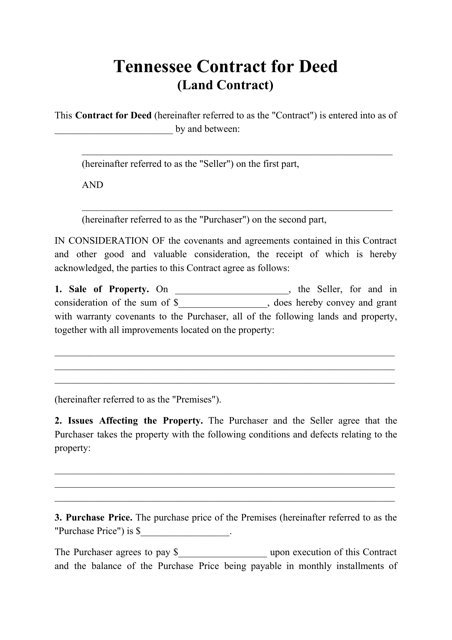

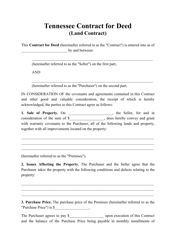

Contract for Deed (Land Contract) - Tennessee

A Contract for Deed (Land Contract) in Tennessee is used as an alternative to traditional mortgage financing. It allows the buyer to make payments directly to the seller over time, with the seller retaining ownership until the full purchase price is paid.

In Tennessee, the contract for deed, also known as a land contract, is typically filed by the seller or the party providing financing for the purchase.

FAQ

Q: What is a Contract for Deed?

A: A Contract for Deed, also known as a Land Contract, is a legal agreement for the sale of a property where the seller finances the purchase for the buyer.

Q: How does a Contract for Deed work?

A: In a Contract for Deed, the buyer takes possession of the property and makes installment payments directly to the seller, who retains legal title until the agreed-upon terms are fulfilled.

Q: What are the advantages of a Contract for Deed?

A: Advantages include flexible financing options, no need for a traditional mortgage, and potential tax benefits for the buyer.

Q: What are the risks of a Contract for Deed?

A: Risks include the potential for the seller to retain legal title until the full payment is made, the possibility of default and losing the property, and the lack of legal protections typically offered by traditional mortgages.

Q: Are there specific laws governing Contracts for Deed in Tennessee?

A: Yes, Tennessee has specific laws that govern Contracts for Deed, including requirements for written agreements and certain disclosures that must be provided to the buyer.

Q: Can a Contract for Deed be canceled in Tennessee?

A: Yes, a Contract for Deed can be canceled in Tennessee, but specific procedures and legal steps must be followed.

Q: Is it recommended to seek legal advice before entering into a Contract for Deed?

A: Yes, it is highly recommended to seek legal advice from an attorney familiar with real estate laws in Tennessee before entering into a Contract for Deed.

Q: Can a Contract for Deed be used for any type of property?

A: Yes, a Contract for Deed can be used for residential as well as commercial properties in Tennessee.

Q: What happens if the buyer defaults on payments in a Contract for Deed?

A: If the buyer defaults on payments, the seller may have the right to terminate the contract and retain possession of the property.

Q: Can a Contract for Deed be refinanced in Tennessee?

A: Yes, it is possible to refinance a Contract for Deed in Tennessee, but the terms and conditions may vary depending on the lender and the buyer's financial situation.