This version of the form is not currently in use and is provided for reference only. Download this version of

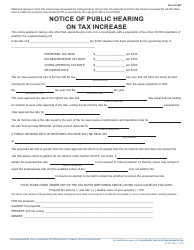

Form 50-280

for the current year.

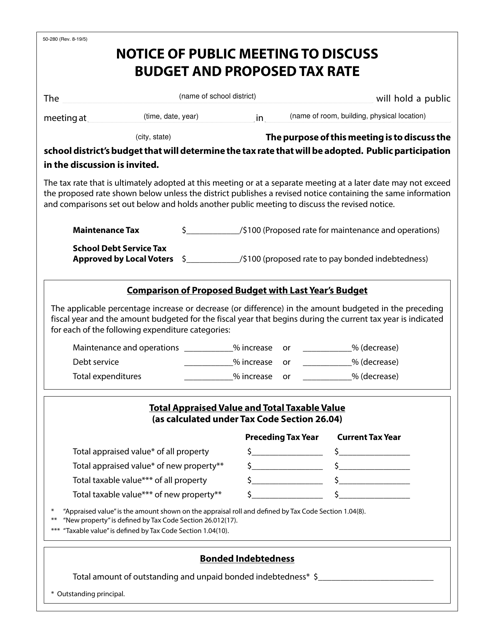

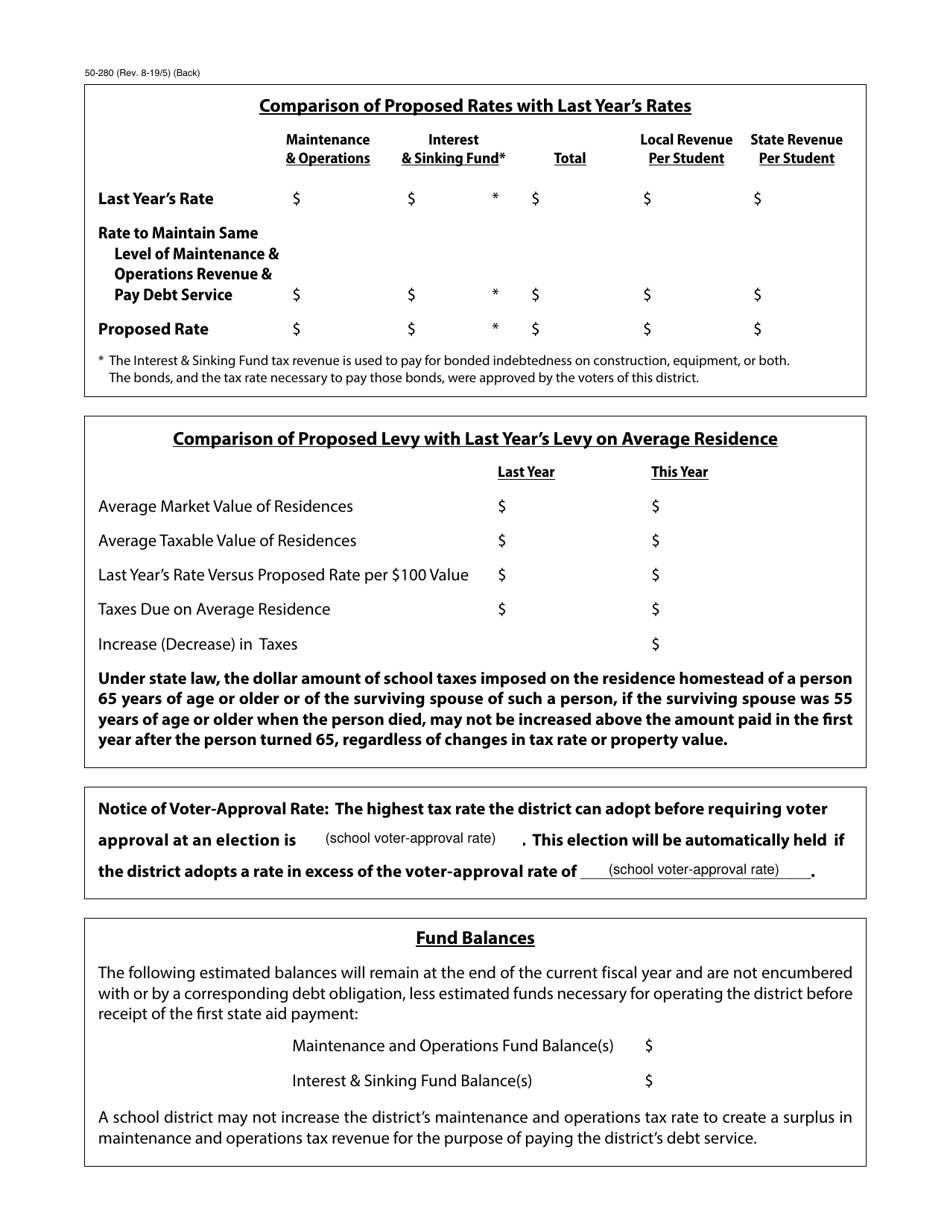

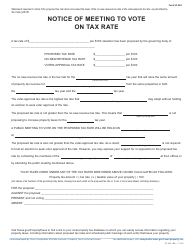

Form 50-280 Notice of Public Meeting to Discuss Budget and Proposed Tax Rate - Texas

What Is Form 50-280?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-280?

A: Form 50-280 is a notice of public meeting to discuss budget and proposed tax rate in Texas.

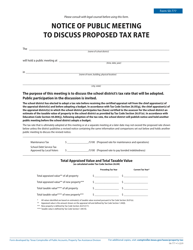

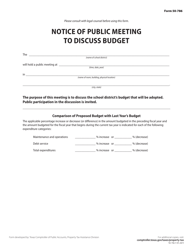

Q: What is the purpose of Form 50-280?

A: The purpose of Form 50-280 is to inform the public about a meeting where the budget and proposed tax rate for Texas will be discussed.

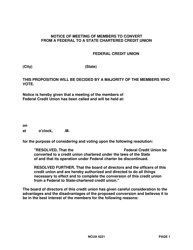

Q: Who is required to file Form 50-280?

A: The government entities in Texas, such as counties, cities, and school districts, are required to file Form 50-280 if they want to hold a public meeting to discuss their budget and proposed tax rate.

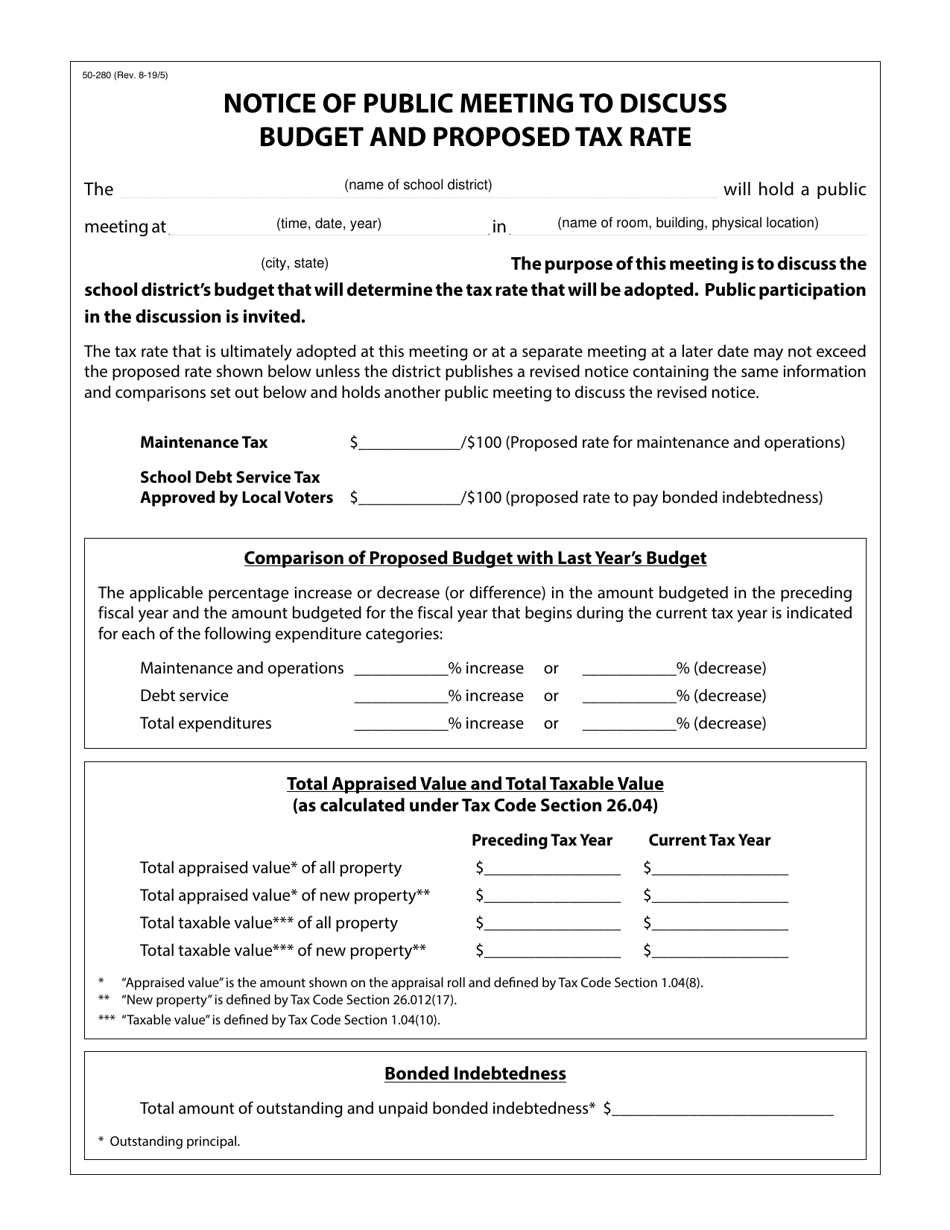

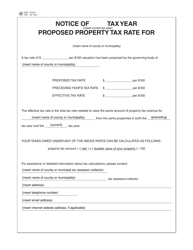

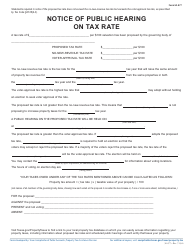

Q: What information is included in Form 50-280?

A: Form 50-280 includes information about the date, time, and location of the public meeting, as well as details about the budget and proposed tax rate.

Q: Is attendance at the public meeting mandatory?

A: Attendance at the public meeting is not mandatory, but it is encouraged for anyone who wants to learn about and provide input on the budget and proposed tax rate.

Q: Can I submit my comments or questions in writing if I cannot attend the public meeting?

A: Yes, you can often submit your comments or questions in writing to the government entity that is holding the public meeting.

Q: What happens after the public meeting?

A: After the public meeting, the government entity will consider the feedback received and make decisions about the budget and proposed tax rate.

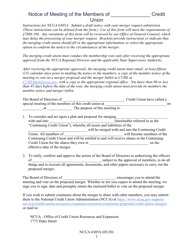

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-280 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.