This version of the form is not currently in use and is provided for reference only. Download this version of

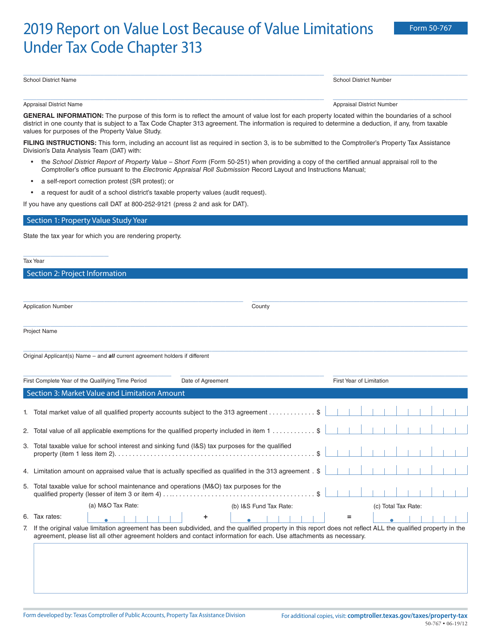

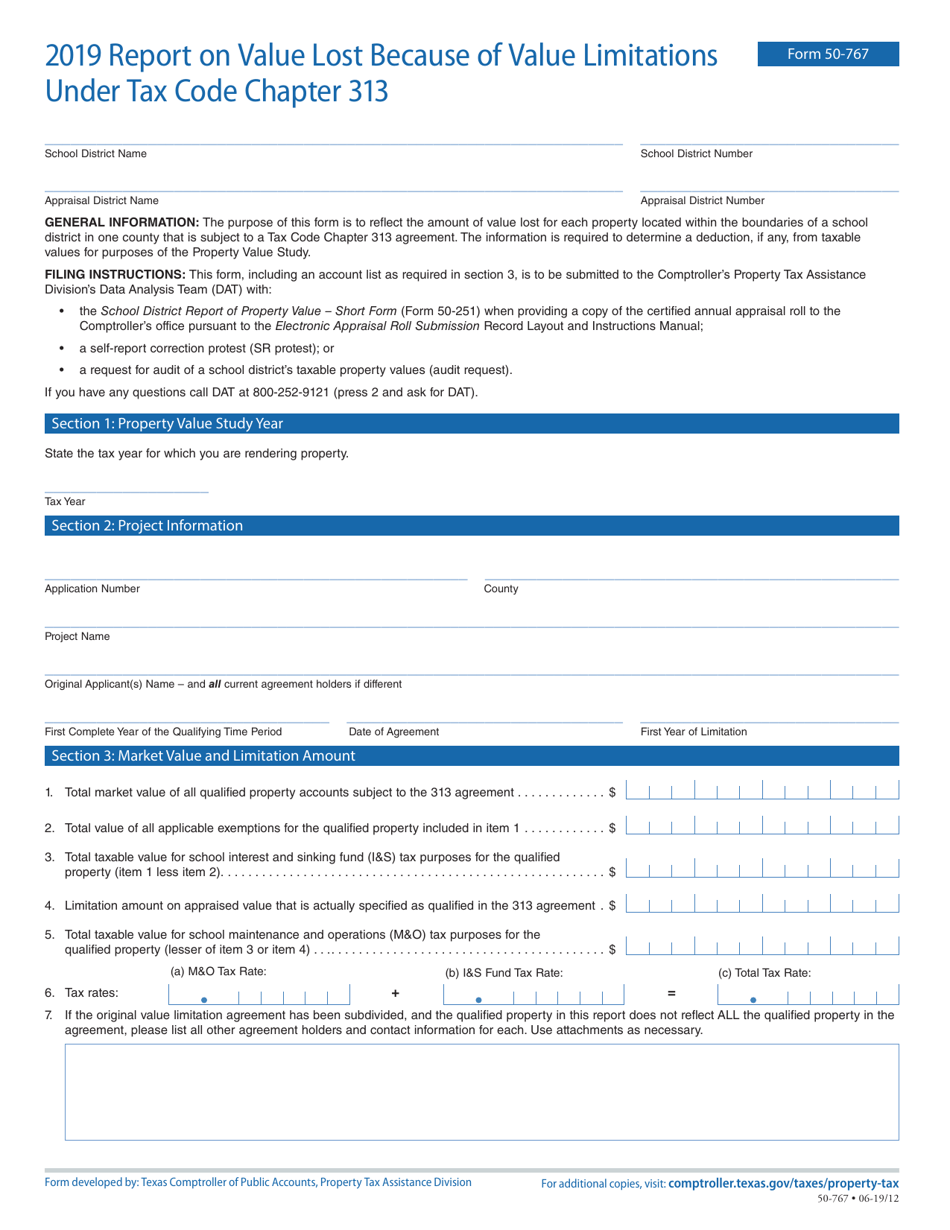

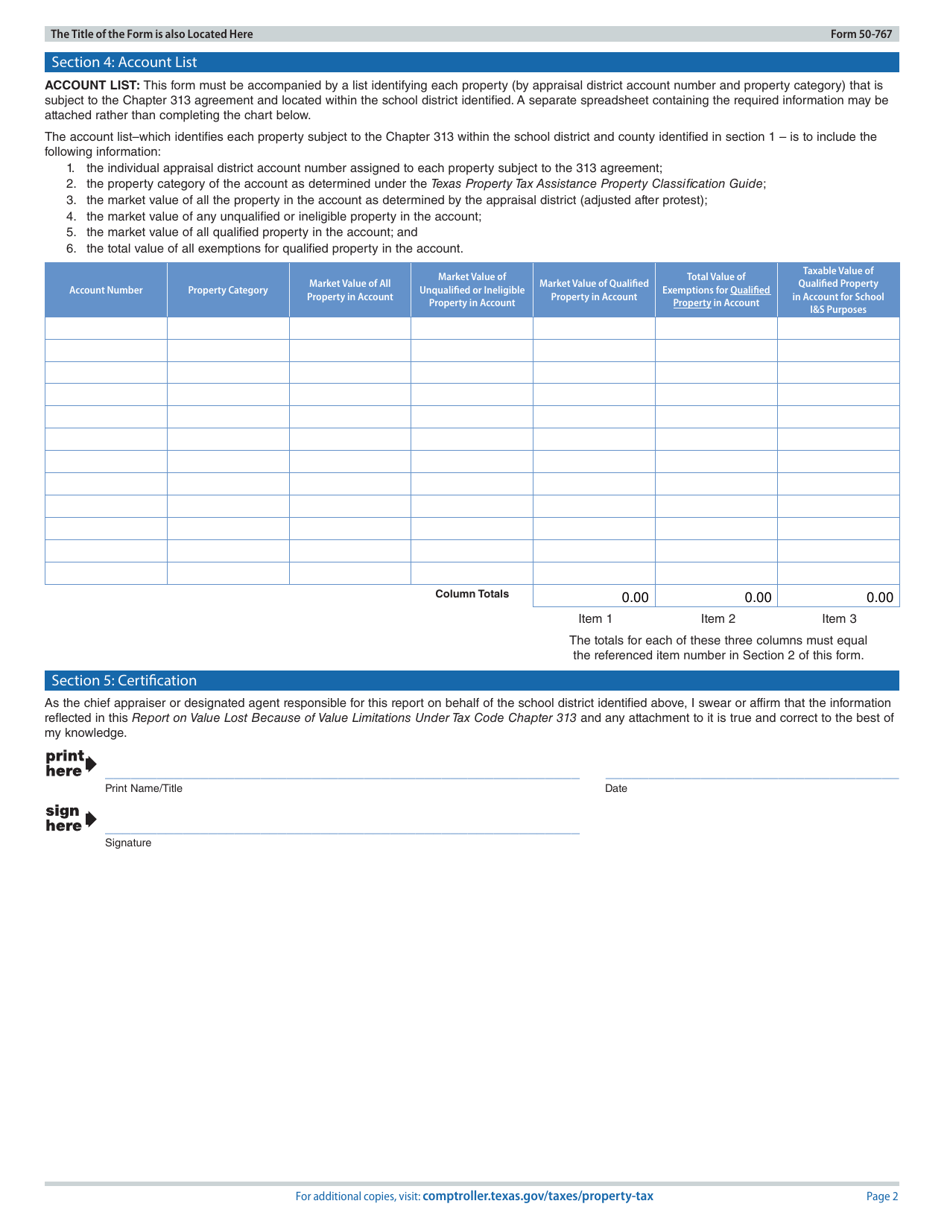

Form 50-767

for the current year.

Form 50-767 Report on Value Lost Because of Value Limitations Under Tax Code Chapter 313 - Texas

What Is Form 50-767?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-767?

A: Form 50-767 is a report used to calculate the value lost due to value limitations under Tax Code Chapter 313 in Texas.

Q: What is Tax Code Chapter 313 in Texas?

A: Tax Code Chapter 313 in Texas provides incentives for certain industries to invest in the state by offering value limitations on property taxes.

Q: Who needs to file Form 50-767?

A: Companies that have been granted a limitation on appraised value under Tax Code Chapter 313 need to file Form 50-767.

Q: What is the purpose of filing Form 50-767?

A: The purpose of filing Form 50-767 is to report the value lost due to the value limitations under Tax Code Chapter 313.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-767 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.