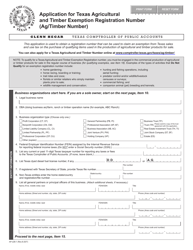

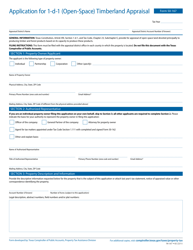

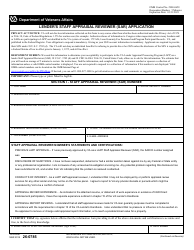

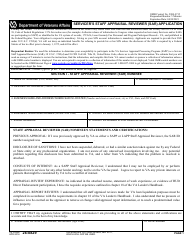

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-165

for the current year.

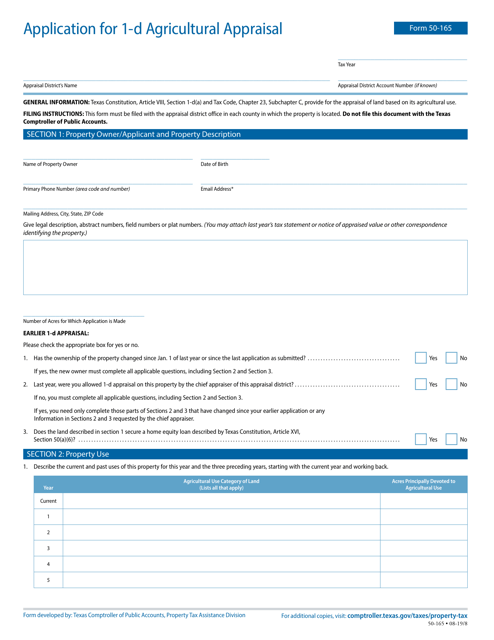

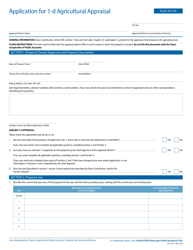

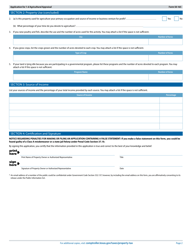

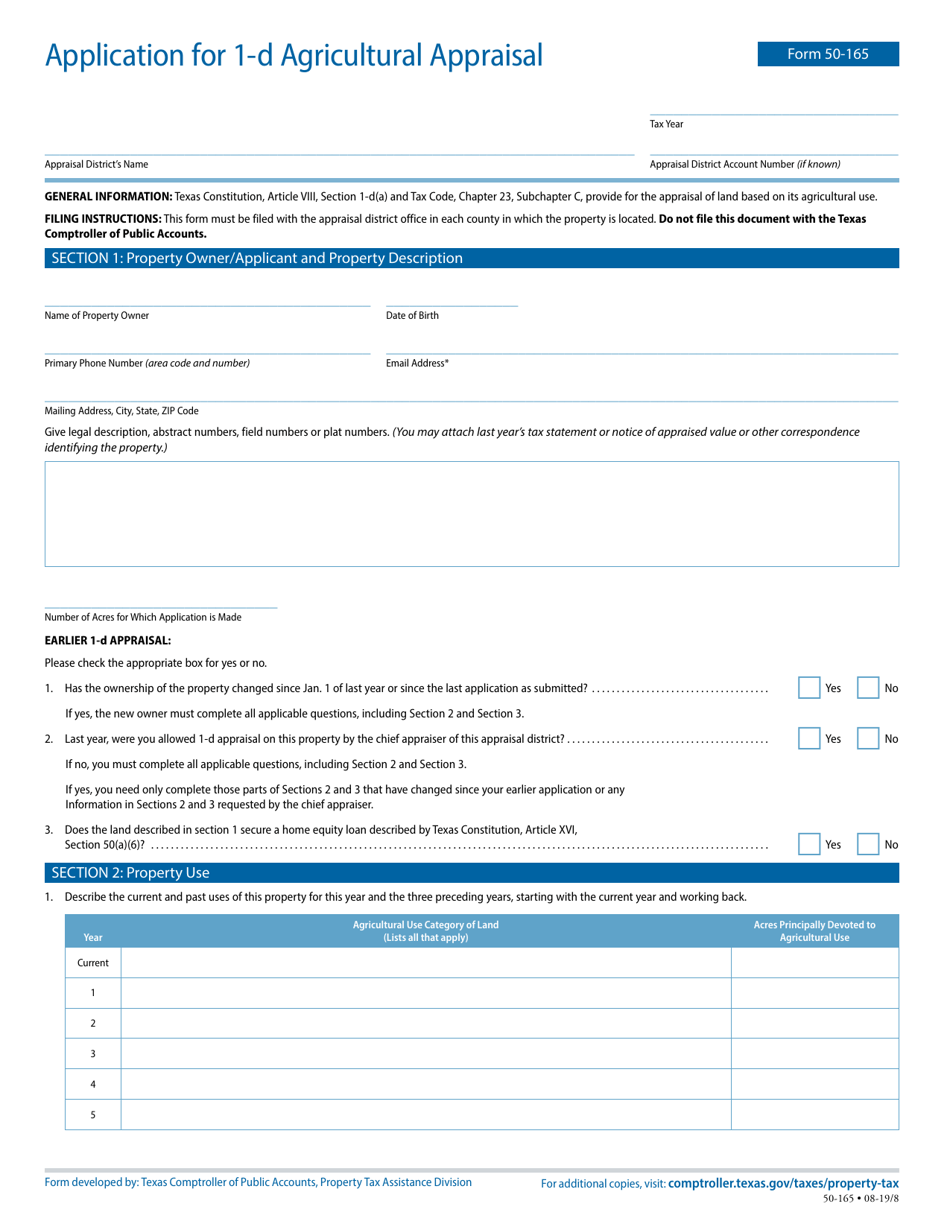

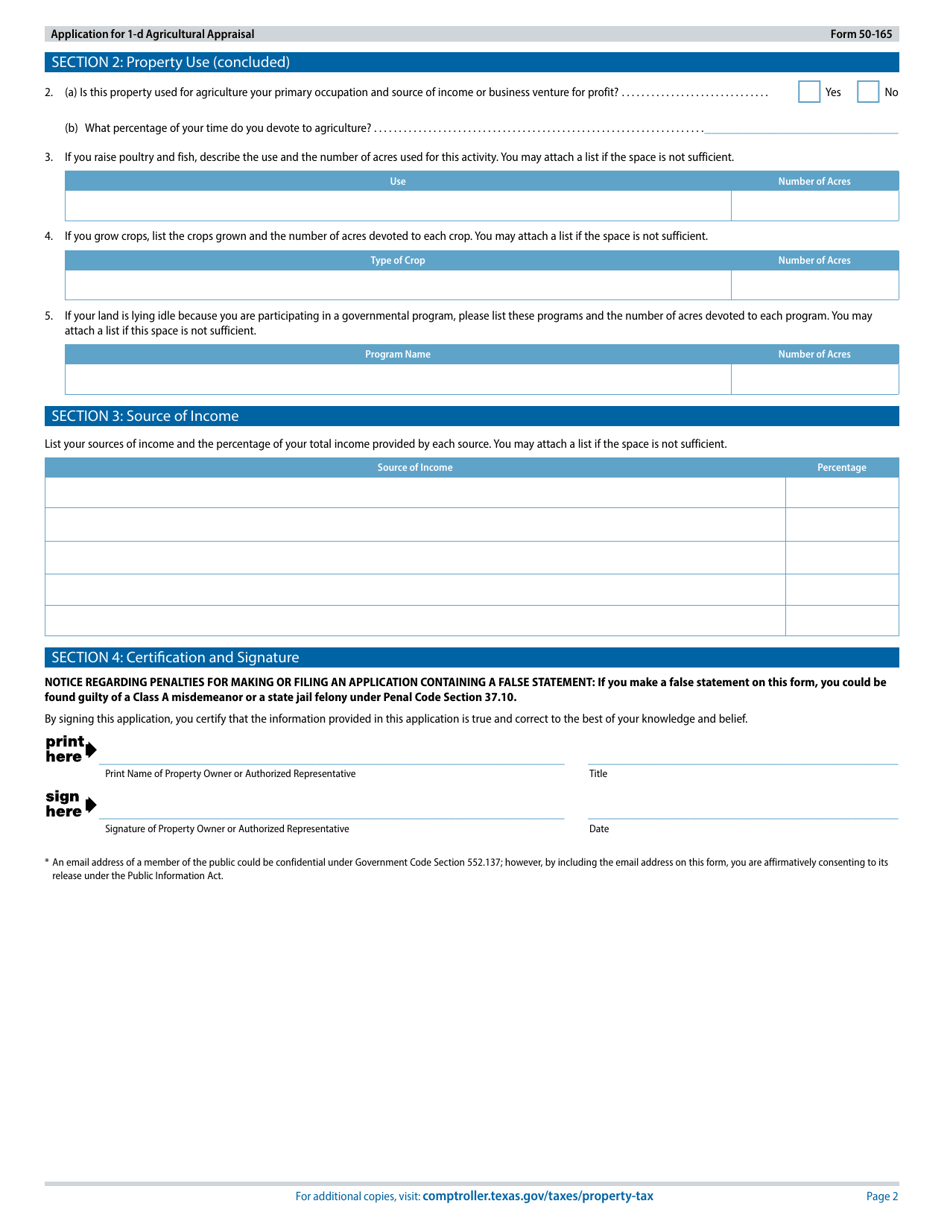

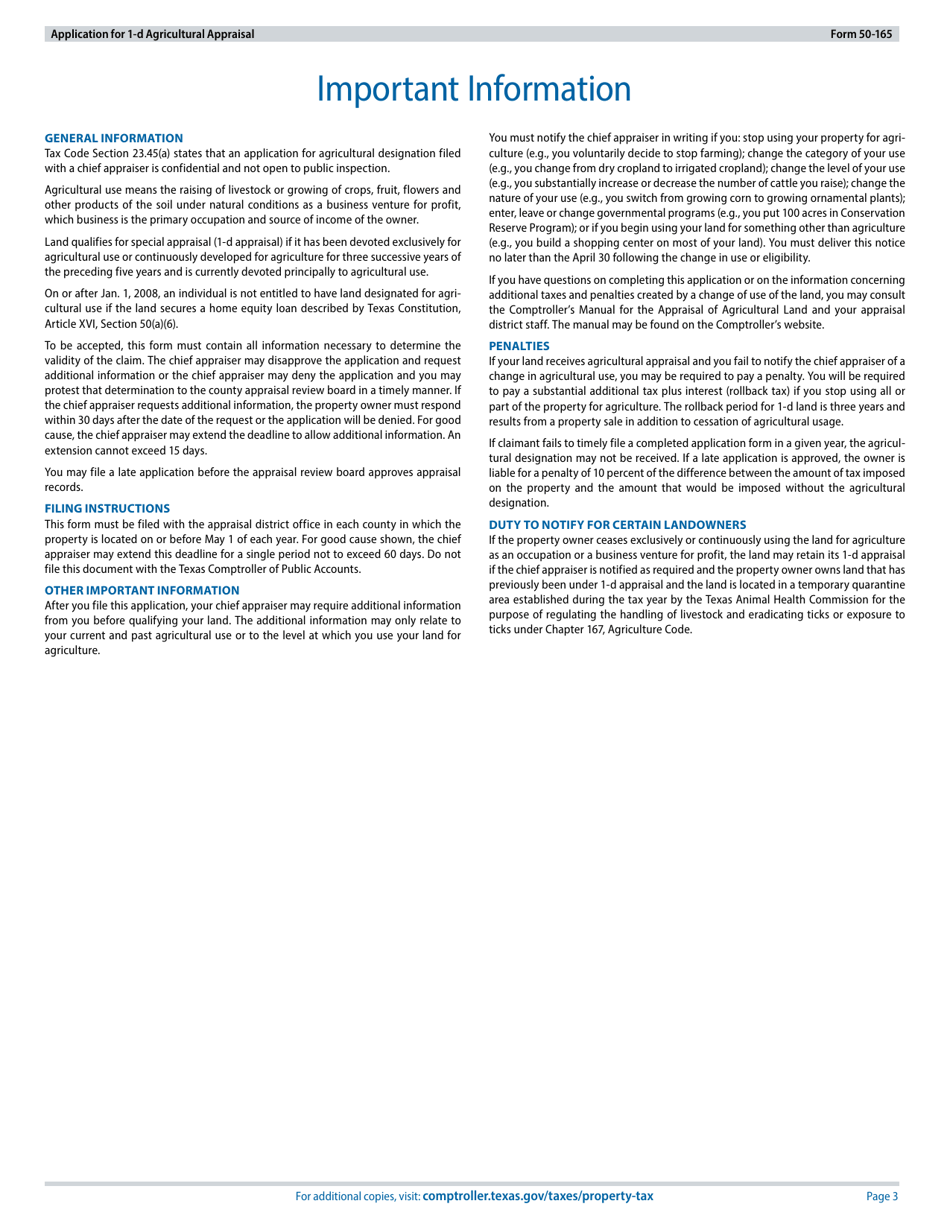

Form 50-165 Application for 1-d Agricultural Appraisal - Texas

What Is Form 50-165?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-165?

A: Form 50-165 is the Application for 1-d Agricultural Appraisal in Texas.

Q: What is the purpose of Form 50-165?

A: The purpose of Form 50-165 is to apply for agricultural appraisal of land in Texas.

Q: Who needs to fill out Form 50-165?

A: Property owners in Texas who want to apply for agricultural appraisal of their land need to fill out Form 50-165.

Q: What information is required on Form 50-165?

A: Form 50-165 requires information such as property owner's name and address, property description, and agricultural use details.

Q: Are there any filing fees for Form 50-165?

A: Filing fees for Form 50-165 may vary depending on the county in Texas. It is best to contact the local county appraisal district office for fee information.

Q: When should I submit Form 50-165?

A: Form 50-165 should be submitted to the local county appraisal district office between January 1st and April 30th of the tax year for which the agricultural appraisal is sought.

Q: What happens after submitting Form 50-165?

A: After submitting Form 50-165, the local county appraisal district will review the application and determine if the property qualifies for agricultural appraisal.

Q: Can I appeal if my application is denied?

A: Yes, if your application for agricultural appraisal is denied, you have the right to appeal the decision.

Q: Is Form 50-165 specific to Texas?

A: Yes, Form 50-165 is specific to Texas and is used for applying for agricultural appraisal in the state.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-165 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.