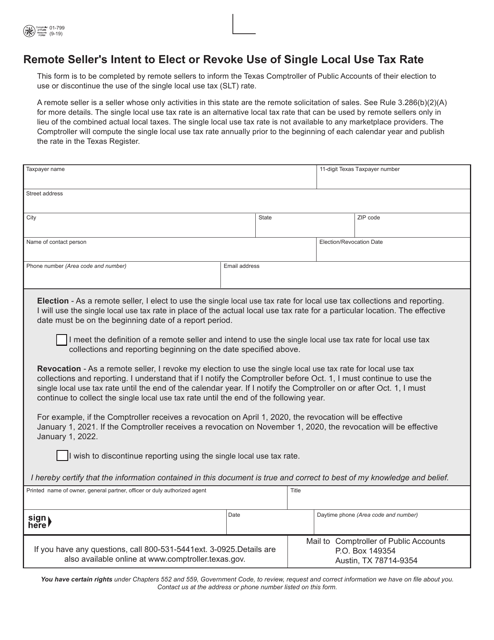

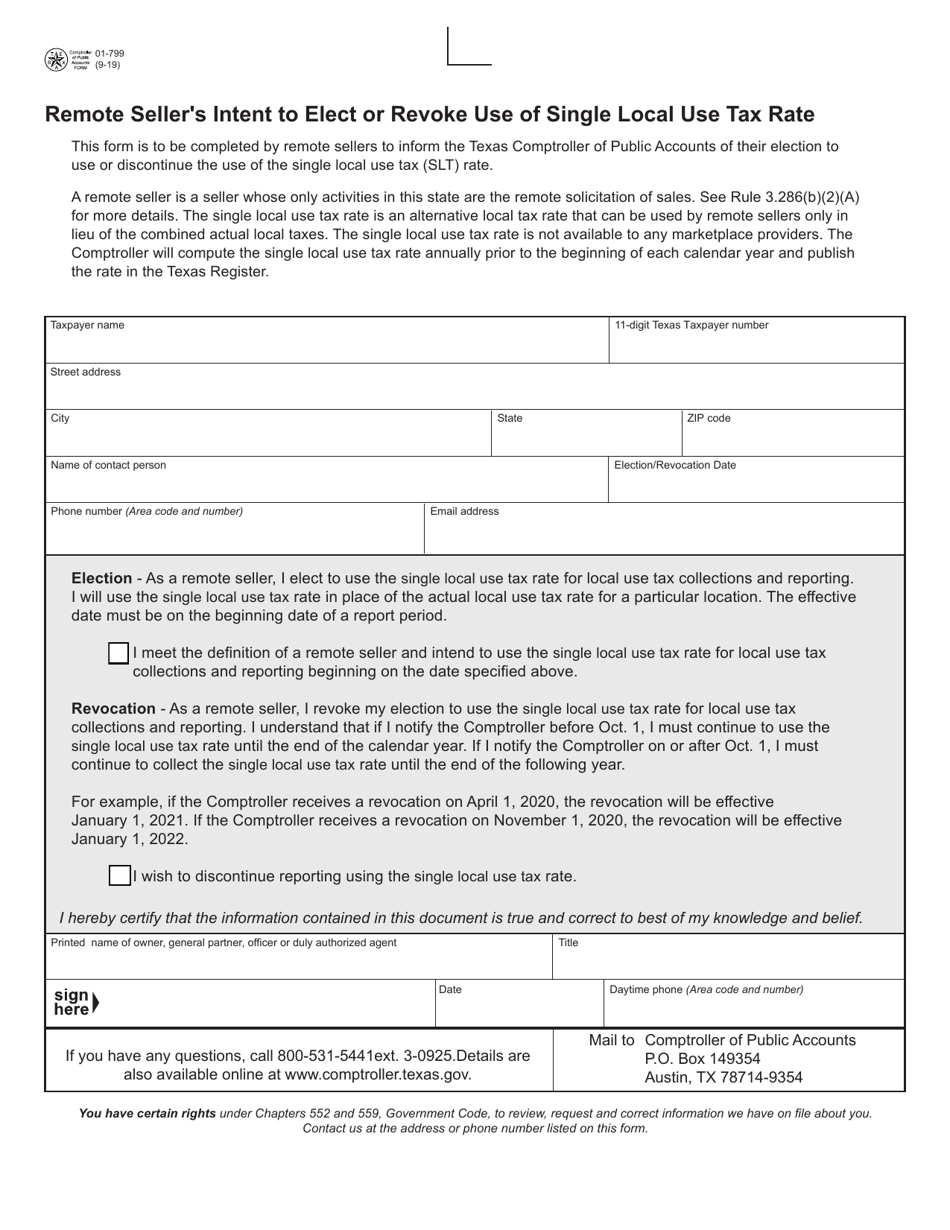

Form 01-799 Remote Seller's Intent to Elect or Revoke Use of Single Local Use Tax Rate - Texas

What Is Form 01-799?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-799?

A: Form 01-799 is a document used in Texas for remote sellers to elect or revoke their use of a single local use tax rate.

Q: What is a remote seller?

A: A remote seller is a business that sells goods or services in Texas but does not have a physical presence in the state.

Q: What is a local use tax rate?

A: A local use tax rate is the tax rate imposed by a specific local jurisdiction on the use of a taxable item.

Q: Why would a remote seller need to elect or revoke the use of a single local use tax rate?

A: Remote sellers may choose to use a single local use tax rate to simplify the process of collecting and remitting local use taxes in Texas.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-799 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.