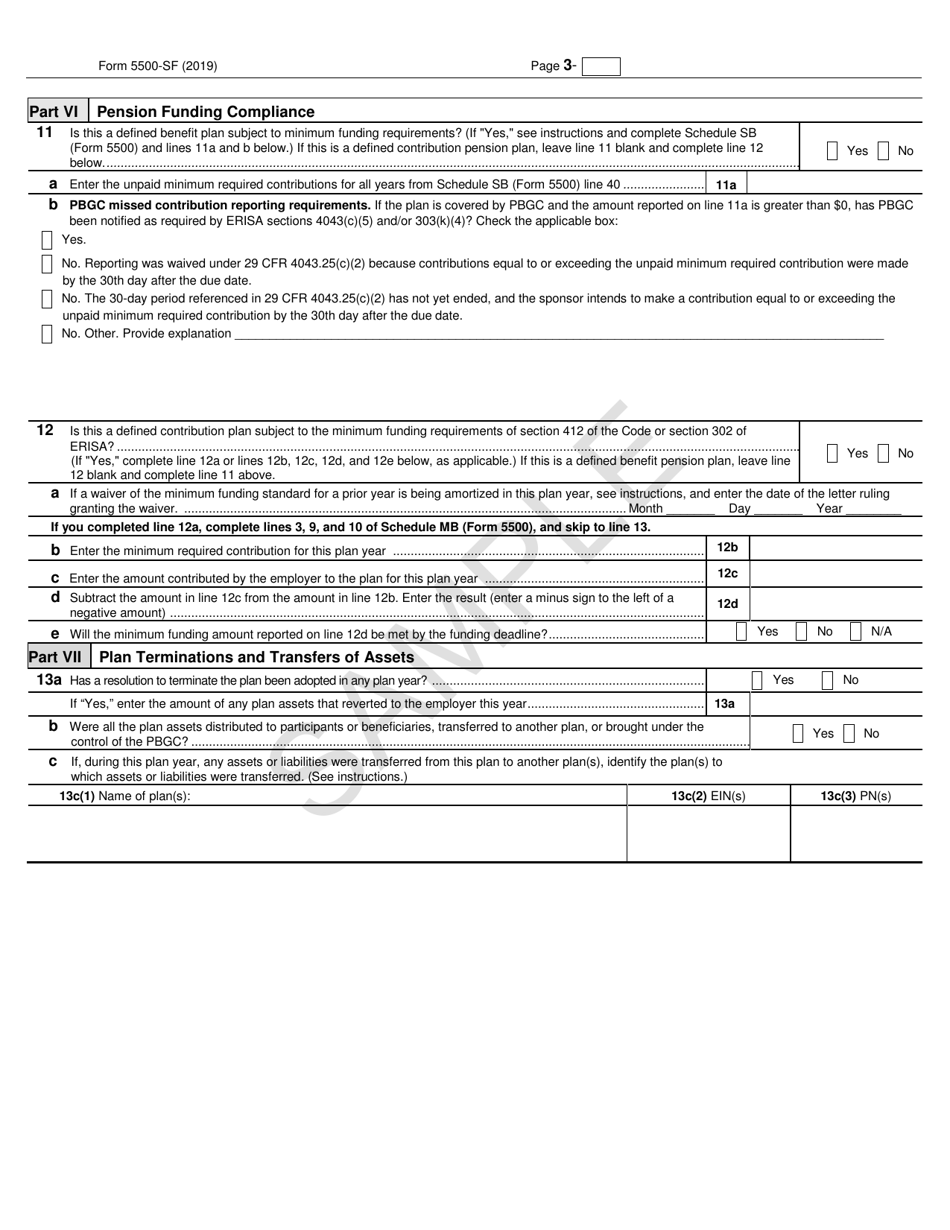

- If the plan is subject to the pension funding requirements, fill out the corresponding section and attach the appropriate schedule;

- Describe plan terminations and transfers of assets.

When Is Form 5500-SF Due?

The Form 5500-SF due date is the last day of the seventh month after the end of the plan year. It is possible to extend the deadline by filing Form 5558, Application for Extension of Time to File Certain Employee Plan Returns, therefore, submitting the report of employee benefit plan 2.5 months later. There is a penalty for late filing from the IRS and the DOL: $25 per day and $1100 per day respectively.

IRS 5500-SF Related Forms:

- IRS Form 5500, Annual Return/Report of Employee Benefit Plan, is a document used to report information about Direct Filing Entities, or DFEs (investment arrangements that manage funds from various plans), and employee benefit plans. Each sponsor or administrator of an employee benefit plan subject to the Employee Retirement Income Security Act of 1974 (ERISA) has to report information about benefit plans every year.

- IRS Form 5500-EZ, Annual Return of a One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign Plan, is a related form used for retirement plans if it is a one-participant plan (a plan that covers only you and your spouse/partner) or a foreign plan (a pension plan maintained outside the U.S. territory for nonresident aliens).