This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

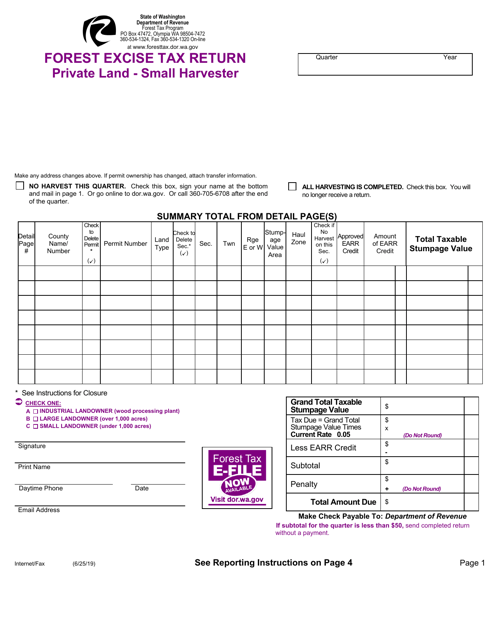

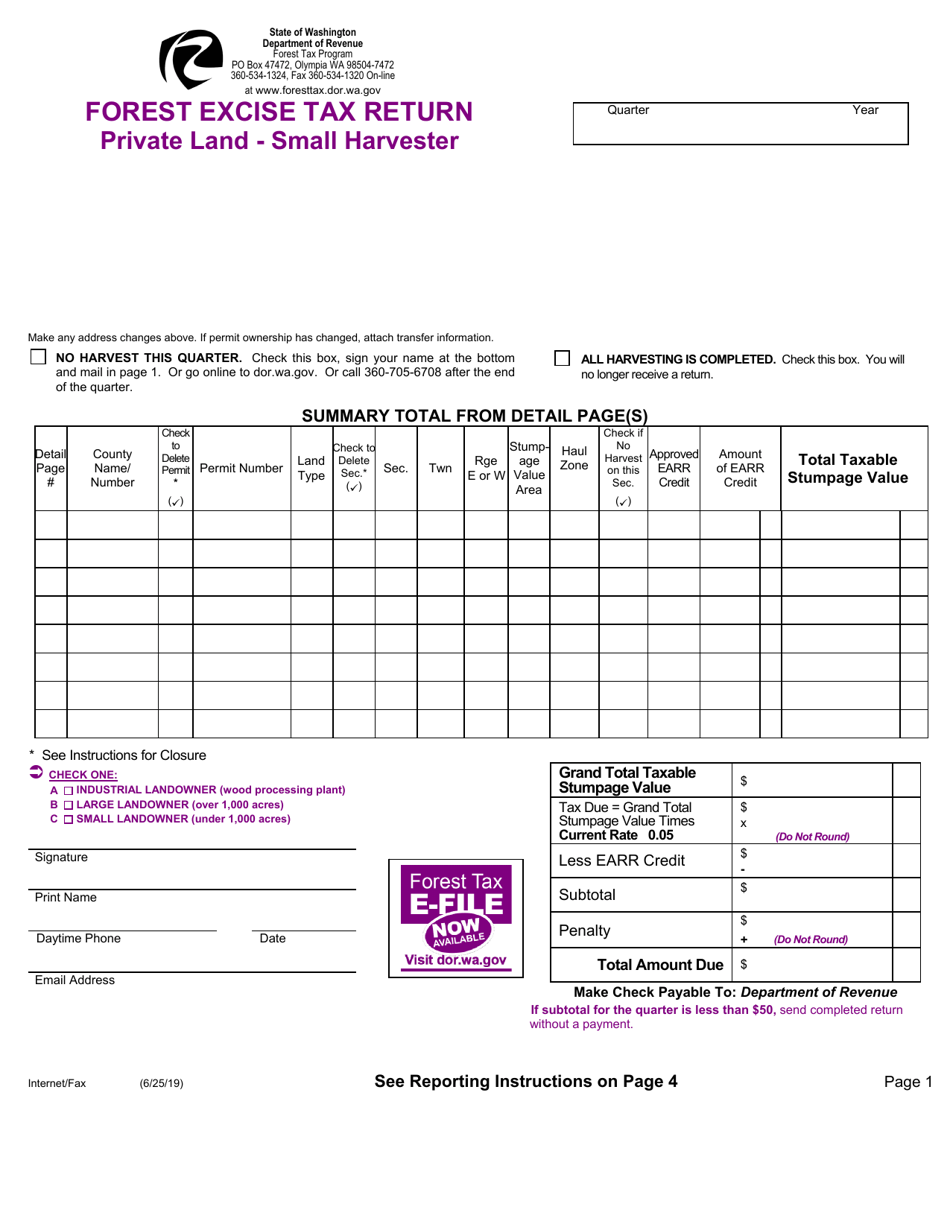

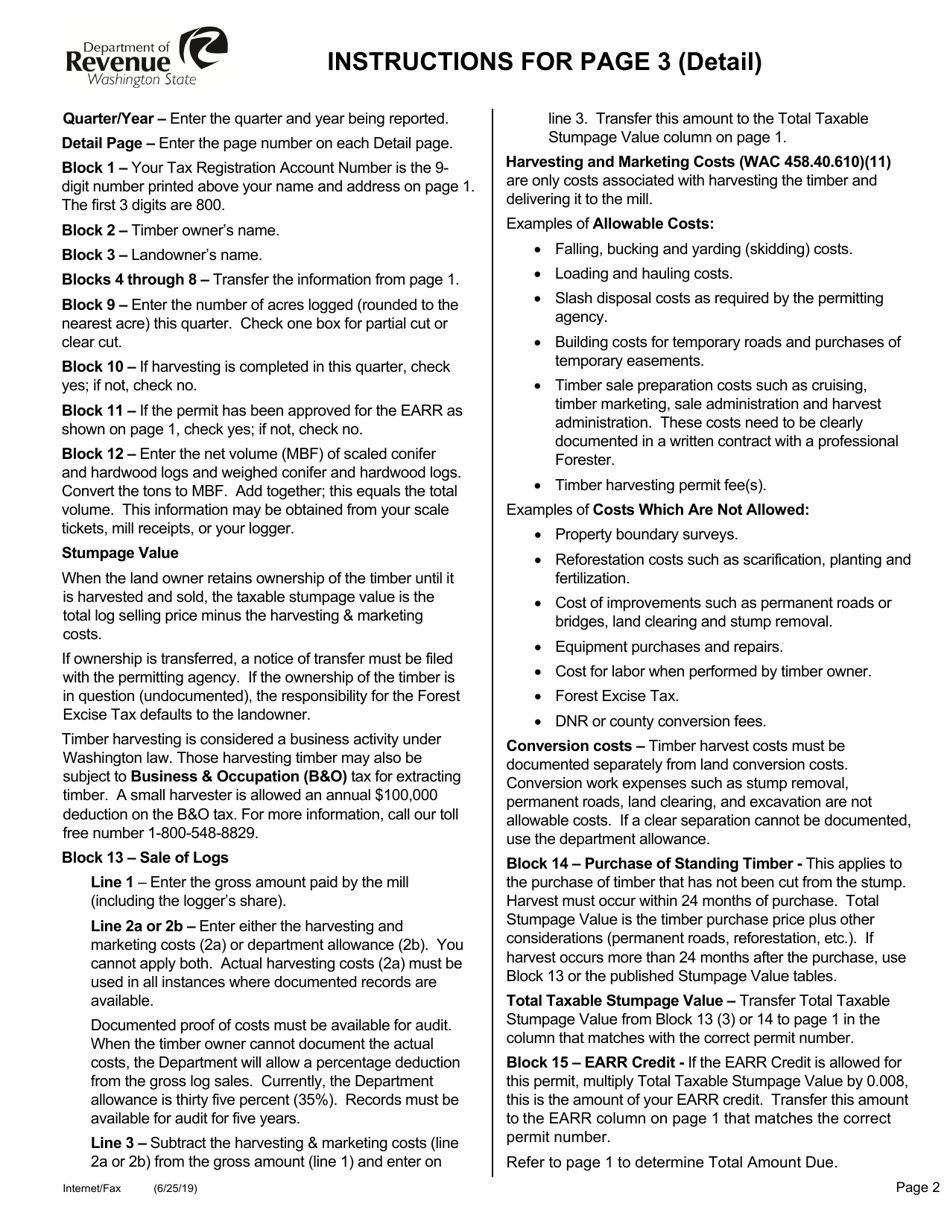

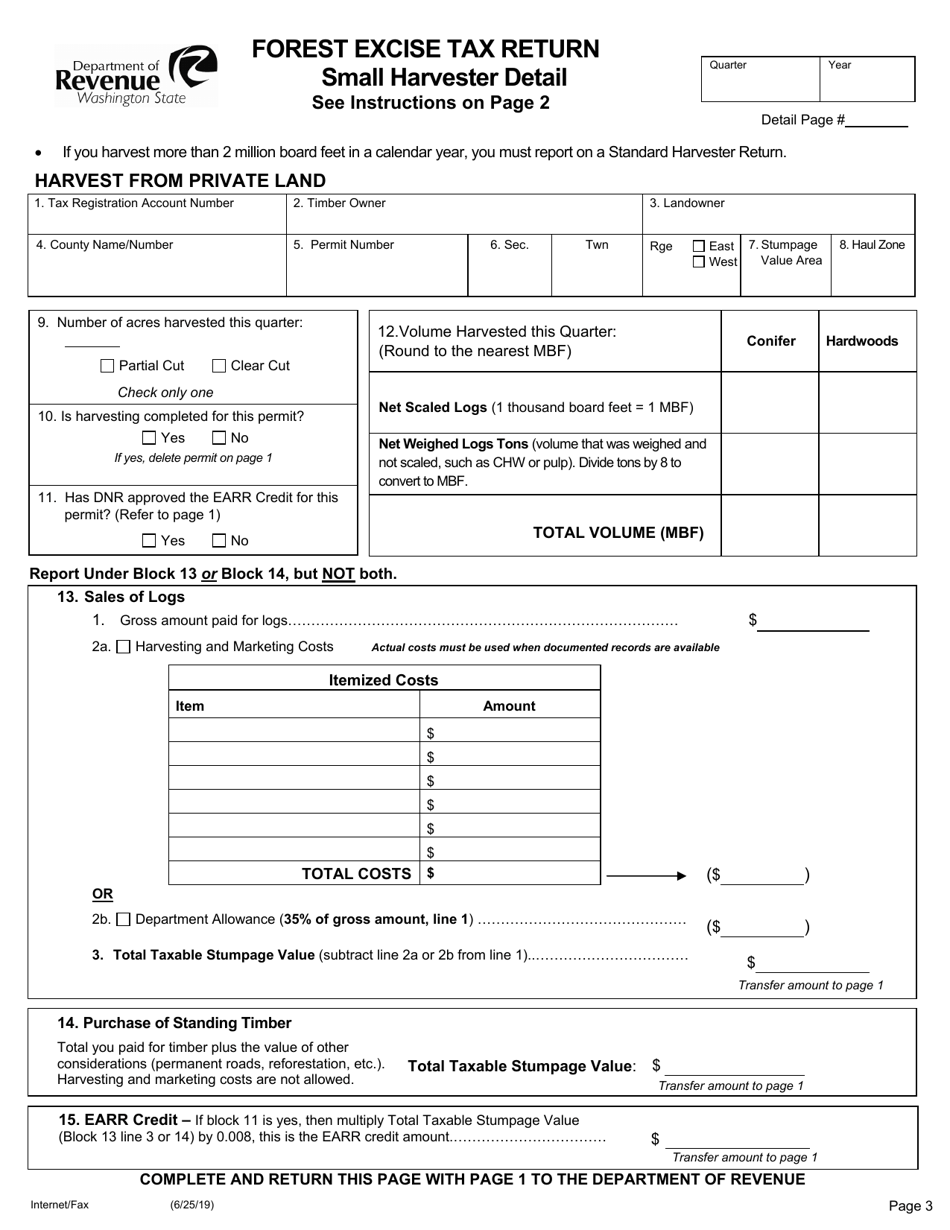

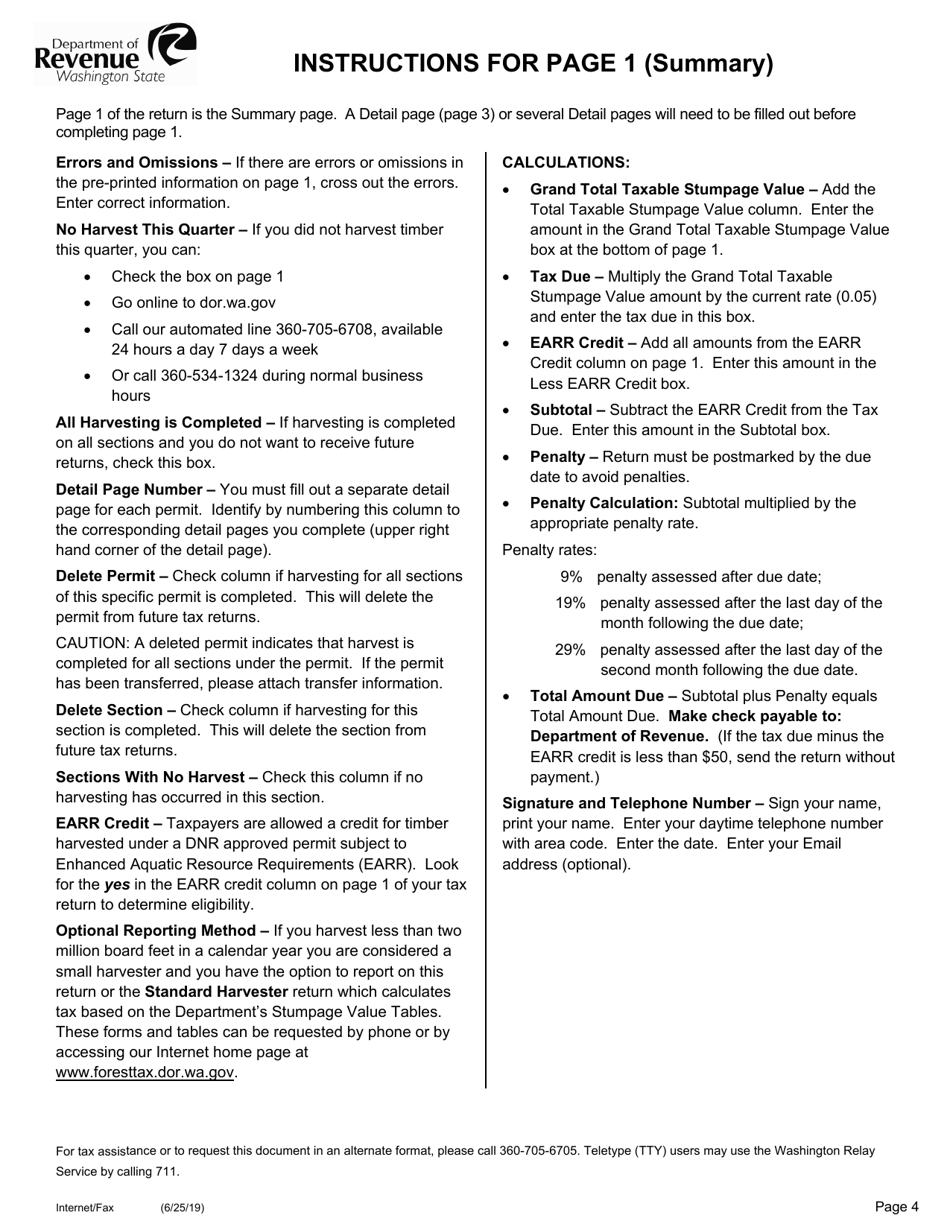

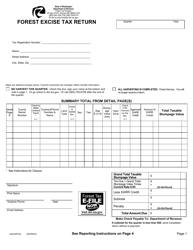

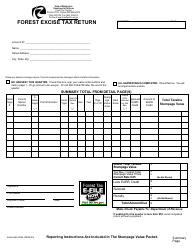

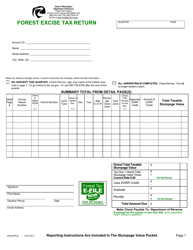

Small Harvester Forest Excise Tax Return - Washington

Small Harvester Forest Excise Tax Return is a legal document that was released by the Washington State Department of Revenue - a government authority operating within Washington.

FAQ

Q: Who needs to file the Small Harvester Forest Excise Tax Return in Washington?

A: Small harvesters who engage in timber harvesting operations in Washington State need to file the tax return.

Q: What is the purpose of the Small Harvester Forest Excise Tax Return?

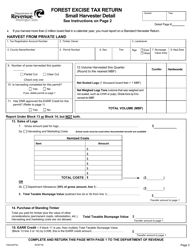

A: The purpose of the tax return is to report and pay the excise tax on timber harvested in Washington State by small harvesters.

Q: What is considered a small harvester in Washington?

A: In Washington, a small harvester is an individual or business entity that harvests less than 2 million board feet of timber in a calendar year.

Q: How often should the Small Harvester Forest Excise Tax Return be filed?

A: The tax return needs to be filed quarterly, regardless of whether any timber was harvested or sold during the quarter.

Q: What happens if the Small Harvester Forest Excise Tax Return is not filed or paid on time?

A: Failure to file or pay the tax on time may result in penalties and interest being assessed by the Washington State Department of Revenue.

Form Details:

- Released on June 25, 2019;

- The latest edition currently provided by the Washington State Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.