This version of the form is not currently in use and is provided for reference only. Download this version of

DOT Form 272-058

for the current year.

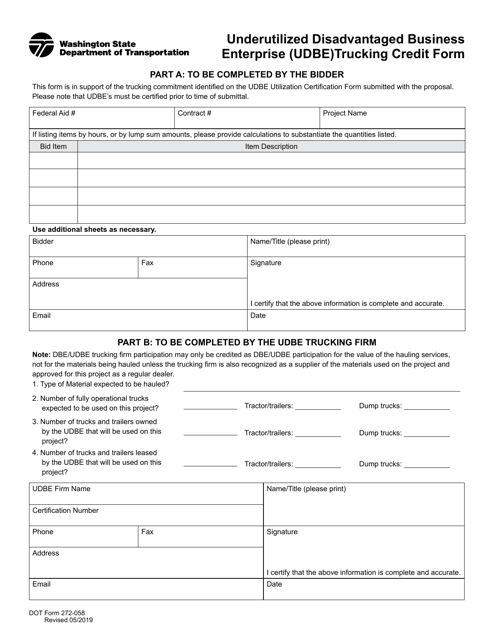

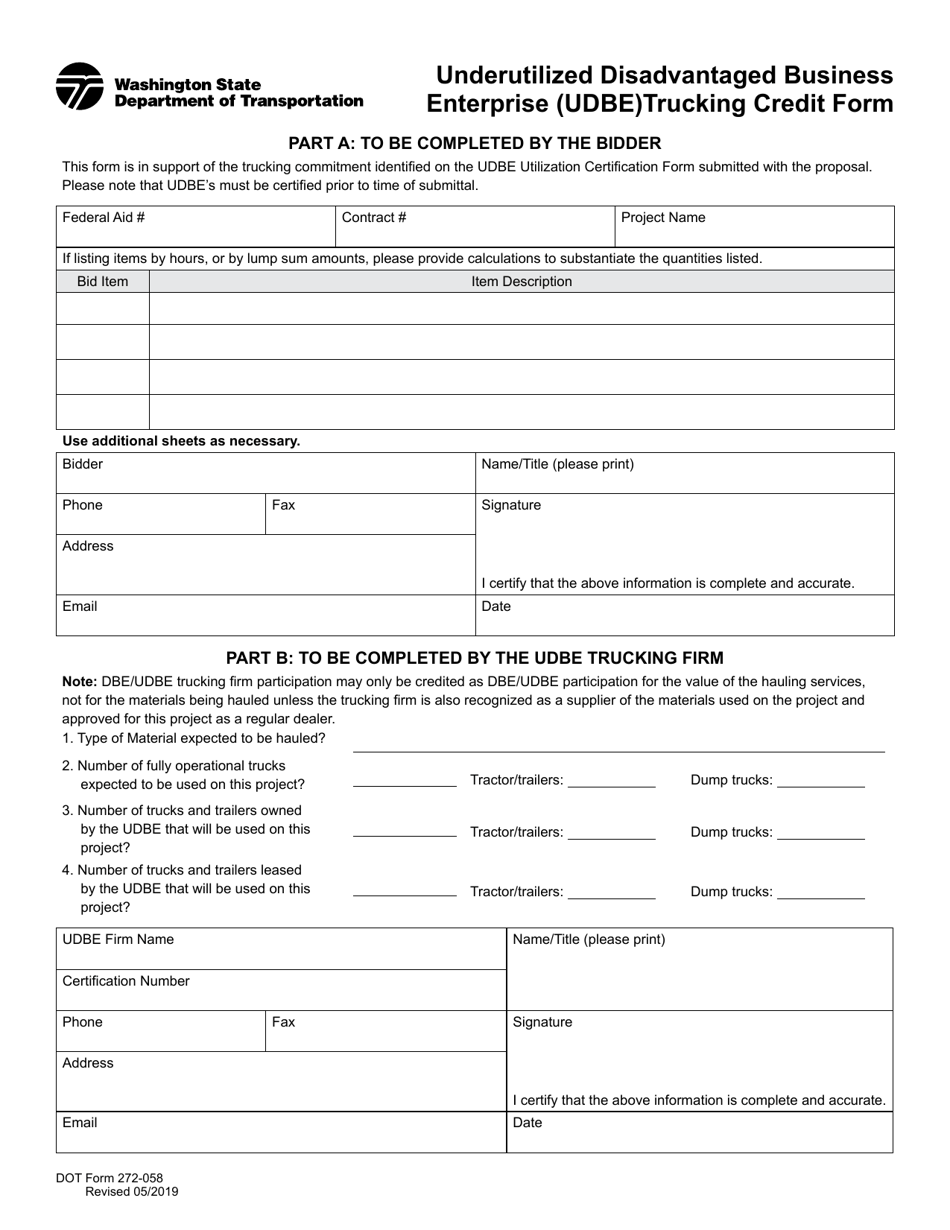

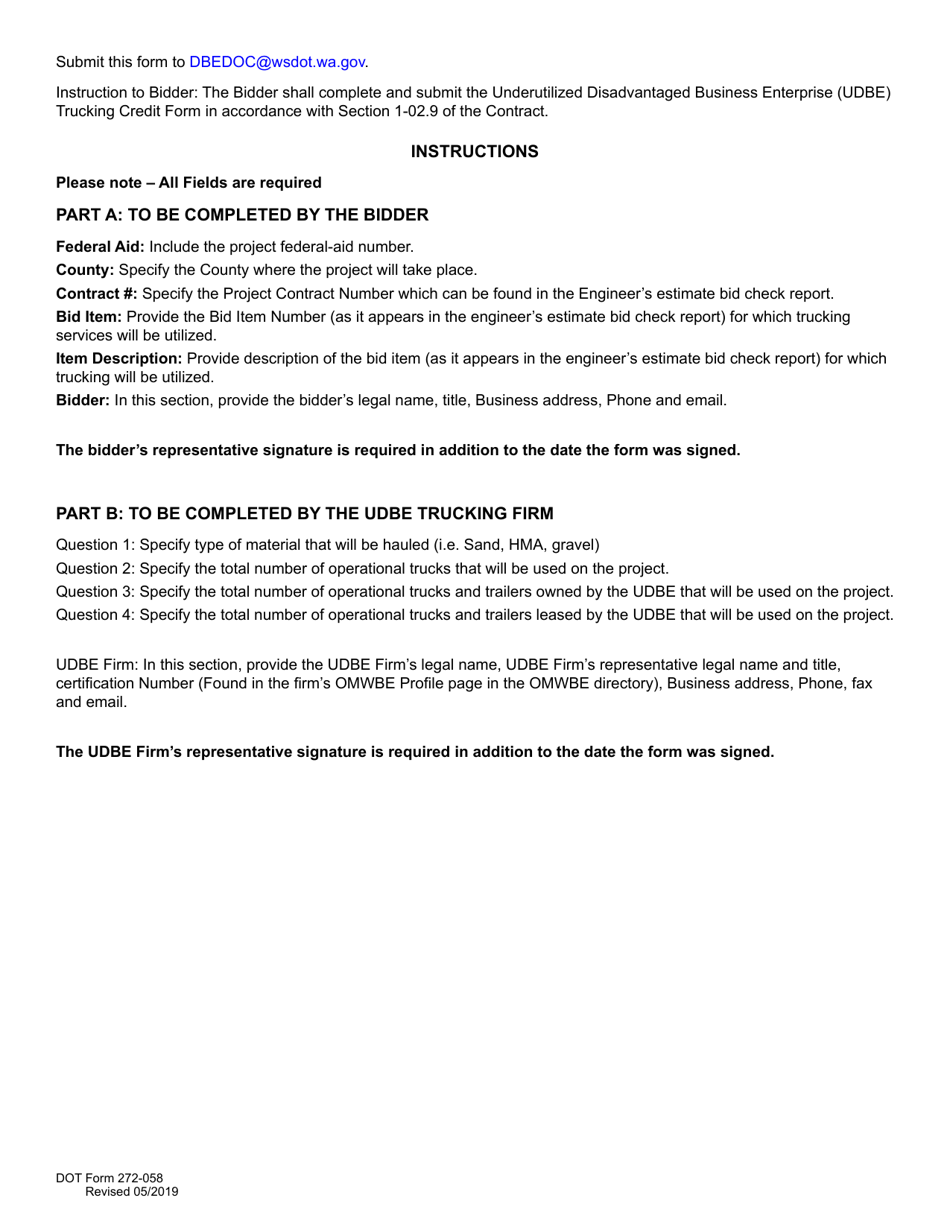

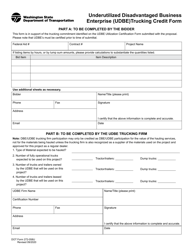

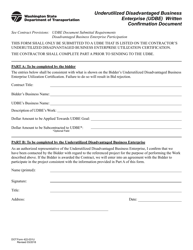

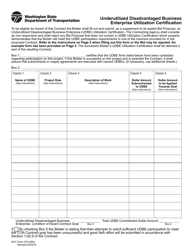

DOT Form 272-058 Underutilized Disadvantaged Business Enterprise (Udbe) Trucking Credit Form - Washington

What Is DOT Form 272-058?

This is a legal form that was released by the Washington State Department of Transportation - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DOT Form 272-058?

A: DOT Form 272-058 is the Underutilized Disadvantaged Business Enterprise (UDbe) Trucking Credit form.

Q: What is the purpose of DOT Form 272-058?

A: The purpose of DOT Form 272-058 is to claim the Underutilized Disadvantaged Business Enterprise (UDbe) Trucking Credit in the state of Washington.

Q: Who can use DOT Form 272-058?

A: Anyone who meets the eligibility requirements for the Underutilized Disadvantaged Business Enterprise (UDbe) Trucking Credit in Washington can use this form.

Q: Is this form specific to Washington state?

A: Yes, DOT Form 272-058 is specific to the state of Washington and cannot be used for credits in other states.

Q: What is the UDbe Trucking Credit?

A: The UDbe Trucking Credit is a credit given to businesses that provide trucking services and meet certain underutilized disadvantaged business enterprise criteria.

Q: What are the eligibility requirements for the UDbe Trucking Credit?

A: The eligibility requirements for the UDbe Trucking Credit include being a certified disadvantaged business enterprise, having a valid Washington State business license, and meeting certain trucking service criteria.

Q: Can I claim the UDbe Trucking Credit without using DOT Form 272-058?

A: No, you must use DOT Form 272-058 to claim the UDbe Trucking Credit in Washington.

Q: Are there any deadlines for filing DOT Form 272-058?

A: Yes, the form must be filed within two years of the end of the calendar year in which the eligible trucking services were provided.

Form Details:

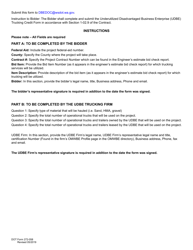

- Released on May 1, 2019;

- The latest edition provided by the Washington State Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of DOT Form 272-058 by clicking the link below or browse more documents and templates provided by the Washington State Department of Transportation.