This version of the form is not currently in use and is provided for reference only. Download this version of

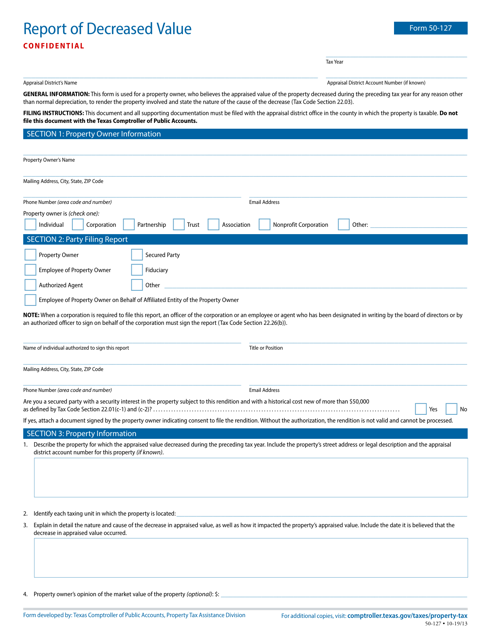

Form 50-127

for the current year.

Form 50-127 Report of Decreased Value - Texas

What Is Form 50-127?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 50-127 Report of Decreased Value?

A: Form 50-127 Report of Decreased Value is a document used in Texas to report a decreased value of property for tax assessment purposes.

Q: When should I use form 50-127?

A: You should use form 50-127 when you believe that the value of your property has decreased and you want to request a reduction in your property taxes.

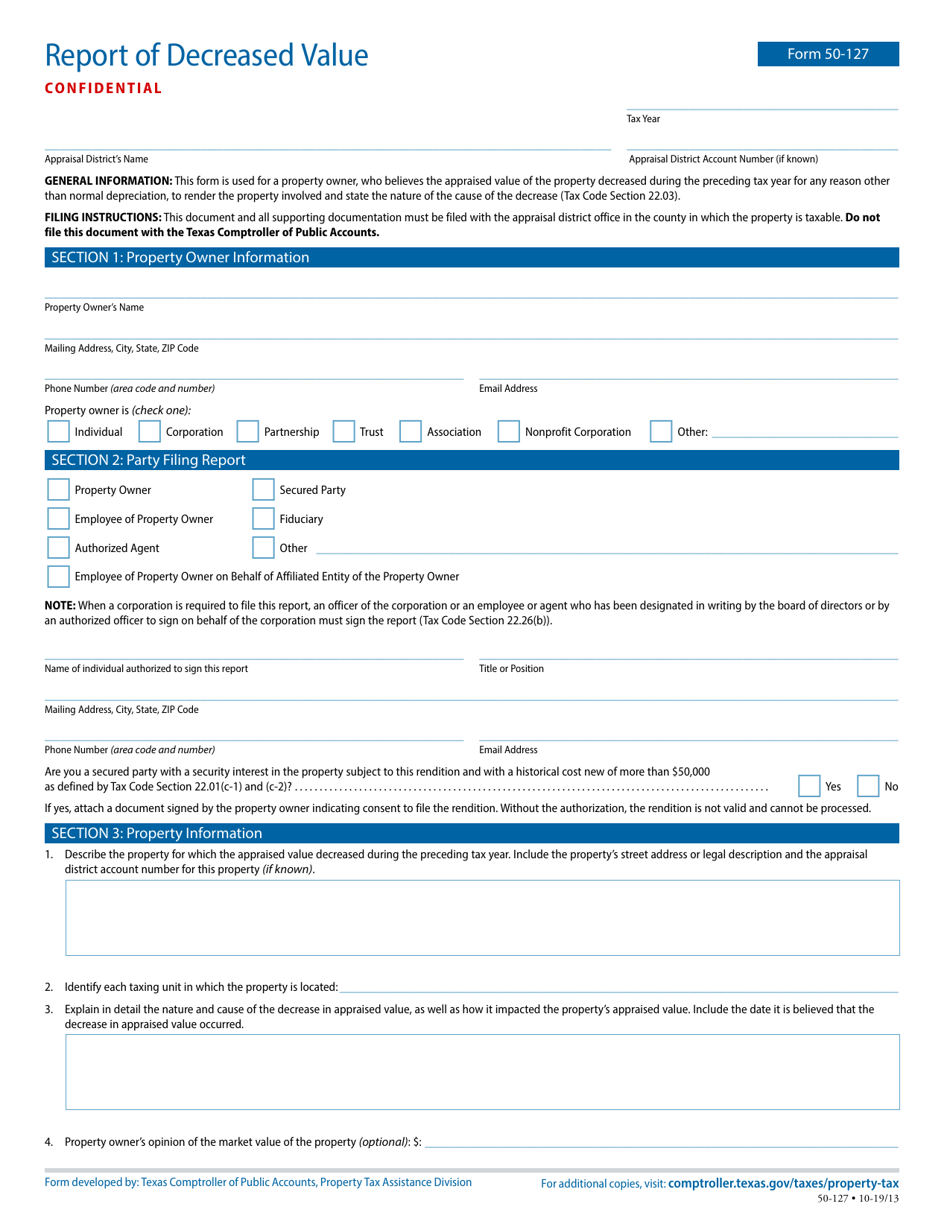

Q: What information do I need to provide on form 50-127?

A: You need to provide information about the property, including its location, description, and the reasons for the decreased value.

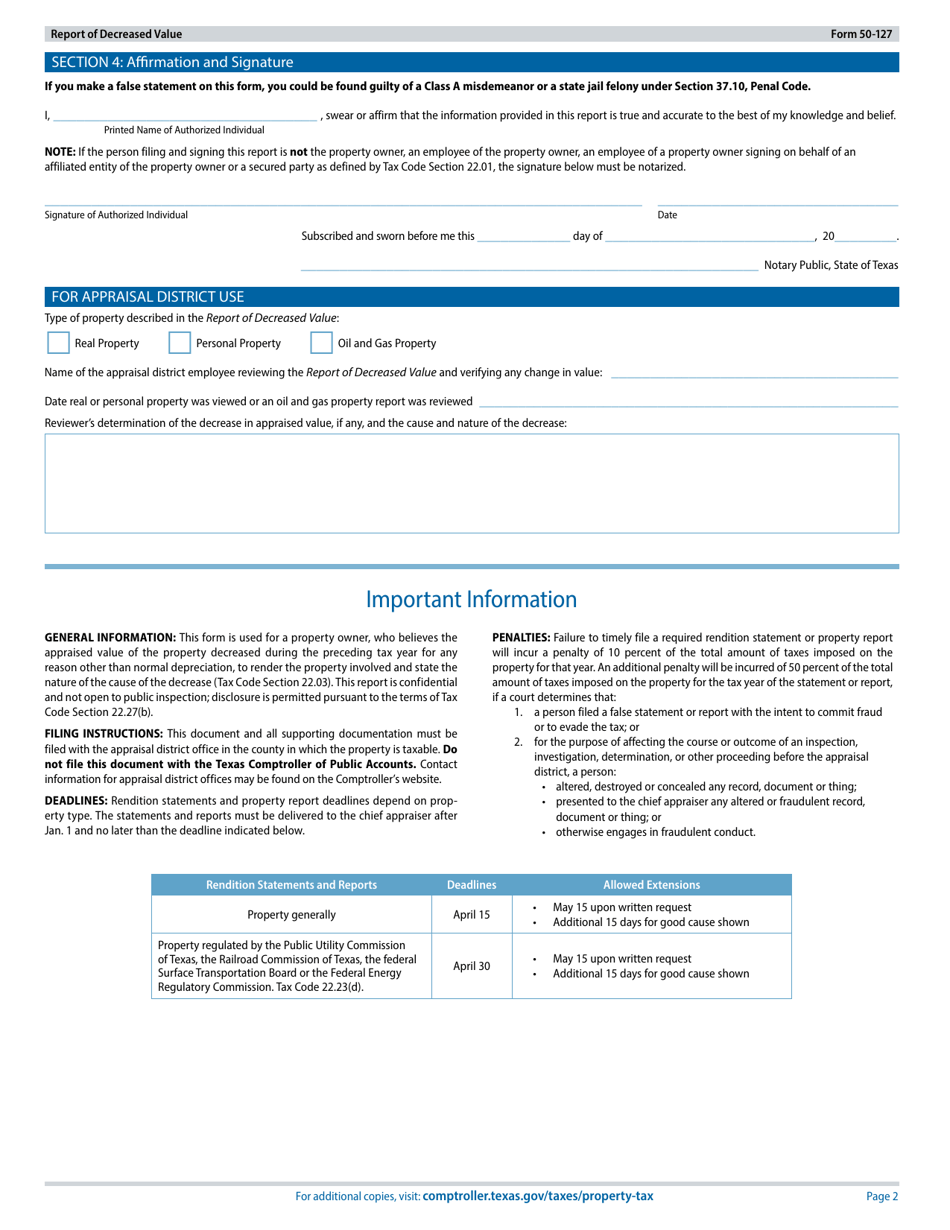

Q: Is there a deadline for submitting form 50-127?

A: Yes, the deadline for submitting form 50-127 is typically May 31 of the year following the tax year in which the decreased value occurred.

Q: Will submitting form 50-127 guarantee a reduction in my property taxes?

A: Submitting form 50-127 does not guarantee a reduction in your property taxes, but it initiates the process for reviewing your property's value.

Q: What happens after I submit form 50-127?

A: After you submit form 50-127, the appraisal district will review your request and determine whether a reduction in value is warranted.

Q: Can I appeal the appraisal district's decision regarding my decreased value request?

A: Yes, if you disagree with the appraisal district's decision, you have the right to appeal it.

Q: Are there any fees associated with submitting form 50-127?

A: There are generally no fees associated with submitting form 50-127.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-127 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.