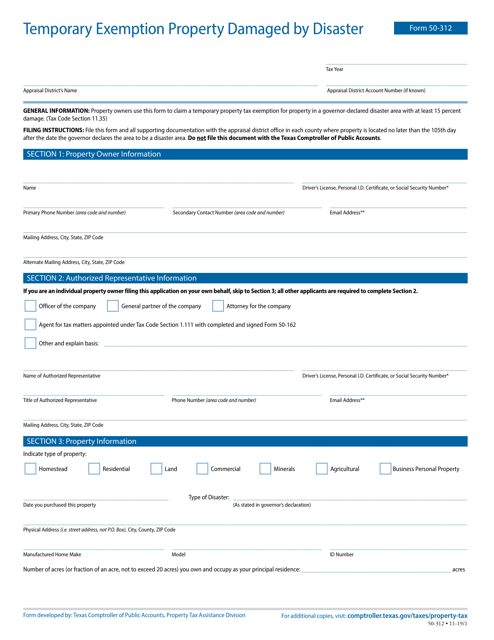

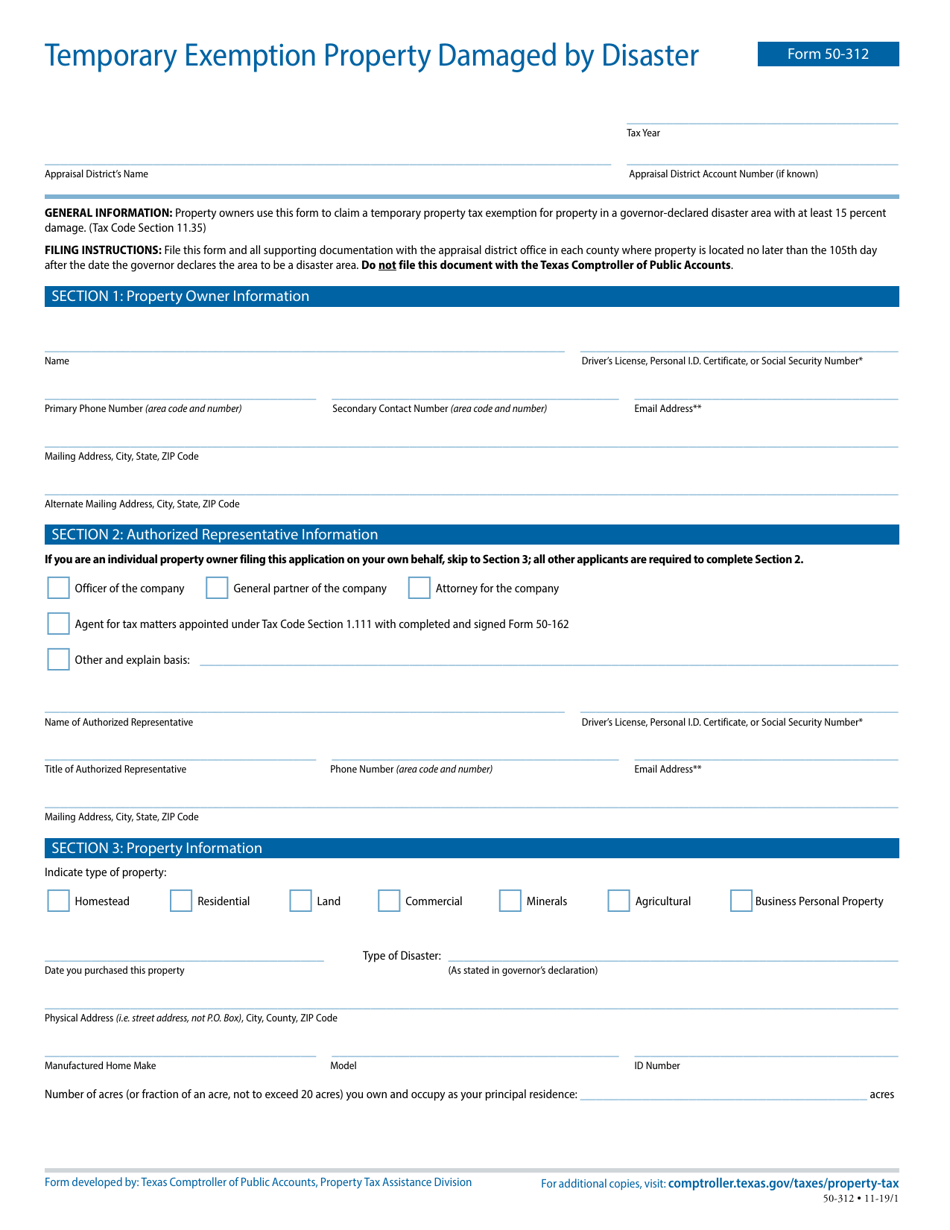

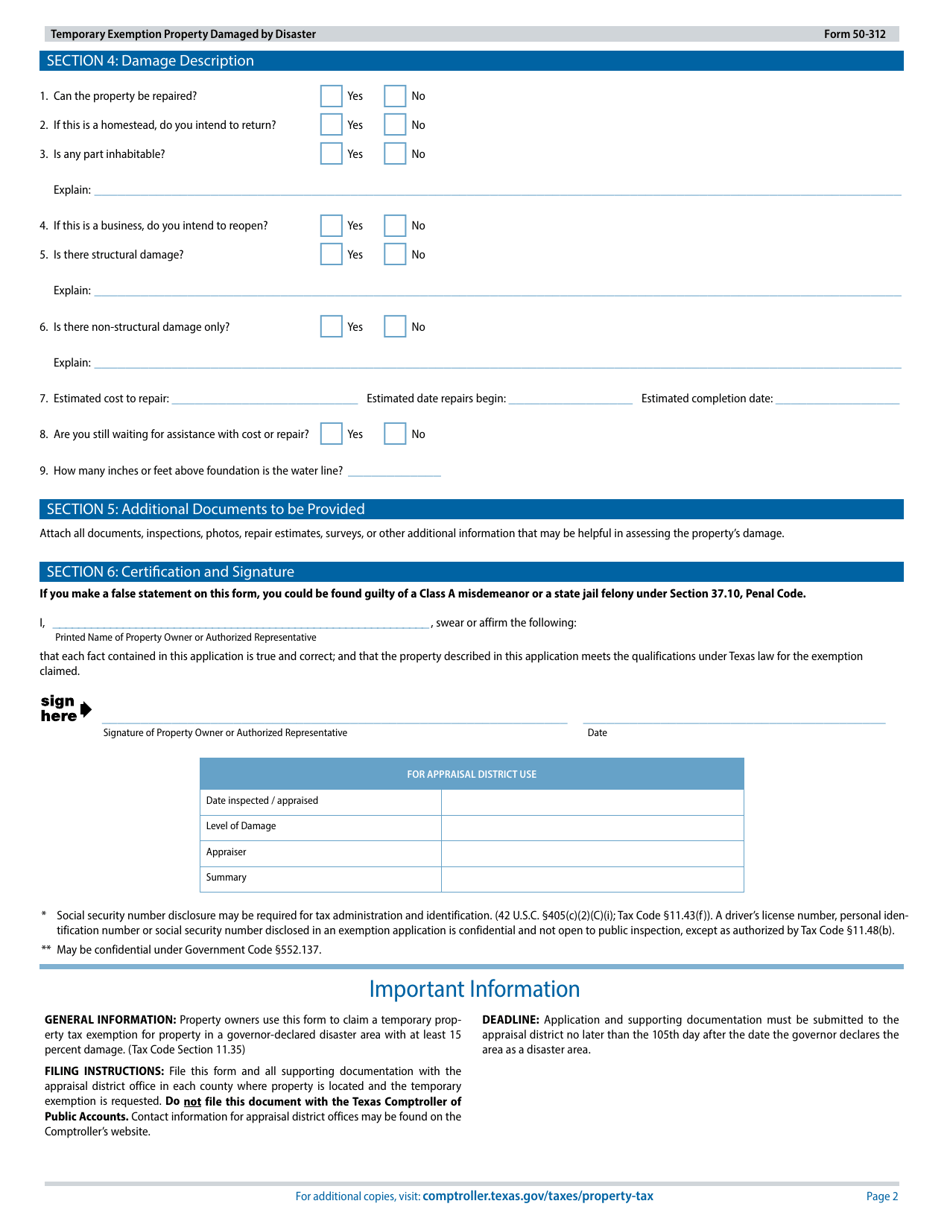

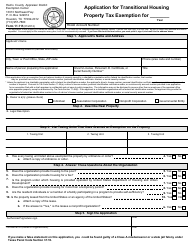

Form 50-312 Temporary Exemption Property Damaged by Disaster - Texas

What Is Form 50-312?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 50-312?

A: Form 50-312 is the Temporary Exemption Property Damaged by Disaster form in Texas.

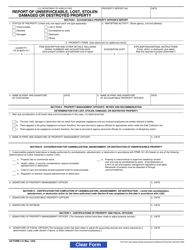

Q: What does this form do?

A: This form allows property owners in Texas to request a temporary exemption from property taxes for property that has been damaged by a disaster.

Q: Who can use this form?

A: Property owners in Texas whose property has been damaged by a disaster can use this form.

Q: What is the purpose of the temporary exemption?

A: The purpose of the temporary exemption is to provide tax relief to property owners who have experienced damage to their property due to a disaster.

Q: How long does the temporary exemption last?

A: The temporary exemption lasts for one year.

Q: When should this form be filed?

A: This form should be filed with the local county appraisal district as soon as possible after the property has been damaged by a disaster.

Q: Are there any eligibility requirements for this exemption?

A: Yes, there are eligibility requirements for this exemption. The property must have been at least 15% damaged by a disaster and the property owner must intend to repair the property.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-312 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.