This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-147

for the current year.

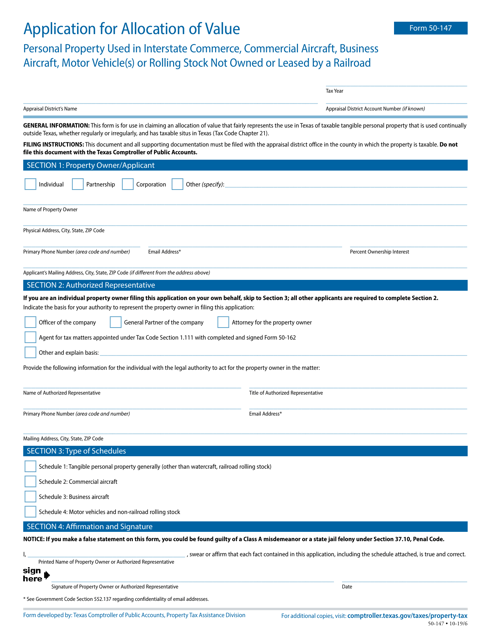

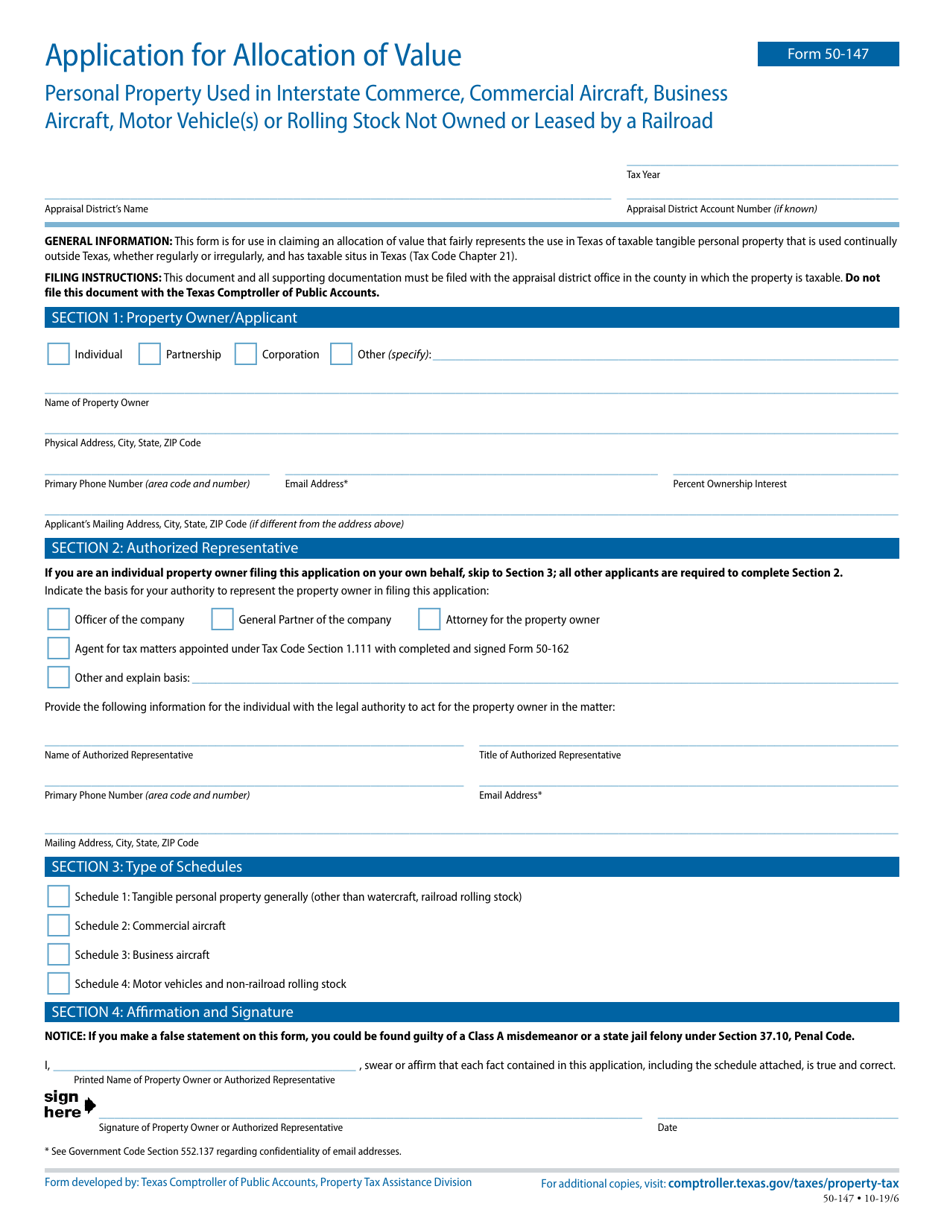

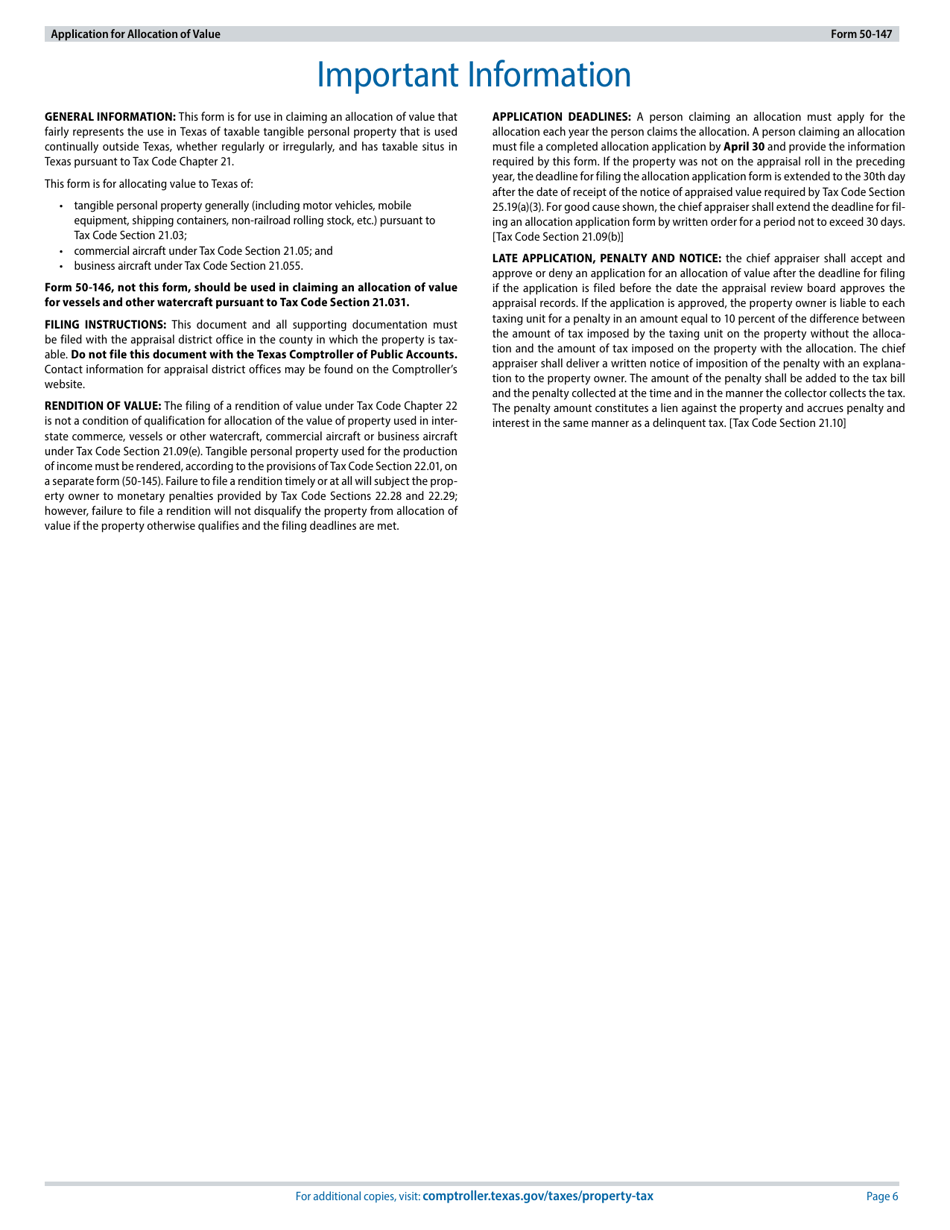

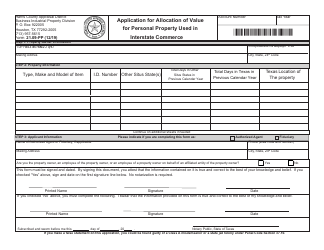

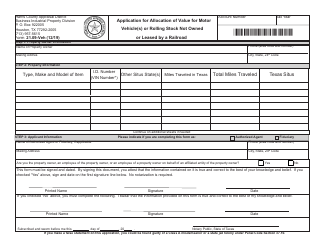

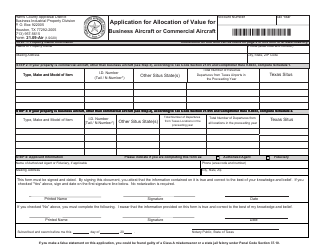

Form 50-147 Application for Allocation of Value for Personal Property Used in Interstate Commerce, Commercial Aircraft, Business Aircraft, Motor Vehicle(S), or Rolling Stock Not Owned or Leased by a Railroad - Texas

What Is Form 50-147?

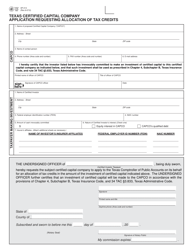

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-147?

A: Form 50-147 is an application for allocation of value for personal property used in interstate commerce or commercial transportation.

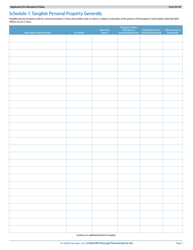

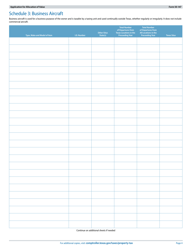

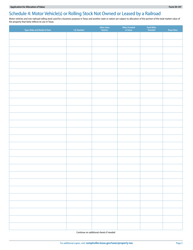

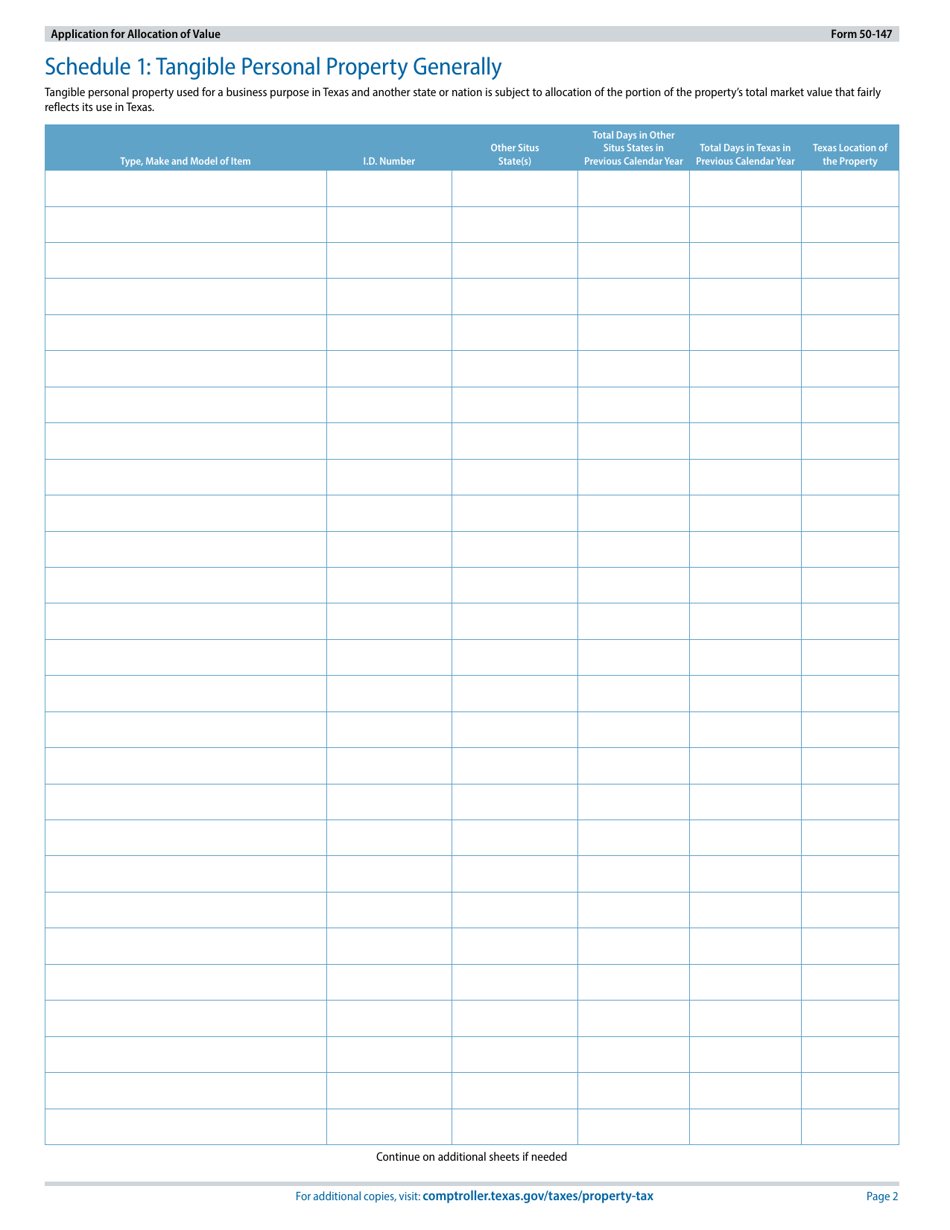

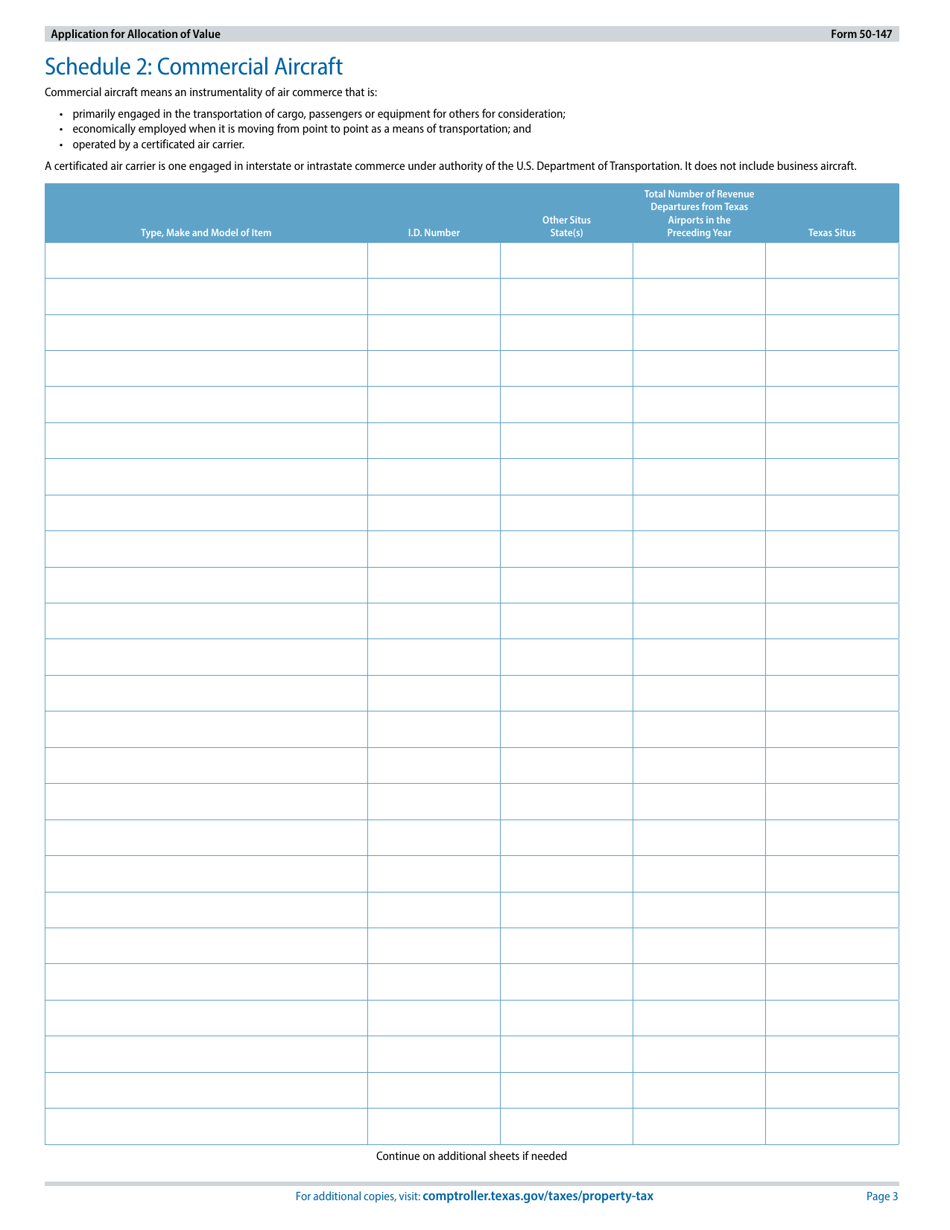

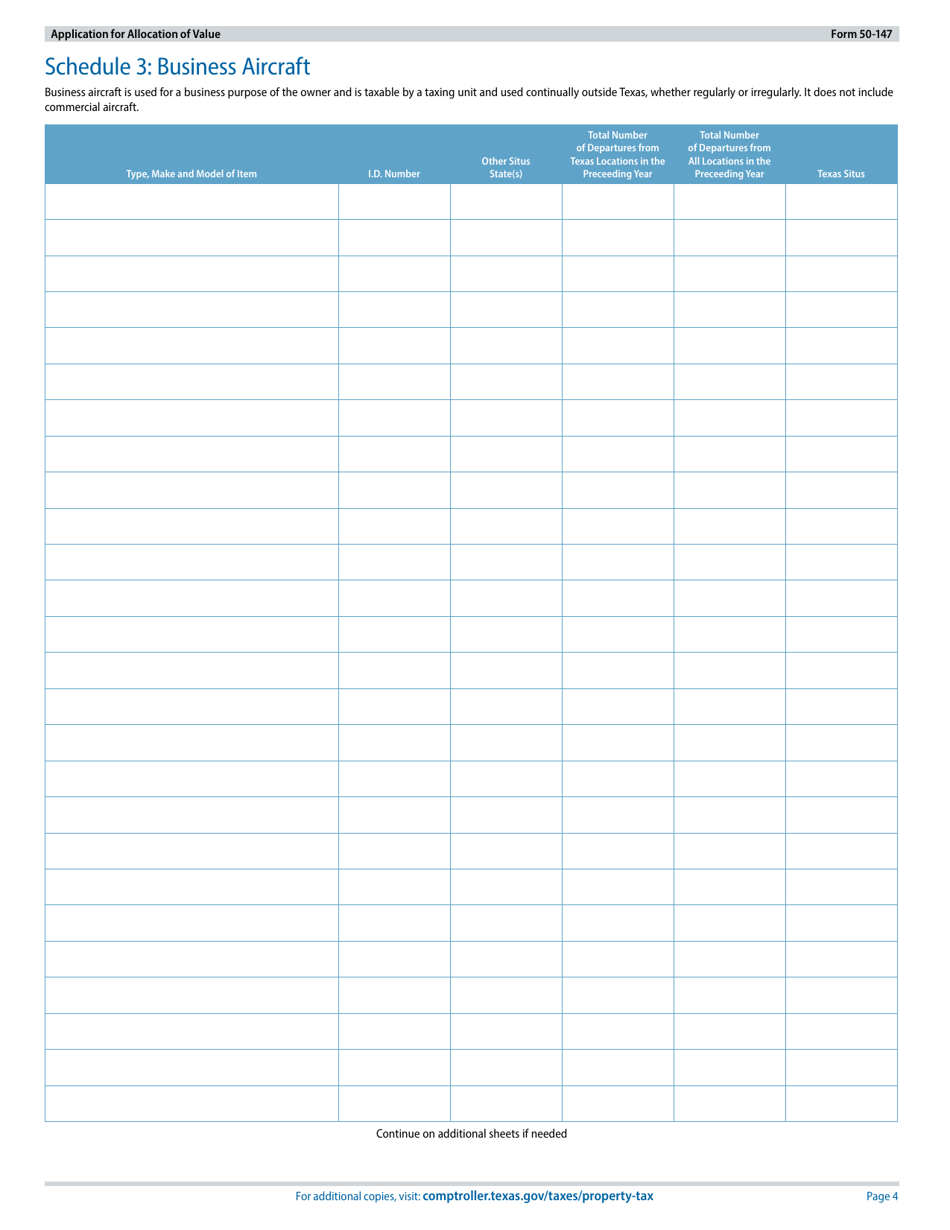

Q: What types of property can be included in Form 50-147?

A: The types of property that can be included in Form 50-147 are commercial aircraft, business aircraft, motor vehicles, or rolling stock not owned or leased by a railroad.

Q: What is the purpose of Form 50-147?

A: The purpose of Form 50-147 is to allocate the value of personal property used in interstate commerce or commercial transportation for tax assessment purposes.

Q: Who should use Form 50-147?

A: Form 50-147 should be used by individuals or companies who own or operate commercial aircraft, business aircraft, motor vehicles, or rolling stock not owned or leased by a railroad.

Q: Are there any filing fees for Form 50-147?

A: There are no filing fees for Form 50-147.

Q: When is the deadline to file Form 50-147?

A: The deadline to file Form 50-147 is April 15th of each year.

Q: What are the consequences of not filing Form 50-147?

A: Failure to file Form 50-147 may result in penalties and interest being assessed.

Q: Is Form 50-147 specific to Texas?

A: Yes, Form 50-147 is specific to the state of Texas.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-147 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.