This version of the form is not currently in use and is provided for reference only. Download this version of

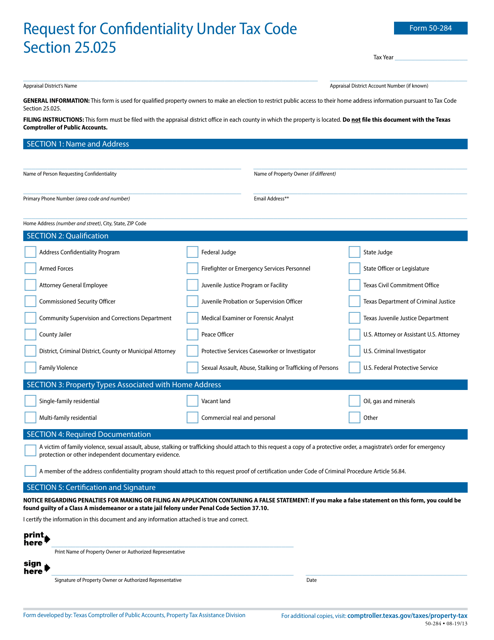

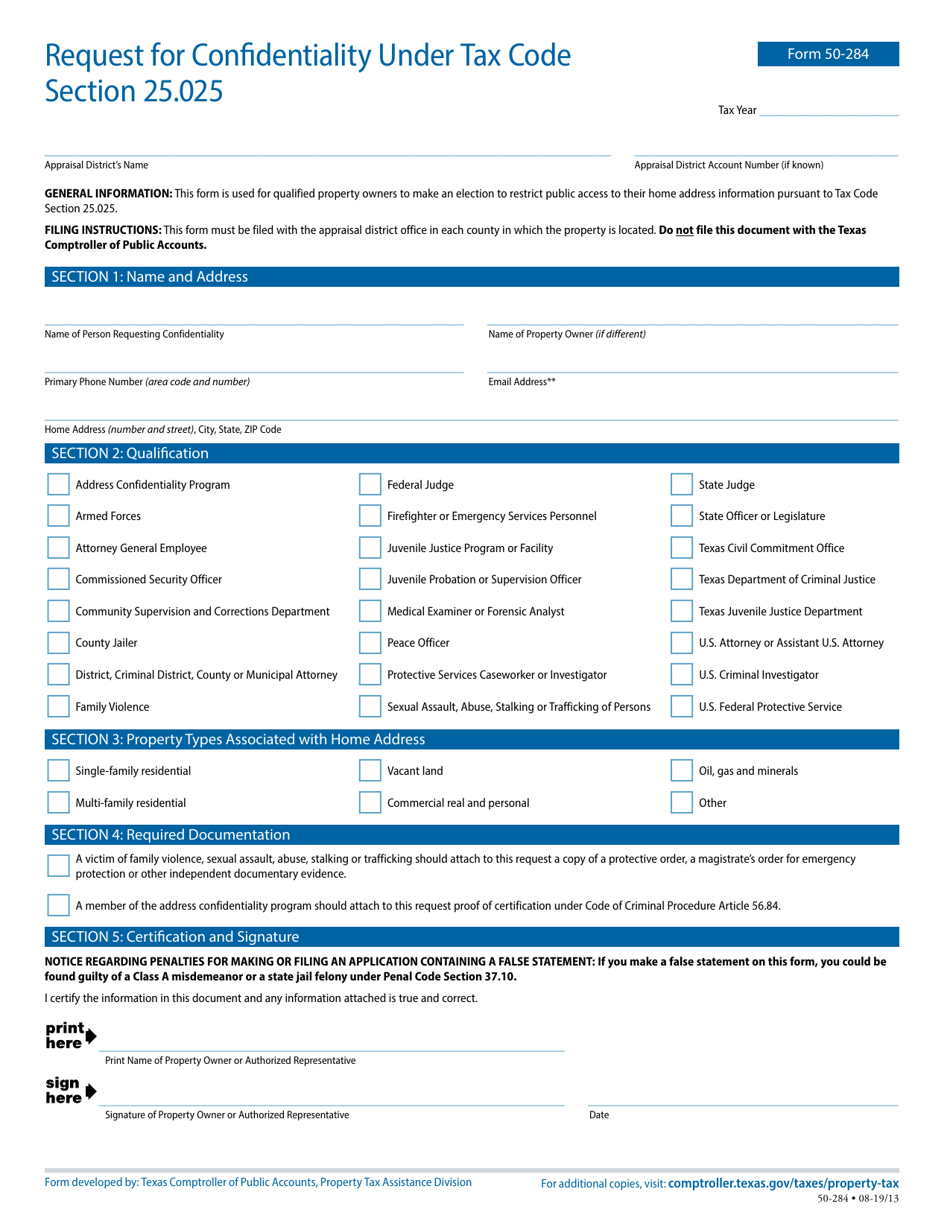

Form 50-284

for the current year.

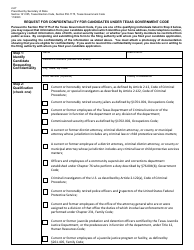

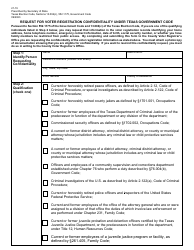

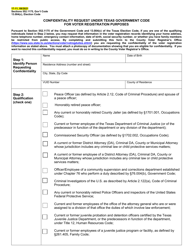

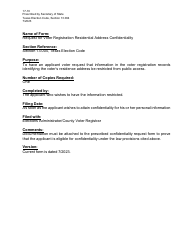

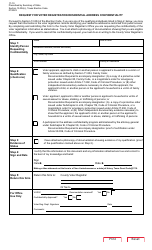

Form 50-284 Request for Confidentiality Under Tax Code Section 25.025 - Texas

What Is Form 50-284?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-284?

A: Form 50-284 is a request for confidentiality under Tax Code Section 25.025 in the state of Texas.

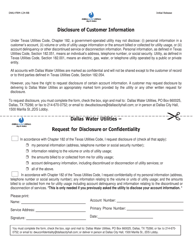

Q: What is the purpose of Form 50-284?

A: The purpose of Form 50-284 is to request confidentiality for certain information under Tax Code Section 25.025.

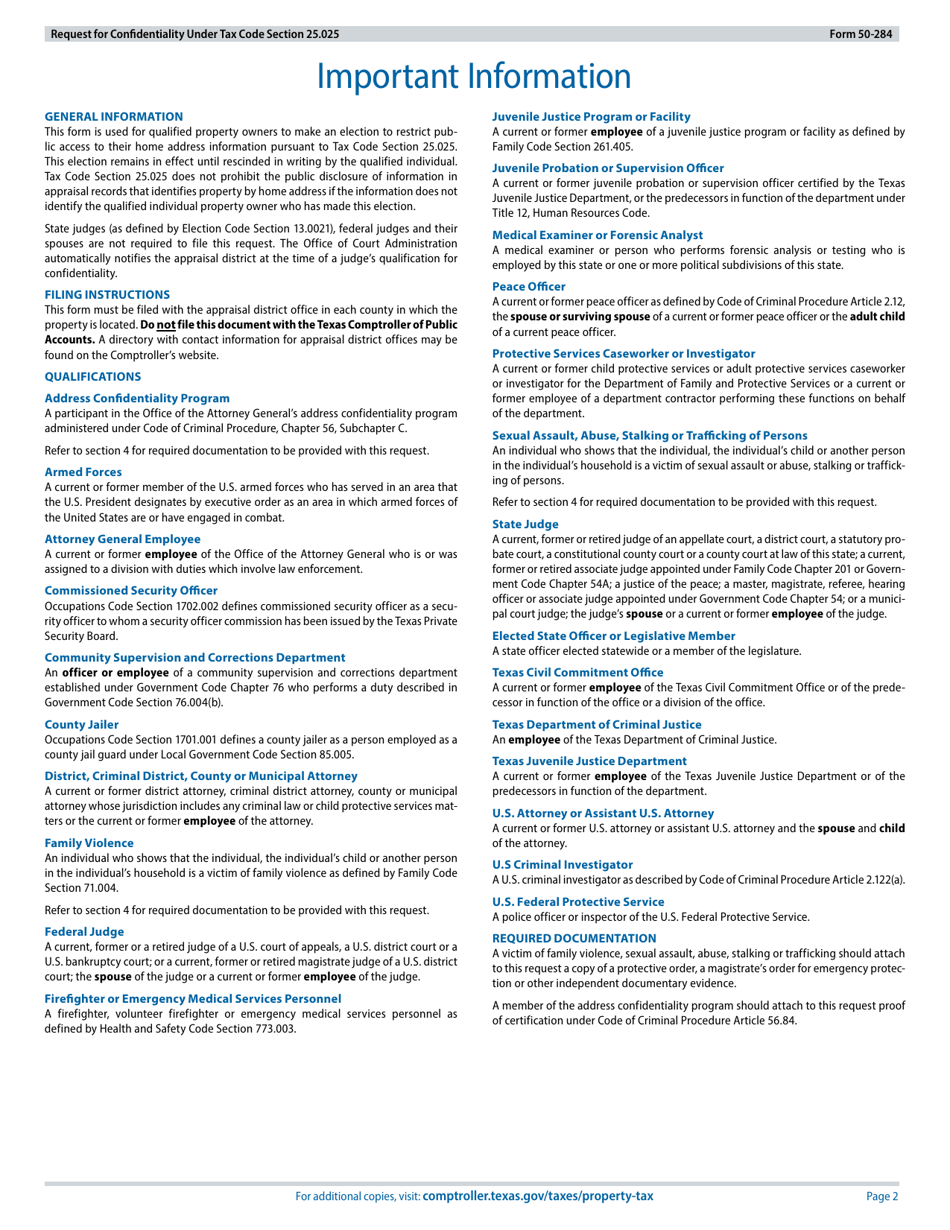

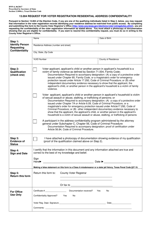

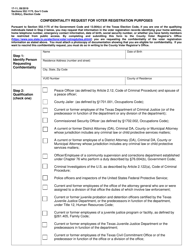

Q: Who needs to fill out Form 50-284?

A: Individuals or entities who want to request confidentiality for certain information under Tax Code Section 25.025 in Texas need to fill out Form 50-284.

Q: What information is required on Form 50-284?

A: Form 50-284 requires information such as the taxpayer's name, address, tax identification number, and a description of the information to be kept confidential.

Q: Is there a fee for submitting Form 50-284?

A: No, there is no fee for submitting Form 50-284.

Q: Can I request confidentiality for all of my tax information?

A: No, confidentiality can only be requested for certain information under Tax Code Section 25.025 in Texas.

Q: How long does the confidentiality request last?

A: The confidentiality request lasts for a period of two years from the date it is approved, unless otherwise specified by the Comptroller.

Q: What happens if my request for confidentiality is denied?

A: If your request for confidentiality is denied, the information will not be kept confidential and may be subject to public disclosure.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-284 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.