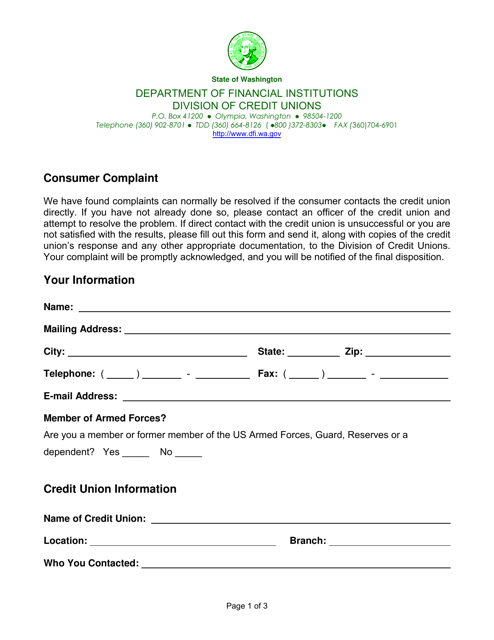

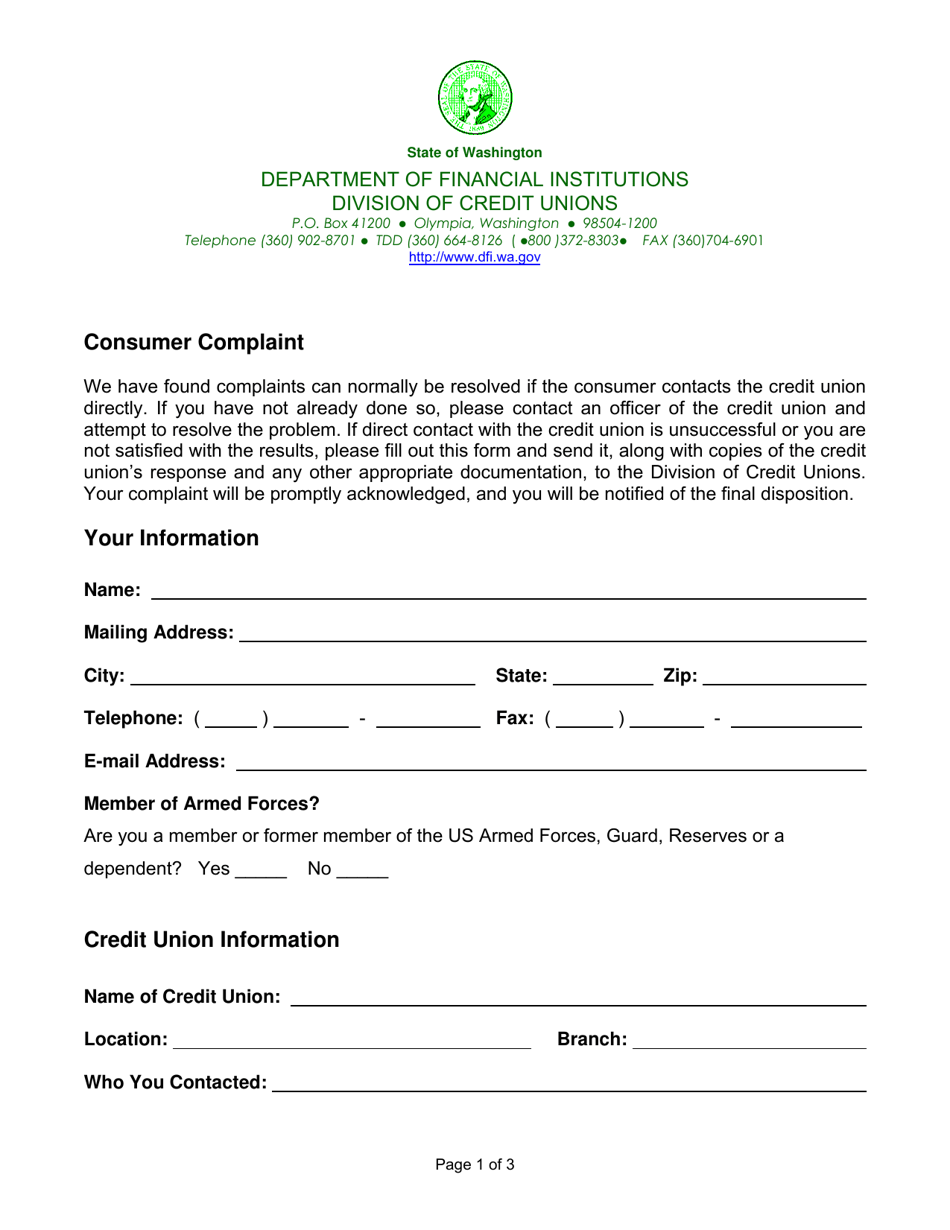

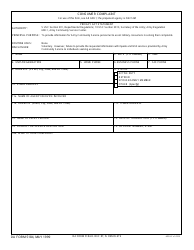

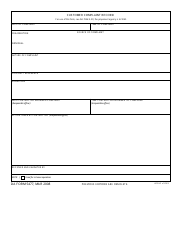

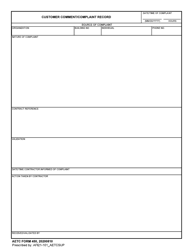

Credit Union Consumer Complaint - Washington

Credit Union Consumer Complaint is a legal document that was released by the Washington State Department of Financial Institutions - a government authority operating within Washington.

FAQ

Q: What is a credit union?

A: A credit union is a financial institution that operates as a non-profit organization and is owned and controlled by its members.

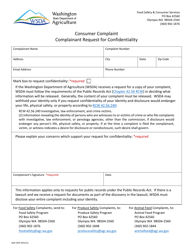

Q: How do I file a consumer complaint against a credit union in Washington?

A: To file a consumer complaint against a credit union in Washington, you can contact the Washington State Department of Financial Institutions (DFI). They have a Consumer Services Division that handles complaints and inquiries.

Q: What can I complain about regarding a credit union in Washington?

A: You can file a complaint regarding issues such as account access, fees, fraud, unfair practices, or any other concerns you have with a credit union in Washington.

Q: What information do I need to provide when filing a complaint?

A: When filing a complaint against a credit union in Washington, make sure to provide details about the issue, your account information, and any supporting documentation you may have.

Q: Are there any fees for filing a complaint?

A: No, there are no fees for filing a complaint against a credit union in Washington.

Q: What is the process after filing a complaint?

A: After you file a complaint against a credit union in Washington, the DFI will review your complaint, investigate the matter, and work towards resolving the issue.

Q: Can I escalate my complaint if I am not satisfied with the resolution?

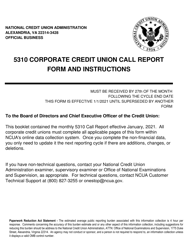

A: Yes, if you are not satisfied with the resolution provided by the credit union or the DFI, you can choose to escalate your complaint to higher authorities, such as the National Credit Union Administration (NCUA).

Q: Are credit unions regulated in Washington?

A: Yes, credit unions in Washington are regulated by the Washington State Department of Financial Institutions (DFI). They ensure compliance with state laws and regulations.

Q: Can I continue using the services of a credit union while a complaint is being resolved?

A: Yes, you can continue to use the services of a credit union while a complaint is being resolved. However, it's important to keep records of any relevant transactions or communications related to your complaint.

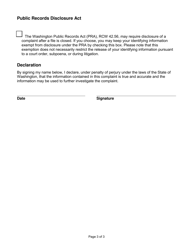

Form Details:

- The latest edition currently provided by the Washington State Department of Financial Institutions;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Washington State Department of Financial Institutions.