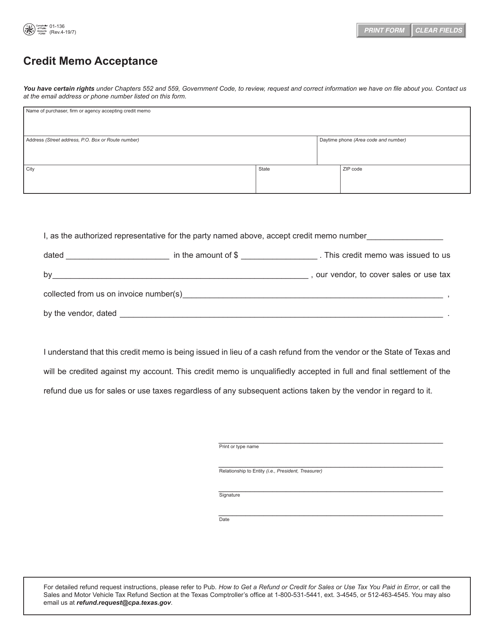

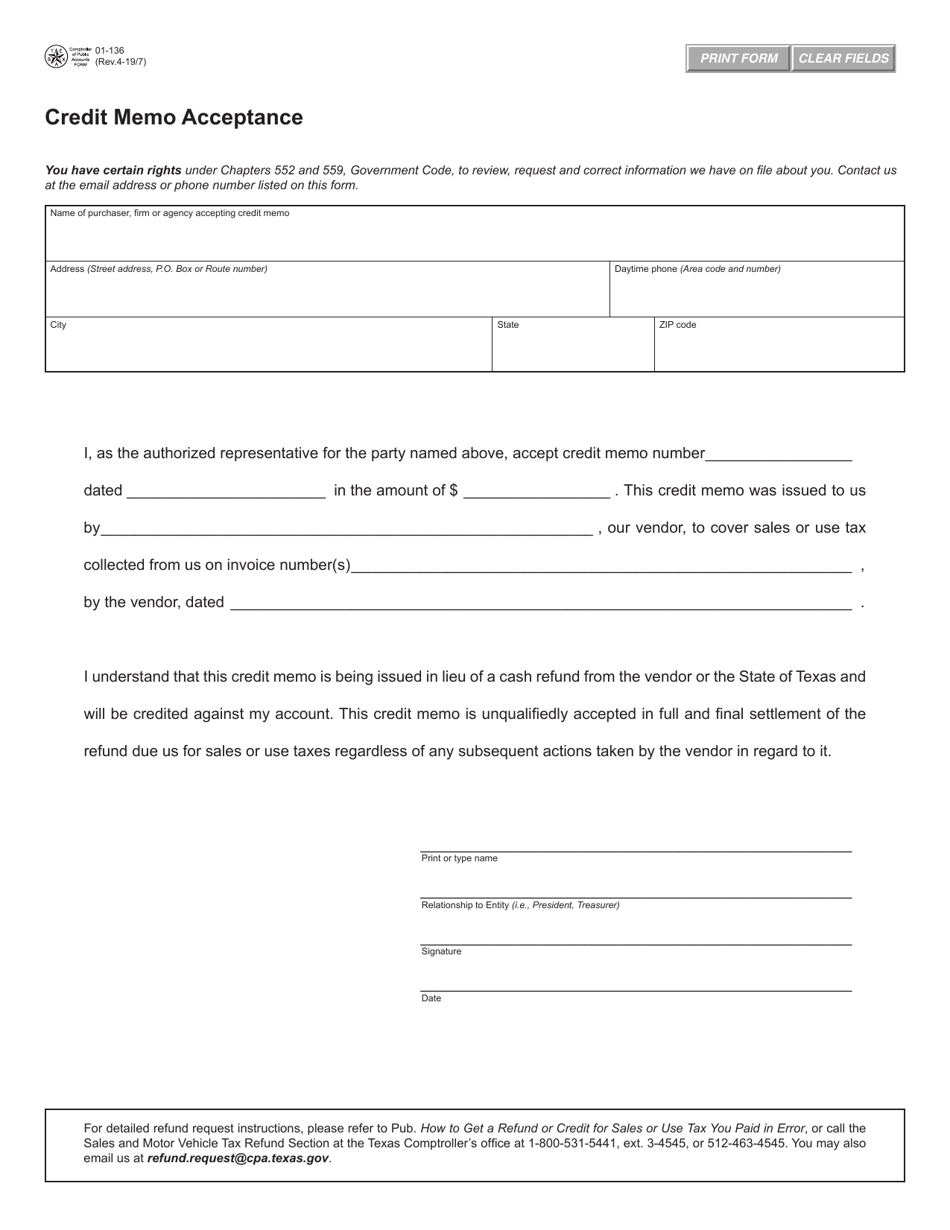

Form 01-136 Credit Memo Acceptance - Texas

What Is Form 01-136?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-136?

A: Form 01-136 is the Credit Memo Acceptance form for the state of Texas.

Q: Who needs to use Form 01-136?

A: Anyone in the state of Texas who has received a credit memo from a seller and wishes to accept it.

Q: What is the purpose of Form 01-136?

A: Form 01-136 is used to formally accept a credit memo, indicating that the recipient agrees to the terms and conditions of the credit.

Q: Are there any fees associated with Form 01-136?

A: No, there are no fees associated with the submission of Form 01-136.

Q: When should Form 01-136 be submitted?

A: Form 01-136 should be submitted within 20 business days from the date of receipt of the credit memo.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-136 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.