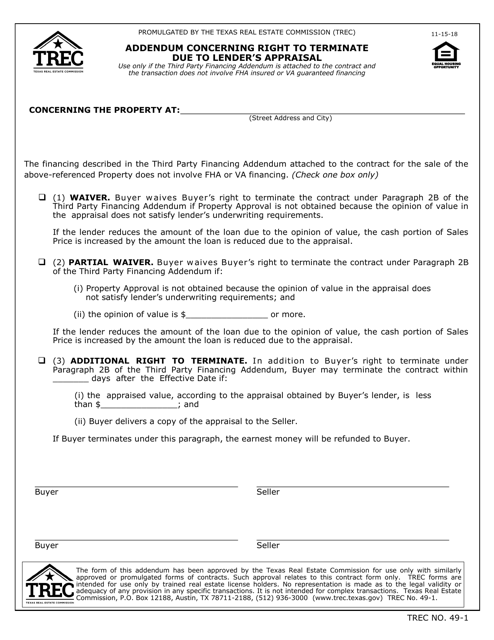

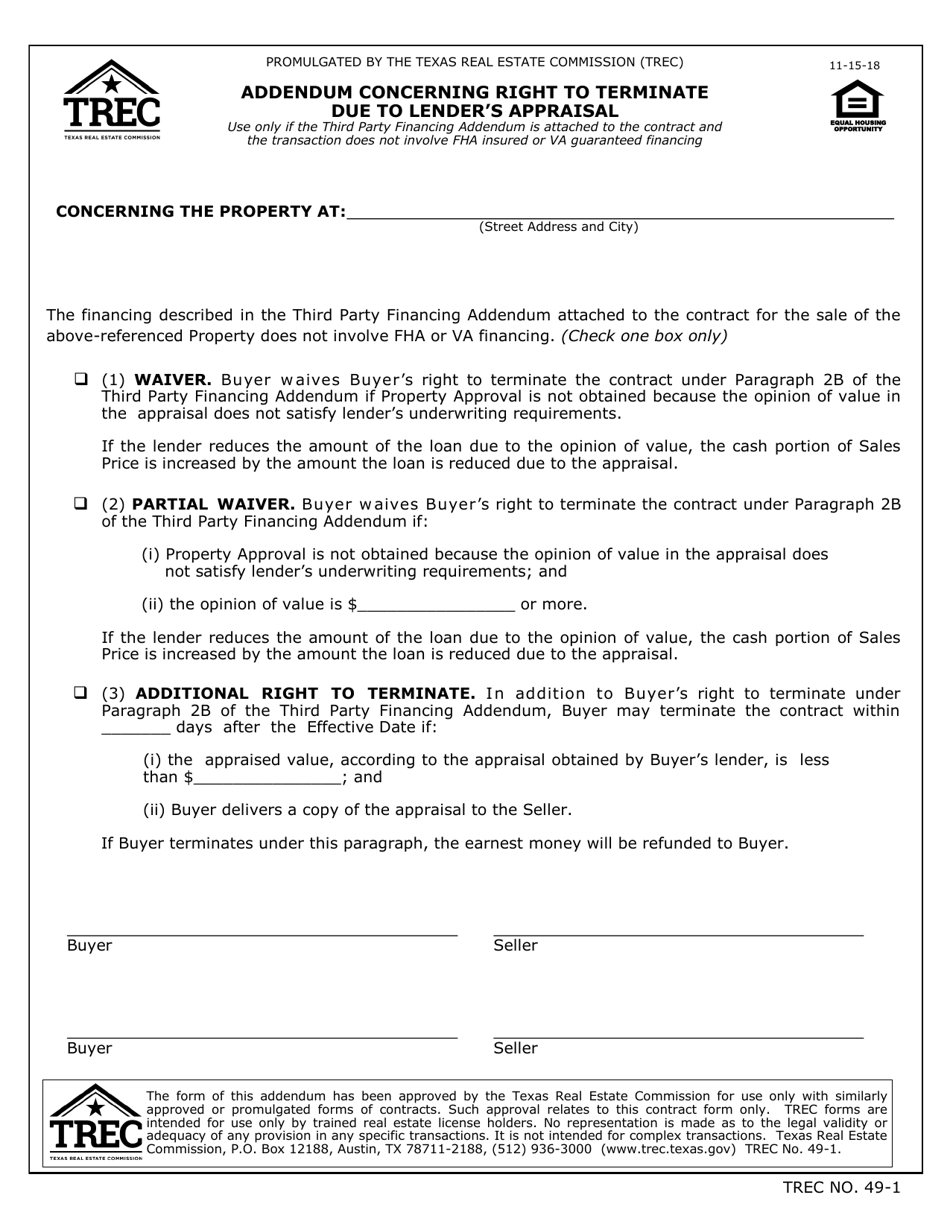

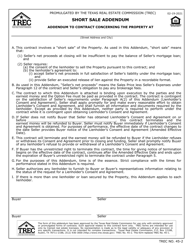

TREC Form 49-1 Addendum Concerning Right to Terminate Due to Lender's Appraisal - Texas

What Is TREC Form 49-1?

This is a legal form that was released by the Texas Real Estate Commission - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

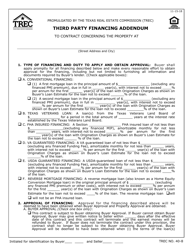

Q: What is TREC Form 49-1 Addendum?

A: TREC Form 49-1 Addendum is a document used in Texas real estate transactions.

Q: What does the TREC Form 49-1 Addendum concern?

A: The TREC Form 49-1 Addendum concerns the right to terminate the contract due to the lender's appraisal.

Q: What is the purpose of the TREC Form 49-1 Addendum?

A: The purpose of the TREC Form 49-1 Addendum is to provide a way for the buyer to terminate the contract if the property does not appraise for the agreed-upon purchase price.

Q: Who can use the TREC Form 49-1 Addendum?

A: The TREC Form 49-1 Addendum can be used by buyers and sellers in Texas real estate transactions.

Q: What happens if the property doesn't appraise for the agreed-upon purchase price?

A: If the property doesn't appraise for the agreed-upon purchase price, the buyer may have the right to terminate the contract and receive a refund of their earnest money.

Q: Is the TREC Form 49-1 Addendum required in all Texas real estate transactions?

A: No, the TREC Form 49-1 Addendum is not required in all Texas real estate transactions. Its use is optional and depends on the terms negotiated between the buyer and the seller.

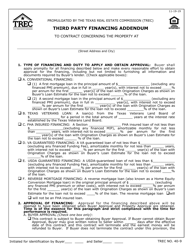

Form Details:

- Released on November 15, 2018;

- The latest edition provided by the Texas Real Estate Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TREC Form 49-1 by clicking the link below or browse more documents and templates provided by the Texas Real Estate Commission.