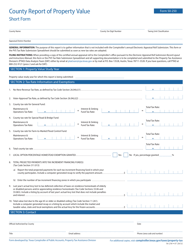

This version of the form is not currently in use and is provided for reference only. Download this version of

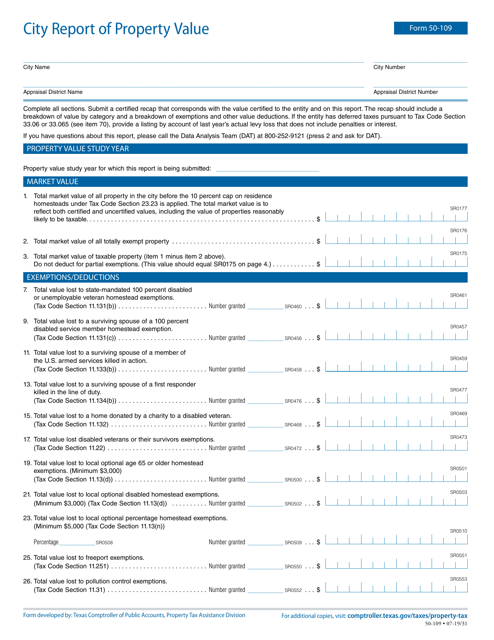

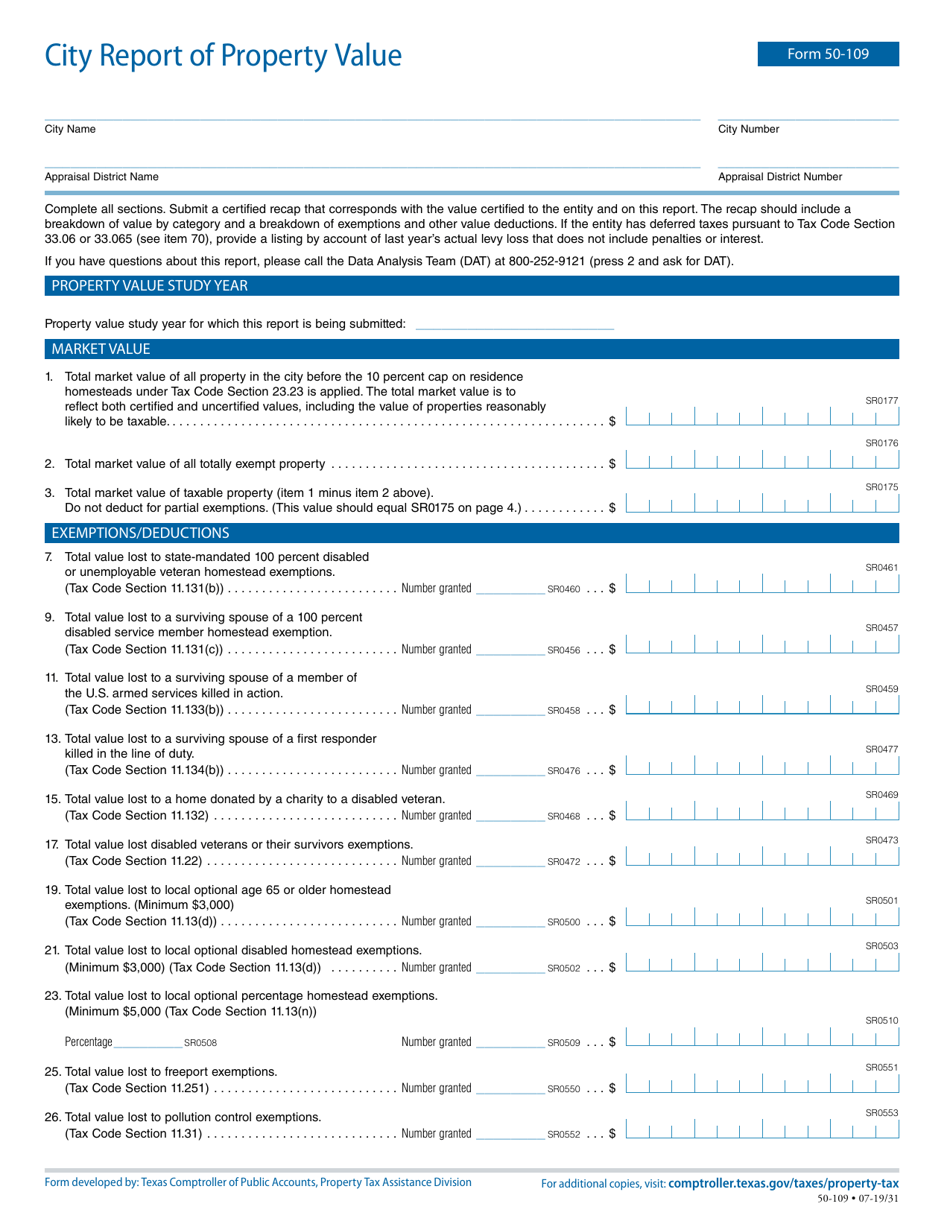

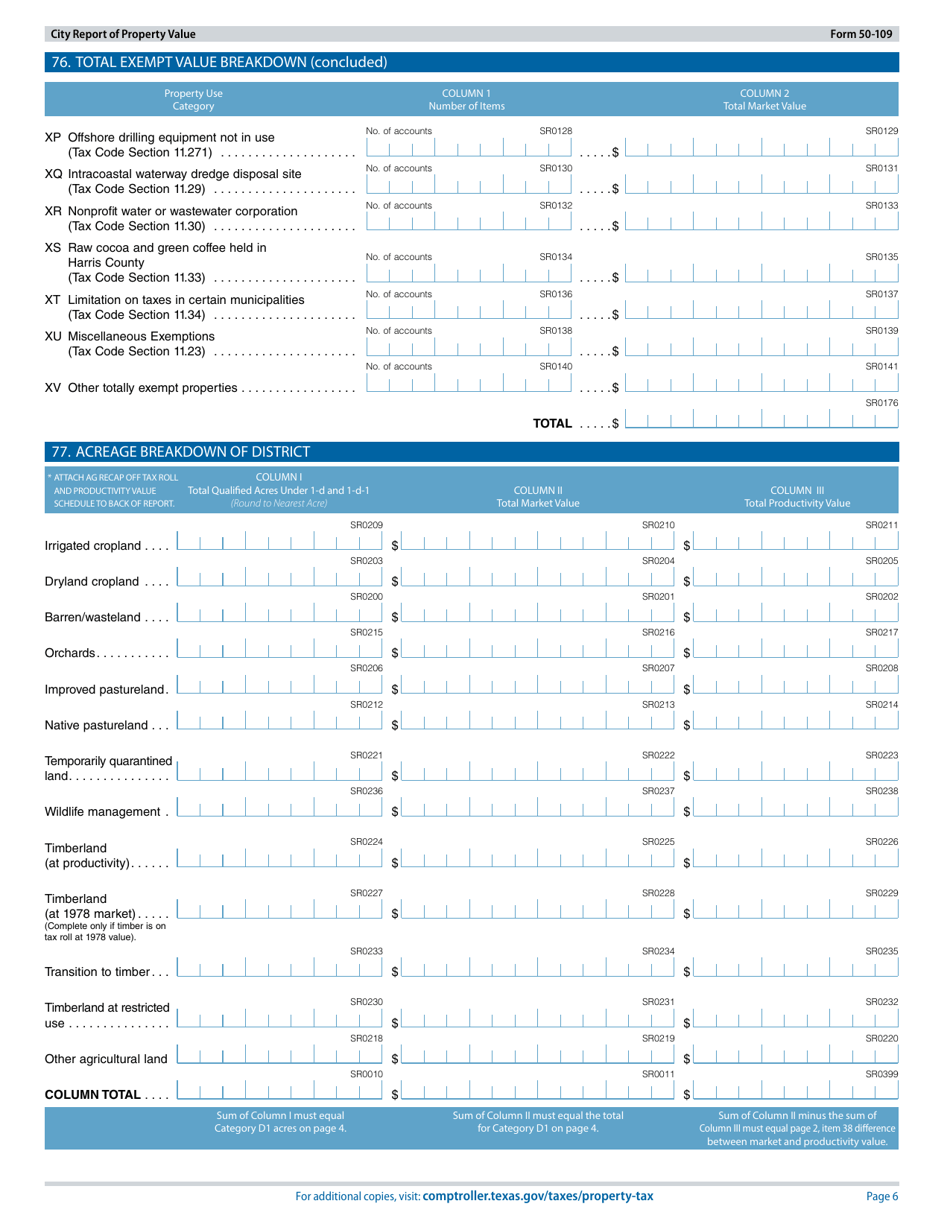

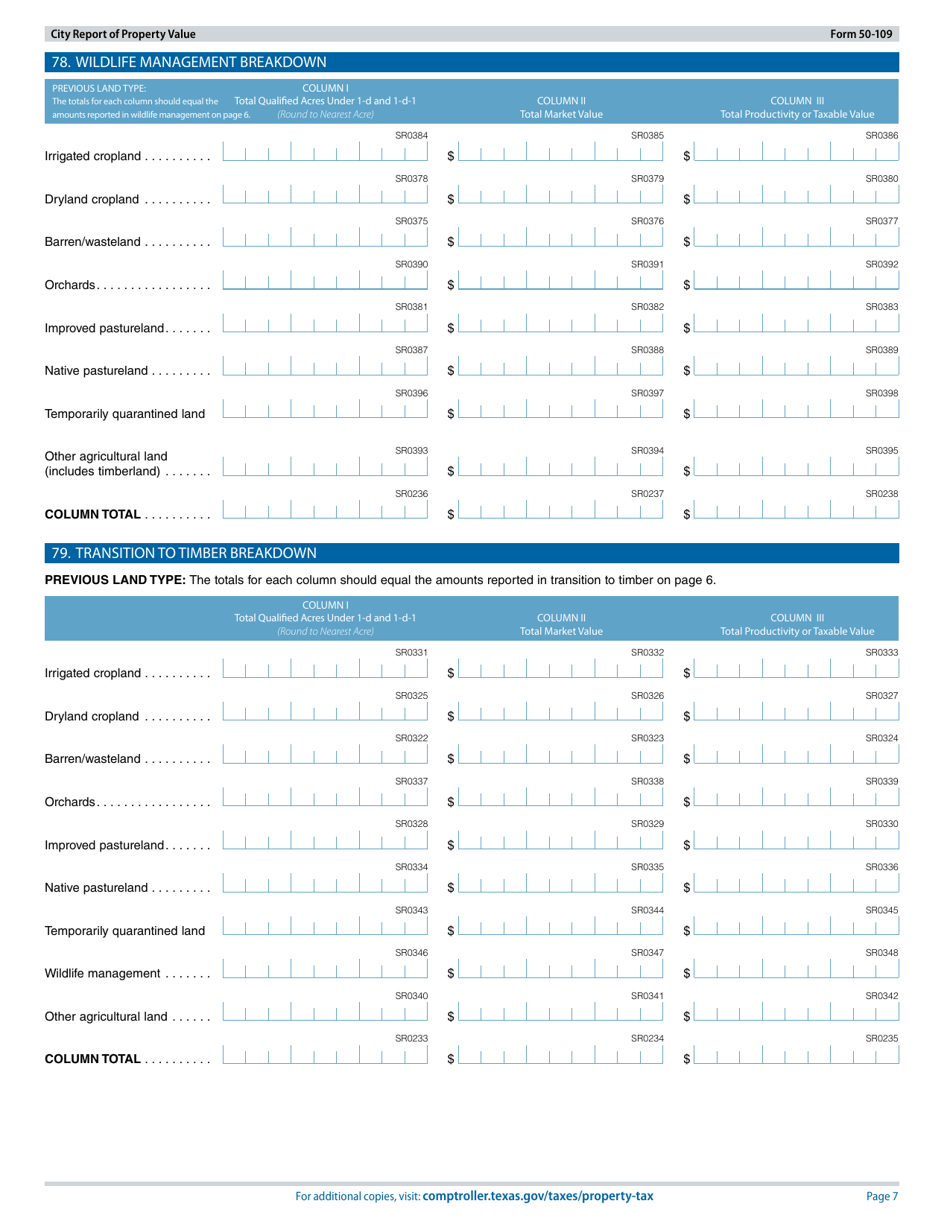

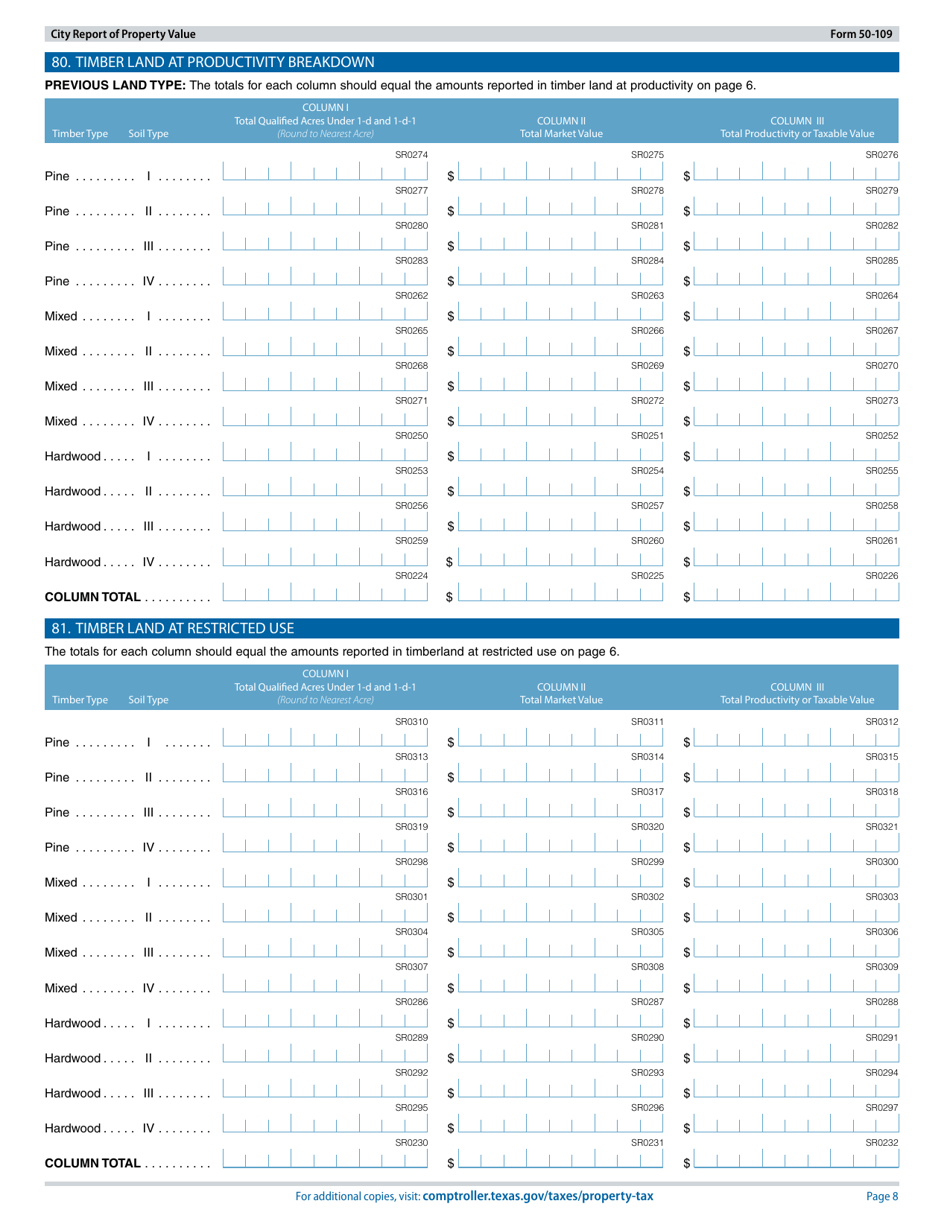

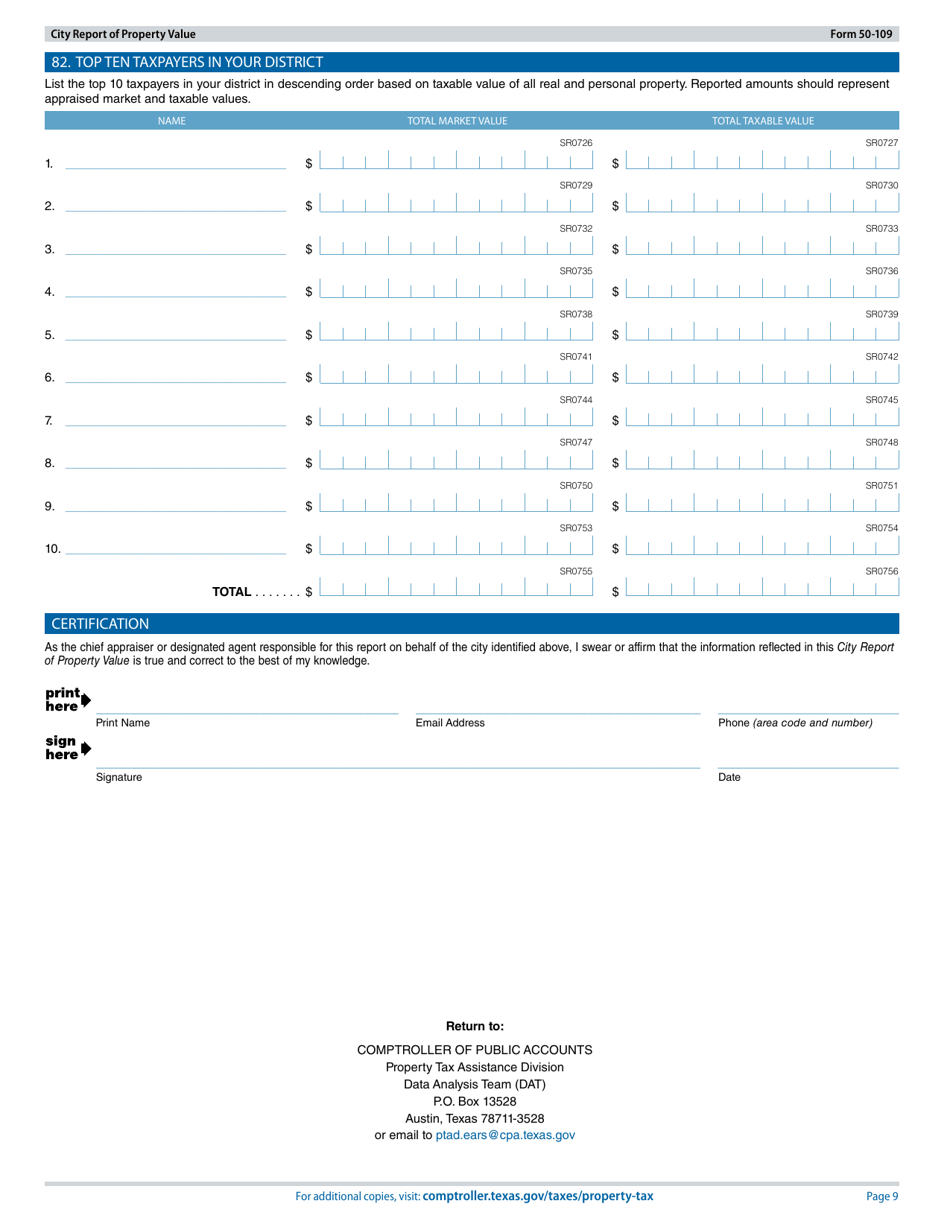

Form 50-109

for the current year.

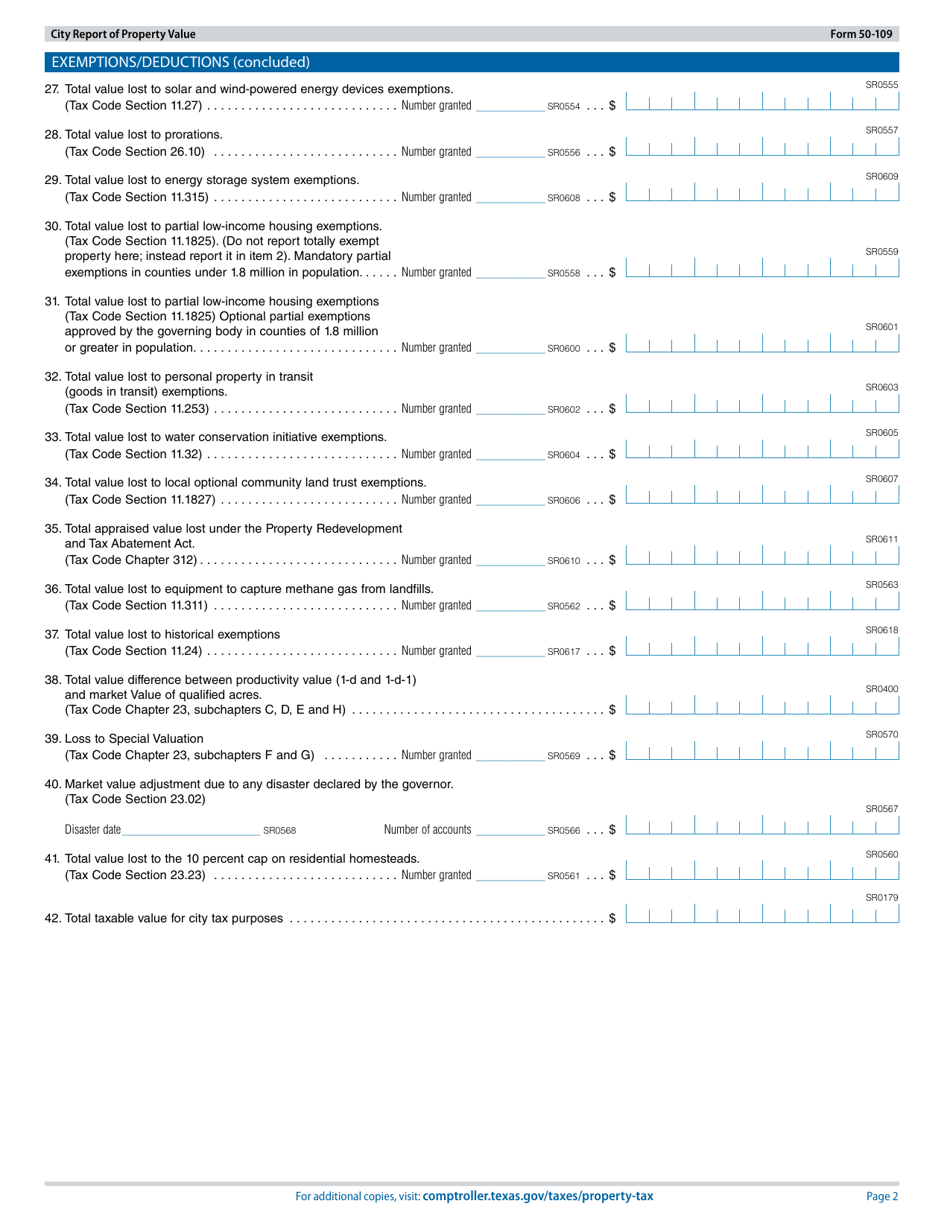

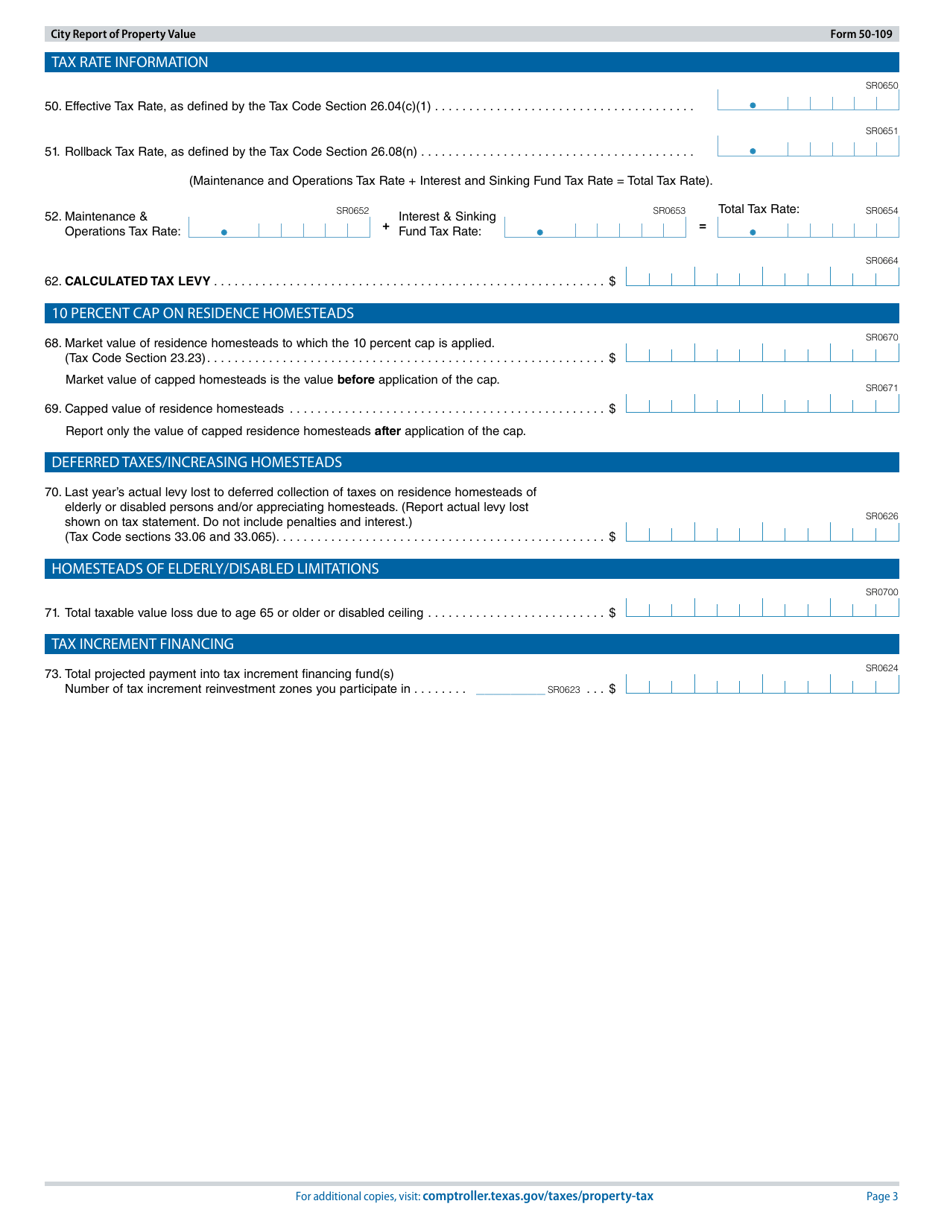

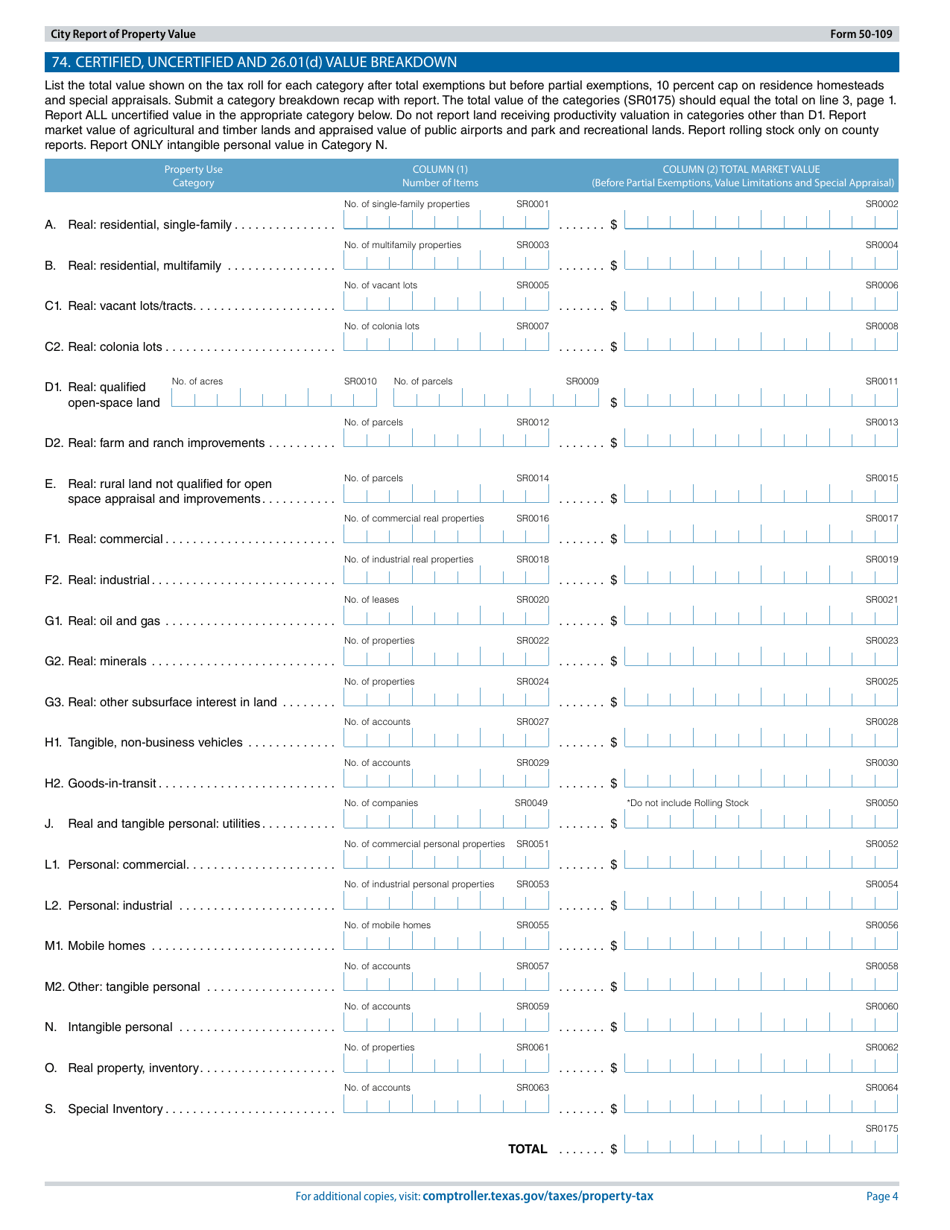

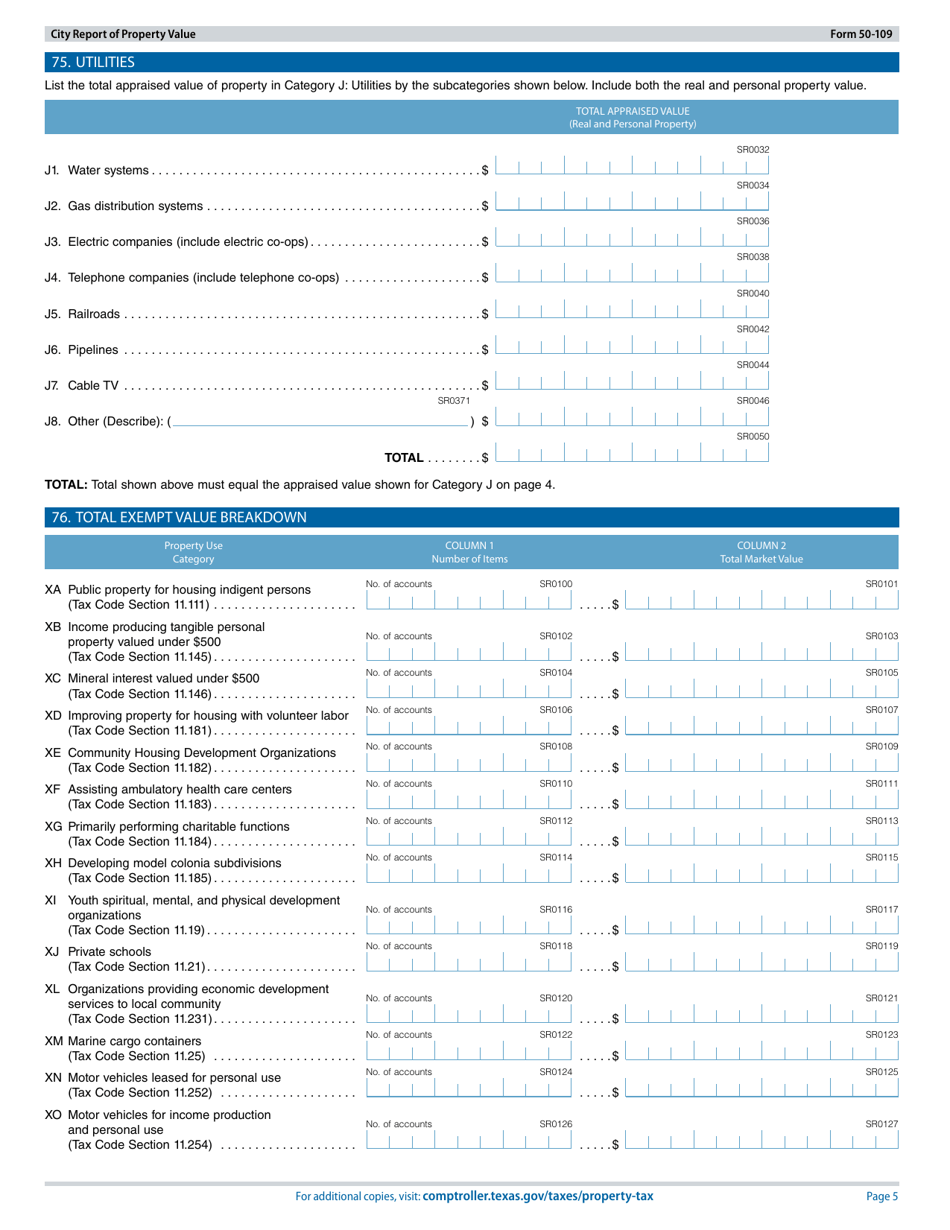

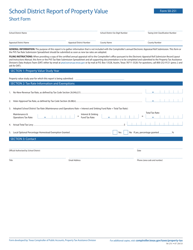

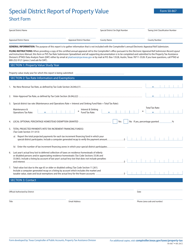

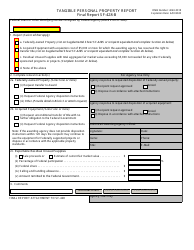

Form 50-109 City Report of Property Value - Texas

What Is Form 50-109?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-109?

A: Form 50-109 is the City Report of Property Value form in Texas.

Q: What is the purpose of Form 50-109?

A: The purpose of Form 50-109 is to report property values to the city in Texas.

Q: Who needs to file Form 50-109?

A: Property owners in Texas need to file Form 50-109 to report their property values to the city.

Q: When is Form 50-109 due?

A: Form 50-109 is usually due on April 30th of each year.

Q: How can Form 50-109 be filed?

A: Form 50-109 can be filed electronically or by mail.

Q: What happens if Form 50-109 is not filed?

A: Failure to file Form 50-109 may result in penalties or fines.

Q: Is Form 50-109 required in all cities in Texas?

A: Form 50-109 may be required in some cities in Texas. It is best to check with the specific city's requirements.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-109 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.