This version of the form is not currently in use and is provided for reference only. Download this version of

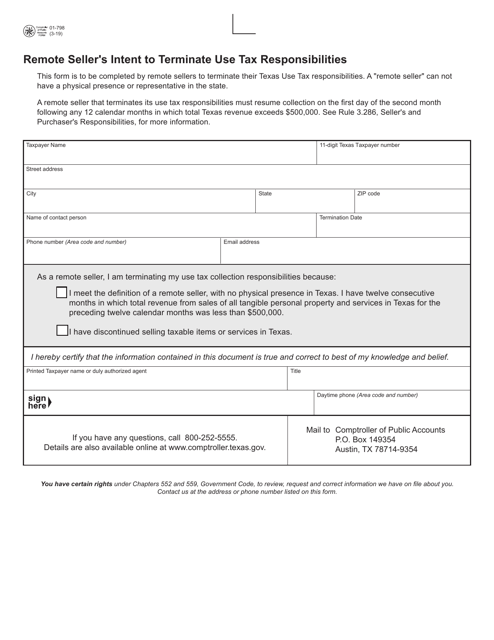

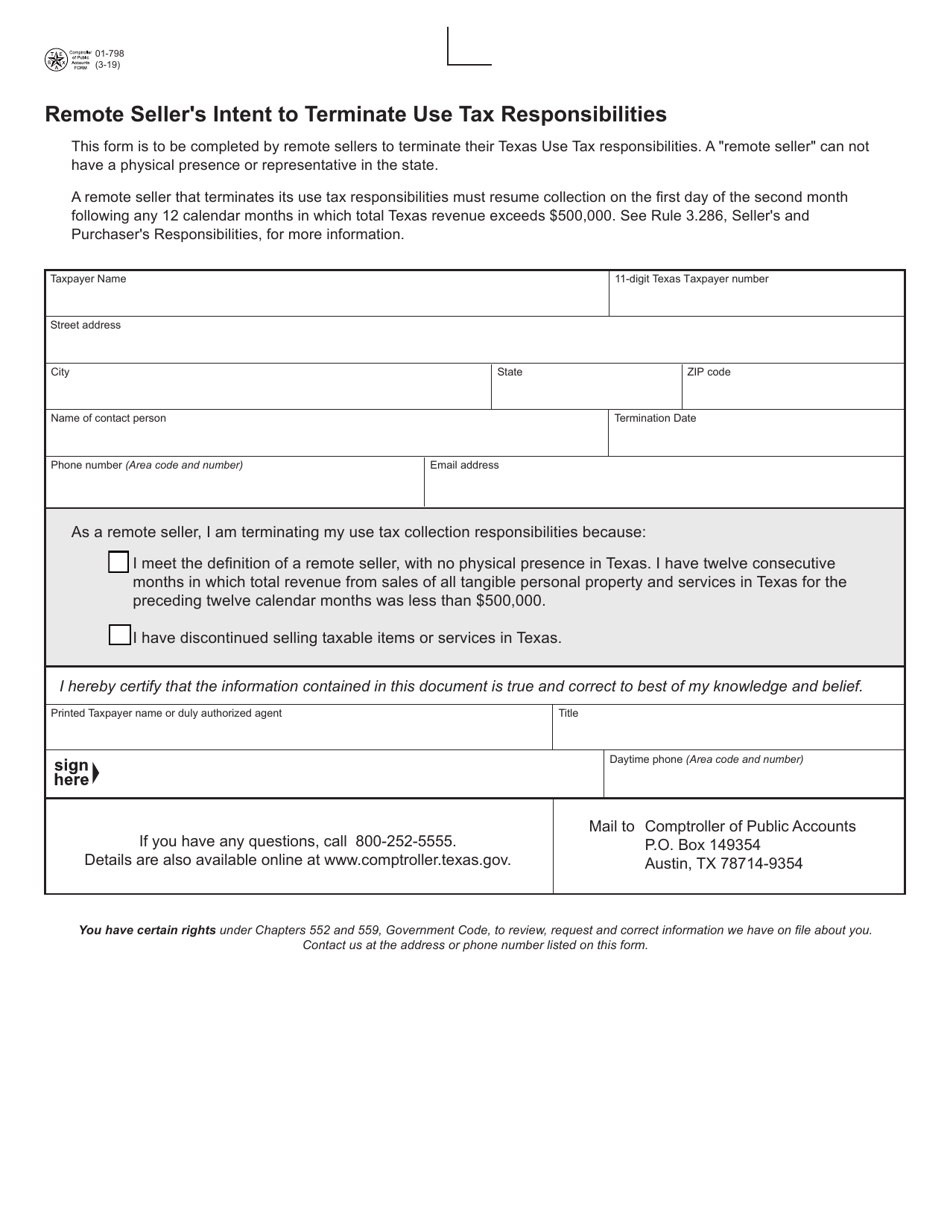

Form 01-798

for the current year.

Form 01-798 Remote Seller's Intent to Terminate Use Tax Responsibilities - Texas

What Is Form 01-798?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-798?

A: Form 01-798 is the Remote Seller's Intent to Terminate Use Tax Responsibilities form in Texas.

Q: Who needs to use Form 01-798?

A: Remote sellers who want to terminate their use tax responsibilities in Texas need to use Form 01-798.

Q: What is use tax?

A: Use tax is a tax imposed on the use, storage, or consumption of taxable items purchased without payment of state and local sales taxes.

Q: What is a remote seller?

A: A remote seller is a seller who does not have a physical presence in Texas but makes sales to Texas customers via internet, mail, or phone.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-798 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.