This version of the form is not currently in use and is provided for reference only. Download this version of

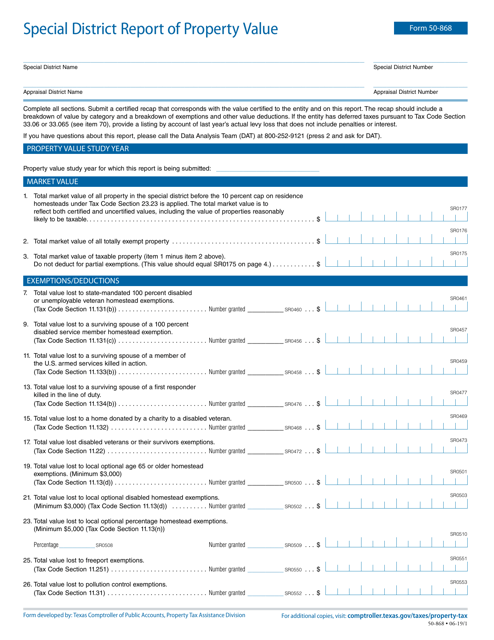

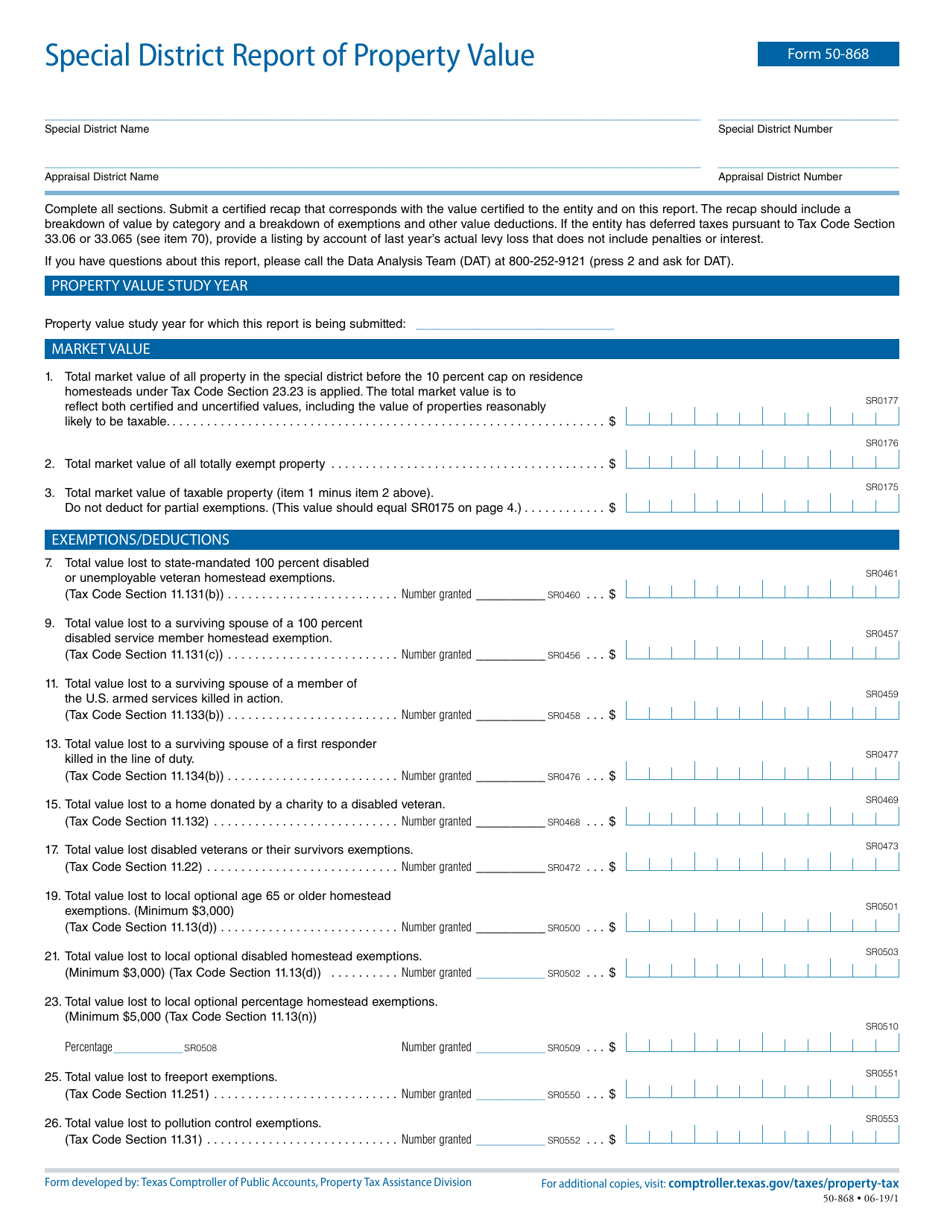

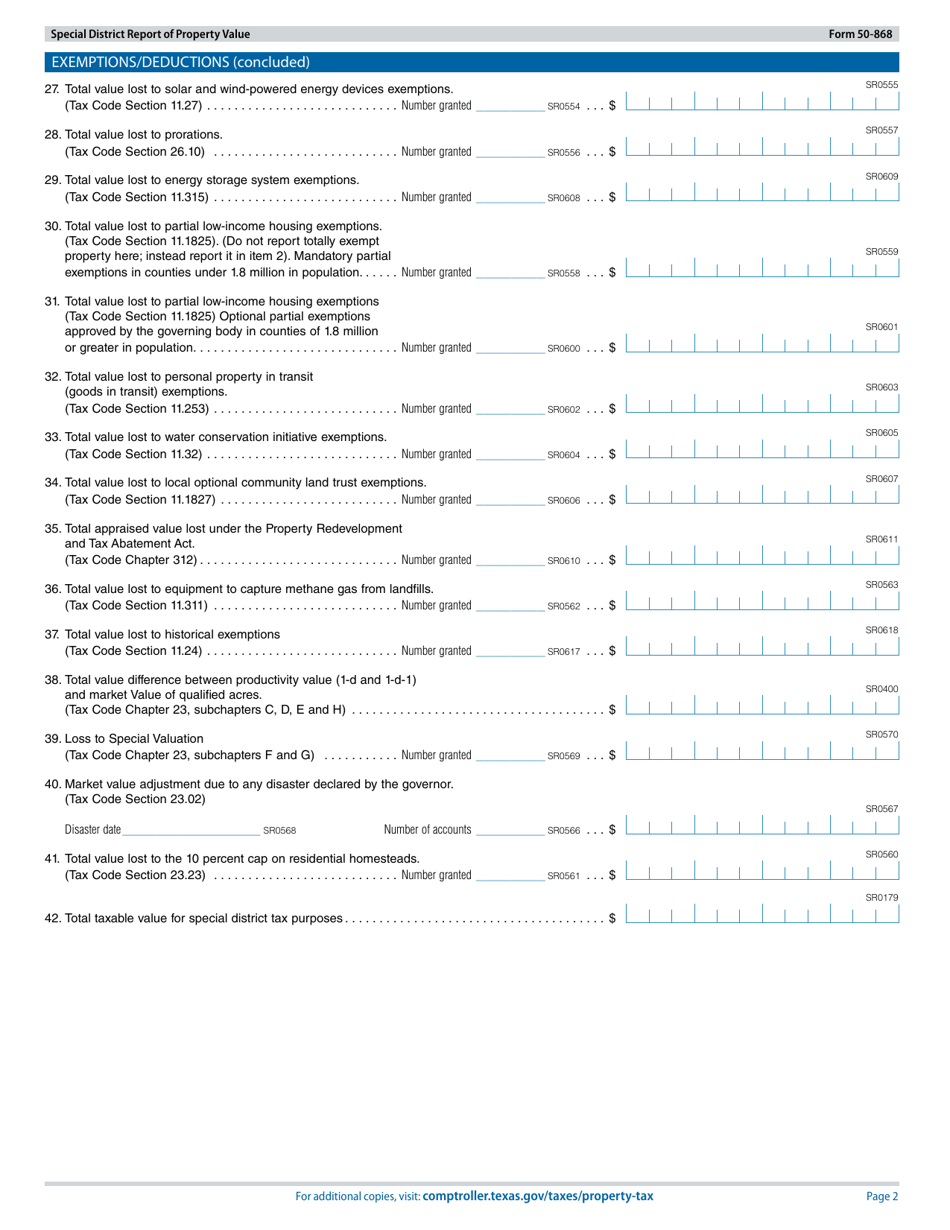

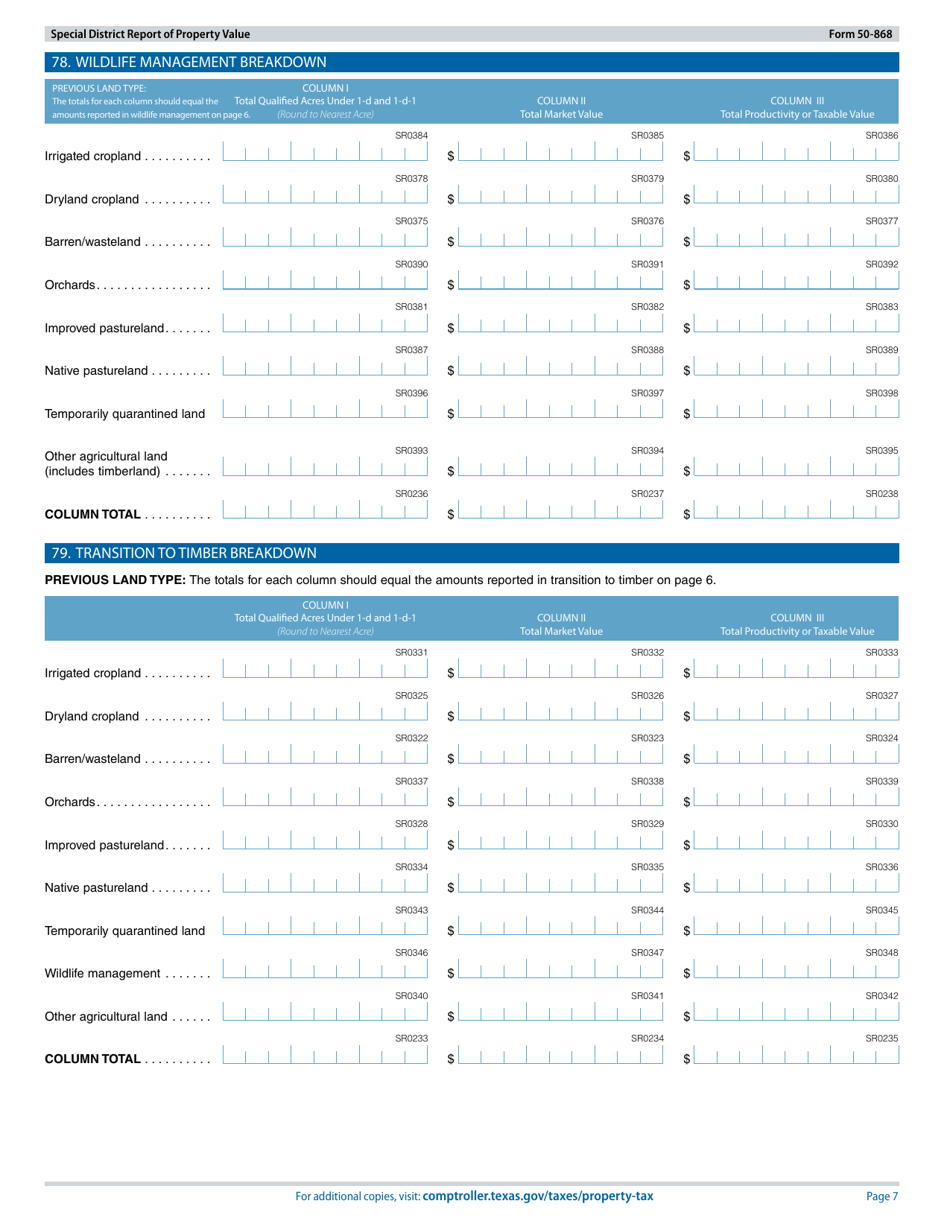

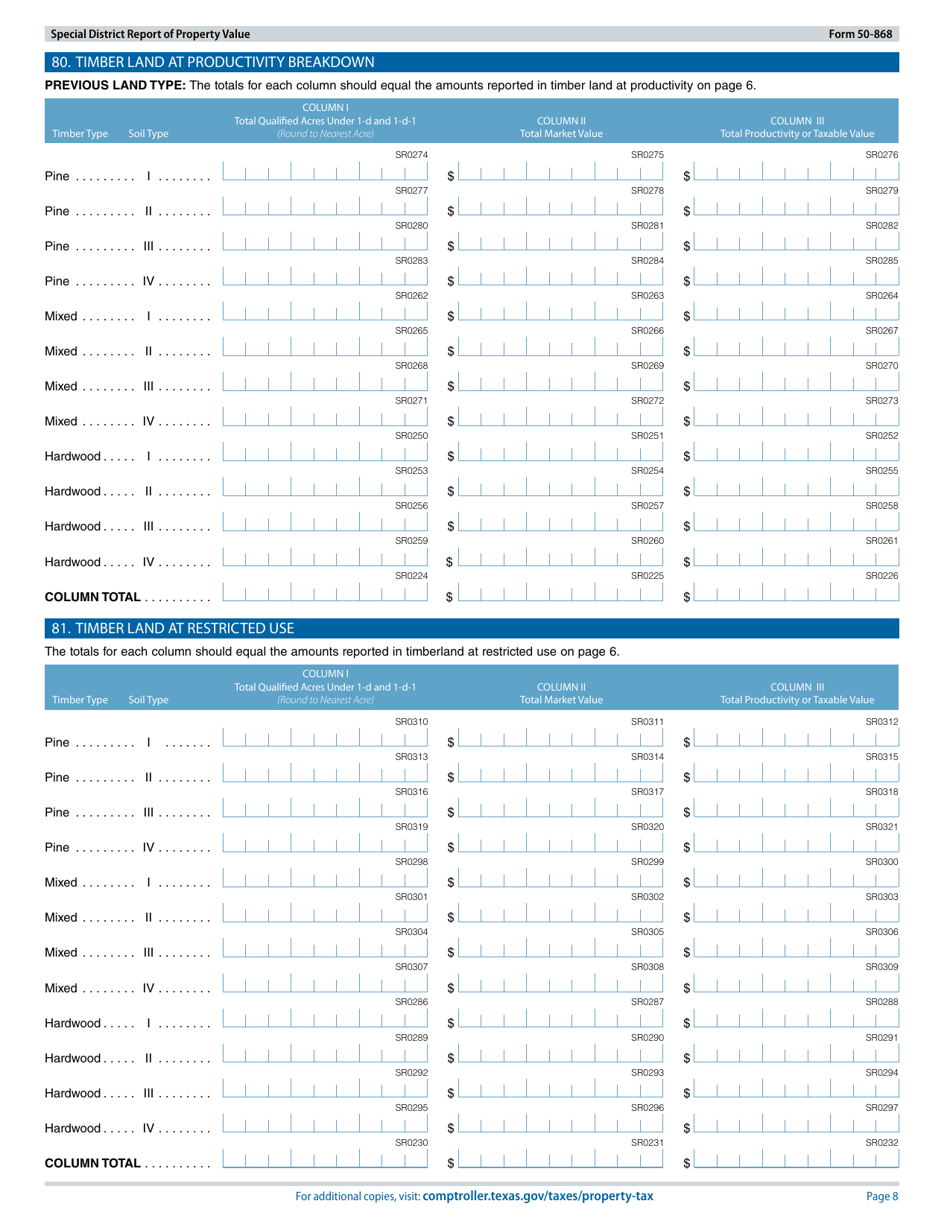

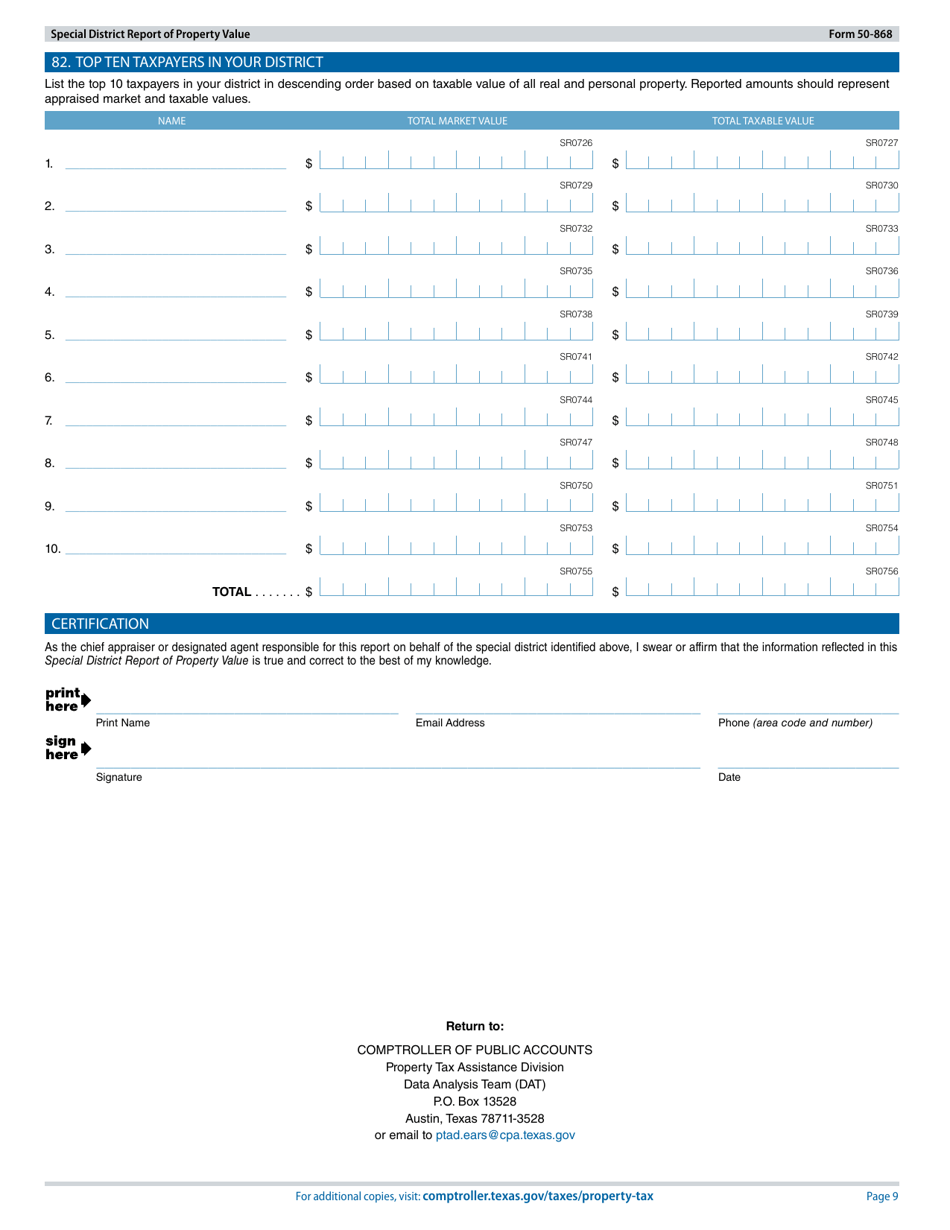

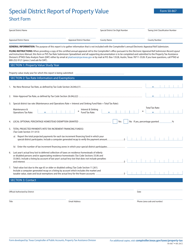

Form 50-868

for the current year.

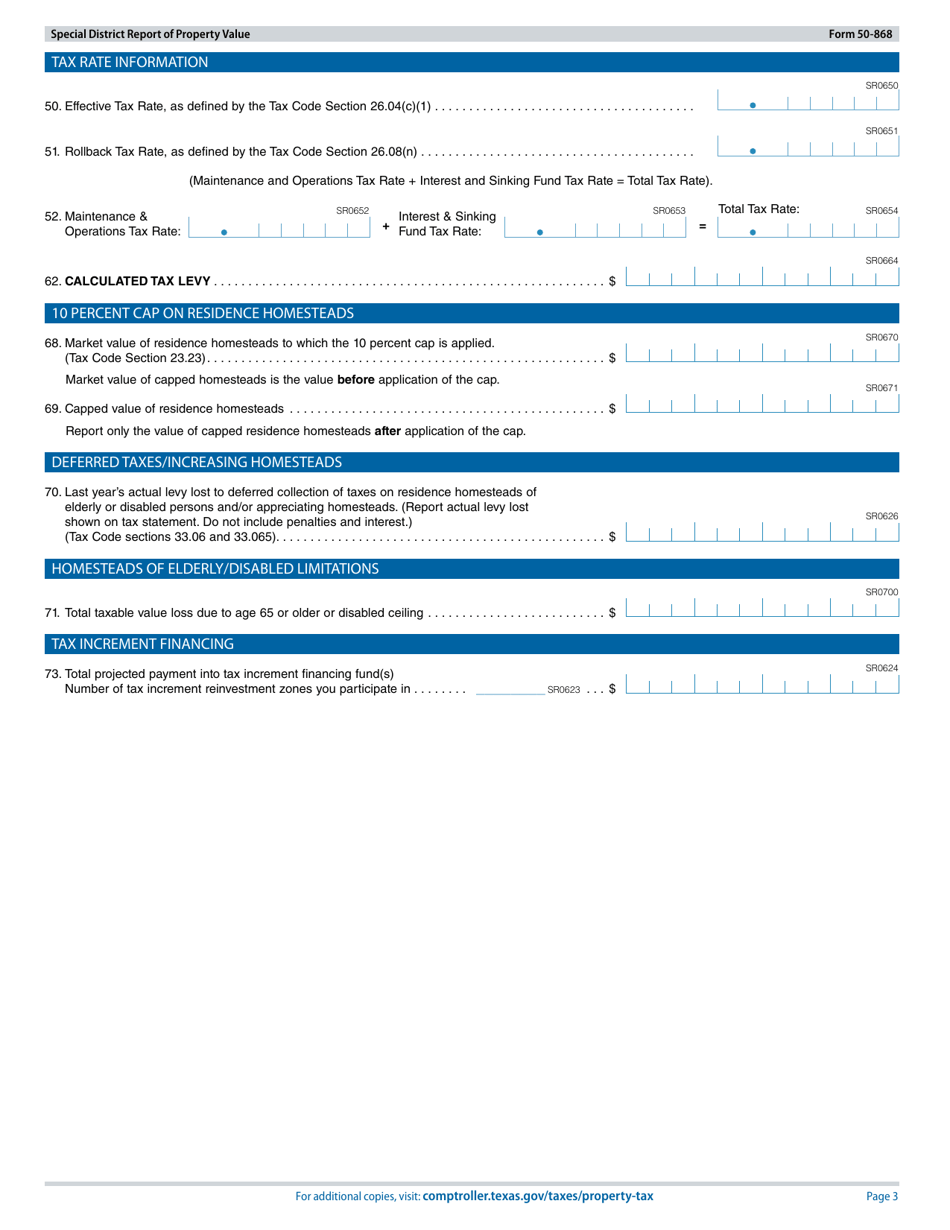

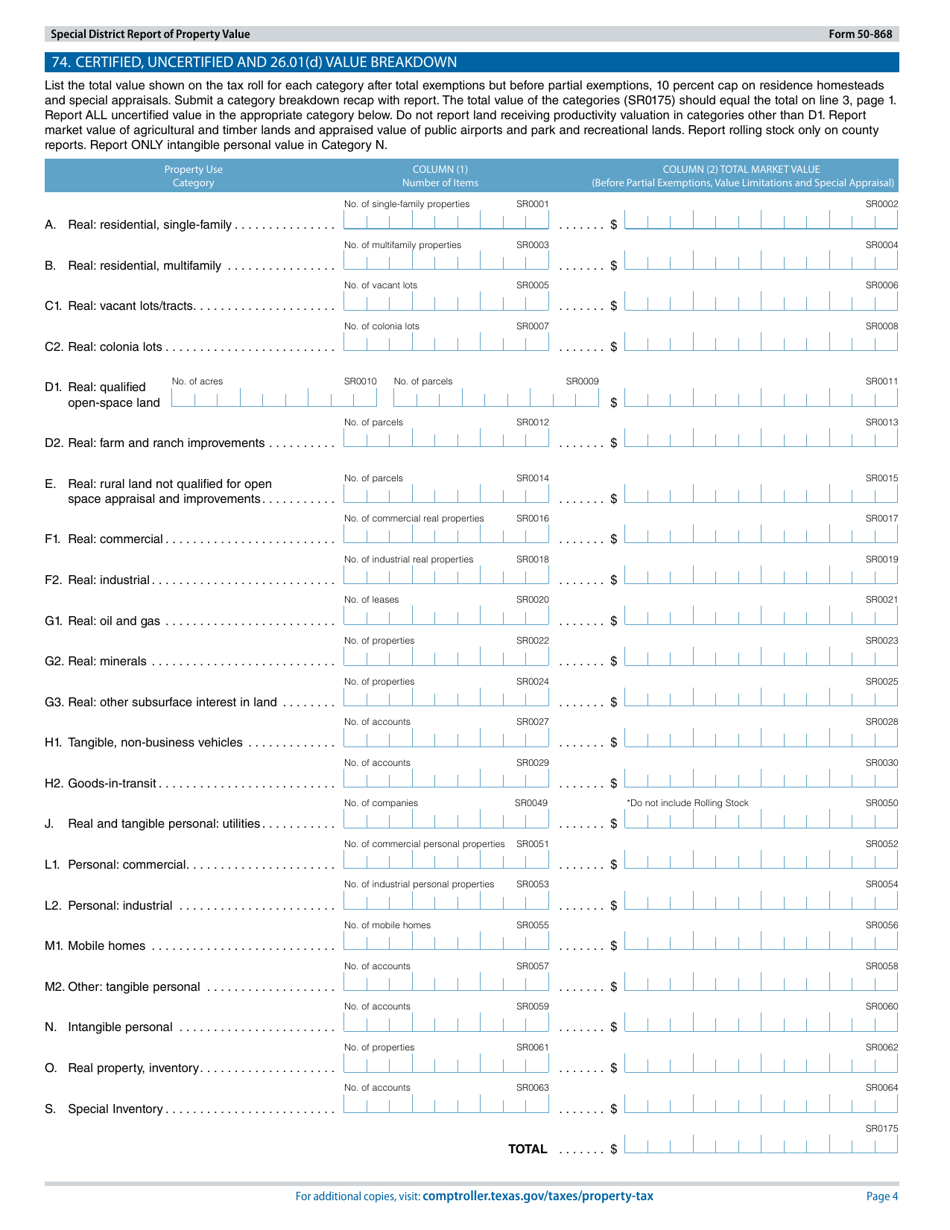

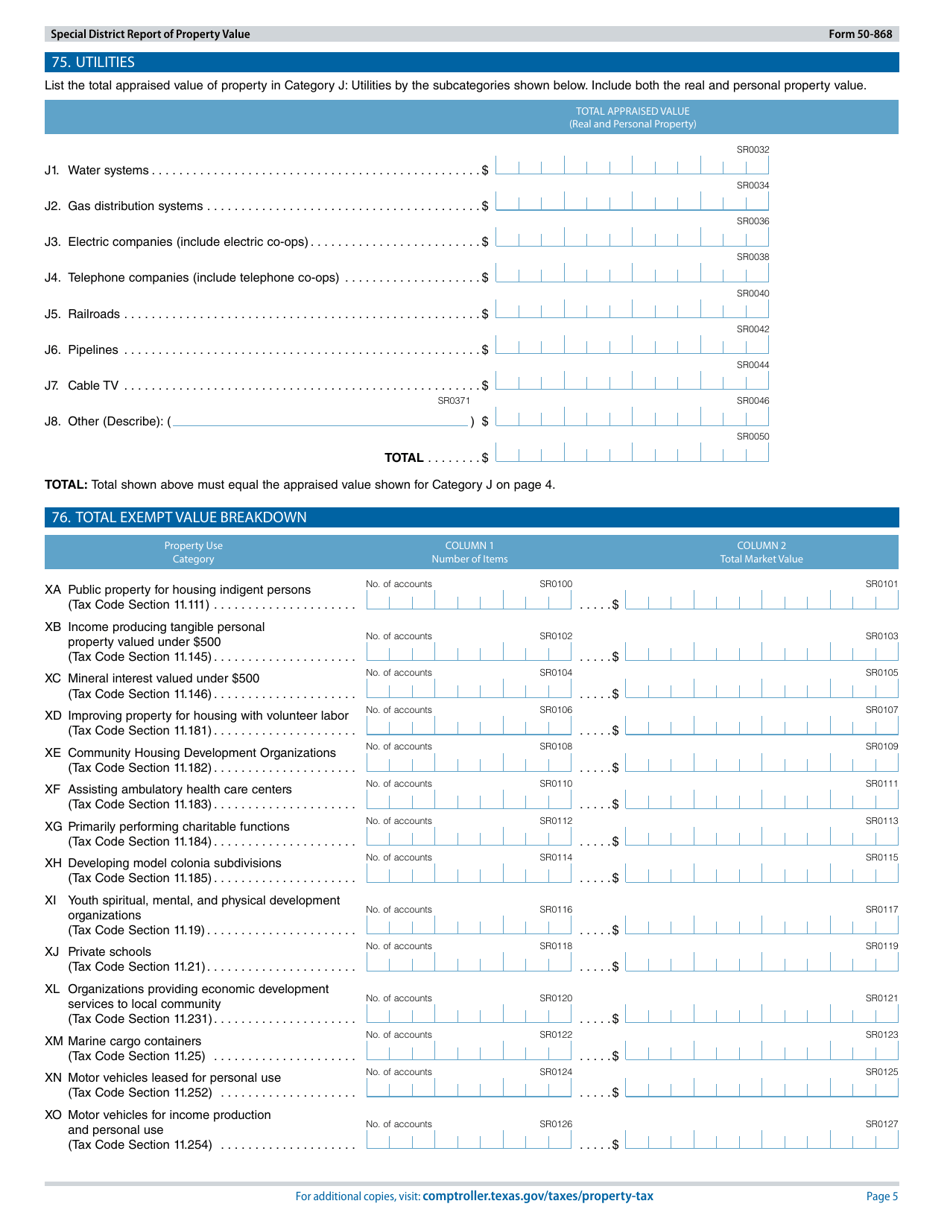

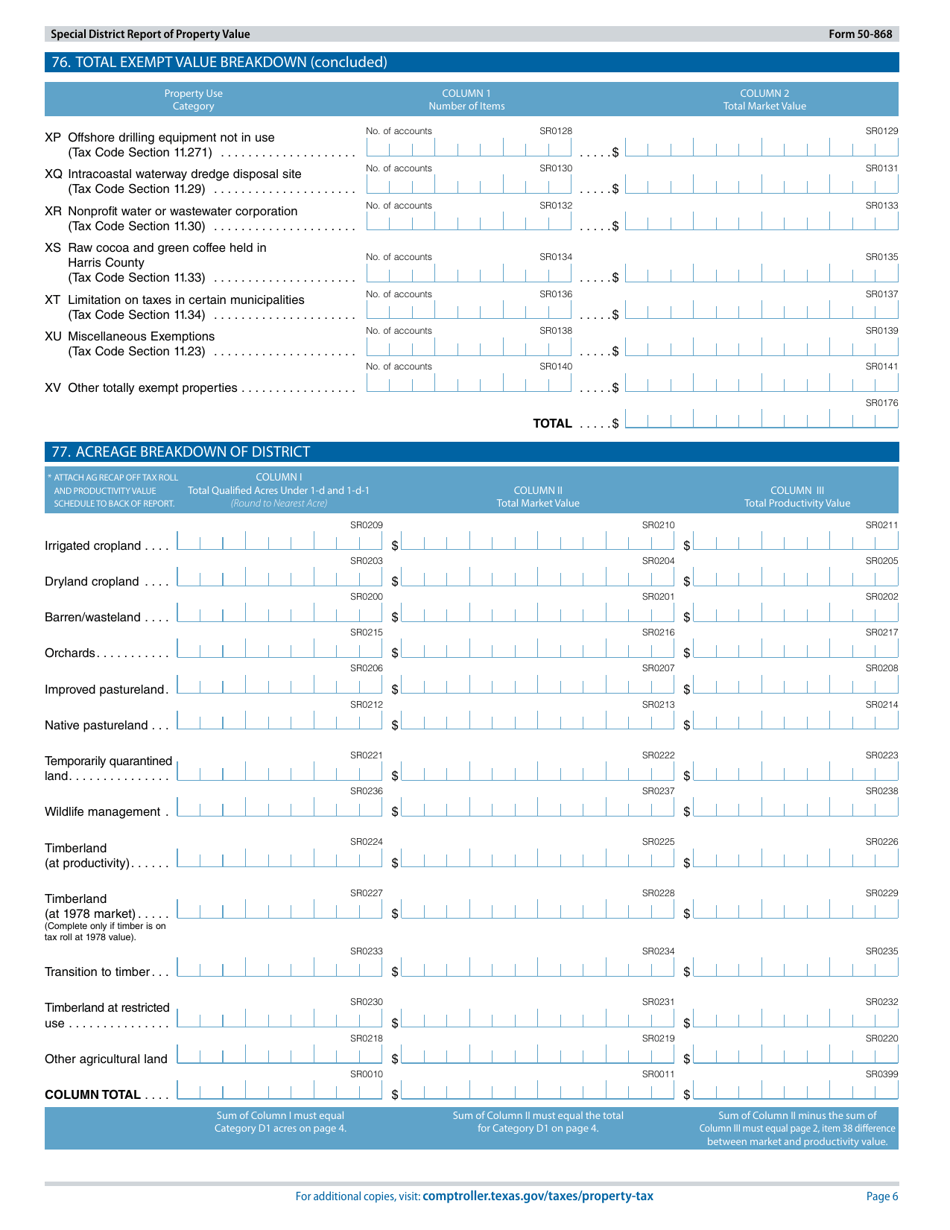

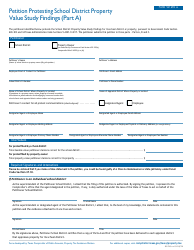

Form 50-868 Special District Report of Property Value - Texas

What Is Form 50-868?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-868?

A: Form 50-868 is the Special District Report of Property Value in Texas.

Q: Who needs to file Form 50-868?

A: Property owners in special districts in Texas need to file Form 50-868.

Q: What is the purpose of Form 50-868?

A: The purpose of Form 50-868 is to report the value of property in special districts in Texas.

Q: When is Form 50-868 due?

A: Form 50-868 is due on April 1st of each year.

Q: What information is required on Form 50-868?

A: Form 50-868 requires property owners to provide details about their property, such as its value, location, and specific district information.

Q: Are there any penalties for not filing Form 50-868?

A: Yes, failure to file Form 50-868 may result in penalties and interest charges.

Q: Can Form 50-868 be filed electronically?

A: Yes, many Texas Central Appraisal Districts allow electronic filing of Form 50-868.

Q: Is Form 50-868 only applicable in Texas?

A: Yes, Form 50-868 is specific to property located in special districts in Texas.

Q: Can I request an extension to file Form 50-868?

A: Yes, you can contact your local Texas Central Appraisal District office to request an extension for filing Form 50-868.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-868 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.