This version of the form is not currently in use and is provided for reference only. Download this version of

Form 540 2EZ

for the current year.

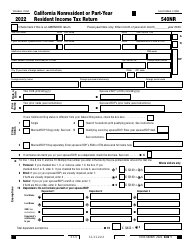

Form 540 2EZ California Resident Income Tax Return - California

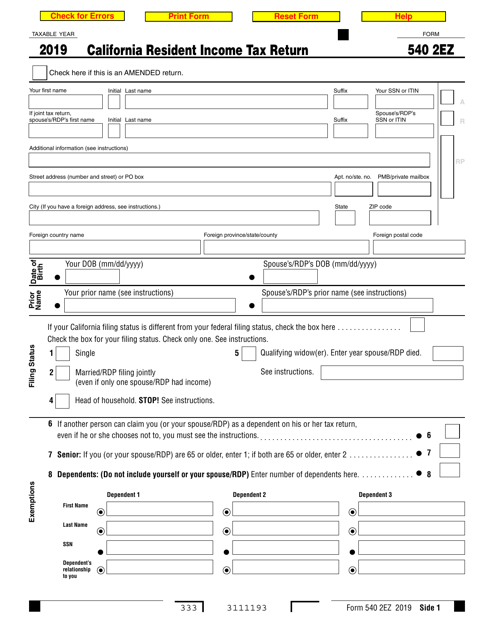

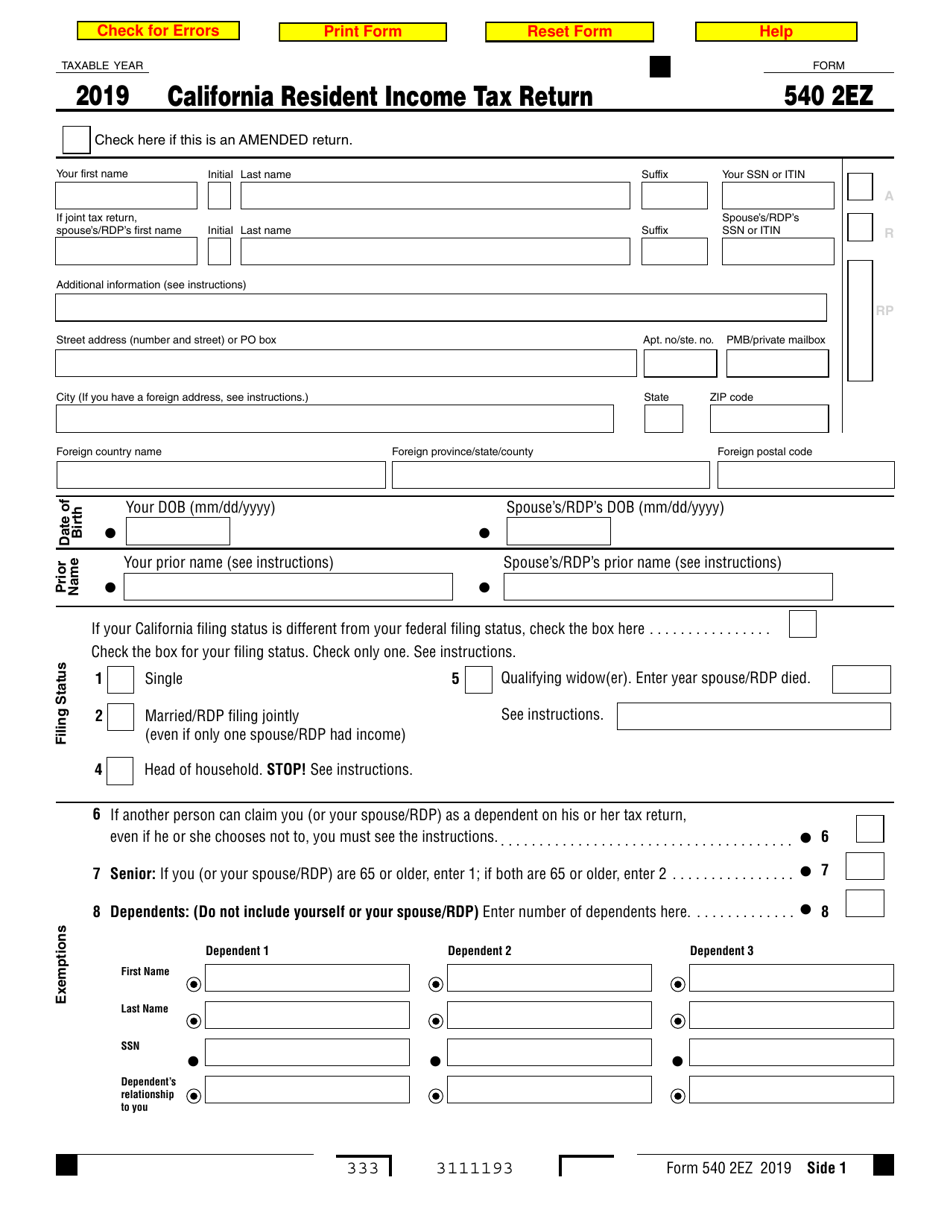

What Is 540 2EZ?

California Form 540 2EZ, California Resident Income Tax Return , is an application developed by the California Franchise Tax Board (FTB) to allow California residents to report their income tax return. Before completing the document, the applicant should check if they qualify to use this application. In order to do so, they must check the requirements listed in the Personal Income Tax Booklet 2019 (for Form 540 2EZ).

California Form 540 2EZ is similar to California Form 540, California Resident Income Tax Return, the difference is in the requirements to the filers and in the amount of information the applicant is supposed to designate. 540 2EZ is smaller, so there are fewer types of applicants who can use it. For example, 540 2EZ cannot be used by taxpayers, who:

- Are blind;

- Do not have any adjustments to income;

- Do not have any itemized deductions;

- Showed their only withholdings on forms W-2 and 1099-R;

- Have three or fewer dependents.

To learn about any more differences between these two applications, the applicant can check the Personal Income Tax Booklet 2019 (for Form 540), which can be found on the official website of California FTB. A fillable California Form 540 2EZ is available for download below.

Form 540 2EZ Instructions

After the applicant has made sure they are eligible to use the 540 2EZ Form, they must fill out the first part of the document. In this part of Form 540 2EZ, the applicant is required to provide the following:

- Full name (including suffix).

- Social Security Number or Individual Taxpayer Identification Number.

- Full address (including zip code).

- Date of birth.

If the tax return is being filed jointly, then the applicant's spouse or registered domestic partner (RDP) must fill in the same information in the designated area.

The next step is to state the applicant's filing status. The application offers four options, the filer is allowed to choose only one of them:

- Single . The applicant was not married or in an RDP.

- Married/RDP filing jointly . Even if only one of the spouses/RDPs had income, they should choose this option.

- Head of Household . In this case, the applicant must attach Form FTB 3532, Head of Household Filing Schedule, to their return.

- Qualifying widow(er) . If the applicant checks this box, they should enter the year their spouse/RDP died.

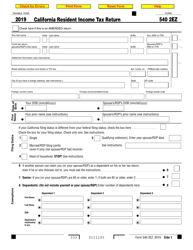

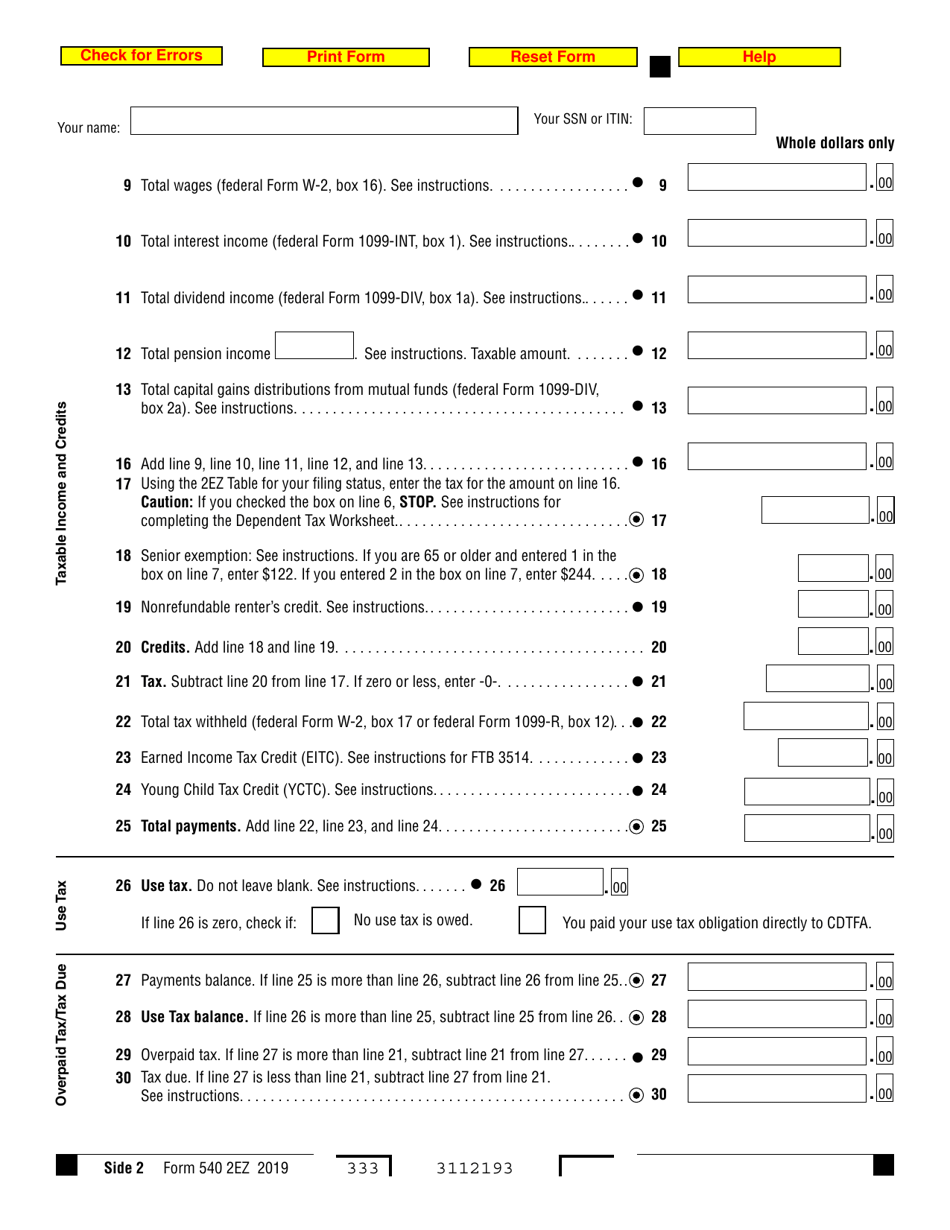

The rest of the document requires the applicant to provide information about their income, credits, contributions, etc. For convenience the statements were organized in a certain order:

- Exemptions . Individuals use this section to enter information about their dependents.

- Taxable Income and Credits . Here a filer must enter their total wages, total interest income, total dividend income, etc.

- Use Tax . The applicant should state the amount of use tax they owe, or whether no use tax is owed.

- Overpaid Tax/Tax Due . The application itself provides all the formulas the applicant might need to count overpaid tax and tax due.

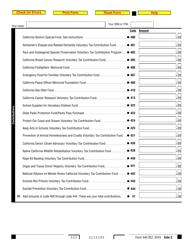

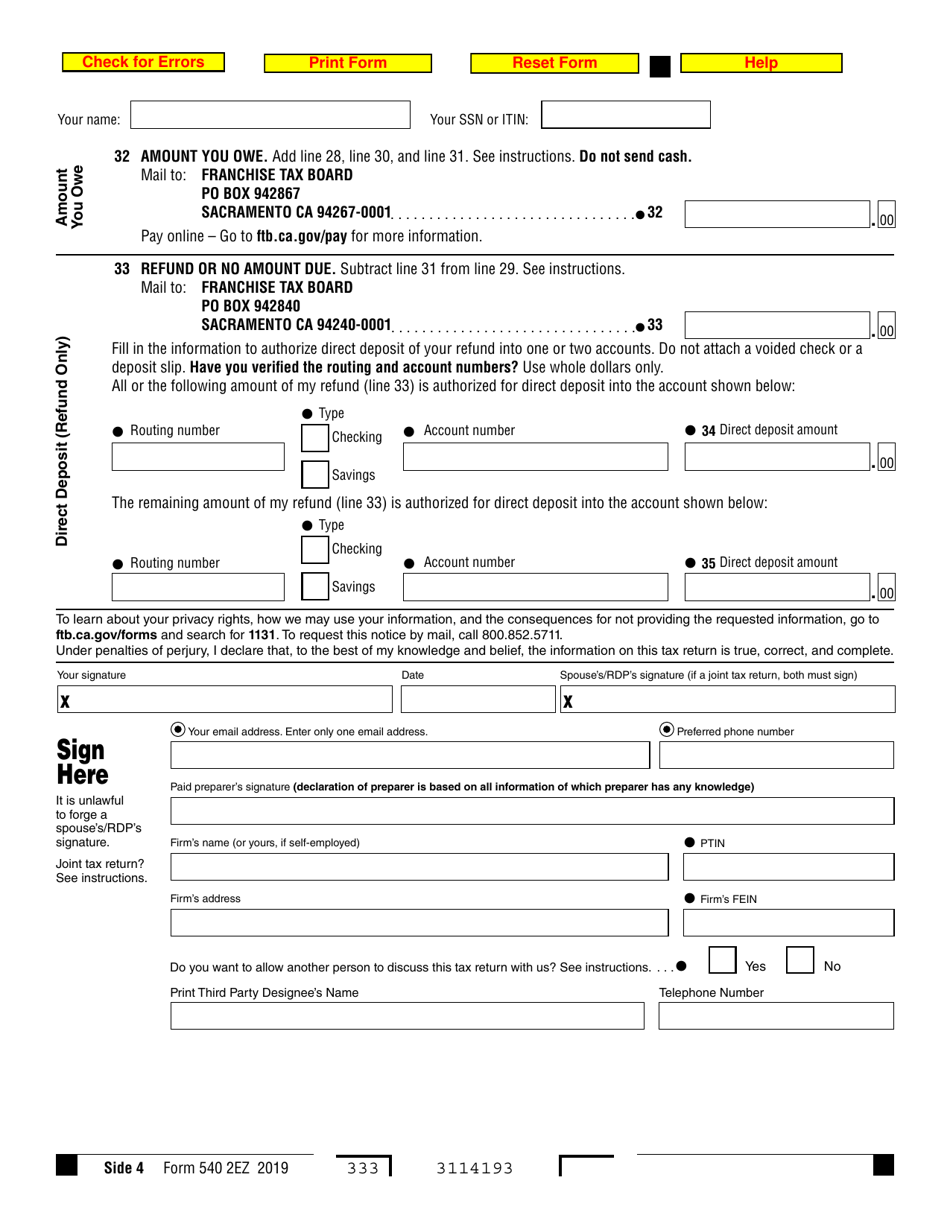

- Contributions . This section is supposed to be filled in if the applicant would like to make a voluntary contribution to one of the funds listed in the application.

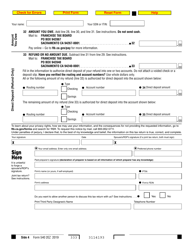

- The amount you owe . By adding numbers in certain lines a filer must count how much they owe to FTB. The applicant must not send cash to the FTB, the payment should be done online.

- Direct Deposit (Refund Only) . A filer must provide information to authorize the direct deposit of their refund.

Where to Mail 540 2EZ?

After completing CA 540 2EZ and signing it, the applicant must mail it to the California FTB:

- PO Box 942867, Sacramento CA 94267-0001 (if the tax return shows an amount due);

- PO Box 942840, Sacramento CA 94240-0001 (if the tax return shows no amount due or a refund).