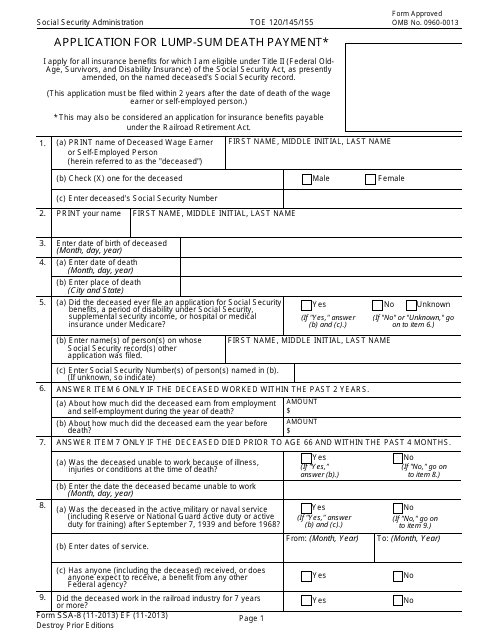

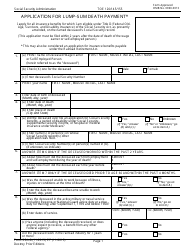

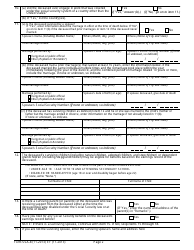

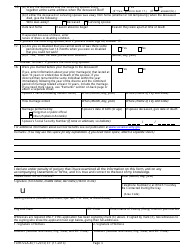

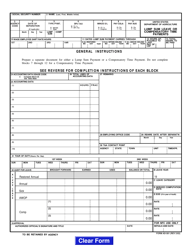

This version of the form is not currently in use and is provided for reference only. Download this version of

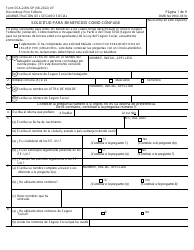

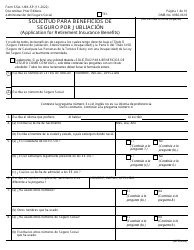

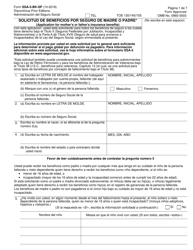

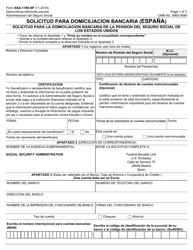

Form SSA-8

for the current year.

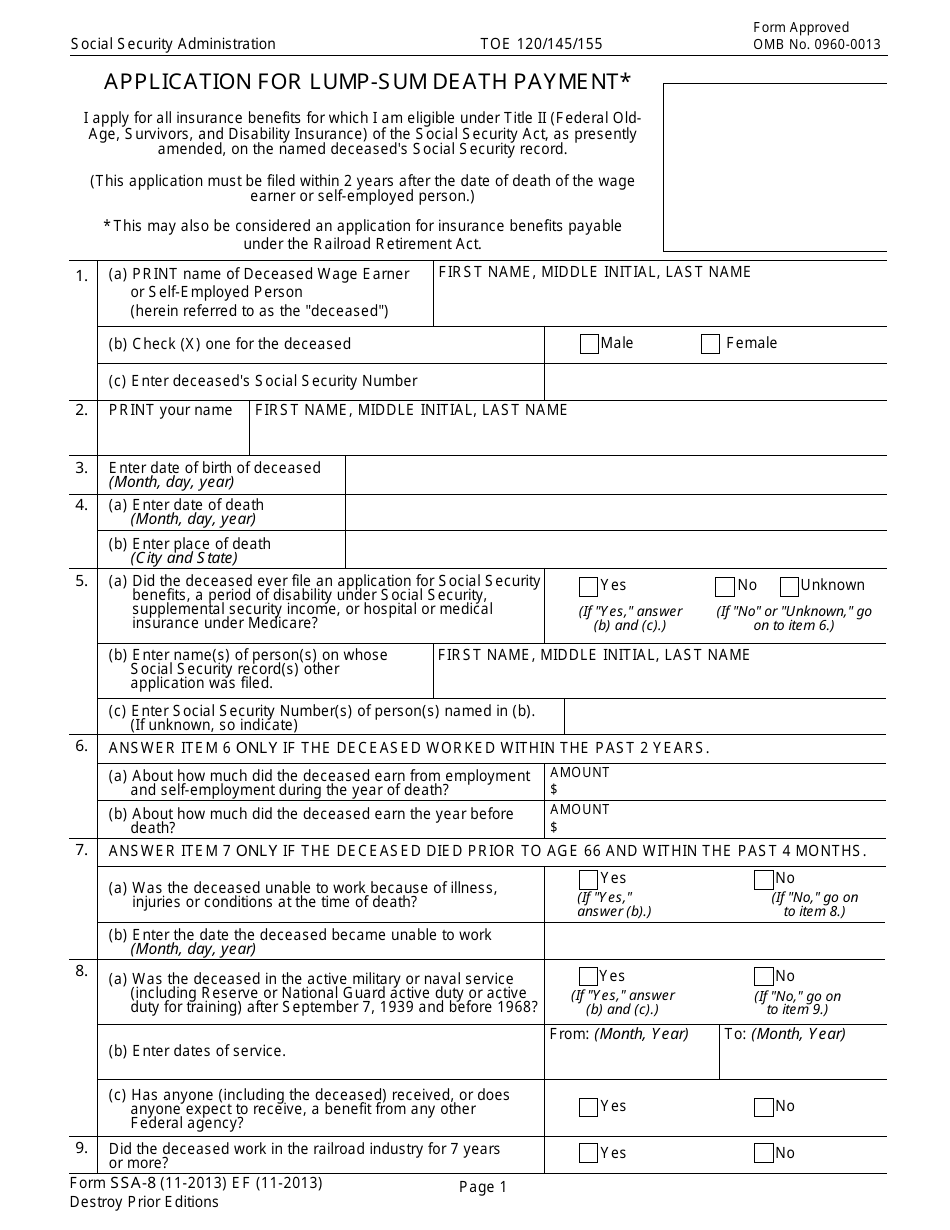

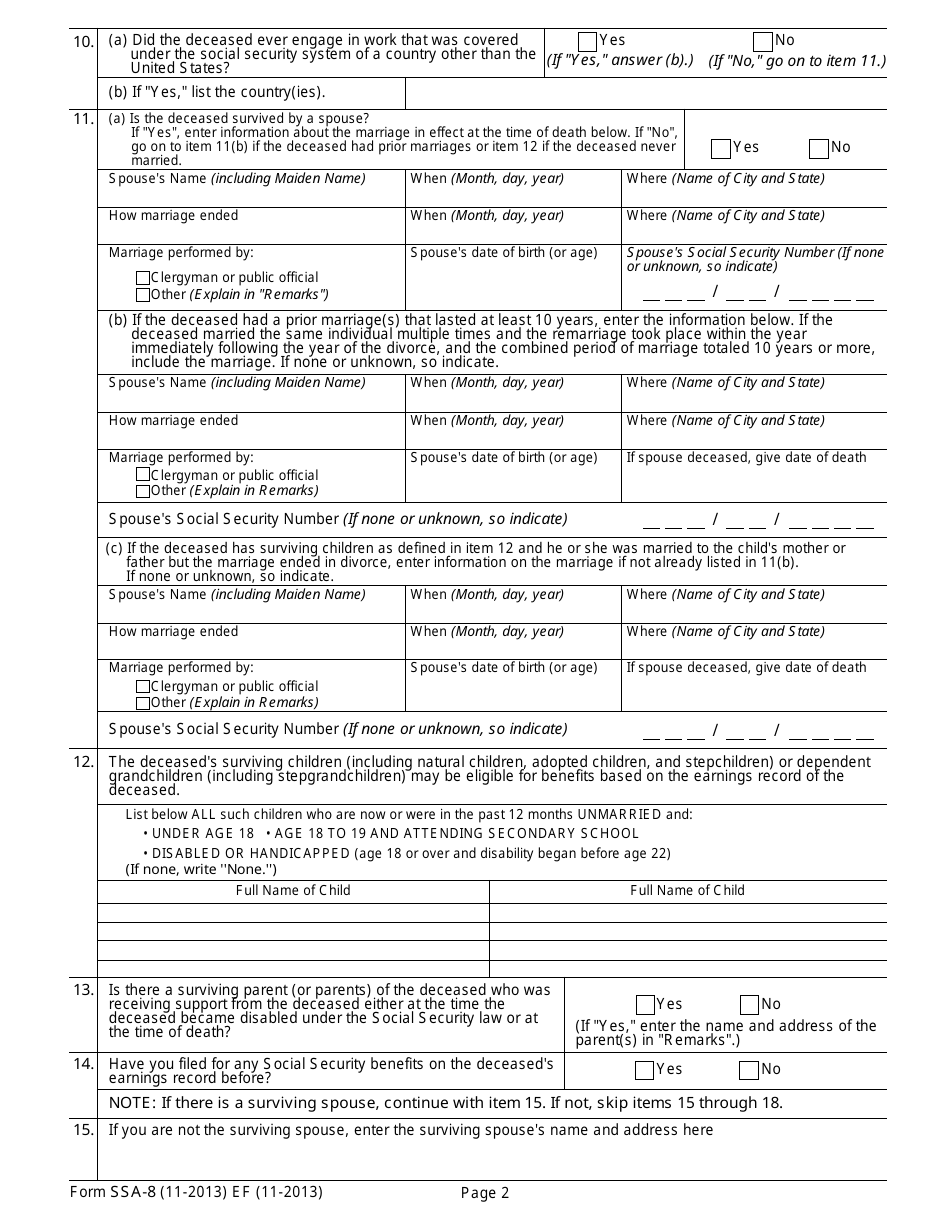

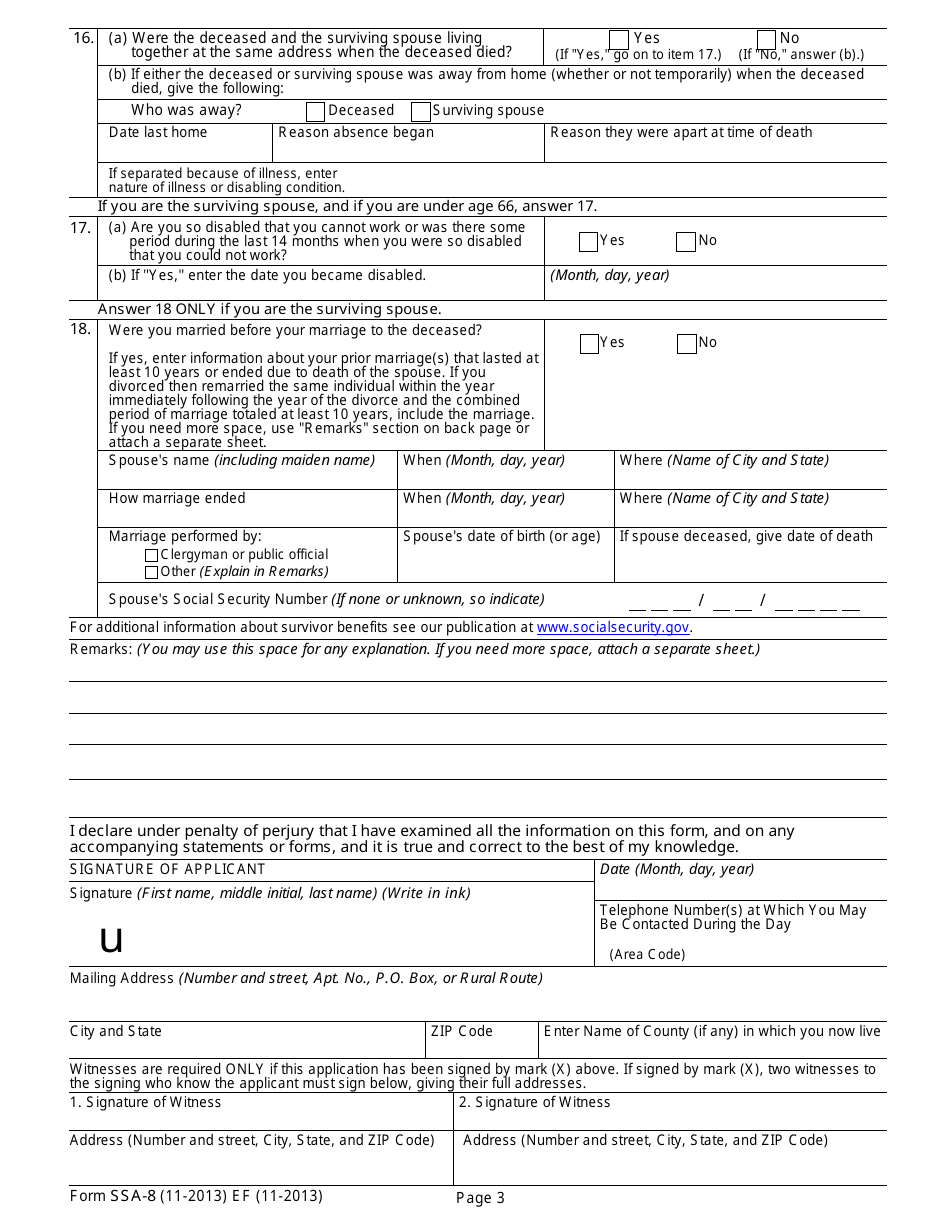

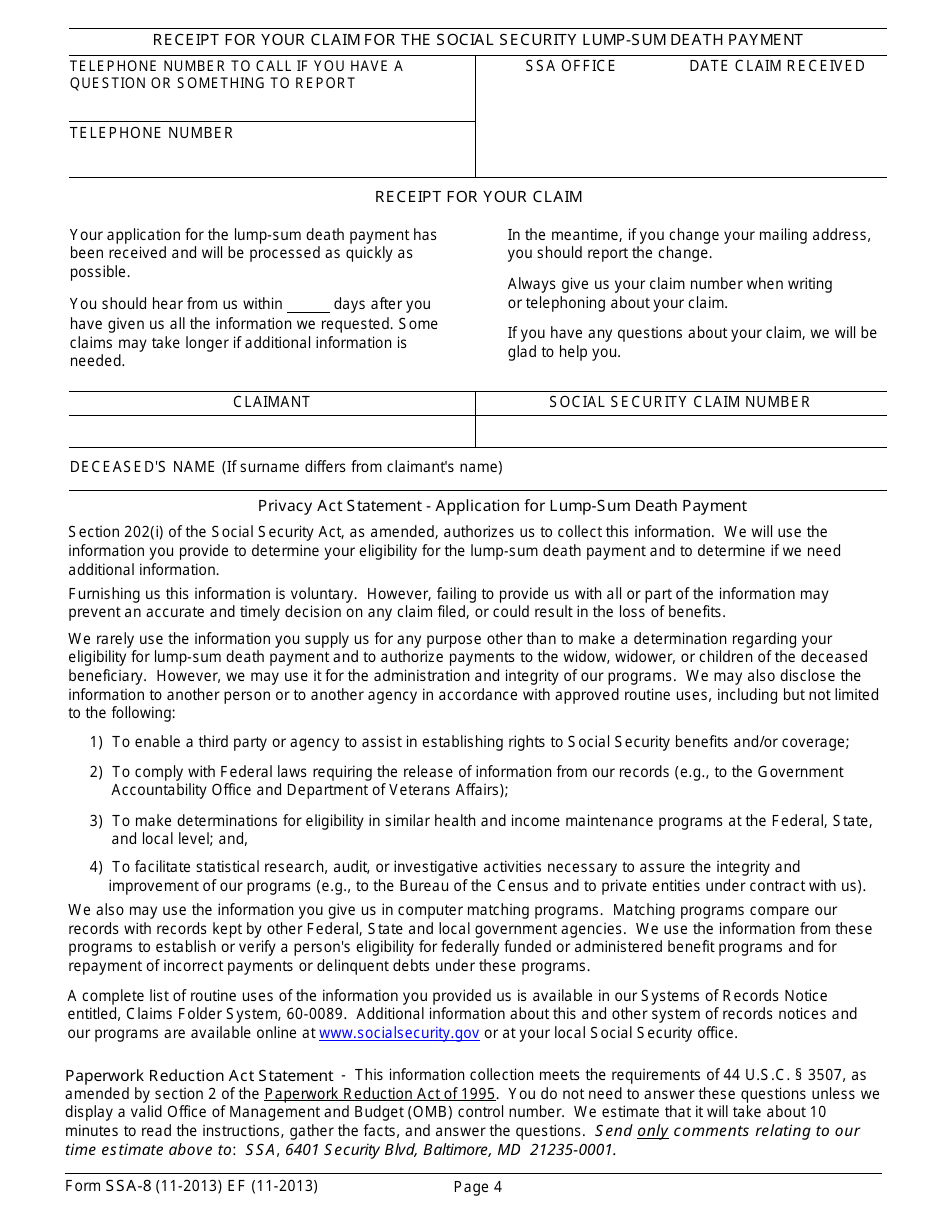

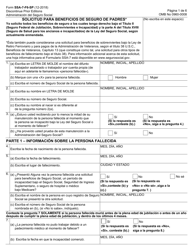

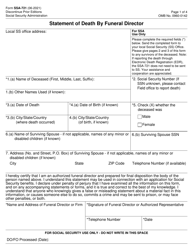

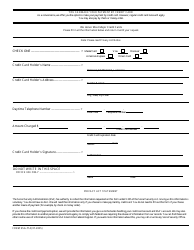

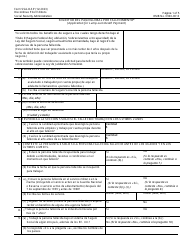

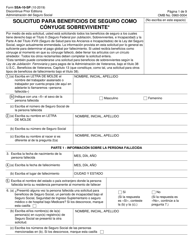

Form SSA-8 Application for Lump-Sum Death Payment

What Is Form SSA-8?

This is a legal form that was released by the U.S. Social Security Administration on November 1, 2013 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SSA-8?

A: Form SSA-8 is an application for a lump-sum death payment.

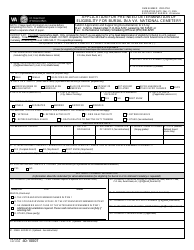

Q: Who can apply for a lump-sum death payment?

A: The surviving spouse or child of a deceased Social Security beneficiary can apply.

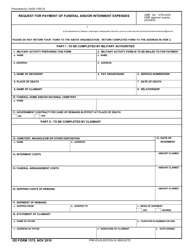

Q: What is the purpose of a lump-sum death payment?

A: The payment provides a one-time amount to help with funeral and burial costs.

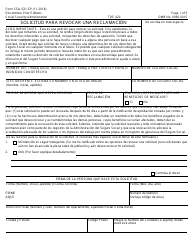

Q: What documents are needed to apply for a lump-sum death payment?

A: You will need the deceased person's Social Security number, death certificate, and your own identification.

Q: Is there a time limit to apply for a lump-sum death payment?

A: Yes, you must apply within two years of the date of death to be eligible.

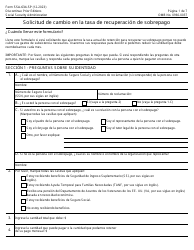

Q: How long does it take to receive a lump-sum death payment?

A: The processing time can vary, but it generally takes about six to eight weeks to receive a decision.

Q: Is the lump-sum death payment taxable?

A: No, the payment is not subject to federal income taxes.

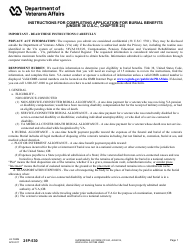

Q: Can I receive a lump-sum death payment if the deceased did not receive Social Security benefits?

A: No, the deceased person must have been eligible for Social Security benefits for you to be eligible for the payment.

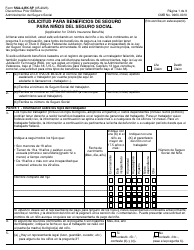

Q: What other benefits may be available to survivors of deceased Social Security beneficiaries?

A: Survivors may be eligible for monthly survivor benefits, depending on their relationship to the deceased.

Form Details:

- Released on November 1, 2013;

- The latest available edition released by the U.S. Social Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SSA-8 by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.