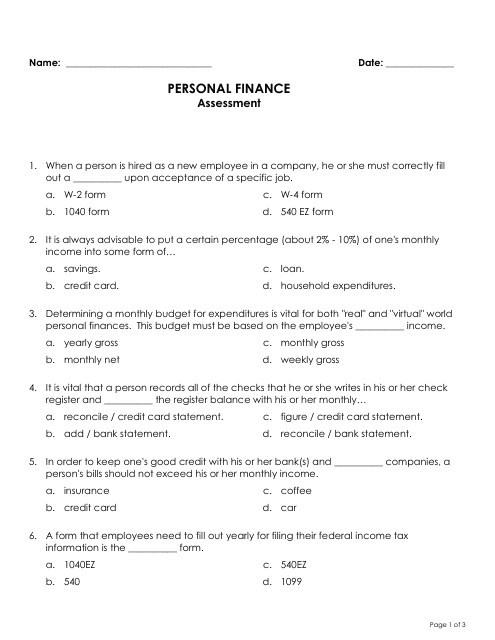

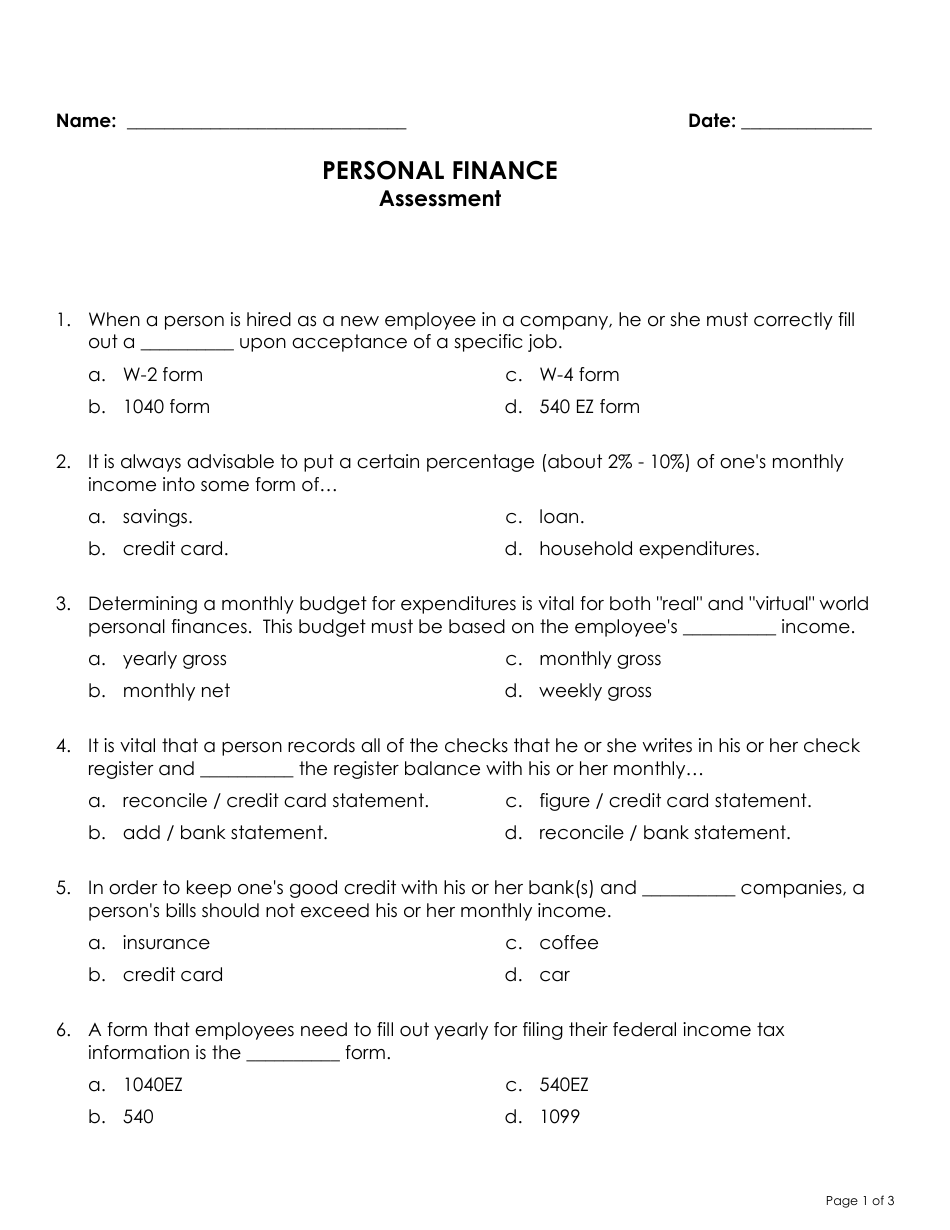

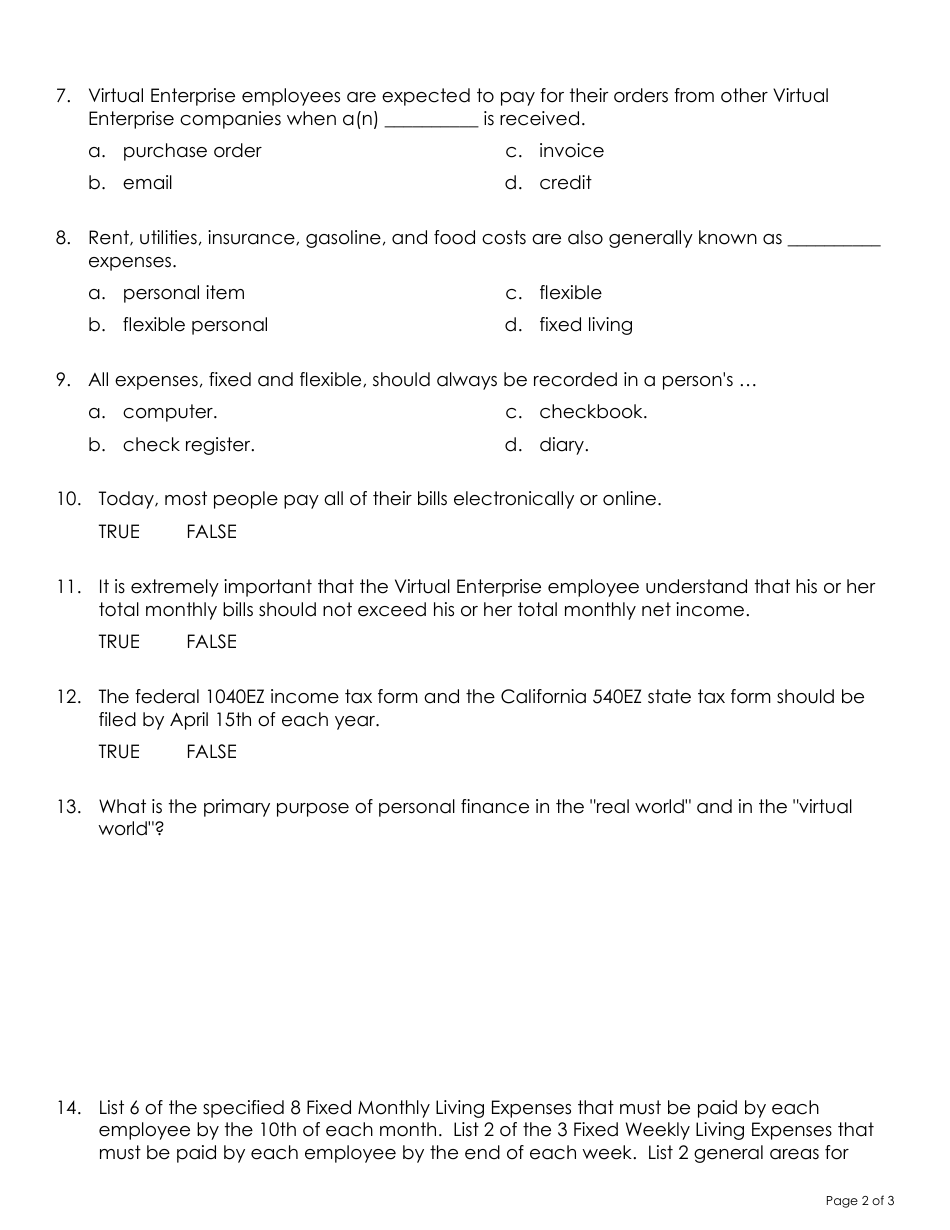

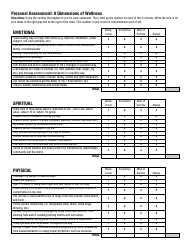

Personal Finance Assessment Template

The Personal Finance Assessment Template is a tool used to evaluate and analyze an individual's financial situation. It helps individuals assess their income, expenses, savings, debt, and financial goals in order to make informed decisions and create a budget or financial plan.

The Personal Finance Assessment Template is typically filled out and filed by the individual or household conducting the assessment.

FAQ

Q: What is a personal finance assessment?

A: A personal finance assessment is an evaluation of your financial situation that helps you understand your income, expenses, and overall financial health.

Q: Why is a personal finance assessment important?

A: A personal finance assessment is important because it gives you a clear picture of your financial situation and helps you make informed decisions about budgeting, saving, and investing.

Q: How do I conduct a personal finance assessment?

A: To conduct a personal finance assessment, gather information about your income, expenses, debts, and assets. Calculate your net worth and analyze your spending habits.

Q: What should I consider in a personal finance assessment?

A: You should consider your income, expenses, debt, savings, investments, and overall financial goals in a personal finance assessment.

Q: What should I do with the results of a personal finance assessment?

A: Use the results of your personal finance assessment to create a budget, set financial goals, and make necessary adjustments to your spending and saving habits.

Q: How often should I conduct a personal finance assessment?

A: It is recommended to conduct a personal finance assessment at least once a year, but you may want to do it more frequently if your financial situation changes significantly.

Q: Can I use a personal finance assessment template?

A: Yes, a personal finance assessment template can provide a helpful framework for conducting your assessment and organizing your financial information.