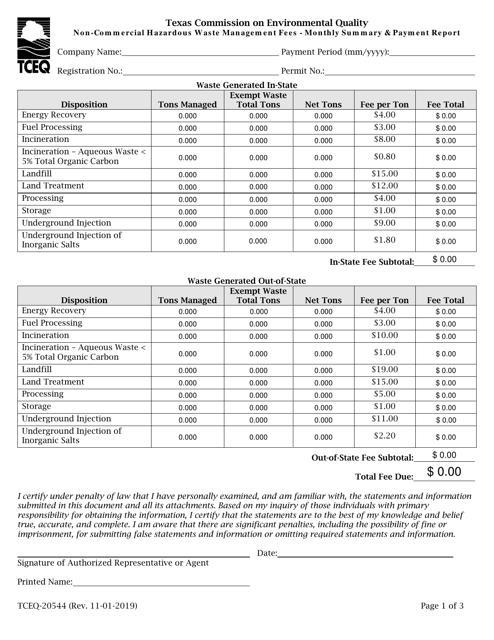

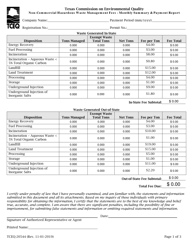

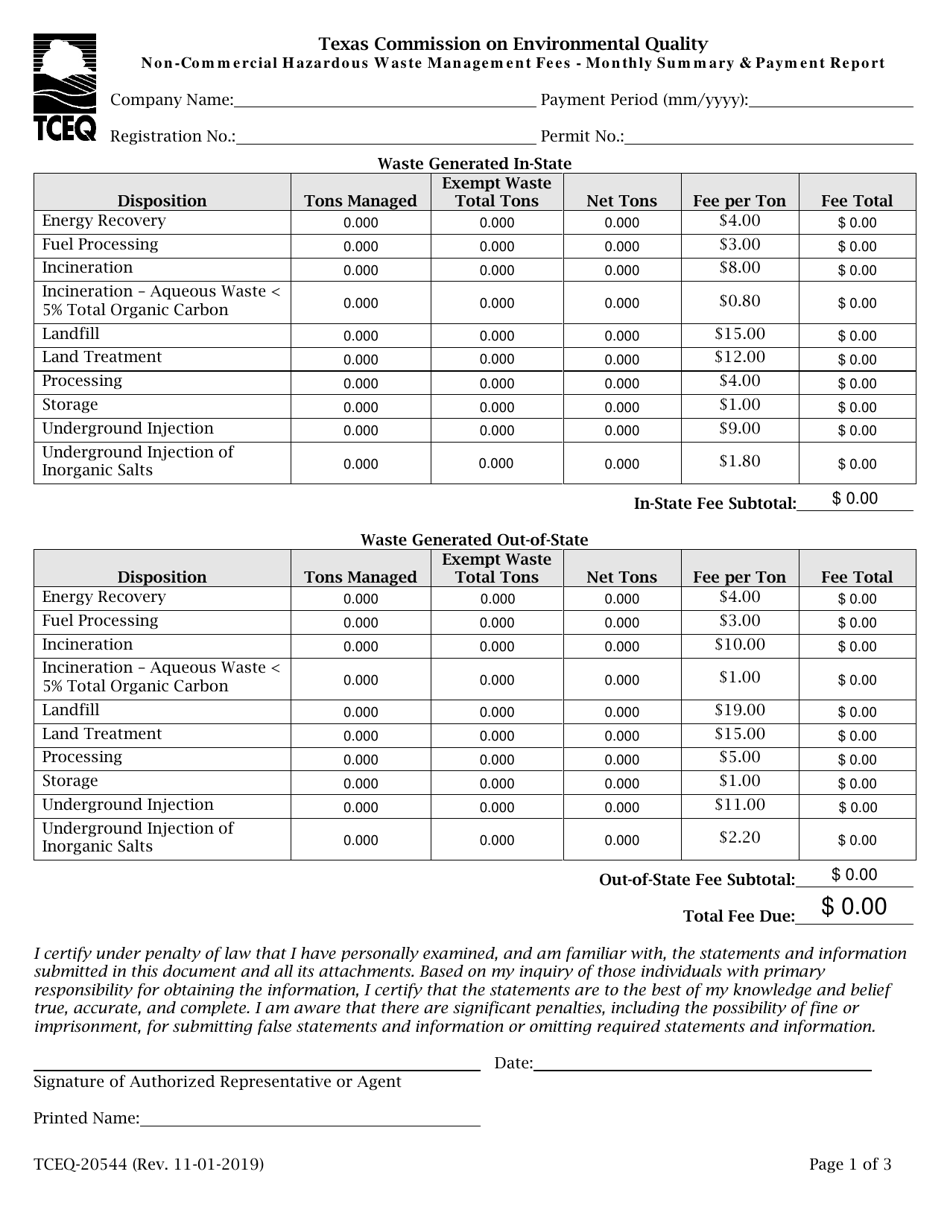

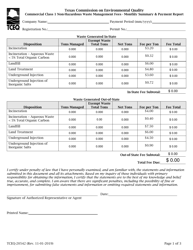

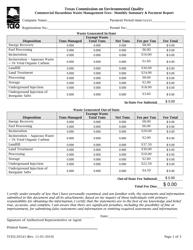

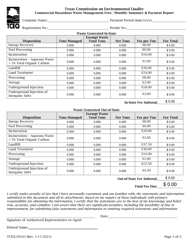

Form 20544 Non-commercial Hazardous Waste Management Fees - Monthly Summary & Payment Report - Texas

What Is Form 20544?

This is a legal form that was released by the Texas Commission on Environmental Quality - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 20544?

A: Form 20544 is a Non-commercial Hazardous Waste Management Fees - Monthly Summary & Payment Report.

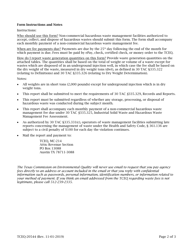

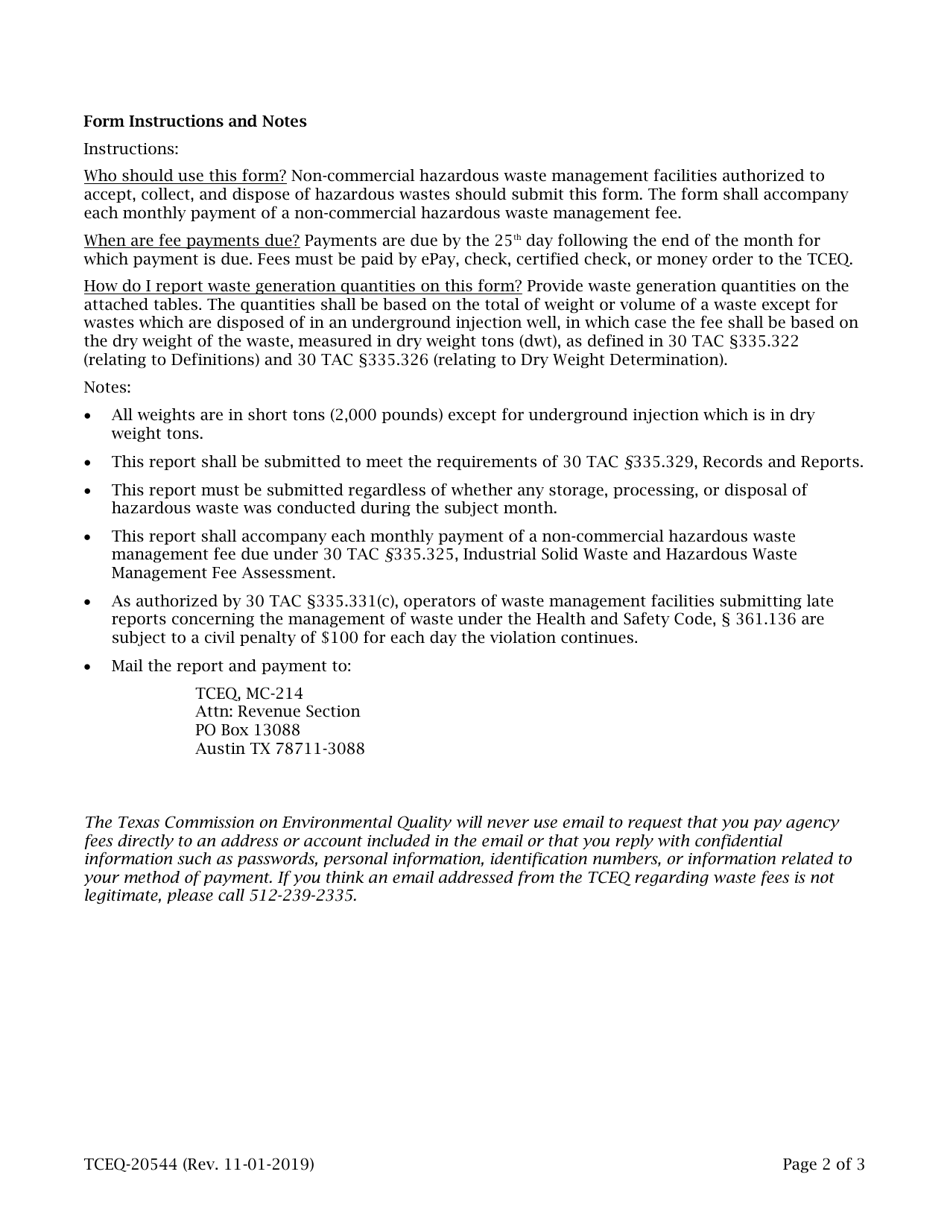

Q: Who needs to file Form 20544?

A: Entities in Texas that generate, transport, store, treat, or dispose of non-commercial hazardous waste are required to file Form 20544.

Q: What is the purpose of Form 20544?

A: Form 20544 is used to report and remit the non-commercial hazardous waste management fees owed to the Texas Commission on Environmental Quality (TCEQ).

Q: When is Form 20544 due?

A: Form 20544 is due on or before the 25th day of the month following the reporting period.

Q: What happens if I don't file Form 20544?

A: Failure to file Form 20544 or pay the fees by the due date may result in penalties and interest.

Q: Is there a fee for filing Form 20544?

A: Yes, there are fees associated with filing Form 20544. The amount of fees owed depends on the amount and type of non-commercial hazardous waste generated.

Q: Can Form 20544 be filed electronically?

A: Yes, Form 20544 can be filed electronically through the TCEQ's e-Services system.

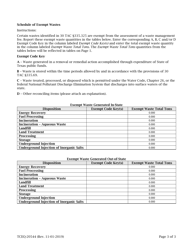

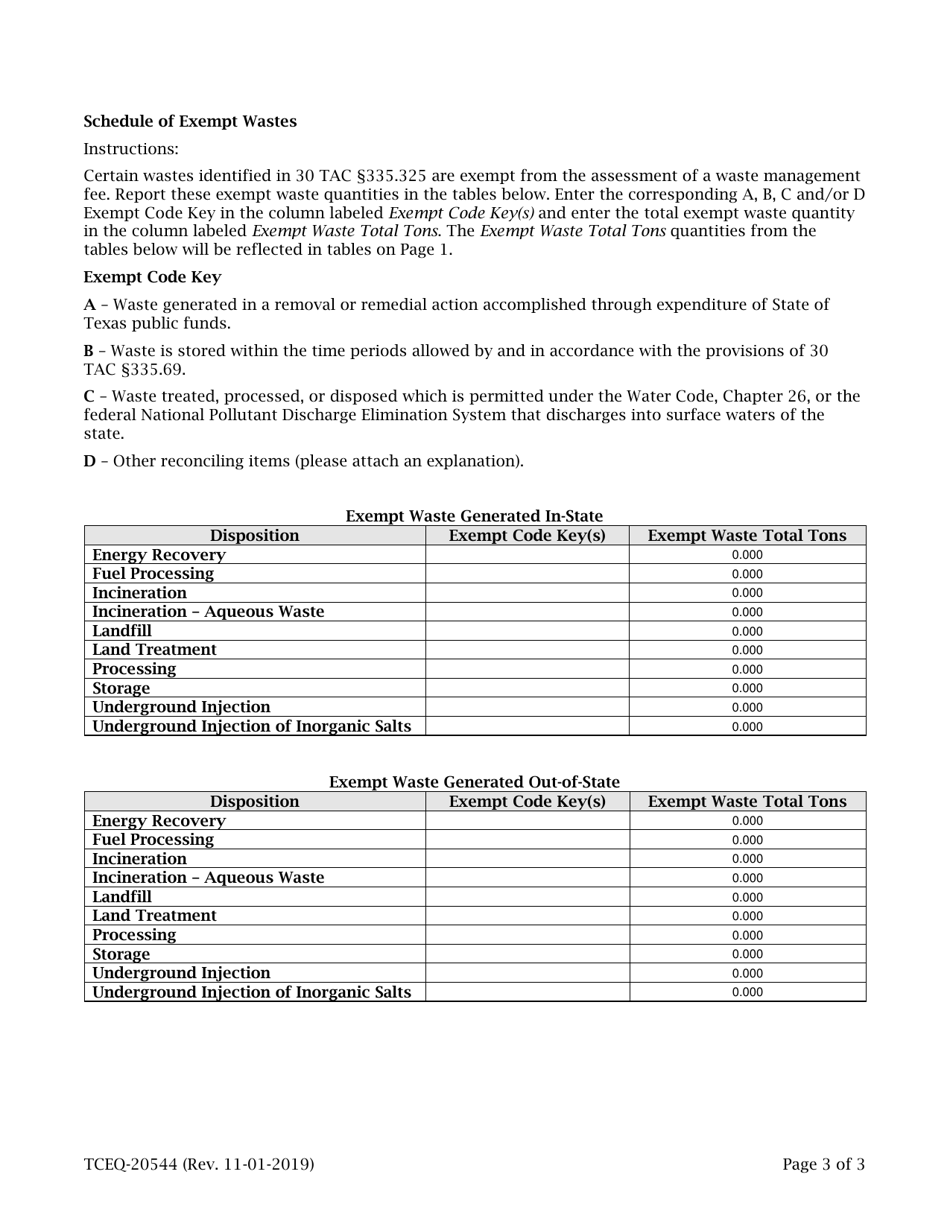

Q: Are there any exemptions to filing Form 20544?

A: Yes, certain exemptions exist for entities that meet specific criteria. It is recommended to review the instructions for Form 20544 to determine eligibility for exemptions.

Q: What types of hazardous waste are covered by Form 20544?

A: Form 20544 covers non-commercial hazardous waste, which includes hazardous waste generated by households, small quantity generators, and conditionally exempt small quantity generators.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Texas Commission on Environmental Quality;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 20544 by clicking the link below or browse more documents and templates provided by the Texas Commission on Environmental Quality.