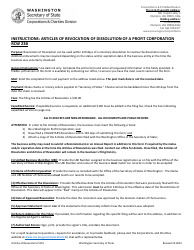

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

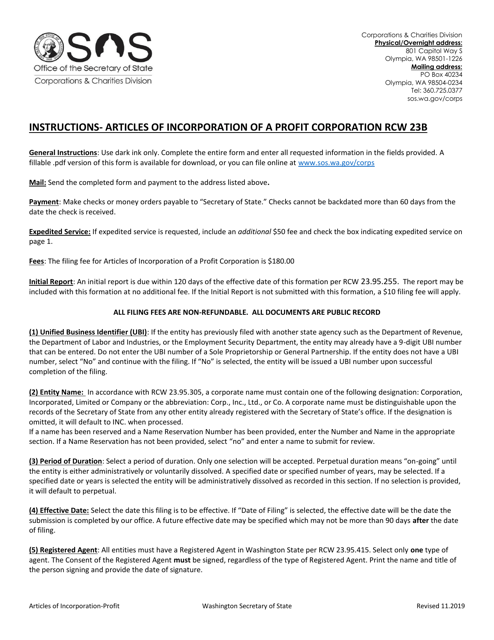

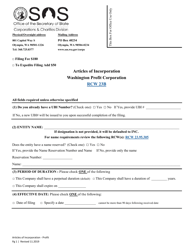

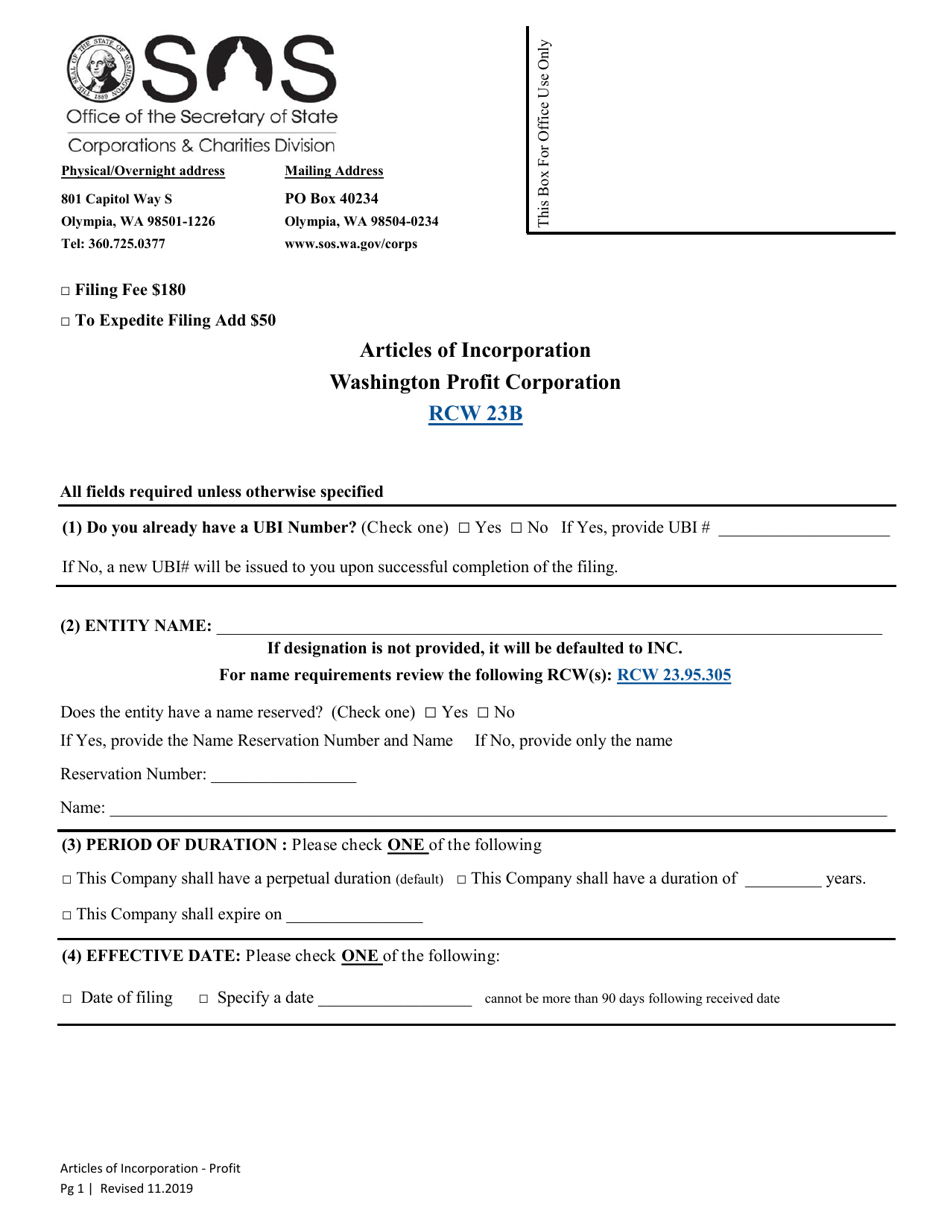

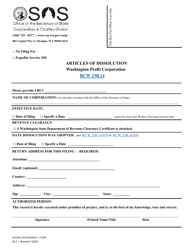

Articles of Incorporation - Washington Profit Corporation - Washington

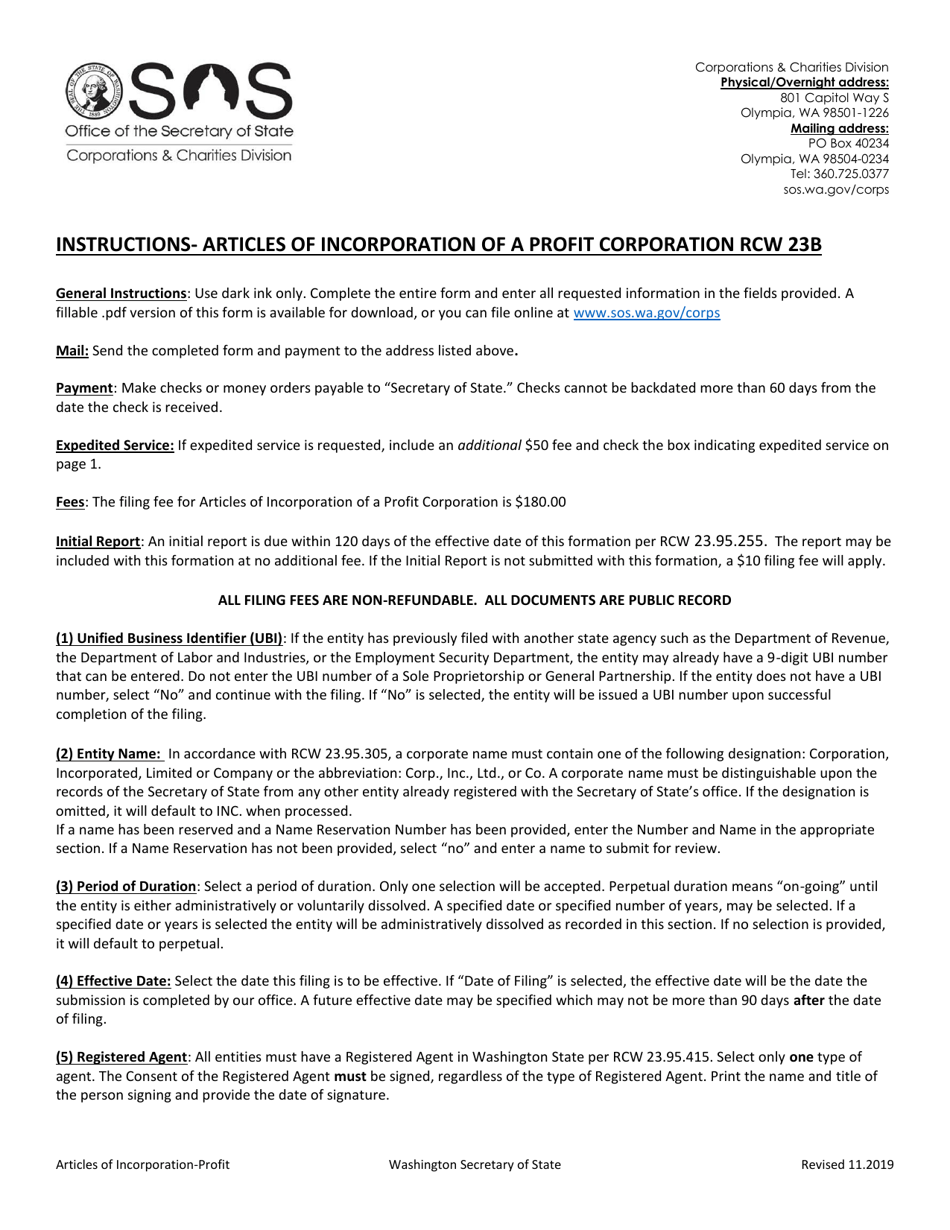

Articles of Incorporation - Washington Profit Corporation is a legal document that was released by the Washington Secretary of State - a government authority operating within Washington.

FAQ

Q: What is the purpose of Articles of Incorporation?

A: The purpose of Articles of Incorporation is to legally establish a corporation in Washington state.

Q: What is a Washington Profit Corporation?

A: A Washington Profit Corporation is a type of corporation that is formed for the purpose of making a profit.

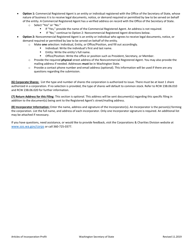

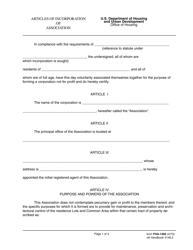

Q: What information is typically included in the Articles of Incorporation?

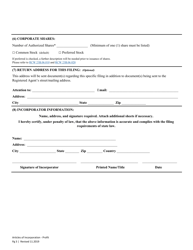

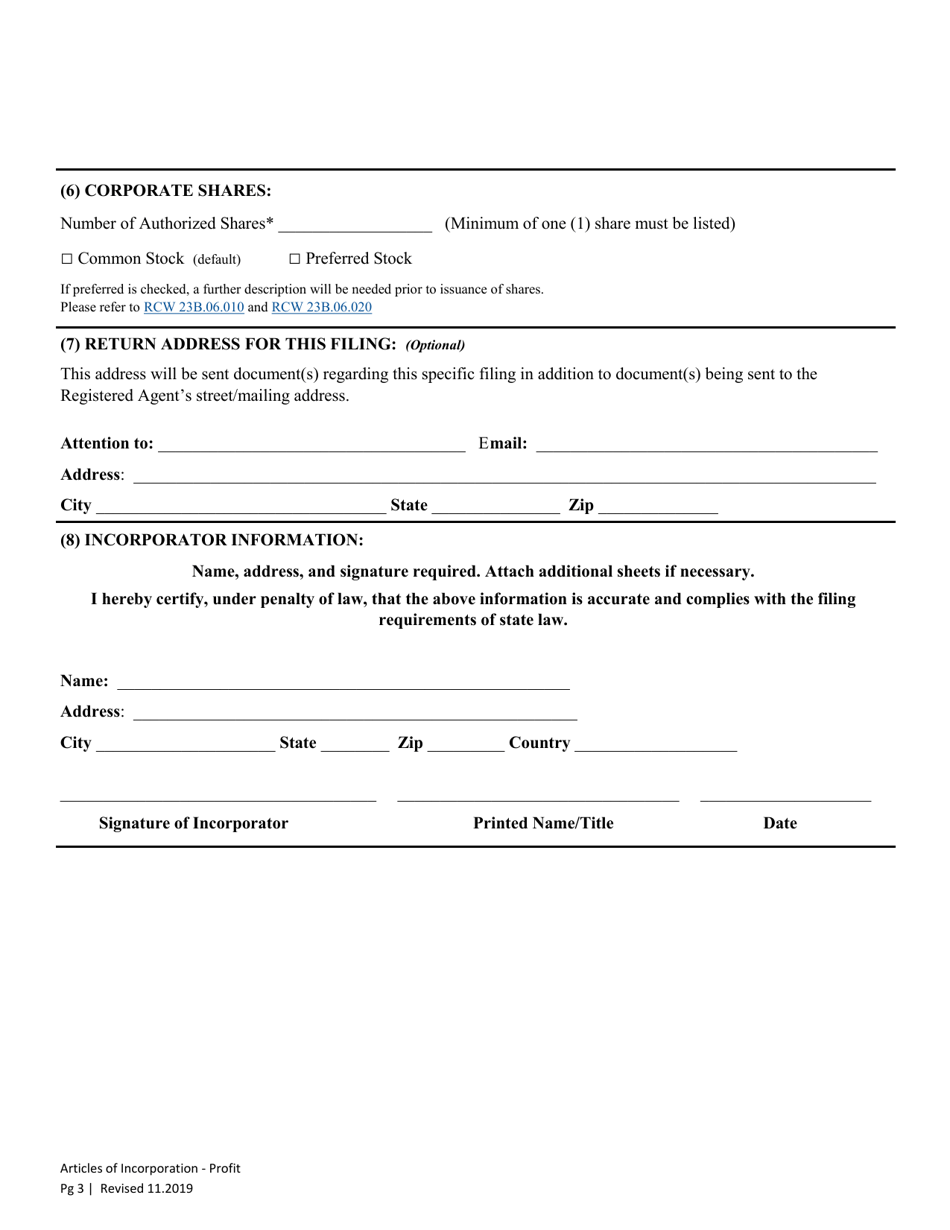

A: The Articles of Incorporation typically include the name of the corporation, the purpose of the corporation, the registered agent's information, the number of authorized shares, and the names and addresses of the initial directors.

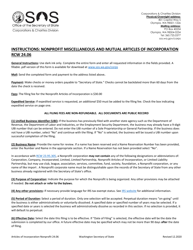

Q: How do I file Articles of Incorporation for a Washington Profit Corporation?

A: To file Articles of Incorporation for a Washington Profit Corporation, you need to submit the completed form and pay the required filing fee to the Washington Secretary of State's office.

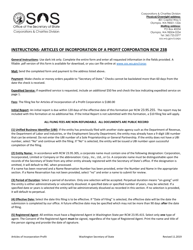

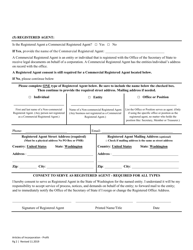

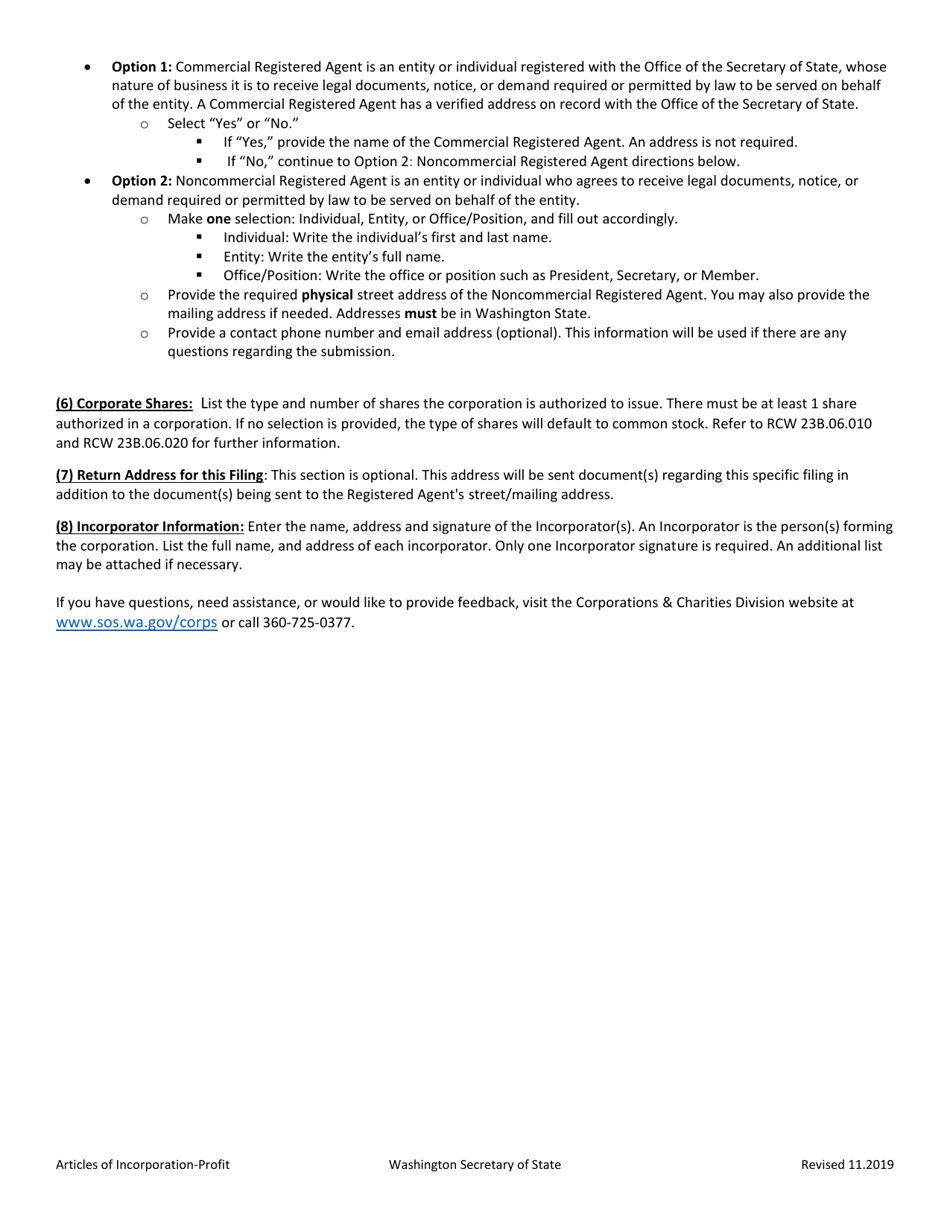

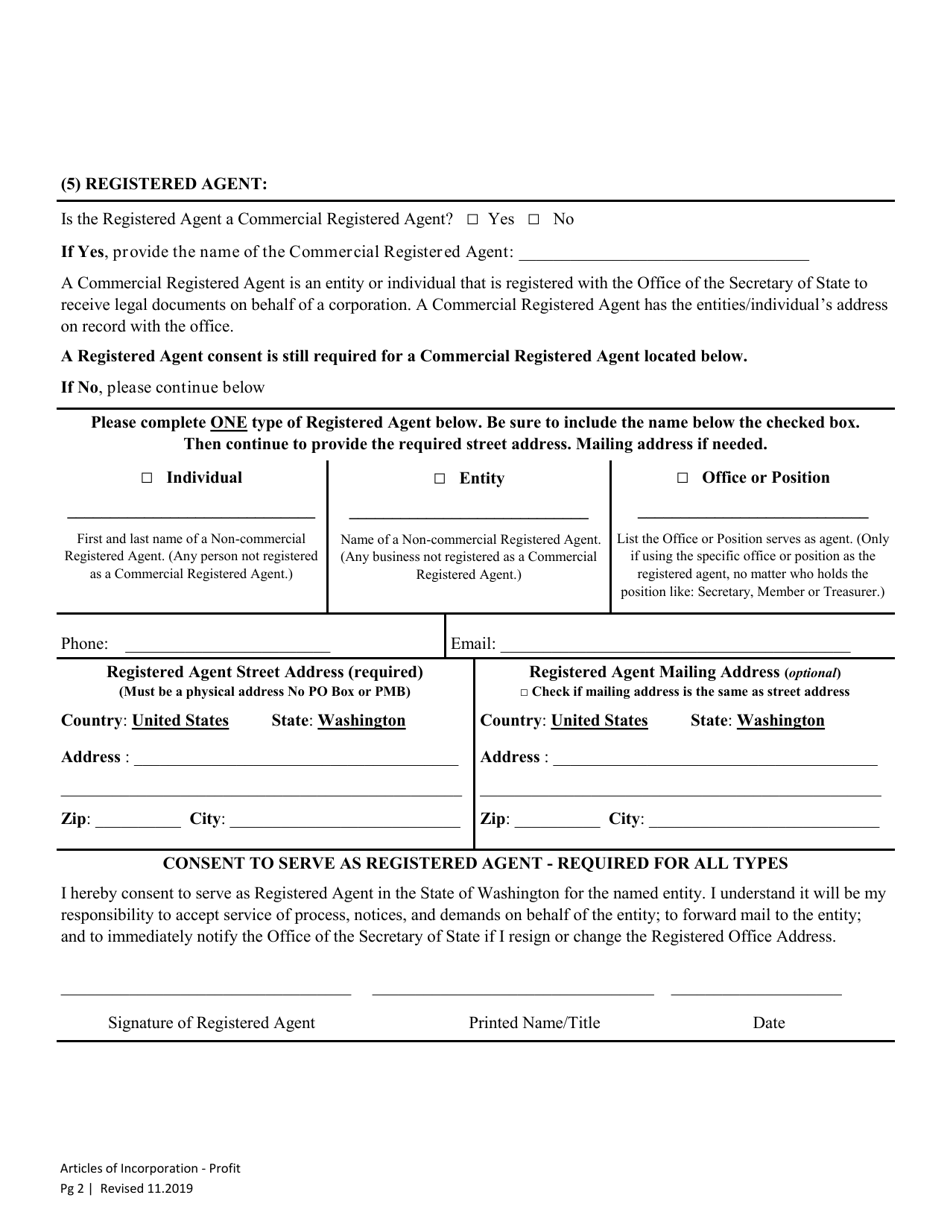

Q: What is a registered agent and why is their information required in the Articles of Incorporation?

A: A registered agent is a person or entity appointed by the corporation to receive legal documents on behalf of the corporation. Their information is required in the Articles of Incorporation to ensure that there is a designated contact for the corporation.

Q: How many authorized shares should be listed in the Articles of Incorporation?

A: The number of authorized shares listed in the Articles of Incorporation will depend on the specific needs and plans of the corporation. It is important to consult with legal and financial professionals to determine the appropriate number of authorized shares.

Q: Do I need to have initial directors listed in the Articles of Incorporation?

A: Yes, the names and addresses of the initial directors should be listed in the Articles of Incorporation.

Q: Can I amend the Articles of Incorporation after they are filed?

A: Yes, you can amend the Articles of Incorporation after they are filed. This typically requires submitting the appropriate amendment form and paying the required fee.

Q: What are the benefits of forming a Washington Profit Corporation?

A: Some benefits of forming a Washington Profit Corporation include limited liability protection for shareholders, potential tax advantages, and the ability to raise capital through the sale of stock.

Form Details:

- Released on November 1, 2019;

- The latest edition currently provided by the Washington Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Washington Secretary of State.