This version of the form is not currently in use and is provided for reference only. Download this version of

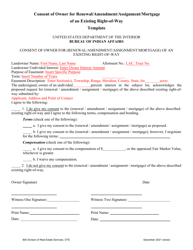

Form 00-985

for the current year.

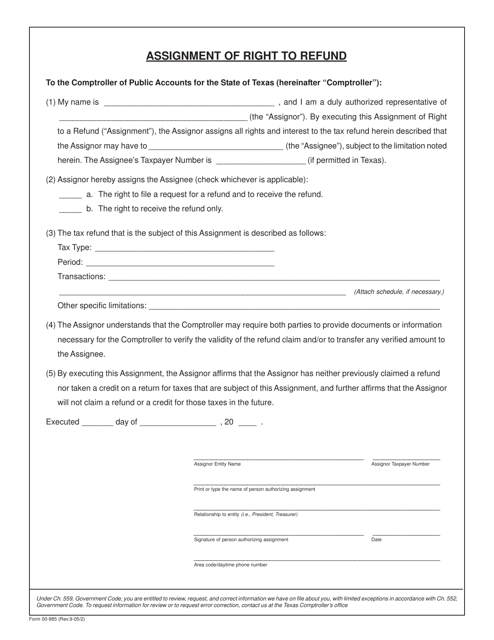

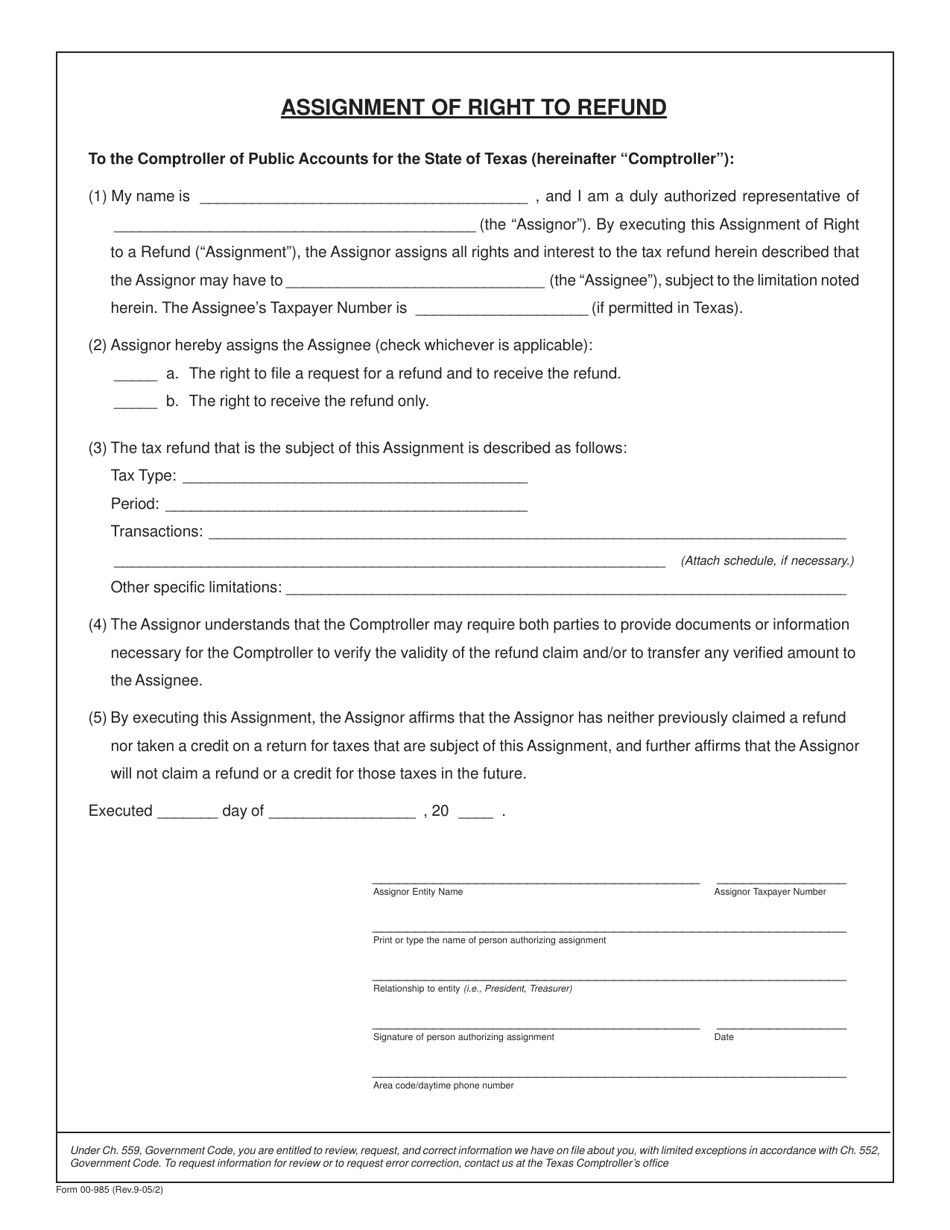

Form 00-985 Assignment of Right to Refund - Texas

What Is Form 00-985?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 00-985?

A: Form 00-985 is an Assignment of Right to Refund document specific to Texas.

Q: What is the purpose of form 00-985?

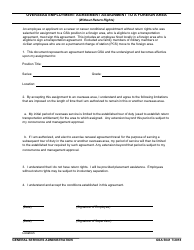

A: The purpose of form 00-985 is to assign the right to claim a refund to another person or entity.

Q: Who can use form 00-985?

A: Form 00-985 can be used by individuals or entities who are eligible for a refund in Texas and want to assign that right to someone else.

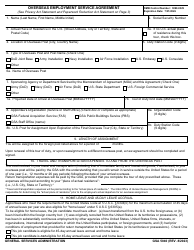

Q: How do I fill out form 00-985?

A: You need to provide your name, address, Social Security Number or Taxpayer Identification Number, the amount of the refund, and the name and address of the assignee.

Q: Is there a fee for filing form 00-985?

A: There is no fee for filing form 00-985 in Texas.

Q: Can I revoke the assignment made on form 00-985?

A: Yes, you can revoke the assignment by submitting a written notice to the assignee and the Texas Comptroller of Public Accounts.

Q: What happens after I submit form 00-985?

A: After submitting form 00-985, the assignee will have the right to claim the refund on your behalf.

Q: Can I assign my refund to multiple assignees using form 00-985?

A: No, you can only assign your refund to one assignee using form 00-985.

Q: Is form 00-985 specific to Texas?

A: Yes, form 00-985 is specific to Texas and cannot be used in other states.

Form Details:

- Released on September 1, 2005;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 00-985 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.