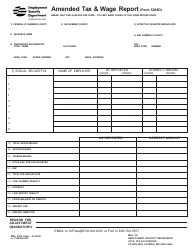

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

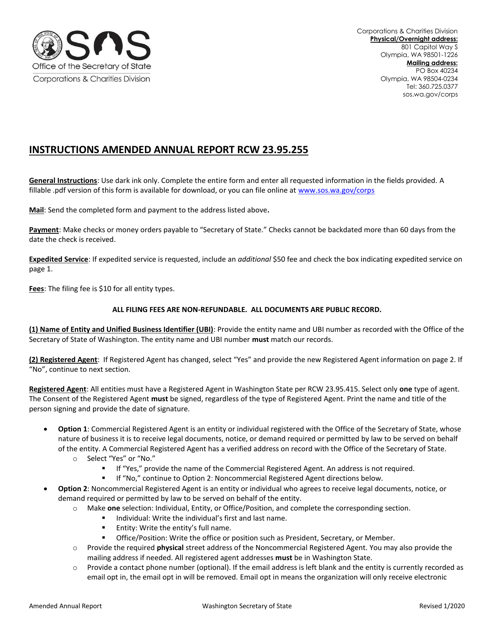

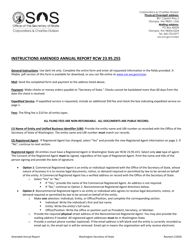

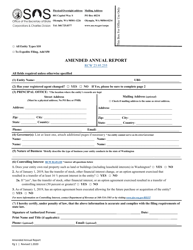

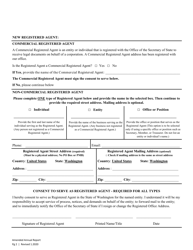

Amended Annual Report - Washington

Amended Annual Report is a legal document that was released by the Washington Secretary of State - a government authority operating within Washington.

FAQ

Q: What is an Amended Annual Report?

A: An Amended Annual Report is a revised version of the original Annual Report that a company must file with the state of Washington.

Q: Why would a company file an Amended Annual Report?

A: A company may file an Amended Annual Report to correct errors or make changes to the information previously submitted in the original Annual Report.

Q: What information needs to be provided in an Amended Annual Report?

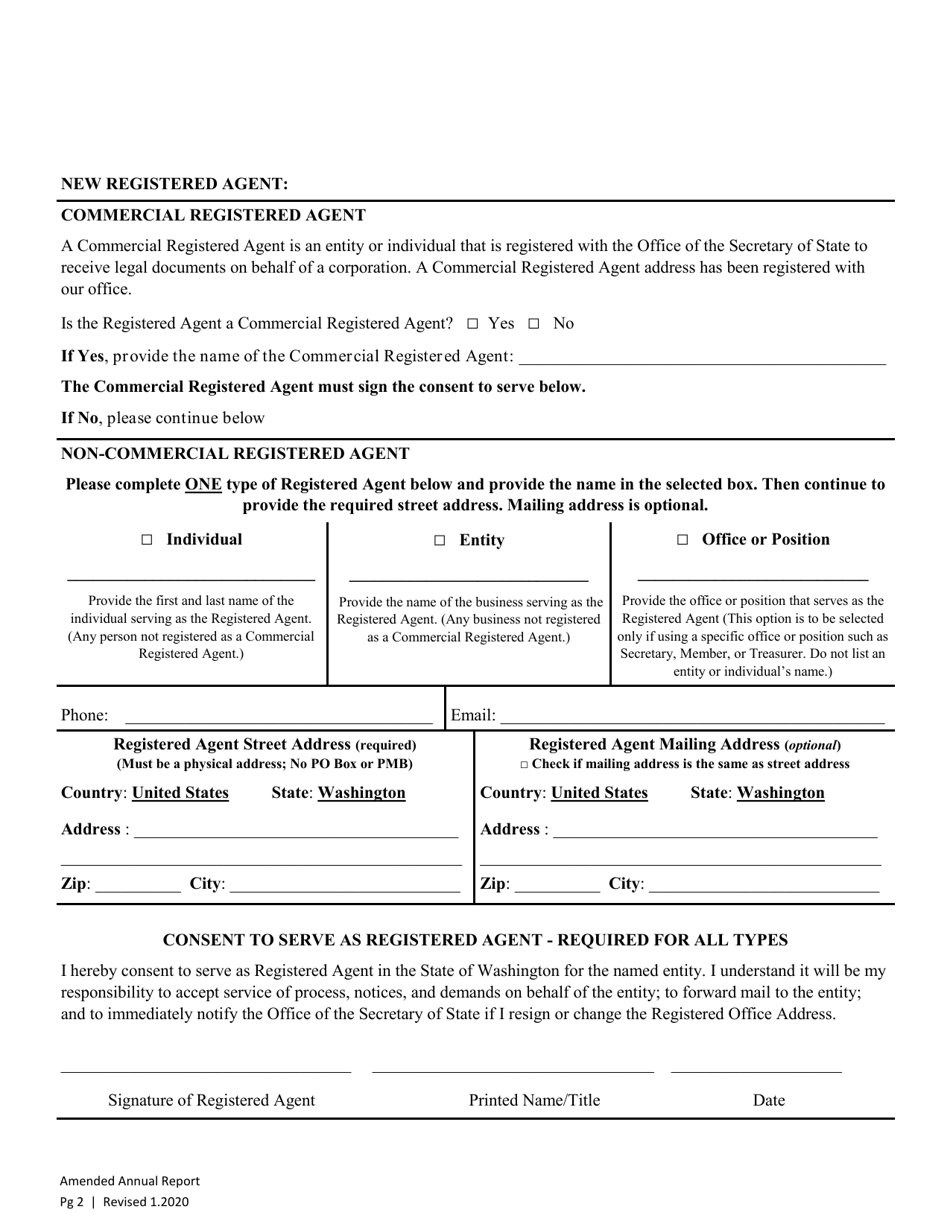

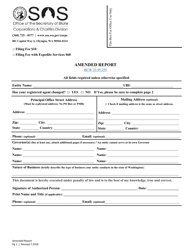

A: The information that needs to be provided in an Amended Annual Report includes the company's name, address, officers, and registered agent.

Q: Is there a deadline for filing an Amended Annual Report in Washington?

A: Yes, there is a deadline for filing an Amended Annual Report in Washington. It is typically due by the end of the anniversary month of the company's formation or registration.

Q: Can a company file multiple Amended Annual Reports in Washington?

A: Yes, a company can file multiple Amended Annual Reports in Washington if necessary.

Q: What happens if a company fails to file an Amended Annual Report in Washington?

A: If a company fails to file an Amended Annual Report in Washington, it may face penalties and the state may dissolve or revoke its registration.

Q: Can a company withdraw an Amended Annual Report after filing it in Washington?

A: No, once an Amended Annual Report is filed in Washington, it cannot be withdrawn.

Form Details:

- Released on January 1, 2020;

- The latest edition currently provided by the Washington Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Washington Secretary of State.