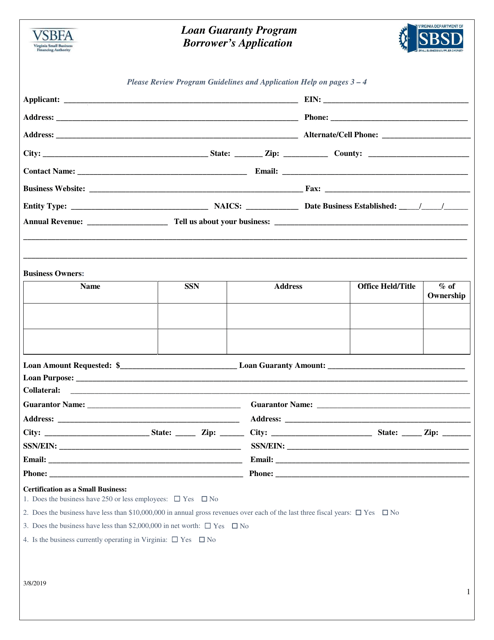

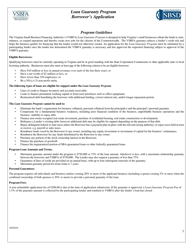

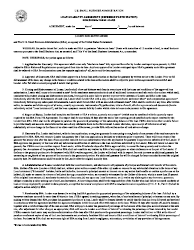

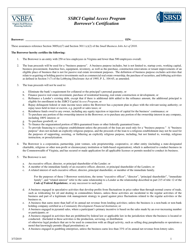

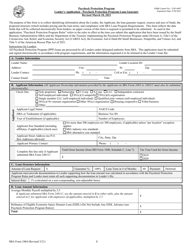

Loan Guaranty Program Borrower's Application - Virginia

Loan Guaranty Program Borrower's Application is a legal document that was released by the Virginia Department of Small Business and Supplier Diversity - a government authority operating within Virginia.

FAQ

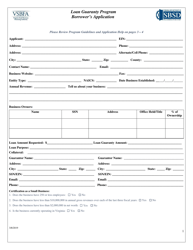

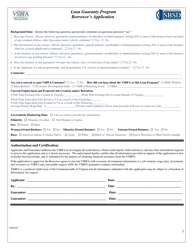

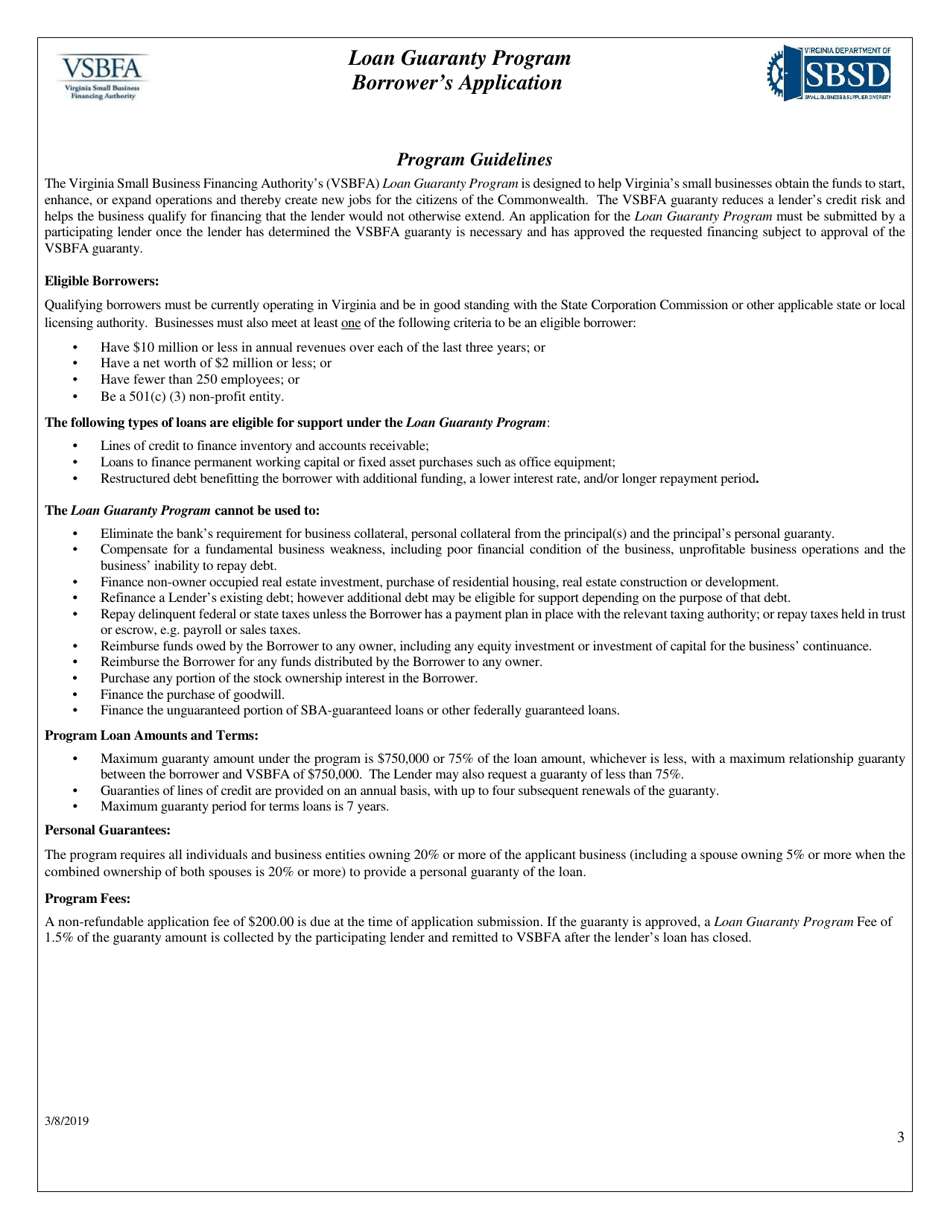

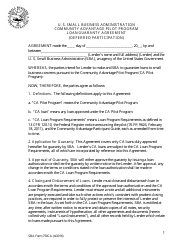

Q: What is the Loan Guaranty Program?

A: The Loan Guaranty Program is a program that provides loan guarantees to small businesses in Virginia.

Q: Who is eligible to apply for the Loan Guaranty Program?

A: Small businesses located in Virginia are eligible to apply for the Loan Guaranty Program.

Q: What is the purpose of the Loan Guaranty Program?

A: The purpose of the Loan Guaranty Program is to help small businesses obtain funding by providing loan guarantees.

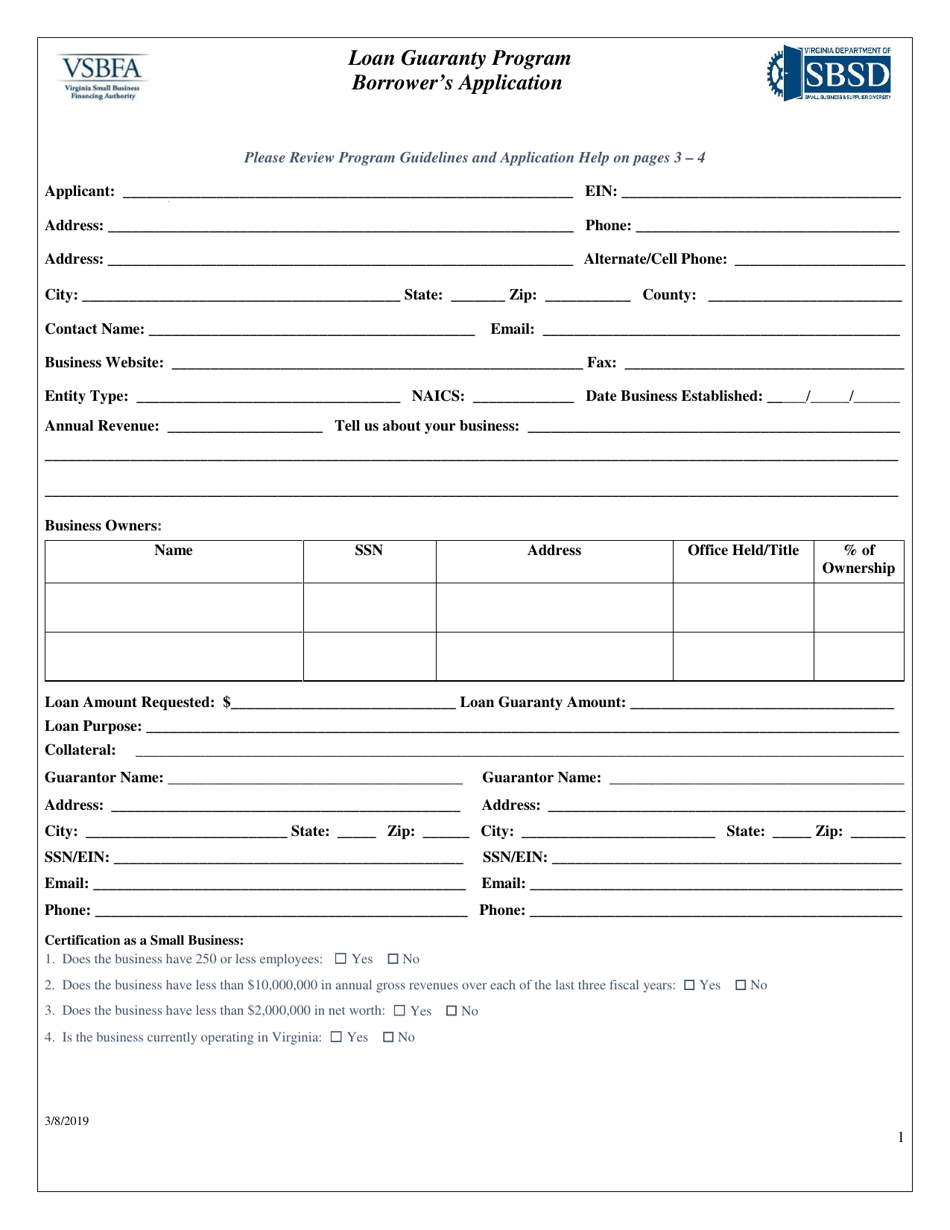

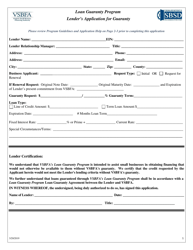

Q: How can I apply for the Loan Guaranty Program?

A: You can apply for the Loan Guaranty Program by submitting a Borrower's Application to the appropriate office in Virginia.

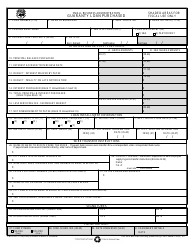

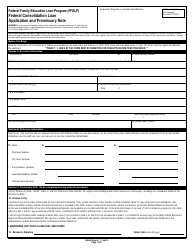

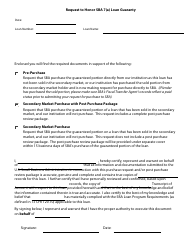

Q: What documents are required for the Loan Guaranty Program application?

A: The application requires you to submit financial statements, business plans, and other relevant documents.

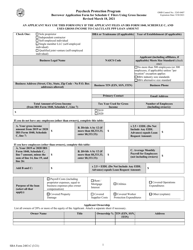

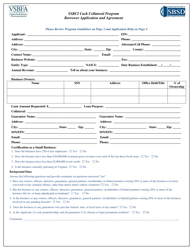

Q: What is the maximum loan amount available through the Loan Guaranty Program?

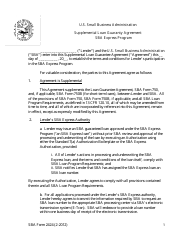

A: The maximum loan amount available through the Loan Guaranty Program is $350,000.

Q: What is the interest rate for loans obtained through the Loan Guaranty Program?

A: The interest rate for loans obtained through the Loan Guaranty Program varies and is determined by the lender.

Q: What is the repayment term for loans obtained through the Loan Guaranty Program?

A: The repayment term for loans obtained through the Loan Guaranty Program is typically determined by the lender.

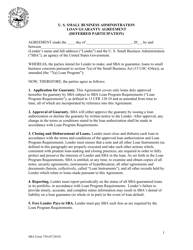

Q: Can the Loan Guaranty Program guarantee 100% of a loan?

A: No, the Loan Guaranty Program does not guarantee 100% of a loan. The guarantee amount is usually a percentage of the loan.

Q: Is there a fee for participating in the Loan Guaranty Program?

A: Yes, there is a fee for participating in the Loan Guaranty Program. The fee is usually a percentage of the loan amount.

Q: How long does it take to process a Loan Guaranty Program application?

A: The processing time for a Loan Guaranty Program application can vary, but it usually takes several weeks.

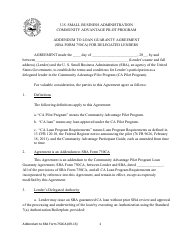

Q: Can the Loan Guaranty Program be used to refinance existing loans?

A: Yes, the Loan Guaranty Program can be used to refinance existing loans, subject to certain conditions.

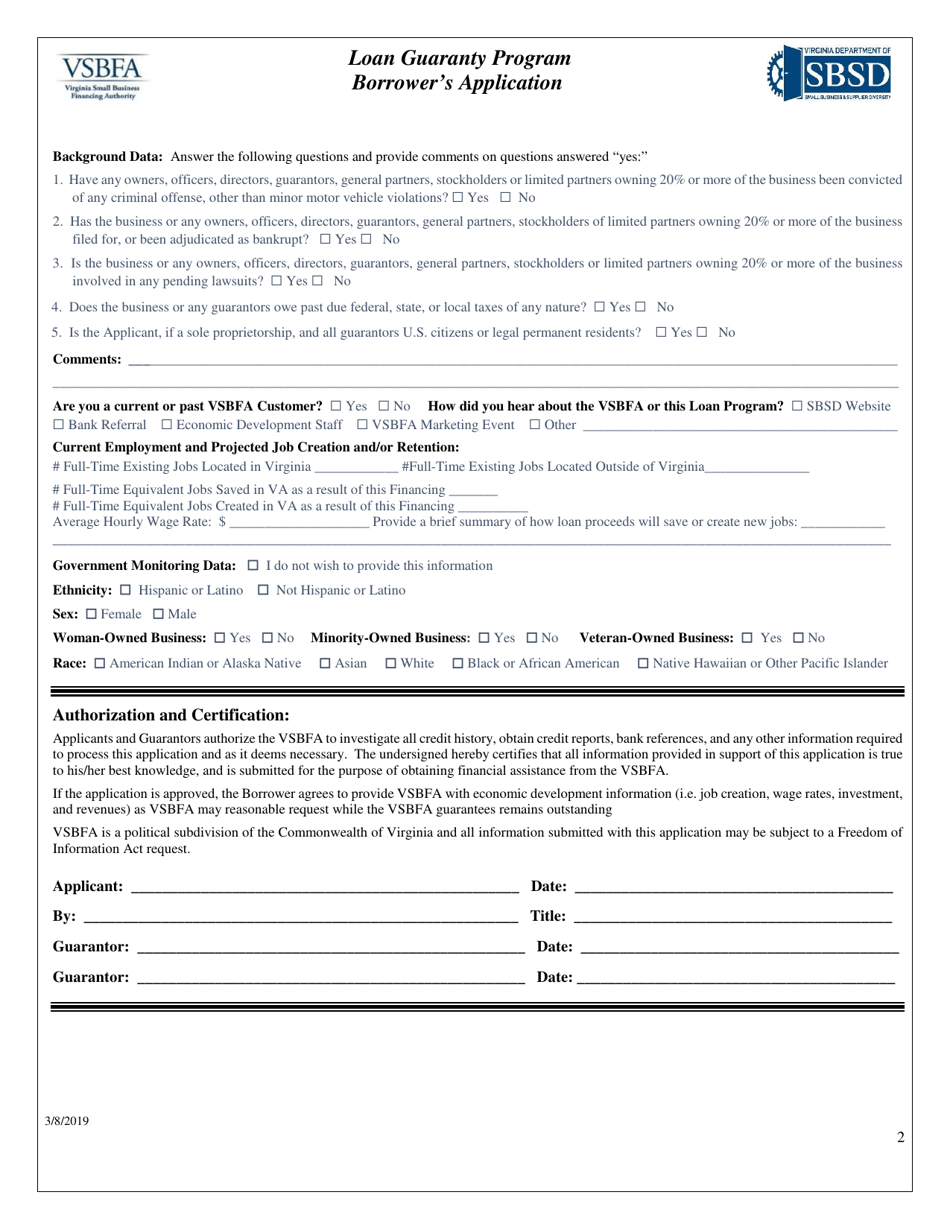

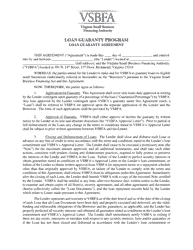

Q: Are personal guarantees required for loans obtained through the Loan Guaranty Program?

A: Yes, personal guarantees are generally required for loans obtained through the Loan Guaranty Program.

Q: Can the Loan Guaranty Program be used for working capital?

A: Yes, the Loan Guaranty Program can be used for working capital, as well as for other eligible business expenses.

Q: Is collateral required for loans obtained through the Loan Guaranty Program?

A: Collateral requirements for loans obtained through the Loan Guaranty Program vary and are determined by the lender.

Form Details:

- Released on March 8, 2019;

- The latest edition currently provided by the Virginia Department of Small Business and Supplier Diversity;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Small Business and Supplier Diversity.