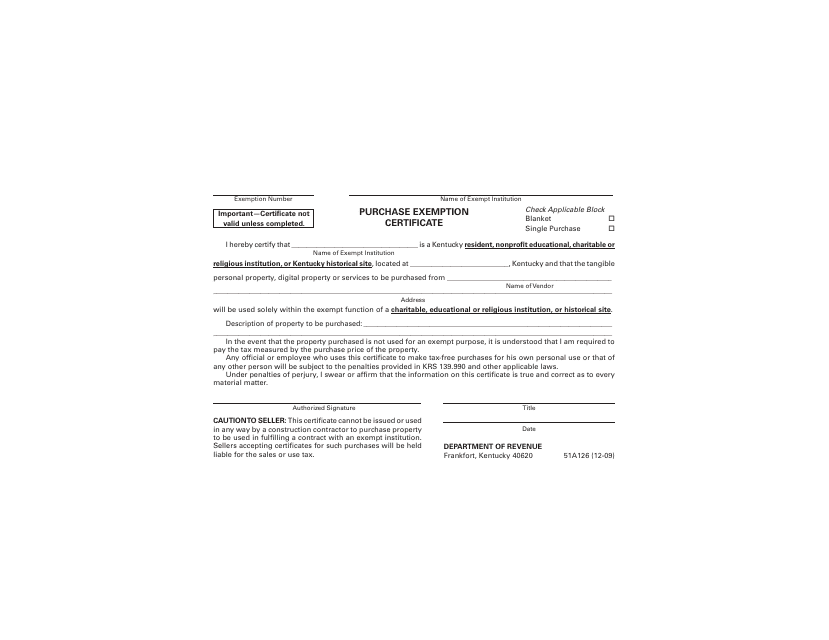

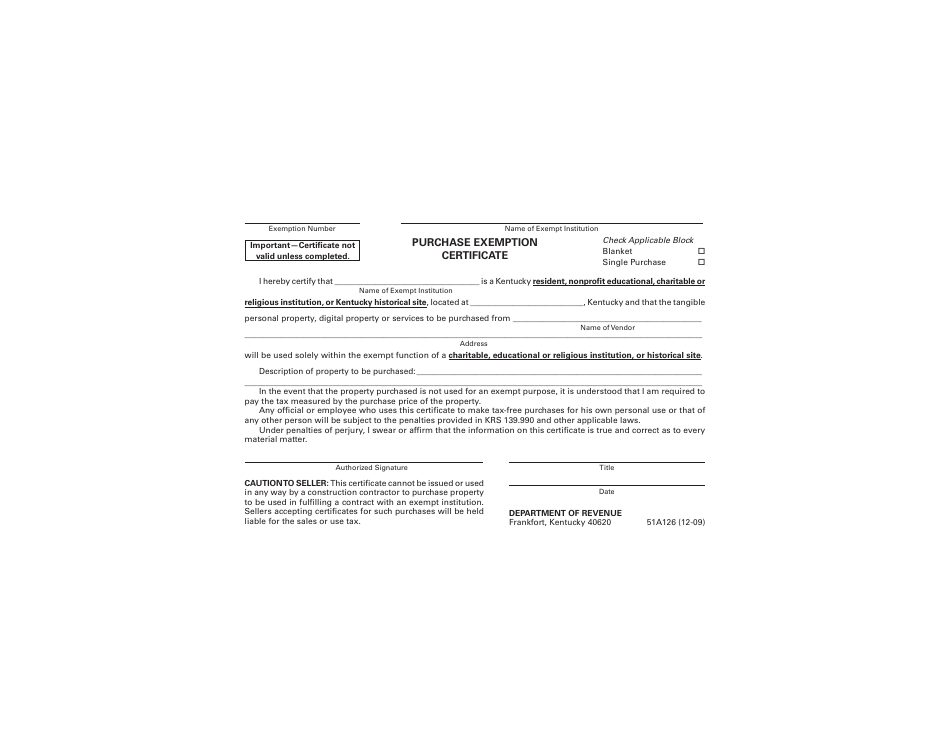

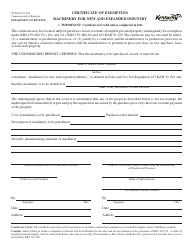

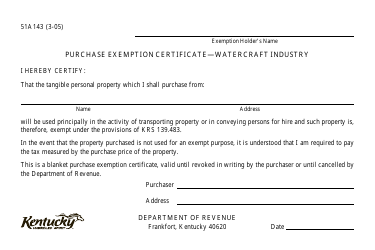

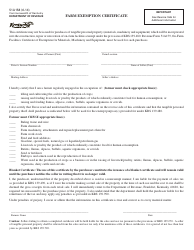

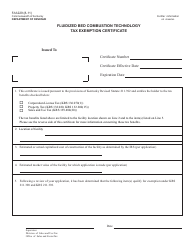

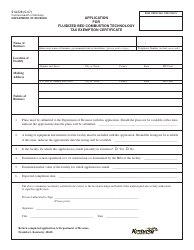

Form 51A126 Purchase Exemption Certificate - Kentucky

What Is Form 51A126?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51A126?

A: Form 51A126 is the Purchase Exemption Certificate for Kentucky.

Q: What is the purpose of Form 51A126?

A: The purpose of Form 51A126 is to claim exemption from sales tax on certain purchases in Kentucky.

Q: Who can use Form 51A126?

A: Form 51A126 can be used by individuals or businesses who qualify for sales tax exemptions in Kentucky.

Q: What purchases can be exempted using Form 51A126?

A: Form 51A126 can be used to claim exemptions for various items, such as farm equipment, manufacturing machinery, and certain nonprofit organization purchases.

Q: Are there any deadlines for submitting Form 51A126?

A: There are no specific deadlines for submitting Form 51A126. It should be provided to the seller at the time of purchase.

Q: Do I need to keep a copy of Form 51A126?

A: Yes, it is recommended to keep a copy of Form 51A126 for your records.

Q: Can I use Form 51A126 for personal purchases?

A: Yes, Form 51A126 can be used for both personal and business purchases, as long as the items qualify for exemption.

Q: Are there any penalties for providing false information on Form 51A126?

A: Yes, providing false information on Form 51A126 can result in penalties, including fines and potential legal consequences.

Form Details:

- Released on December 1, 2009;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A126 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.