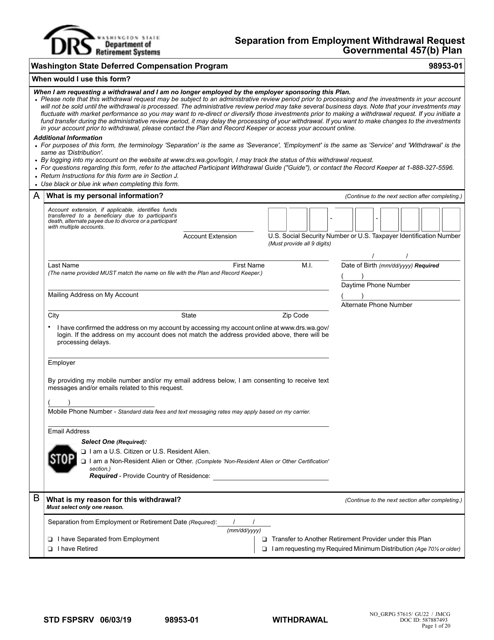

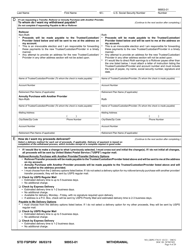

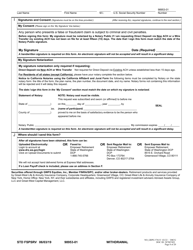

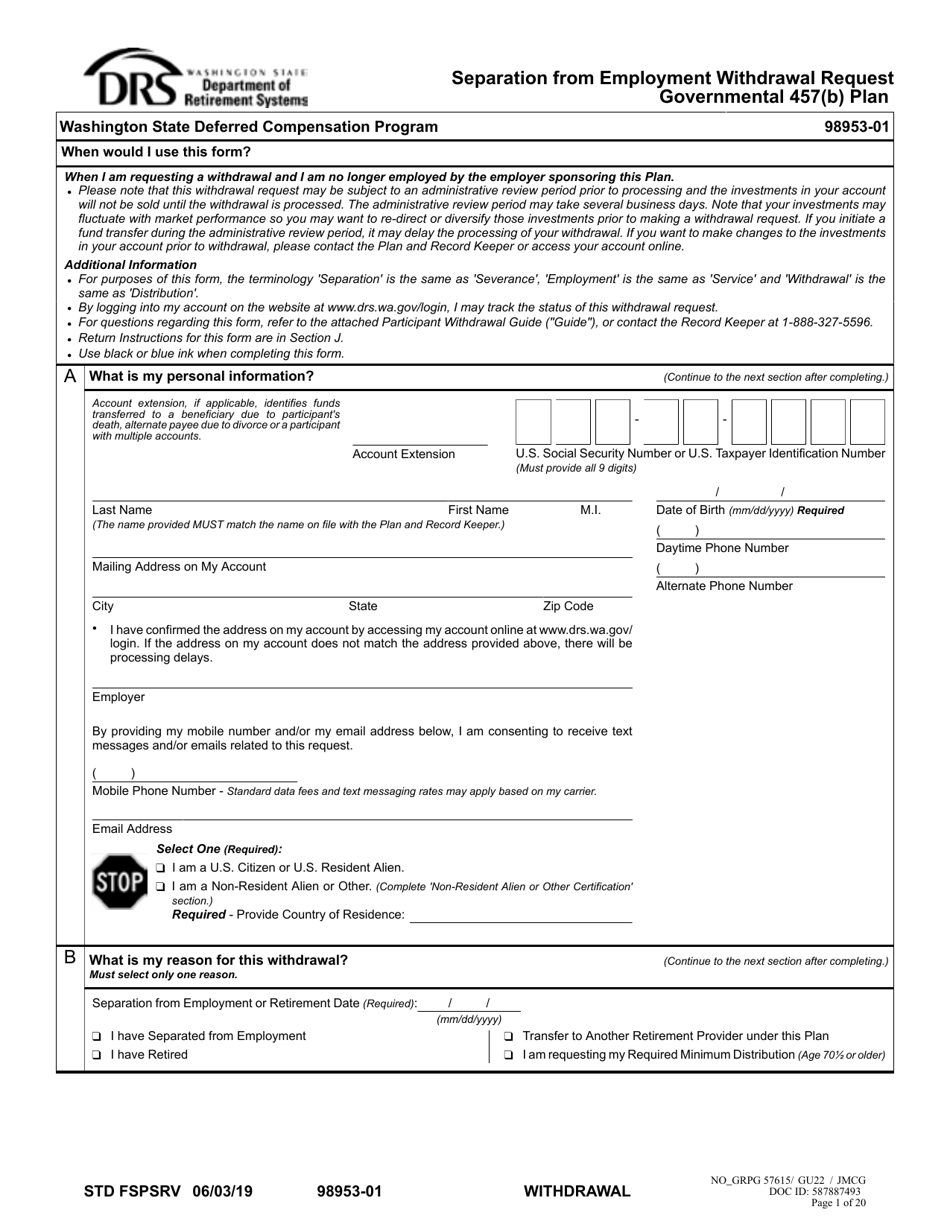

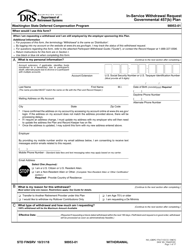

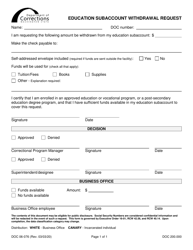

Separation From Employment Withdrawal Request - Washington

Separation From Employment Withdrawal Request is a legal document that was released by the Washington State Department of Retirement Systems - a government authority operating within Washington.

FAQ

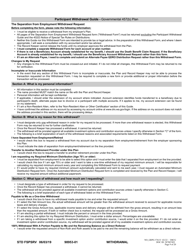

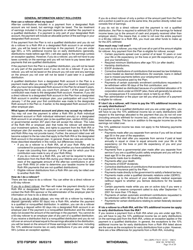

Q: What is a Separation From Employment Withdrawal Request?

A: A Separation From Employment Withdrawal Request is a form that allows individuals in Washington to withdraw funds from their retirement account when they are separated from their employer.

Q: Who can use a Separation From Employment Withdrawal Request?

A: Individuals who are separated from their employer in Washington can use a Separation From Employment Withdrawal Request.

Q: What is the purpose of a Separation From Employment Withdrawal Request?

A: The purpose of a Separation From Employment Withdrawal Request is to allow individuals to access funds from their retirement account when they are no longer employed.

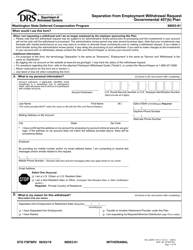

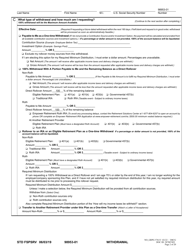

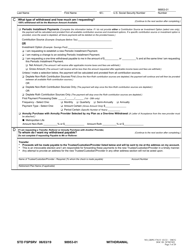

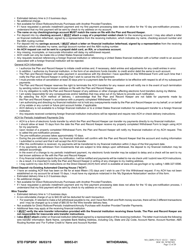

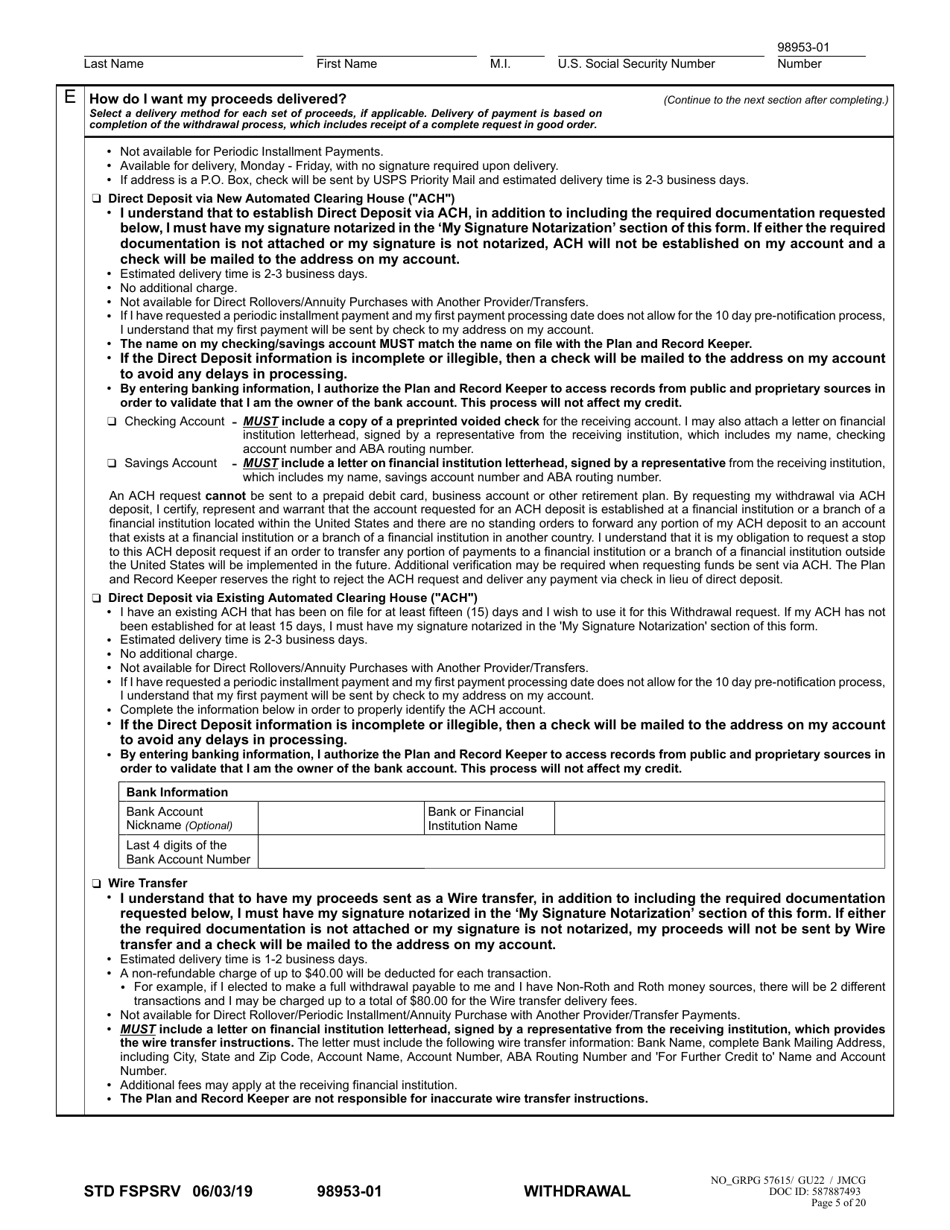

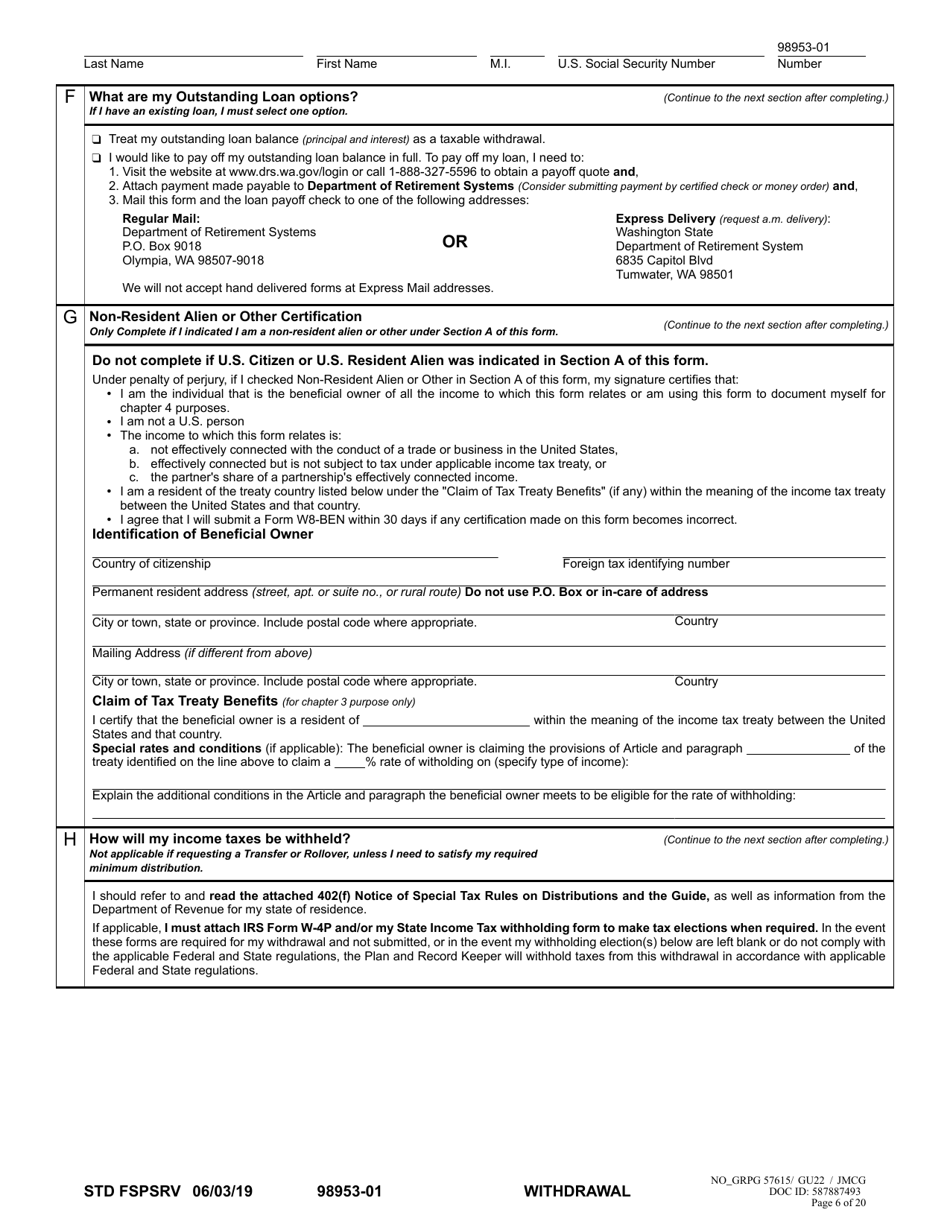

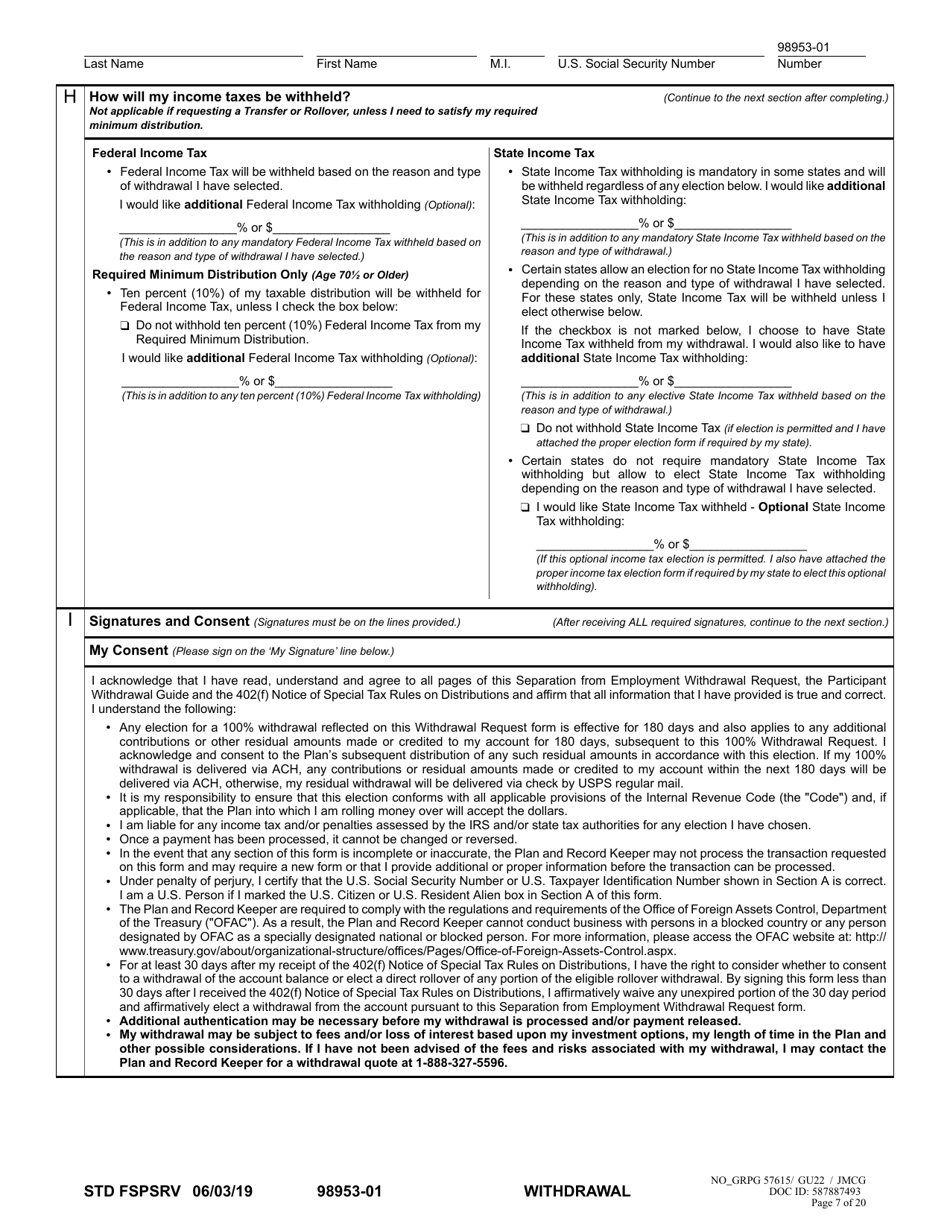

Q: How do I fill out a Separation From Employment Withdrawal Request?

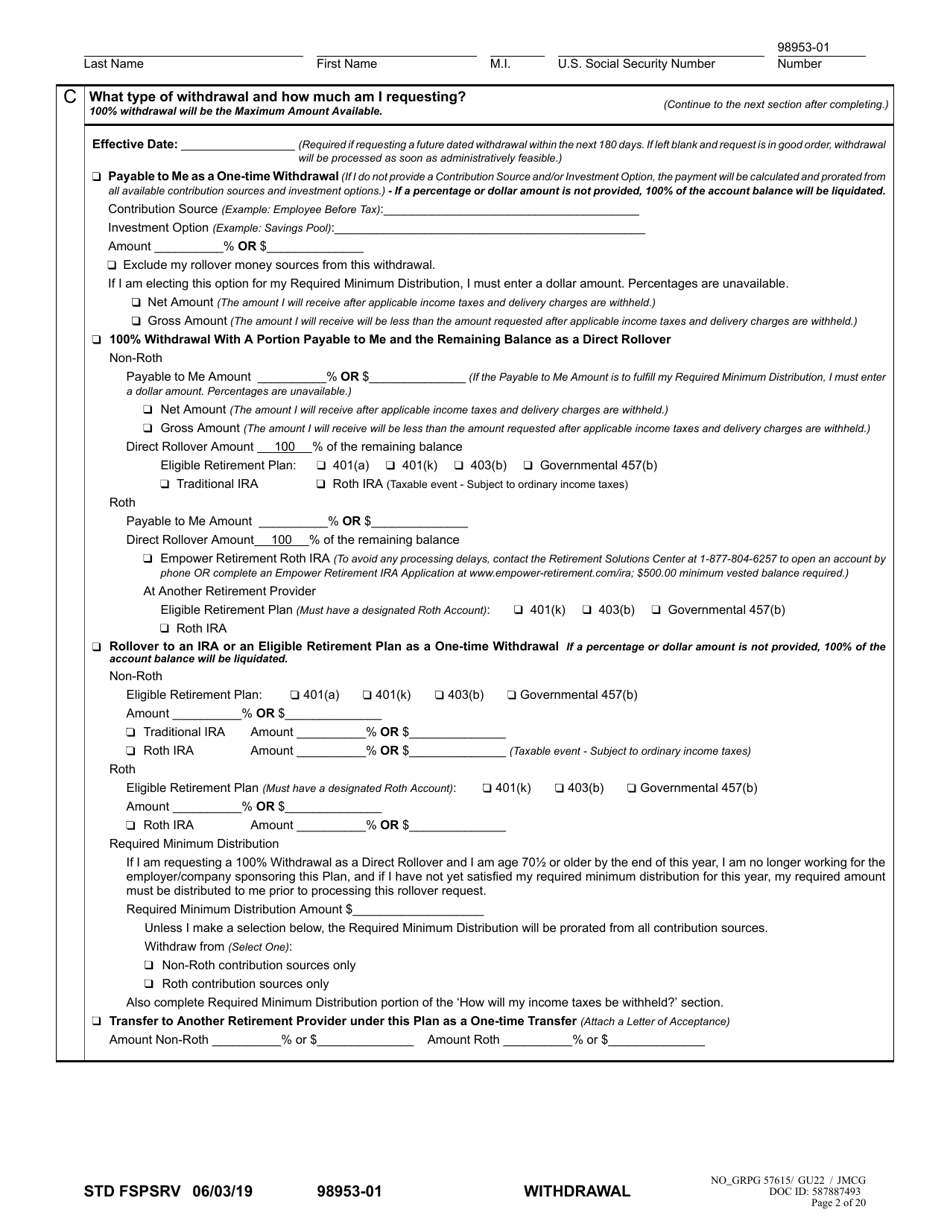

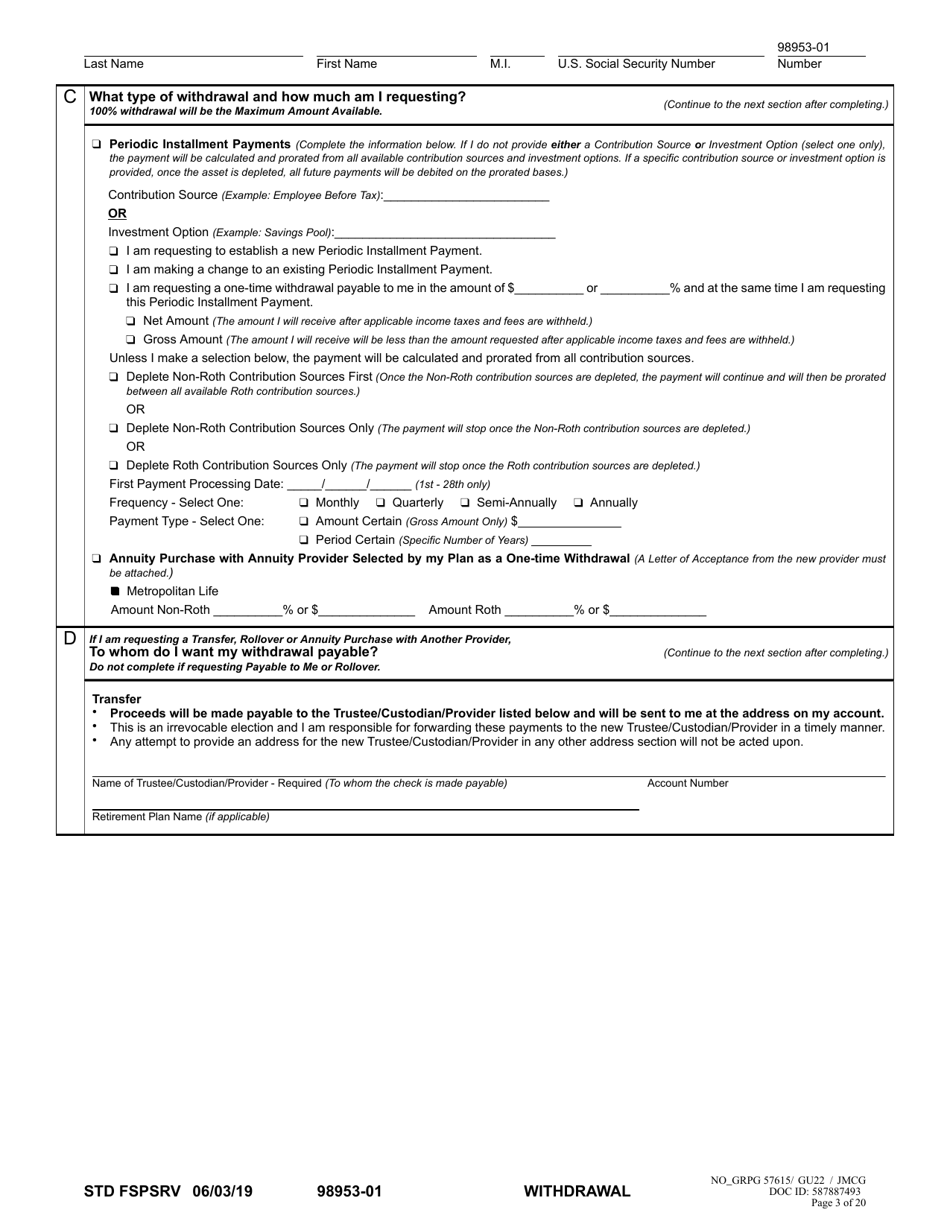

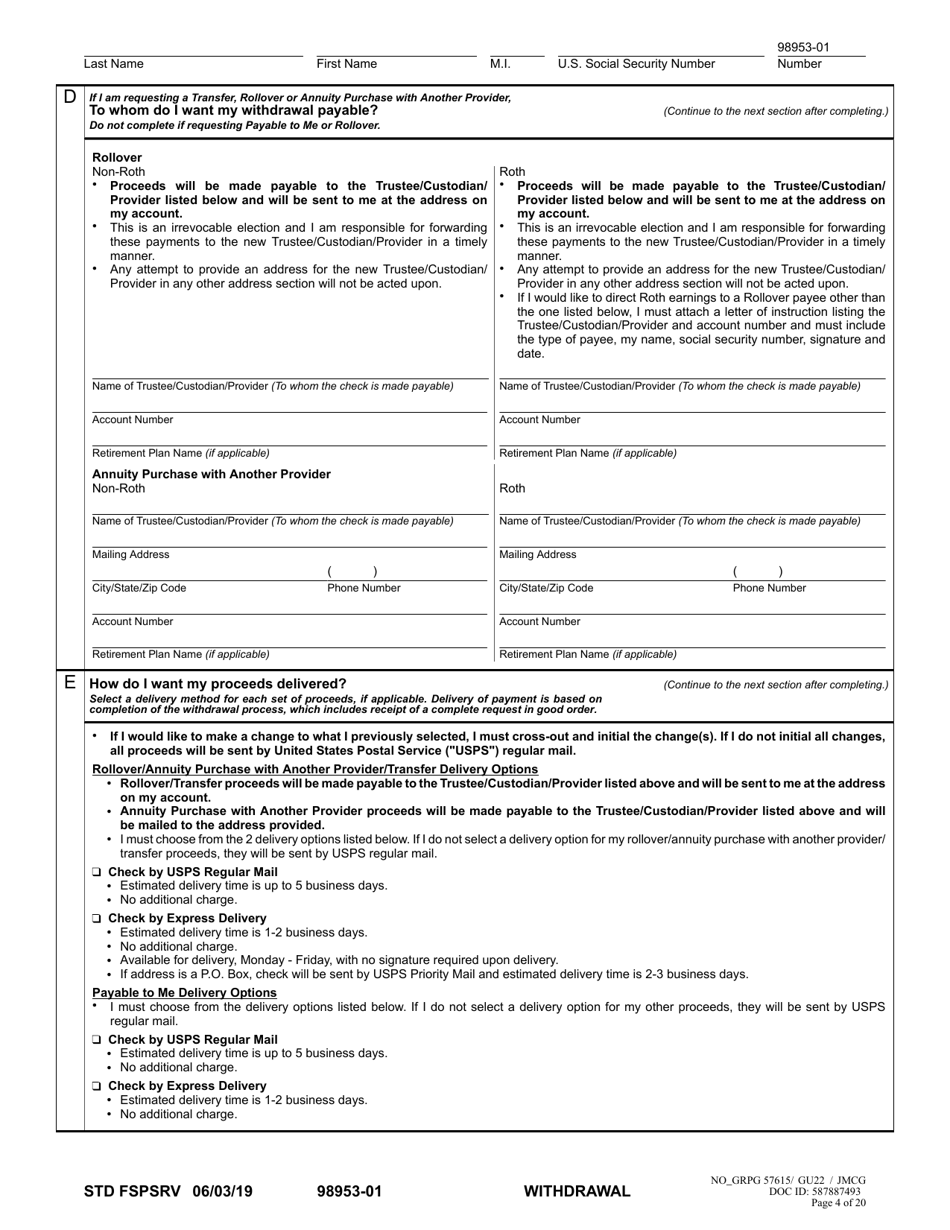

A: To fill out a Separation From Employment Withdrawal Request, you will need to provide your personal information, details about your retirement account, and the reason for your separation from employment.

Q: What documentation do I need to submit with a Separation From Employment Withdrawal Request?

A: You may need to submit documentation such as proof of your separation from employment, proof of your retirement account balance, and any other supporting documents requested by your retirement account provider.

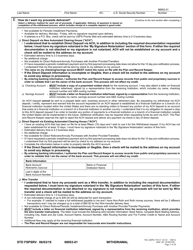

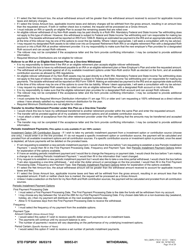

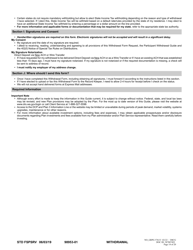

Q: How long does it take to process a Separation From Employment Withdrawal Request?

A: The processing time for a Separation From Employment Withdrawal Request can vary depending on your retirement account provider, but it typically takes a few weeks to process.

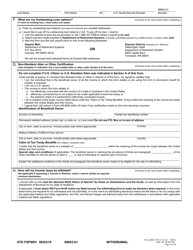

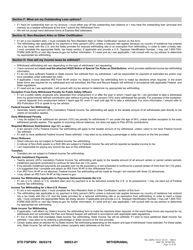

Q: Are there any taxes or penalties for withdrawing funds using a Separation From Employment Withdrawal Request?

A: Yes, there may be taxes and penalties associated with withdrawing funds from your retirement account using a Separation From Employment Withdrawal Request. It is important to consult with a tax advisor or financial professional to understand the potential tax implications.

Q: Can I roll over the funds from a Separation From Employment Withdrawal Request into another retirement account?

A: In some cases, you may be able to roll over the funds from a Separation From Employment Withdrawal Request into another retirement account. It is important to check with your retirement account provider for specific instructions.

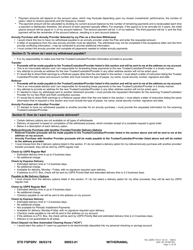

Q: What happens if I do not use a Separation From Employment Withdrawal Request?

A: If you do not use a Separation From Employment Withdrawal Request, you may not be able to access the funds in your retirement account until you meet the requirements for a different type of withdrawal.

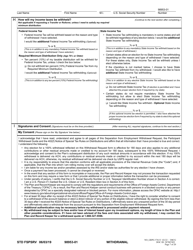

Form Details:

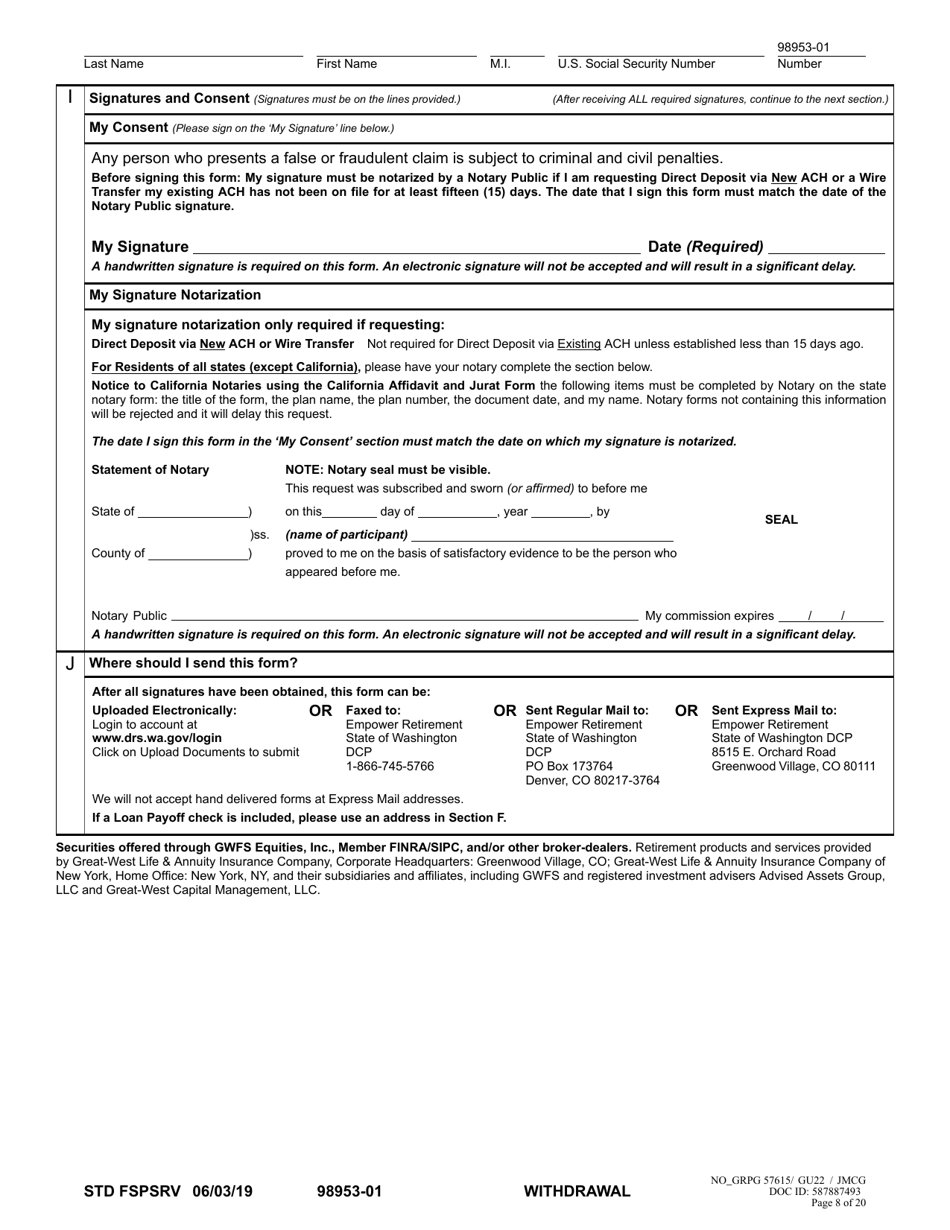

- Released on June 3, 2019;

- The latest edition currently provided by the Washington State Department of Retirement Systems;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Washington State Department of Retirement Systems.