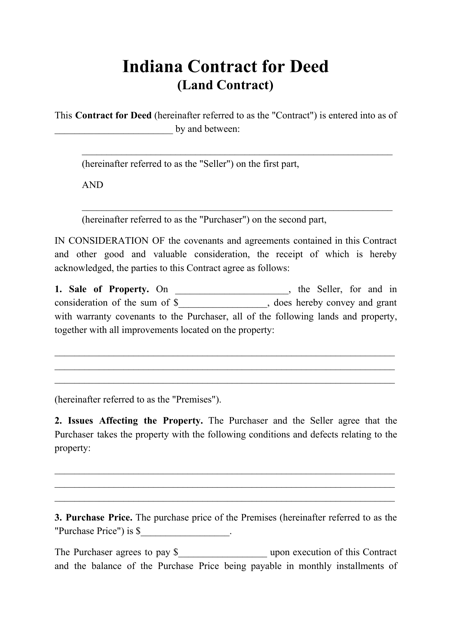

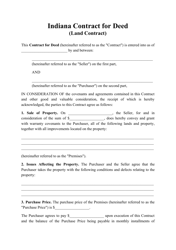

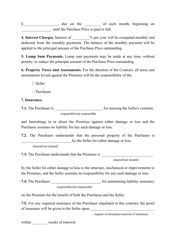

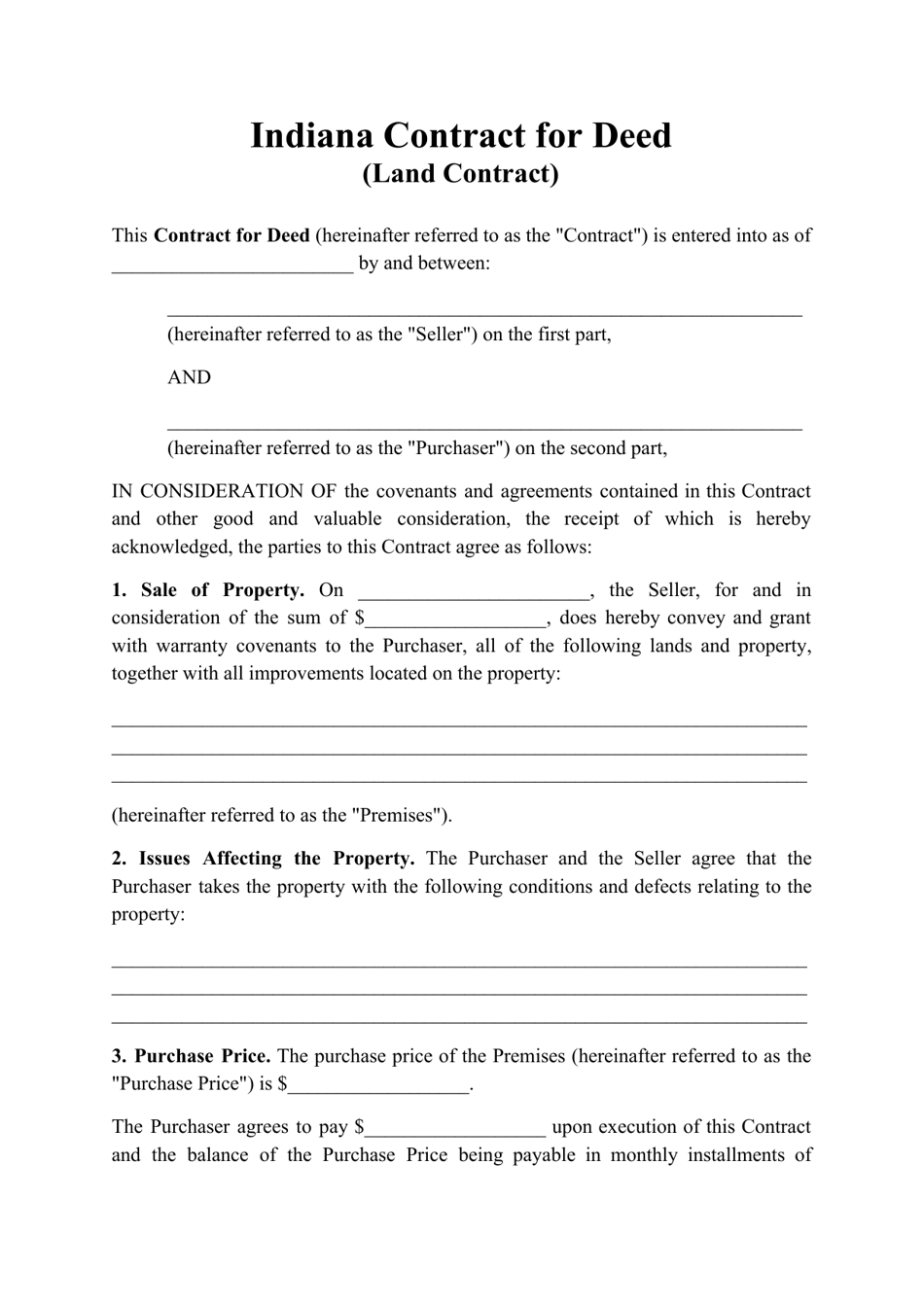

Contract for Deed (Land Contract) - Indiana

A Contract for Deed, also known as a Land Contract, is a legal agreement in Indiana for the sale of real estate. It allows the buyer to make payments directly to the seller over time, without needing to secure traditional financing from a bank. Once the full payment is made, the seller transfers the title of the property to the buyer.

In Indiana, the buyer typically files the Contract for Deed, also known as a Land Contract.

FAQ

Q: What is a Contract for Deed?

A: A Contract for Deed (also known as a Land Contract) is a legal agreement between a buyer and seller for the purchase of real estate property.

Q: How does a Contract for Deed work?

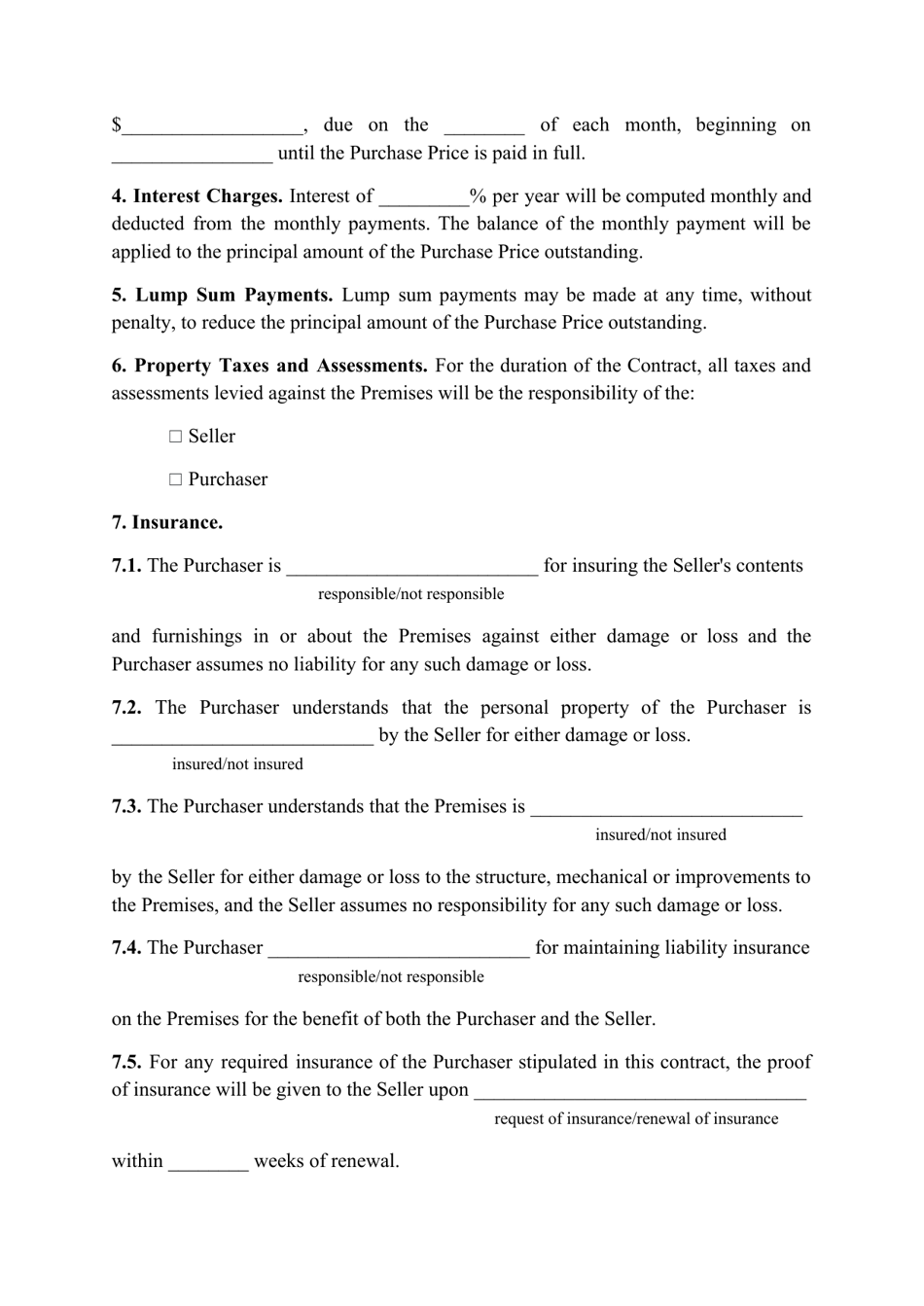

A: In a Contract for Deed, the seller finances the purchase and the buyer makes installment payments directly to the seller, instead of obtaining a traditional mortgage from a bank.

Q: What are the benefits of a Contract for Deed?

A: The benefits of a Contract for Deed include flexible financing options, potentially faster closing, and the ability for buyers with poor credit to purchase property.

Q: What are the risks of a Contract for Deed?

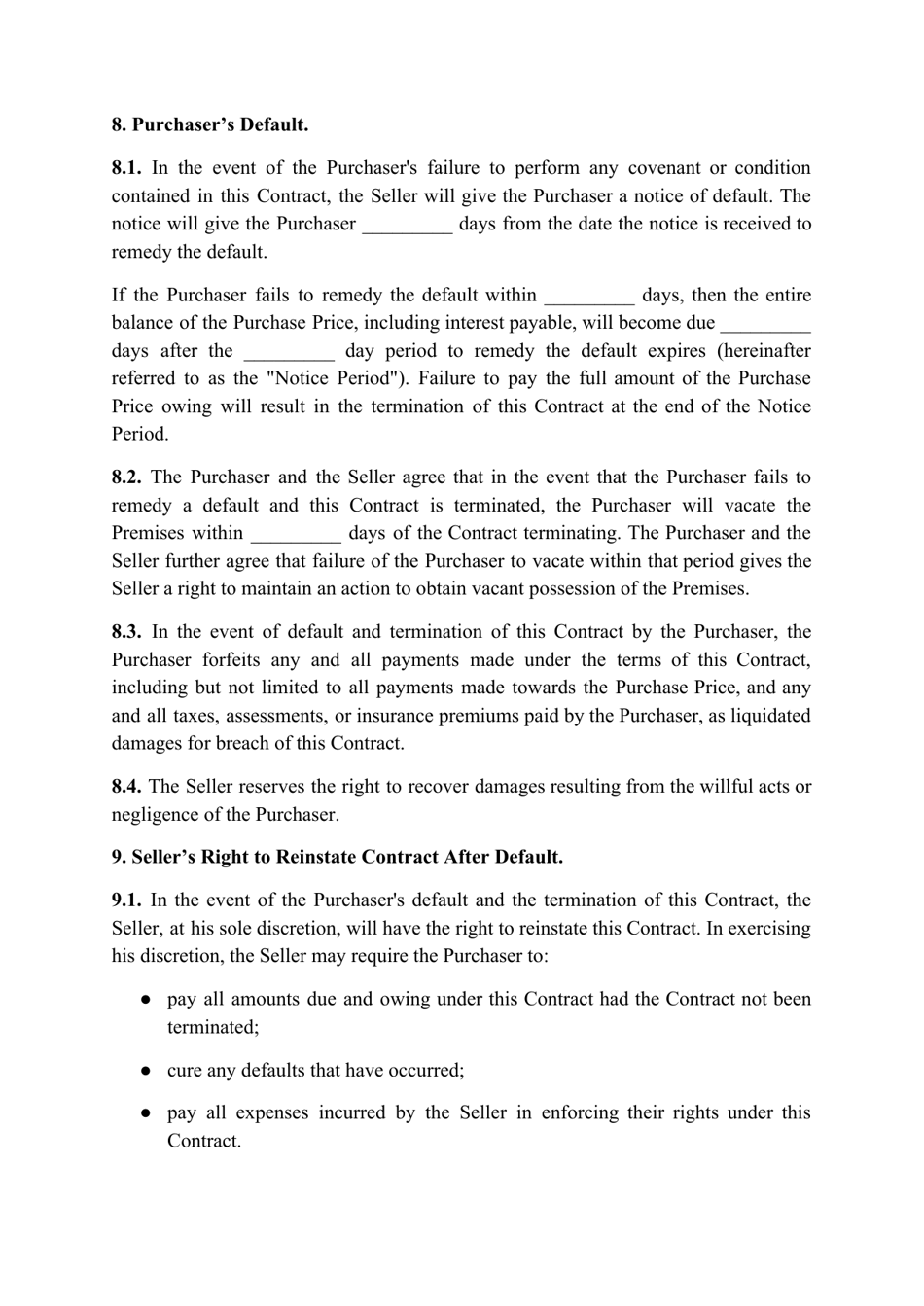

A: Risks of a Contract for Deed include the buyer not getting a clear legal title until the contract is fully paid, possible forfeiture of property if payments are missed, and limited legal protections for buyers.

Q: Are Contract for Deeds common in Indiana?

A: Yes, Contract for Deeds are relatively common in Indiana, particularly for rural or undeveloped land.

Q: Do I need a lawyer to create a Contract for Deed?

A: While it is not required, it is strongly recommended to have a lawyer review and help create a Contract for Deed to ensure that it is legally enforceable and protects your interests.

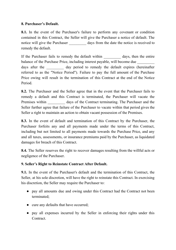

Q: Can a Contract for Deed be canceled?

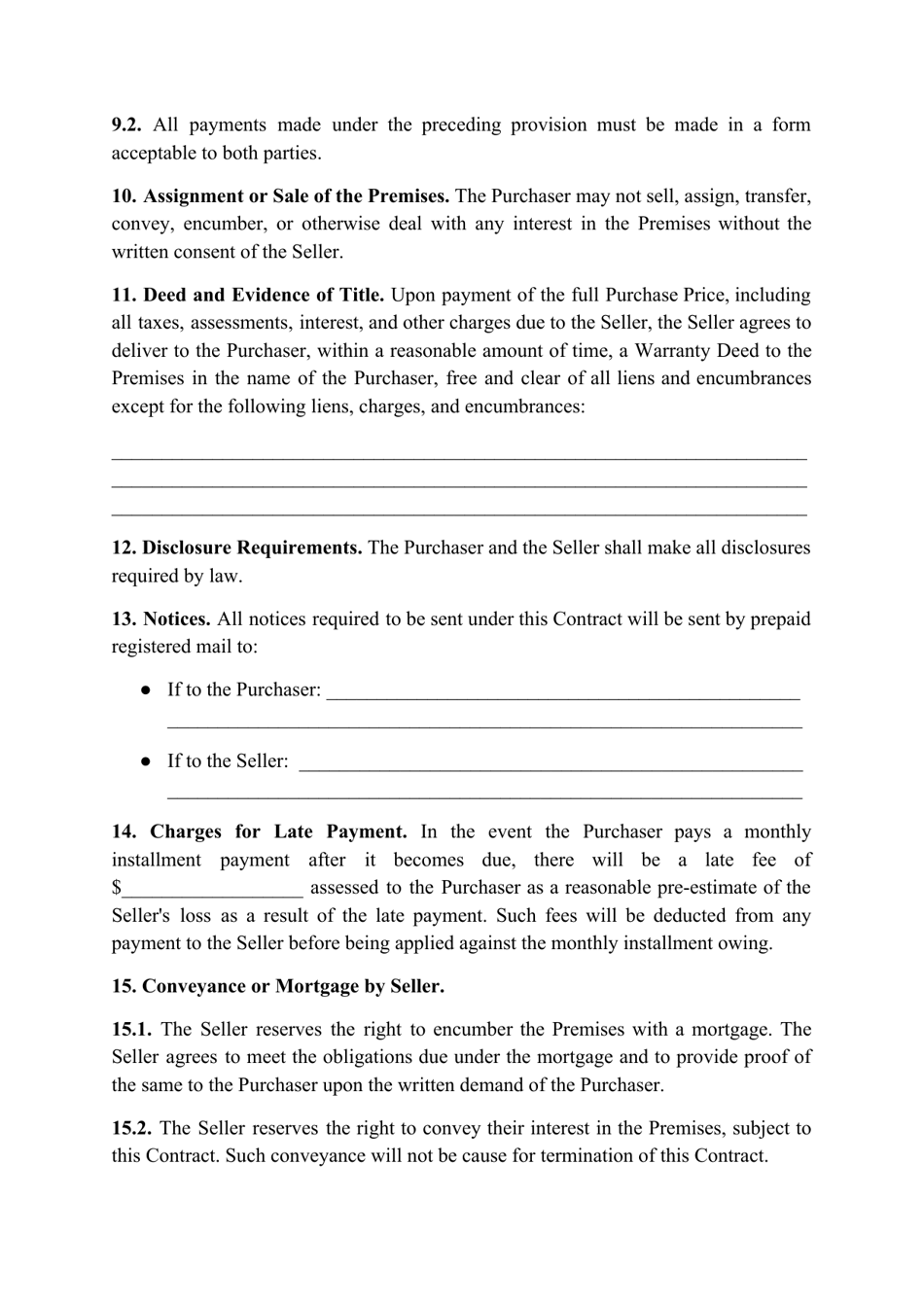

A: A Contract for Deed can be canceled by mutual agreement of both the buyer and seller, or by the buyer defaulting on the contract and the seller deciding to cancel.

Q: What happens if I default on a Contract for Deed?

A: If a buyer defaults on a Contract for Deed, the seller may have the right to terminate the contract, keep any payments made, and repossess the property.

Q: Is it possible to refinance a Contract for Deed?

A: It is generally not possible to refinance a Contract for Deed since it does not involve a traditional mortgage lender. However, it may be possible for the buyer to obtain alternative financing to pay off the contract if desired.