This version of the form is not currently in use and is provided for reference only. Download this version of

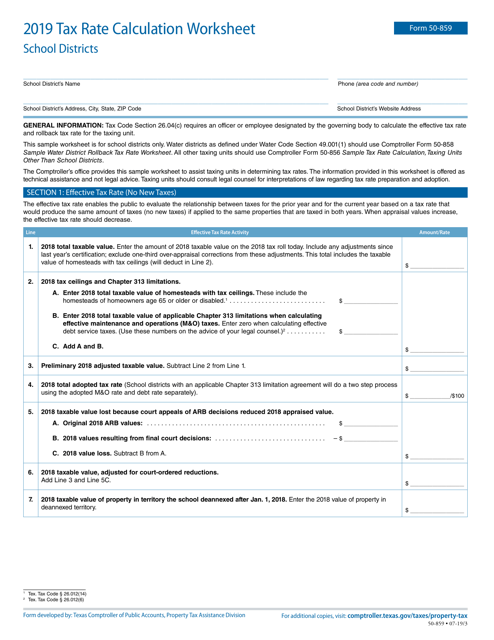

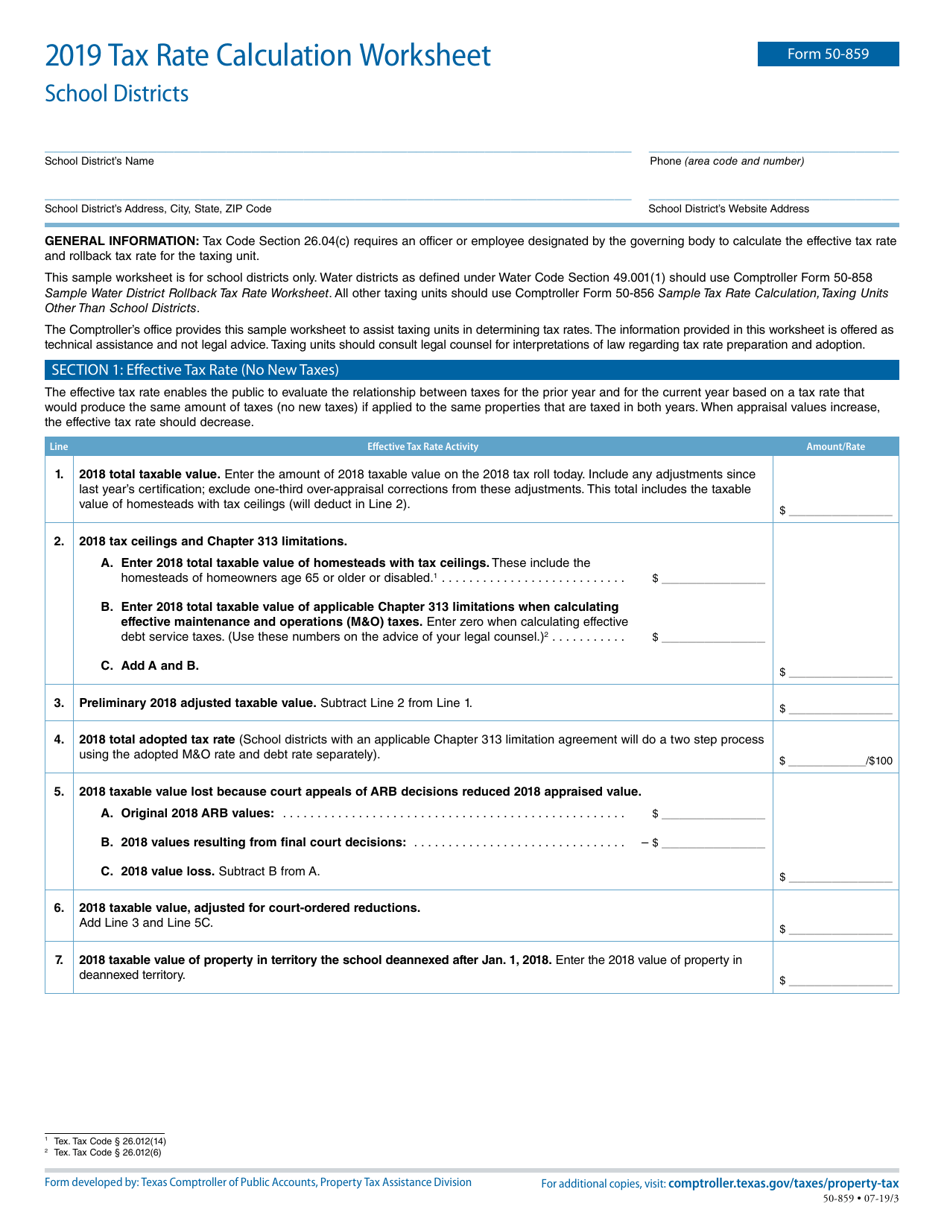

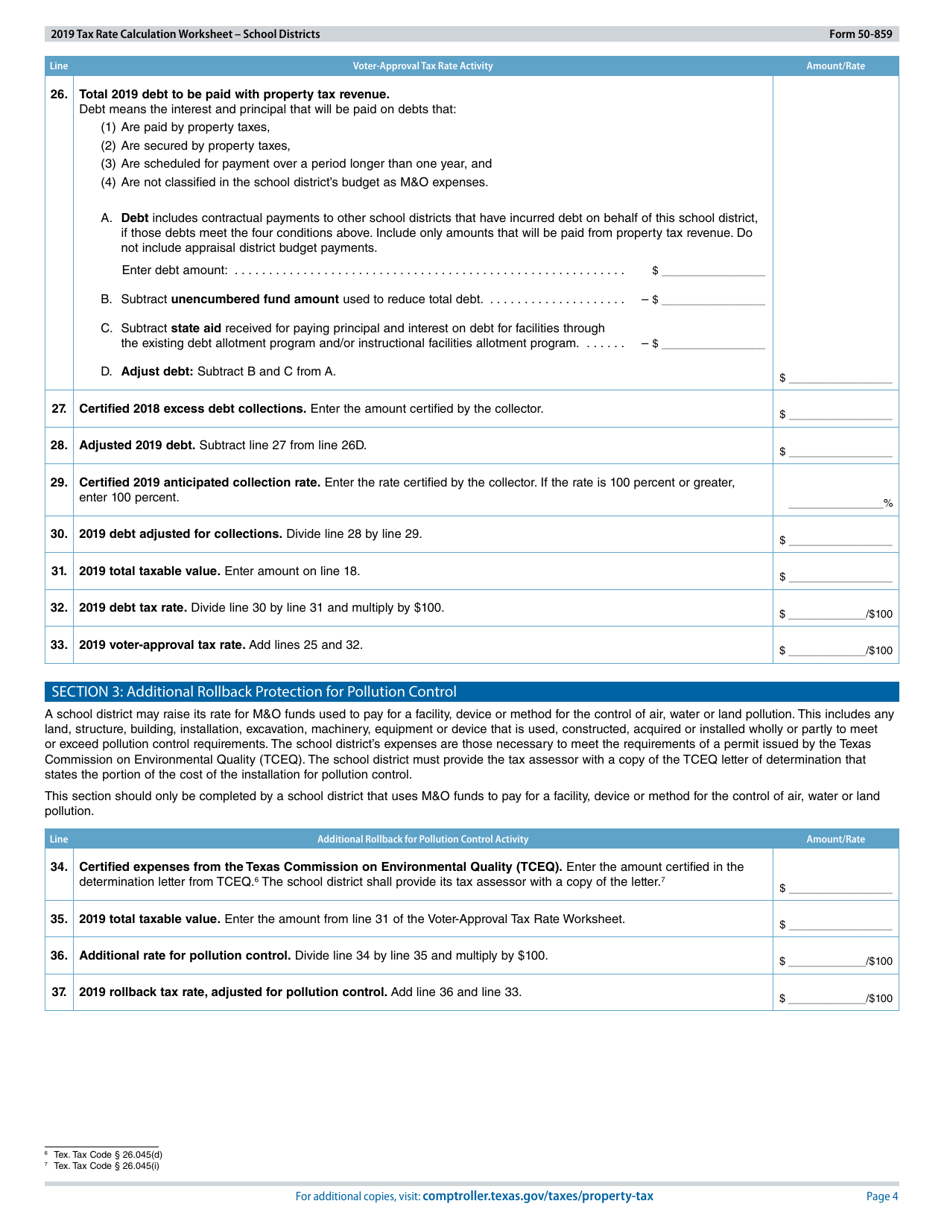

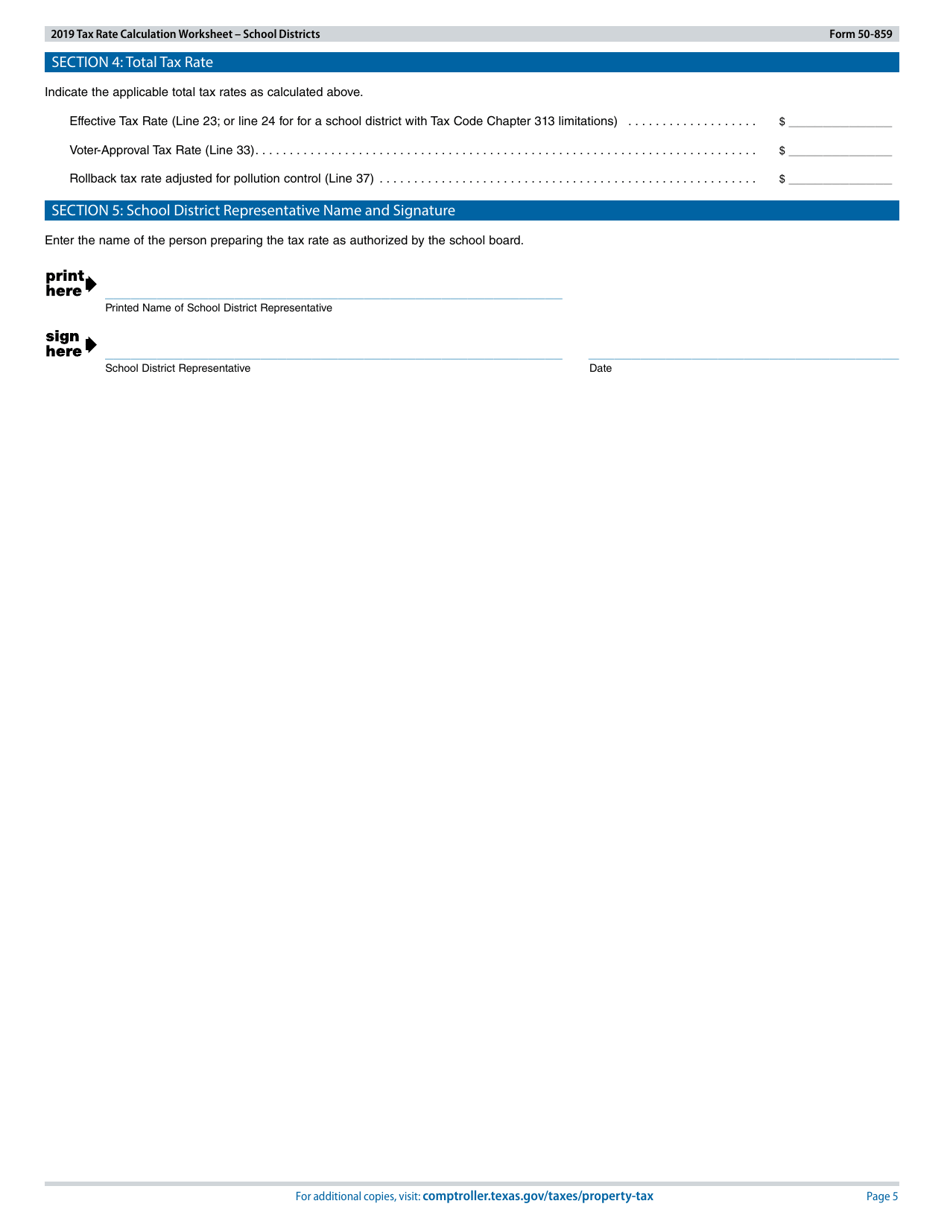

Form 50-859

for the current year.

Form 50-859 Tax Rate Calculation Worksheet School Districts - Texas

What Is Form 50-859?

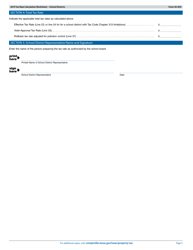

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-859?

A: Form 50-859 is a Tax Rate Calculation Worksheet for school districts in Texas.

Q: What is the purpose of Form 50-859?

A: The purpose of Form 50-859 is to calculate the tax rate for school districts in Texas.

Q: Who needs to fill out Form 50-859?

A: School districts in Texas need to fill out Form 50-859.

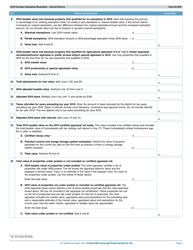

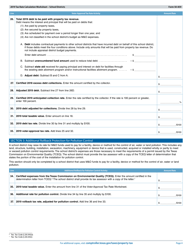

Q: What information is required on Form 50-859?

A: Form 50-859 requires information about the school district's taxable value, voter-approval tax rate, and maintenance and operations tax rate.

Q: Is Form 50-859 specific to a particular school district?

A: No, Form 50-859 is used by all school districts in Texas.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-859 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.