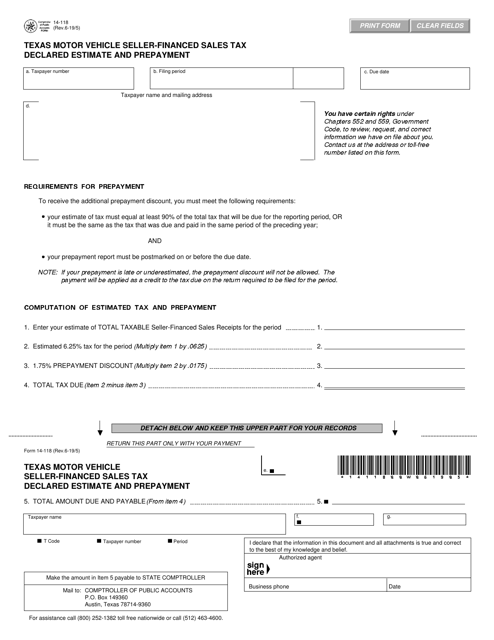

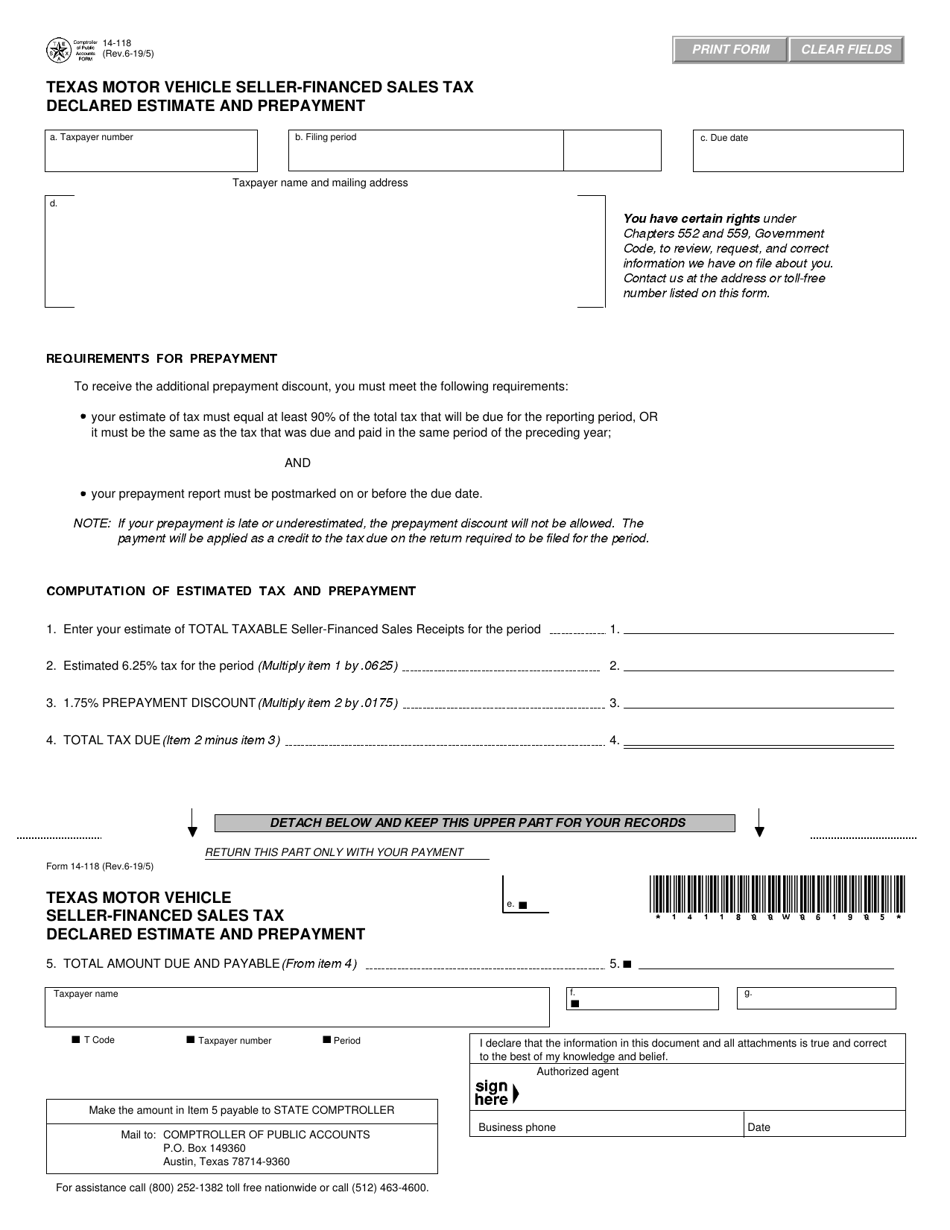

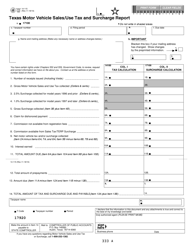

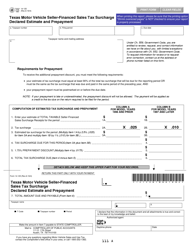

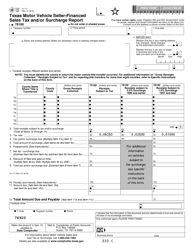

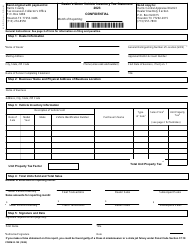

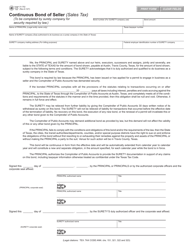

Form 14-118 Texas Motor Vehicle Seller-Financed Sales Tax Declared Estimate and Prepayment - Texas

What Is Form 14-118?

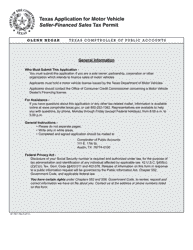

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 14-118?

A: Form 14-118 is a document used in Texas for seller-financed motor vehicle sales tax declaration and prepayment.

Q: What is the purpose of Form 14-118?

A: The purpose of Form 14-118 is to declare and prepay the sales tax on seller-financed motor vehicle sales in Texas.

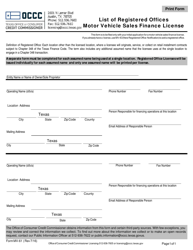

Q: Who uses Form 14-118?

A: This form is used by sellers who finance the sale of motor vehicles in Texas.

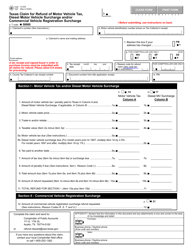

Q: What is seller-financed motor vehicle sales tax?

A: Seller-financed motor vehicle sales tax is the tax paid on the sale of a motor vehicle when the seller provides financing to the buyer.

Q: When is Form 14-118 filed?

A: Form 14-118 must be filed on or before the 20th day of each month for the previous month's sales.

Q: What information does Form 14-118 require?

A: Form 14-118 requires information about the seller, buyer, vehicle, and the amount of tax due.

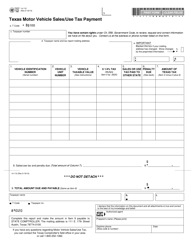

Q: What happens if I don't file Form 14-118?

A: Failure to file Form 14-118 or pay the required tax can result in penalties, interest, and other enforcement actions by the Texas Comptroller.

Q: Can I make prepayments for future motor vehicle sales?

A: Yes, sellers can make prepayments for estimated sales tax on future motor vehicle sales using Form 14-118.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 14-118 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.