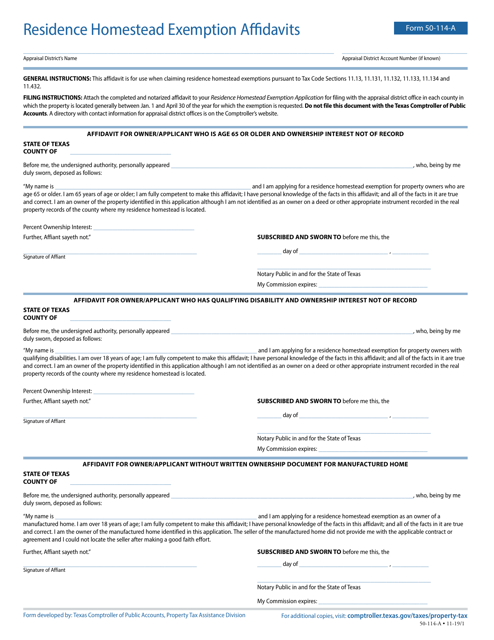

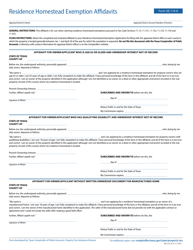

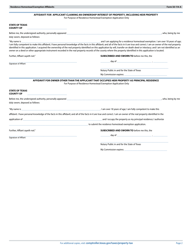

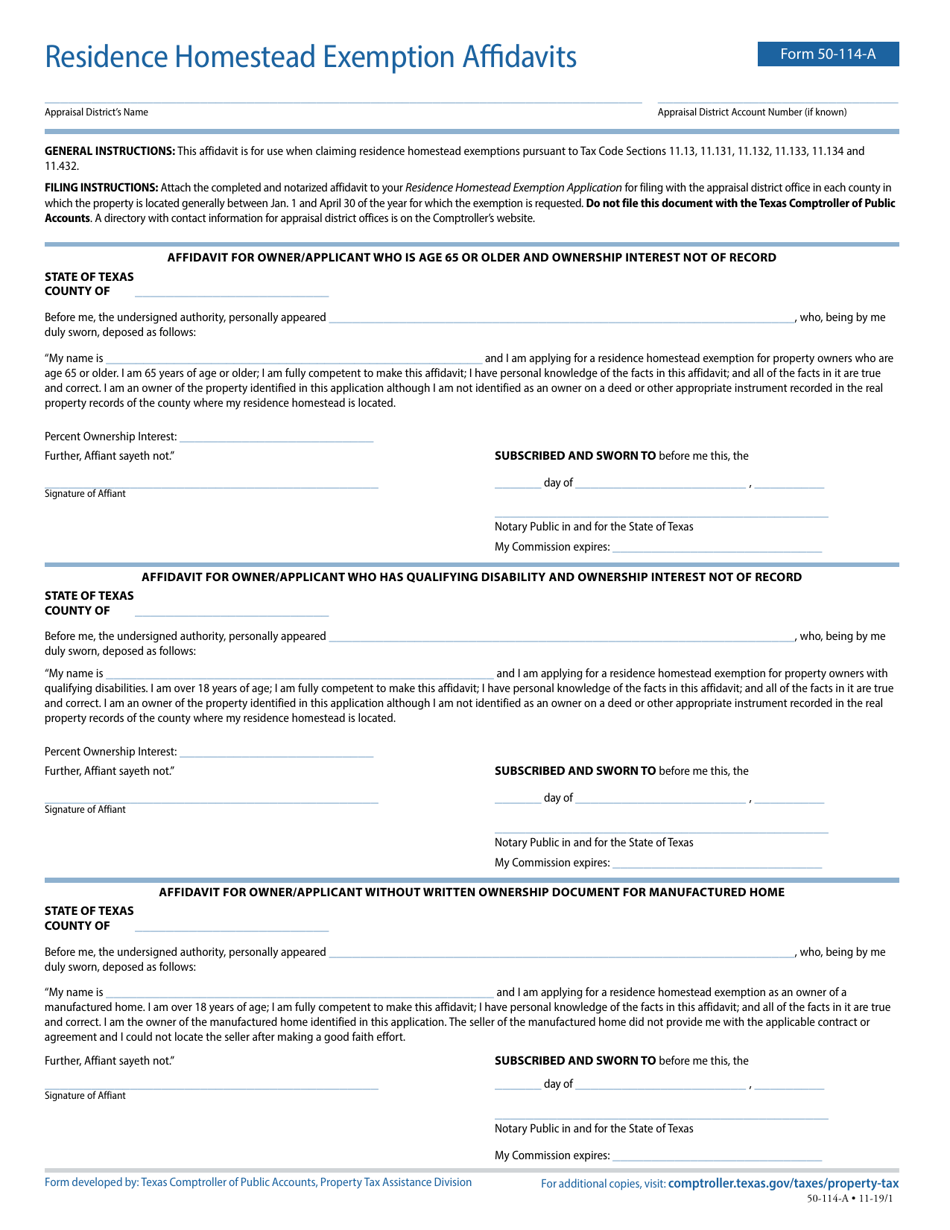

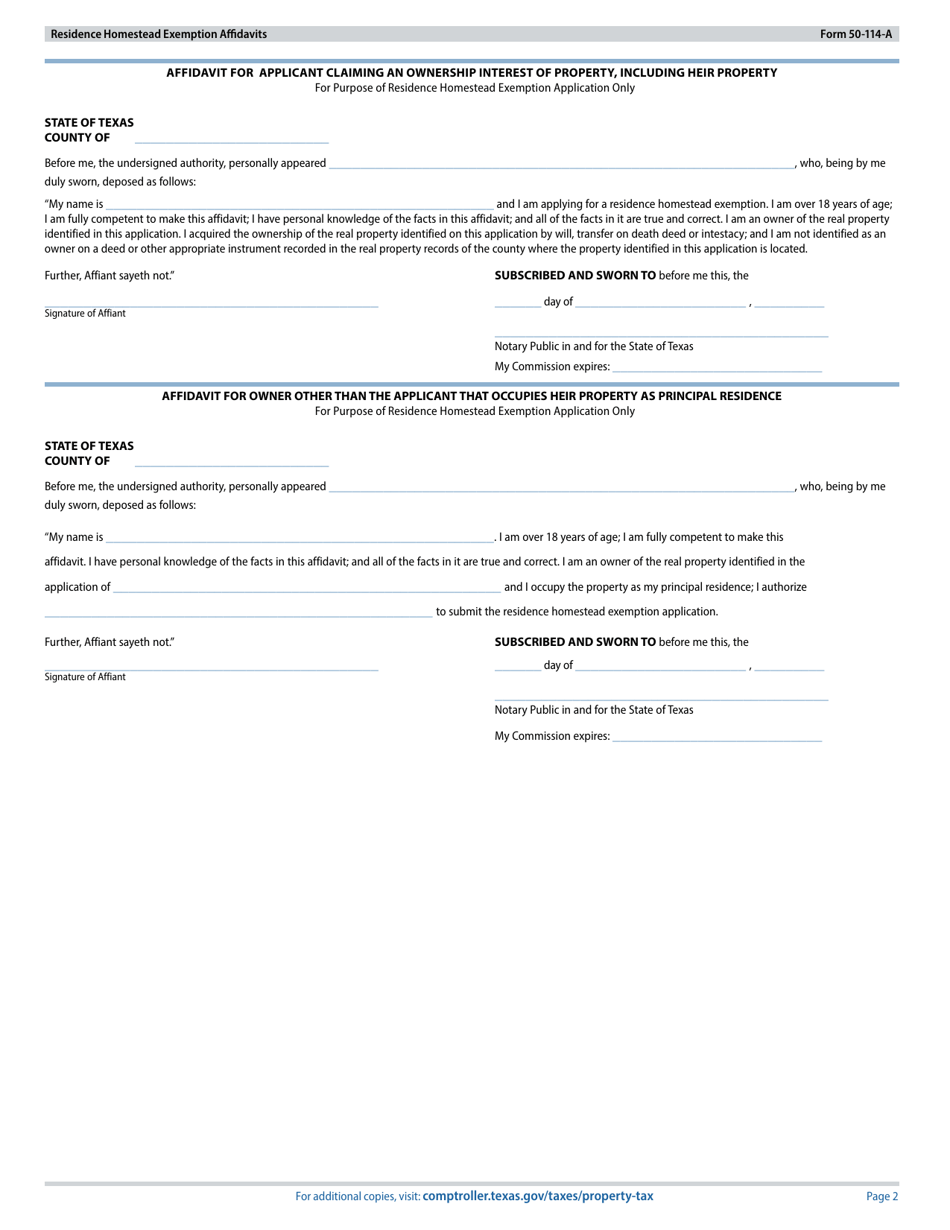

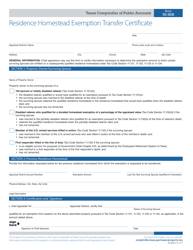

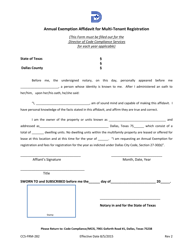

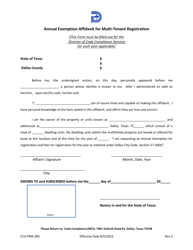

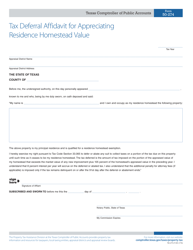

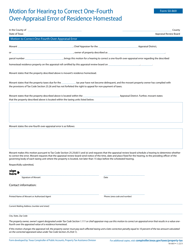

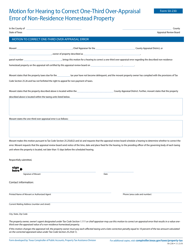

Form 50-114-A Residence Homestead Exemption Affidavits - Texas

What Is Form 50-114-A?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

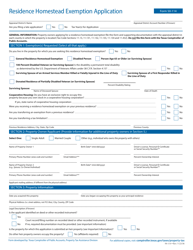

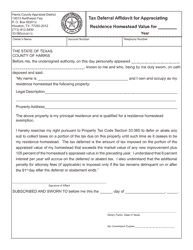

Q: What is Form 50-114-A Residence Homestead Exemption Affidavits?

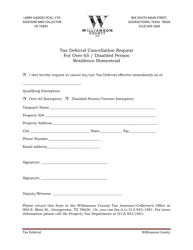

A: Form 50-114-A is a document used in Texas to apply for a residence homestead exemption.

Q: What is a residence homestead exemption?

A: A residence homestead exemption is a property tax exemption that reduces the amount of property taxes owed on a person's primary residence.

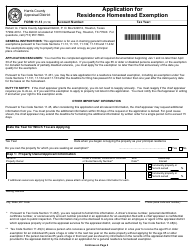

Q: Who is eligible for a residence homestead exemption?

A: Generally, homeowners who live in their property as their primary residence are eligible for a residence homestead exemption.

Q: What are the benefits of a residence homestead exemption?

A: The main benefit of a residence homestead exemption is a reduction in the amount of property taxes owed on a person's primary residence.

Q: How can I apply for a residence homestead exemption using Form 50-114-A?

A: You can apply for a residence homestead exemption in Texas by completing and submitting Form 50-114-A to the appropriate county appraisal district.

Q: Are there any deadlines for applying for a residence homestead exemption?

A: Yes, the deadline for filing a residence homestead exemption application is usually April 30th of the year following the year the exemption is sought.

Q: Is there a fee for applying for a residence homestead exemption?

A: No, there is no fee for applying for a residence homestead exemption in Texas.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-114-A by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.