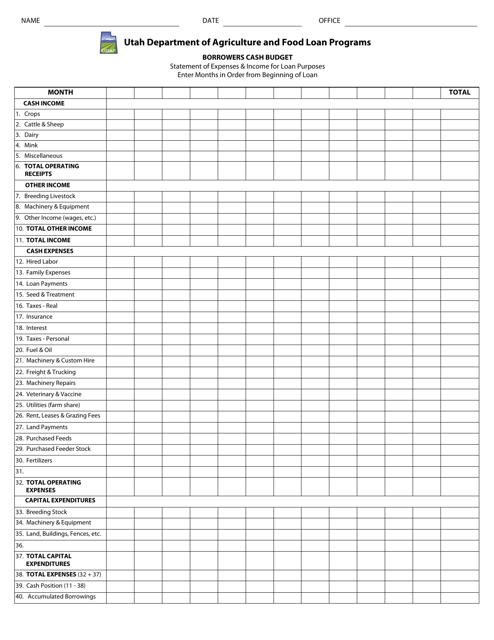

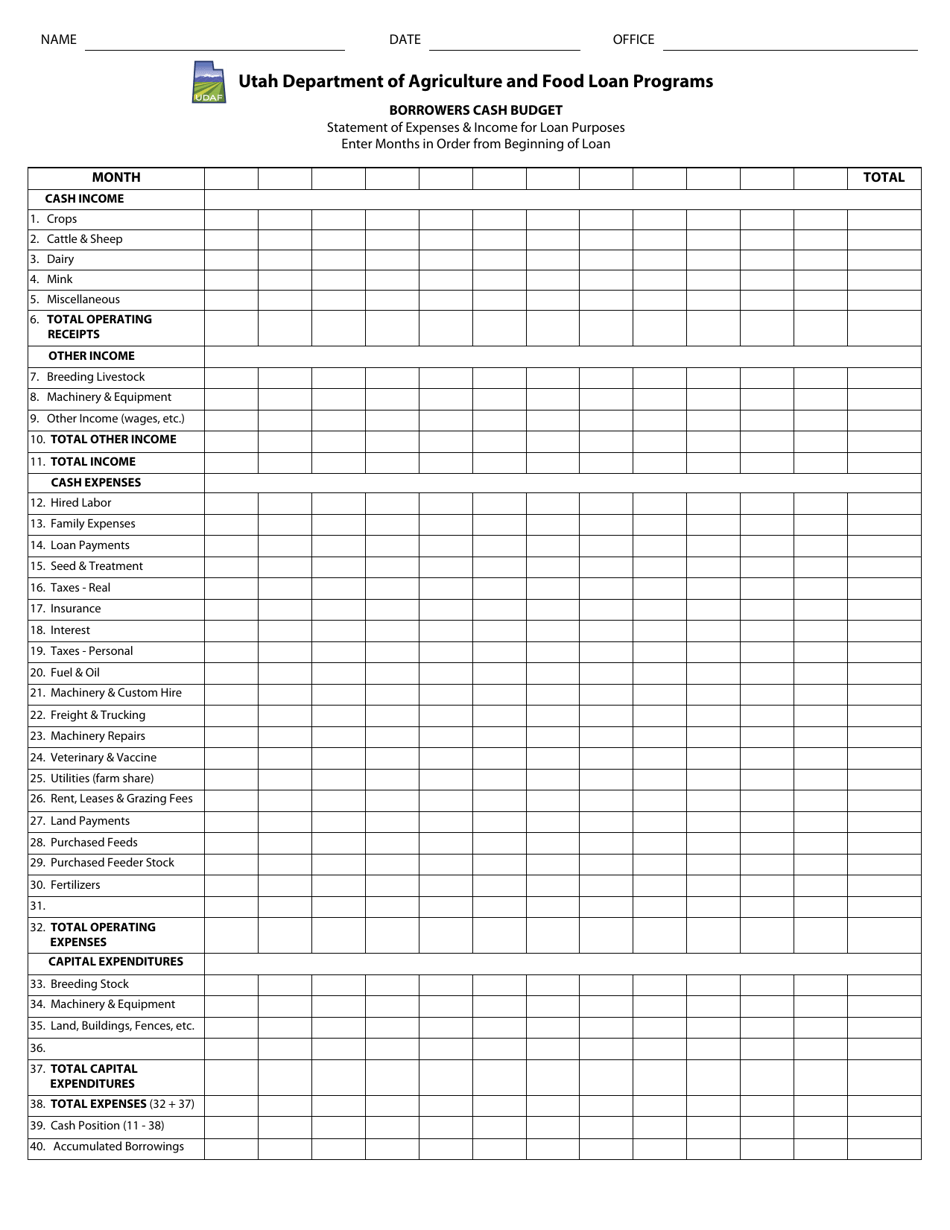

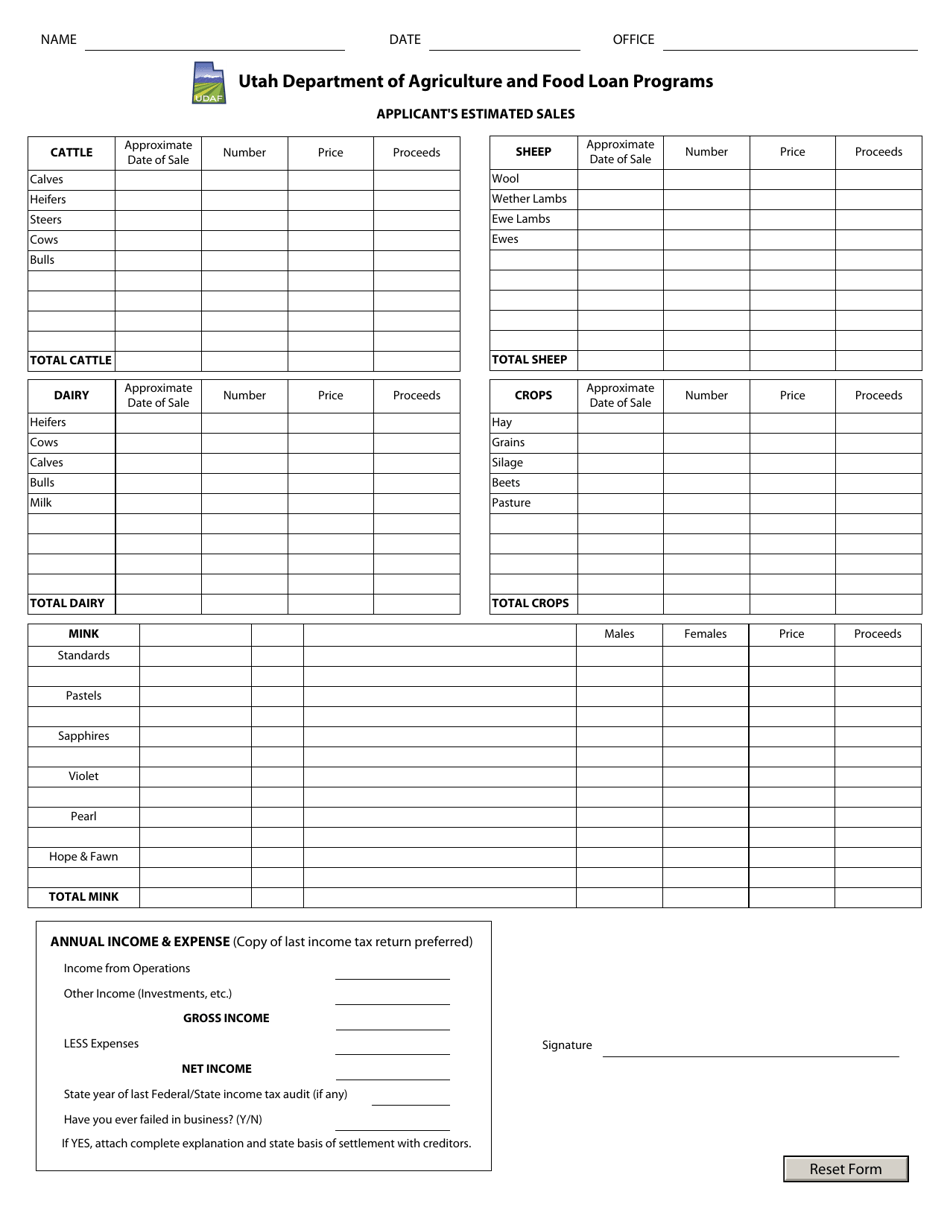

Borrowers Cash Budget - Utah

Borrowers Cash Budget is a legal document that was released by the Utah Department of Agriculture and Food - a government authority operating within Utah.

FAQ

Q: What is a borrower's cash budget?

A: A borrower's cash budget is a financial plan that outlines the funds available to cover expenses.

Q: Why is a cash budget important for borrowers?

A: A cash budget helps borrowers track their income and expenses, ensuring they have enough funds to meet their financial obligations.

Q: How can a borrower create a cash budget?

A: To create a cash budget, borrowers need to track their income, list their expenses, and allocate funds accordingly.

Q: What expenses should be included in a borrower's cash budget?

A: Expenses that should be included in a borrower's cash budget are rent/mortgage payments, utilities, groceries, transportation costs, and any other regular financial obligations.

Q: What should borrowers do if their expenses exceed their income in the cash budget?

A: If expenses exceed income in the cash budget, borrowers should look for ways to cut costs, increase income, or consider borrowing less to avoid financial difficulties.

Q: Why is it important for borrowers to have a positive cash flow?

A: Having a positive cash flow ensures that borrowers have excess funds after meeting their financial obligations, allowing them to save or invest for the future.

Form Details:

- The latest edition currently provided by the Utah Department of Agriculture and Food;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Utah Department of Agriculture and Food.