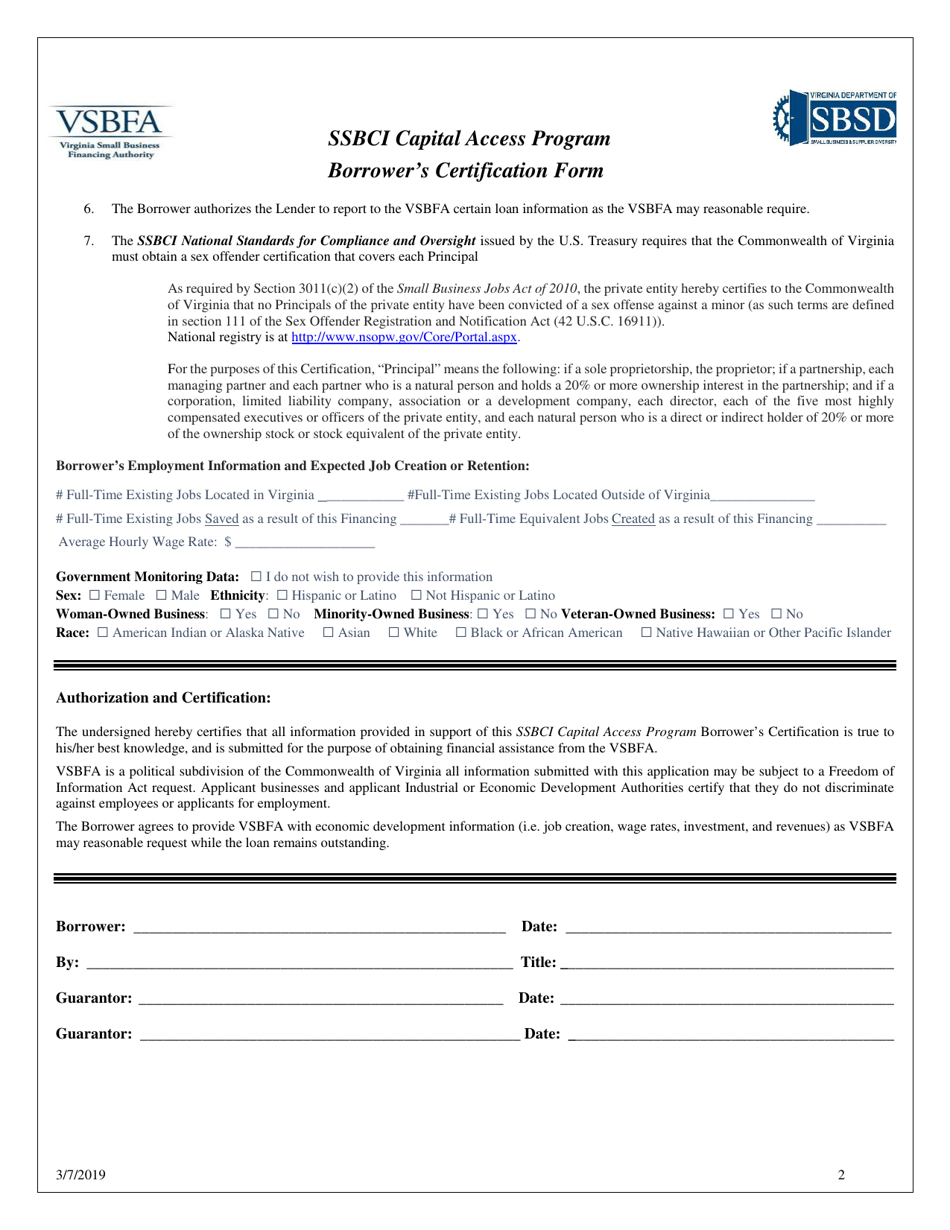

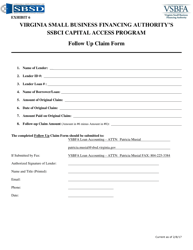

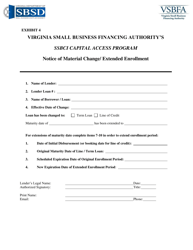

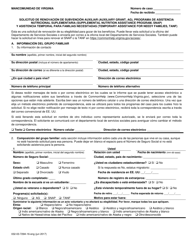

Ssbci Capital Access Program Borrower's Certification - Virginia

Ssbci Capital Access Program Borrower's Certification is a legal document that was released by the Virginia Department of Small Business and Supplier Diversity - a government authority operating within Virginia.

FAQ

Q: What is the SSBIC Capital Access Program?

A: The SSBIC Capital Access Program is a program in Virginia that provides access to capital for small businesses.

Q: Who is eligible for the SSBIC Capital Access Program?

A: Small businesses located in Virginia are eligible for the SSBIC Capital Access Program.

Q: What can the capital be used for?

A: The capital provided by the SSBIC Capital Access Program can be used for various business purposes, such as expanding operations, purchasing equipment, or hiring employees.

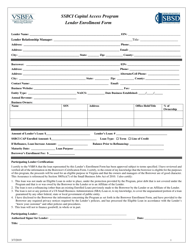

Q: How can I apply for the SSBIC Capital Access Program?

A: To apply for the SSBIC Capital Access Program, you need to contact the Virginia Small Business Financing Authority (VSBFA) and complete the application process.

Q: Are there any fees or costs associated with the program?

A: Yes, there are fees associated with the SSBIC Capital Access Program. These fees include an application fee and an annual commitment fee.

Q: How much capital can I access through this program?

A: The amount of capital a small business can access through the SSBIC Capital Access Program varies and is determined on a case-by-case basis.

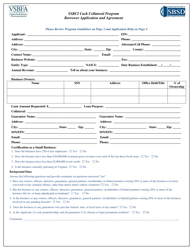

Q: Is there any collateral required?

A: Yes, collateral is typically required for loans provided through the SSBIC Capital Access Program.

Q: Are there any specific requirements for loan repayment?

A: Yes, there are specific requirements for loan repayment, such as making timely payments and fulfilling any other conditions set by the lender.

Q: Can I use the capital to refinance existing debt?

A: Yes, the capital provided by the SSBIC Capital Access Program can be used to refinance existing debt under certain circumstances.

Q: Is there a maximum loan term?

A: Yes, there is a maximum loan term for loans provided through the SSBIC Capital Access Program, which is typically 10 years.

Form Details:

- Released on March 7, 2019;

- The latest edition currently provided by the Virginia Department of Small Business and Supplier Diversity;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Small Business and Supplier Diversity.