This version of the form is not currently in use and is provided for reference only. Download this version of

Form WPF GARN01.0250

for the current year.

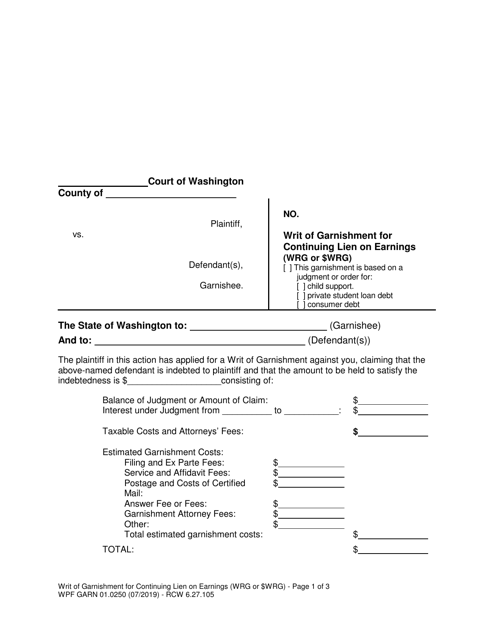

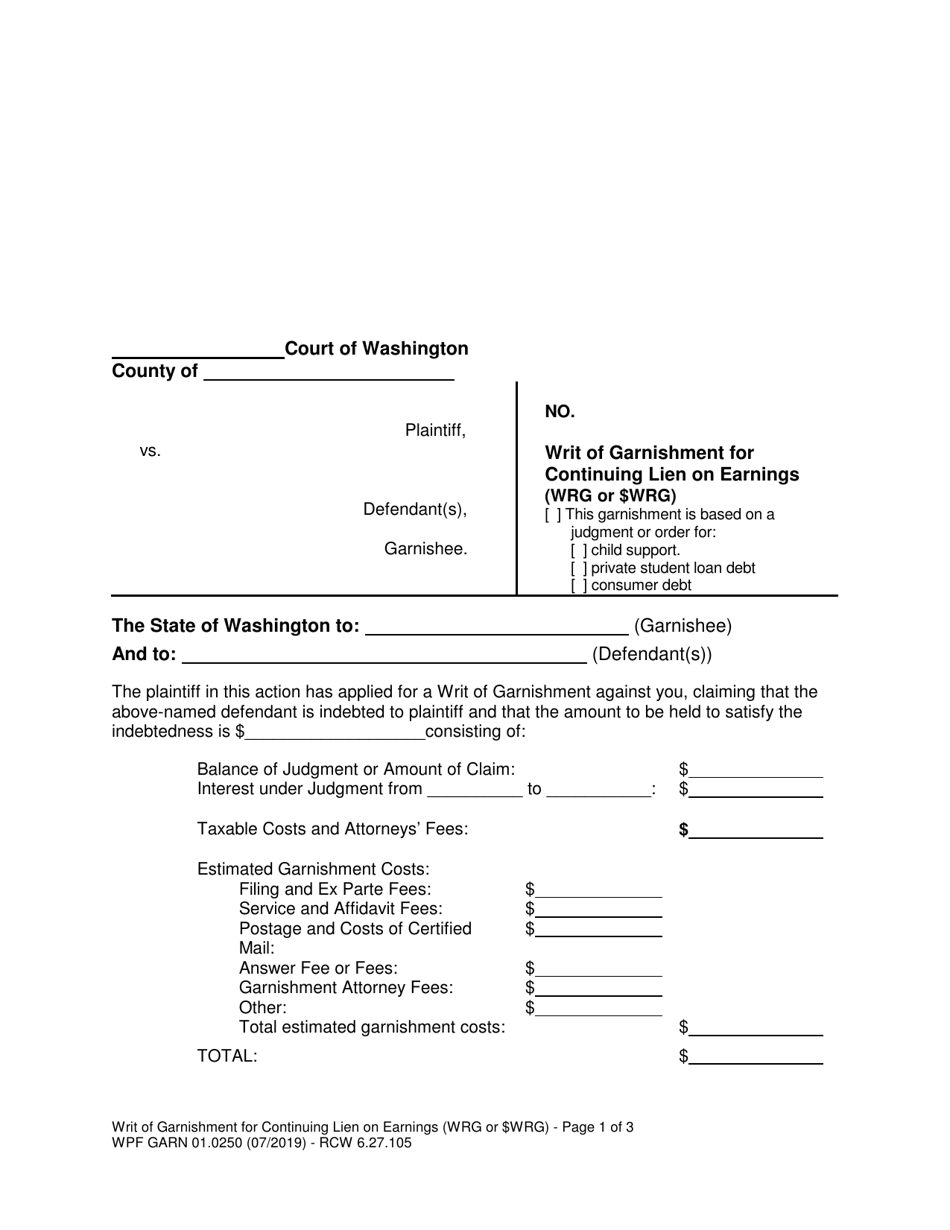

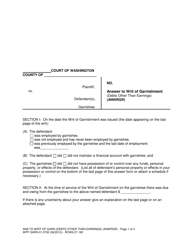

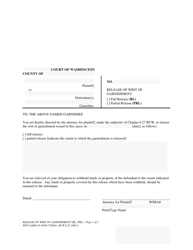

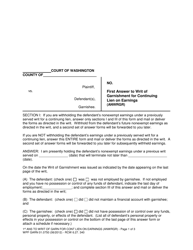

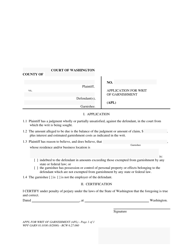

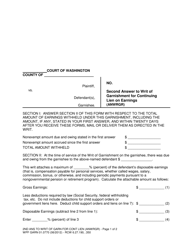

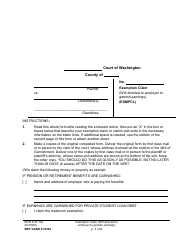

Form WPF GARN01.0250 Writ of Garnishment for Continuing Lien on Earnings (Wrg or $wrg) - Washington

What Is Form WPF GARN01.0250?

This is a legal form that was released by the Washington State Courts - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WPF GARN01.0250?

A: Form WPF GARN01.0250 is the Writ of Garnishment for Continuing Lien on Earnings (Wrg or $wrg) used in Washington.

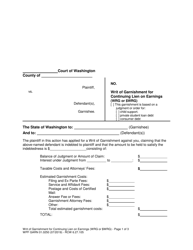

Q: What is a Writ of Garnishment?

A: A Writ of Garnishment is a legal document used to authorize the collection of a debt directly from a debtor's wages or bank account.

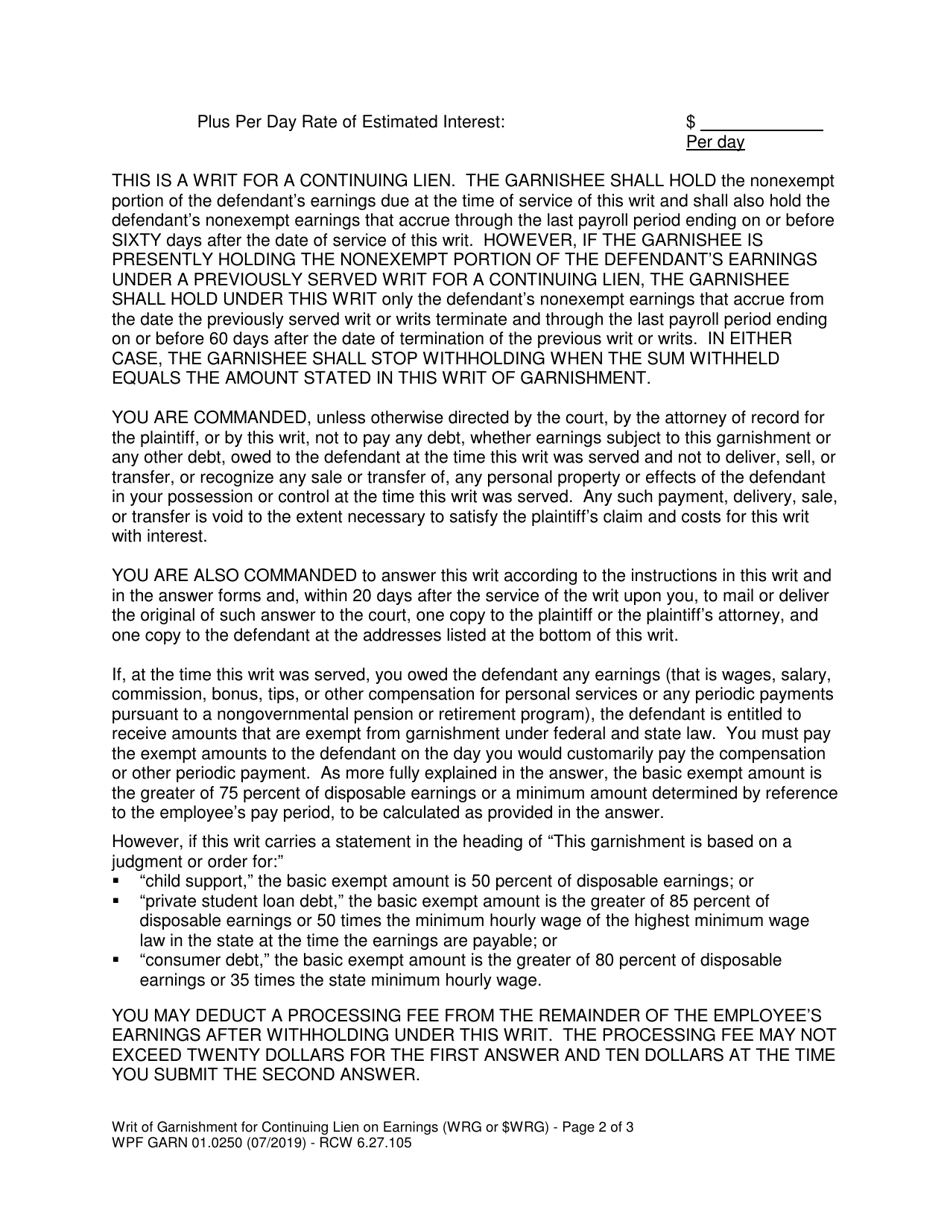

Q: What is a Continuing Lien on Earnings?

A: A Continuing Lien on Earnings is a type of garnishment that allows for ongoing deductions from a debtor's earnings until the debt is fully paid.

Q: Who can use Form WPF GARN01.0250?

A: Form WPF GARN01.0250 is typically used by creditors or judgment holders in Washington who want to collect a debt through wage garnishment.

Q: What information is required on Form WPF GARN01.0250?

A: Form WPF GARN01.0250 requires information such as the debtor's name and address, the creditor's information, details of the debt, and the amount to be garnished from the debtor's earnings.

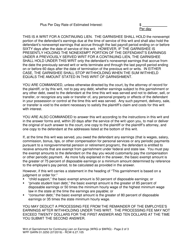

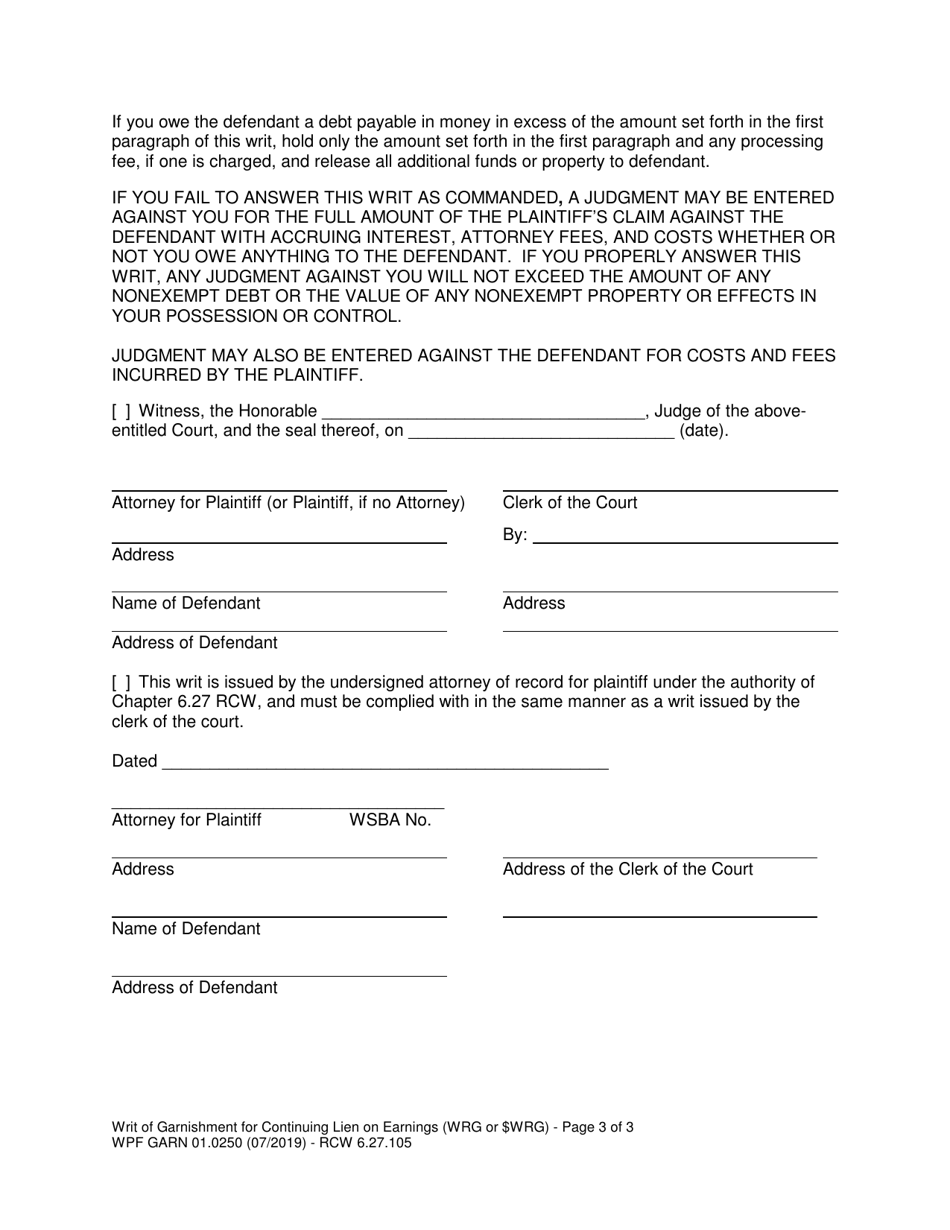

Q: What should I do if I receive a Writ of Garnishment?

A: If you receive a Writ of Garnishment, you should review the document carefully and consult with an attorney if needed. It is important to understand your rights and options for responding to the garnishment.

Q: Can a debtor object to a Writ of Garnishment?

A: Yes, a debtor has the right to object to a Writ of Garnishment. They may have grounds for objection, such as exemption from garnishment or an error in the amount being claimed.

Q: What happens if a debtor ignores a Writ of Garnishment?

A: If a debtor ignores a Writ of Garnishment, their wages may be garnished, and the funds will be deducted from their paycheck until the debt is fully paid.

Q: Are there any exemptions from wage garnishment in Washington?

A: Yes, there are exemptions from wage garnishment in Washington. Certain types of income, such as Social Security benefits or certain public assistance payments, may be protected from garnishment.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Washington State Courts;

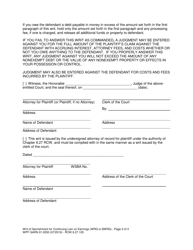

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WPF GARN01.0250 by clicking the link below or browse more documents and templates provided by the Washington State Courts.