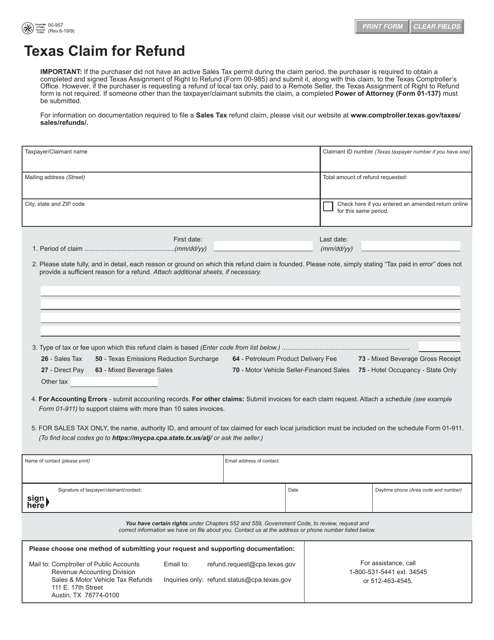

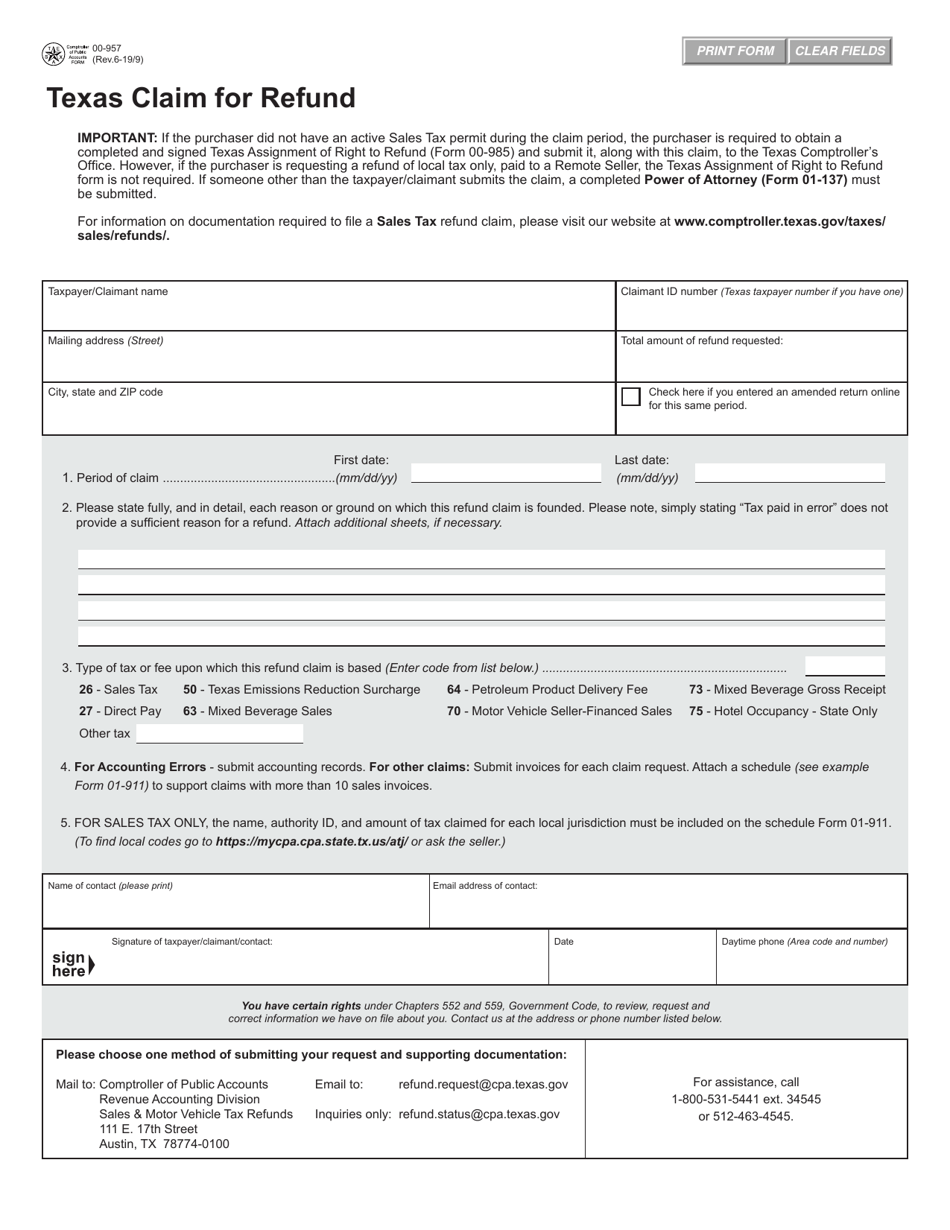

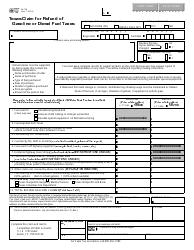

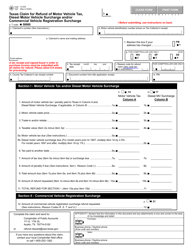

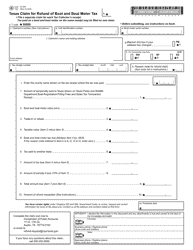

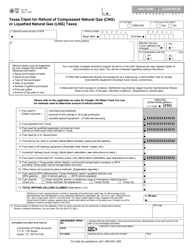

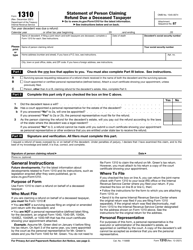

Form 00-957 Texas Claim for Refund - Texas

What Is Form 00-957?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

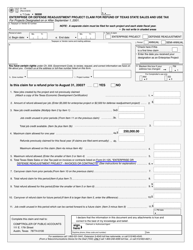

Q: What is Form 00-957?

A: Form 00-957 is the Texas Claim for Refund form.

Q: What is the purpose of Form 00-957?

A: Form 00-957 is used to request a refund of taxes paid to the State of Texas.

Q: Who can use Form 00-957?

A: Anyone who has overpaid taxes to the State of Texas can use Form 00-957 to request a refund.

Q: What information is required on Form 00-957?

A: Form 00-957 requires information such as the taxpayer's name, address, social security number, and the reason for the refund request.

Q: How do I submit Form 00-957?

A: Form 00-957 can be submitted by mail to the Texas Comptroller of Public Accounts.

Q: Is there a deadline for submitting Form 00-957?

A: Yes, Form 00-957 must be submitted within four years from the date the tax was paid.

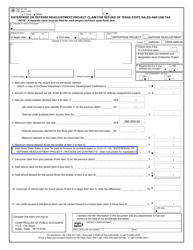

Q: How long does it take to receive a refund after submitting Form 00-957?

A: The processing time for a refund request can vary, but typically it takes around six to eight weeks to receive a refund.

Q: Are there any fees associated with submitting Form 00-957?

A: No, there are no fees associated with submitting Form 00-957.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 00-957 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.