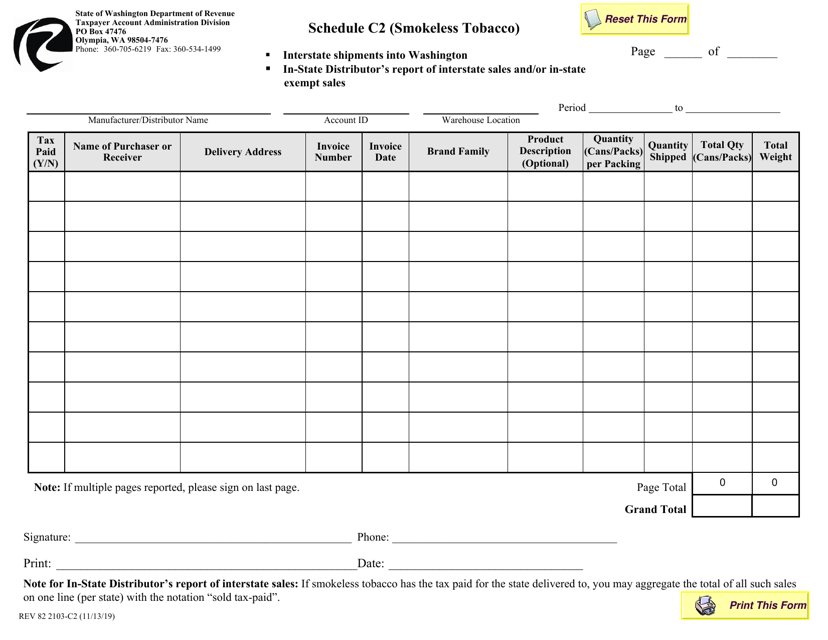

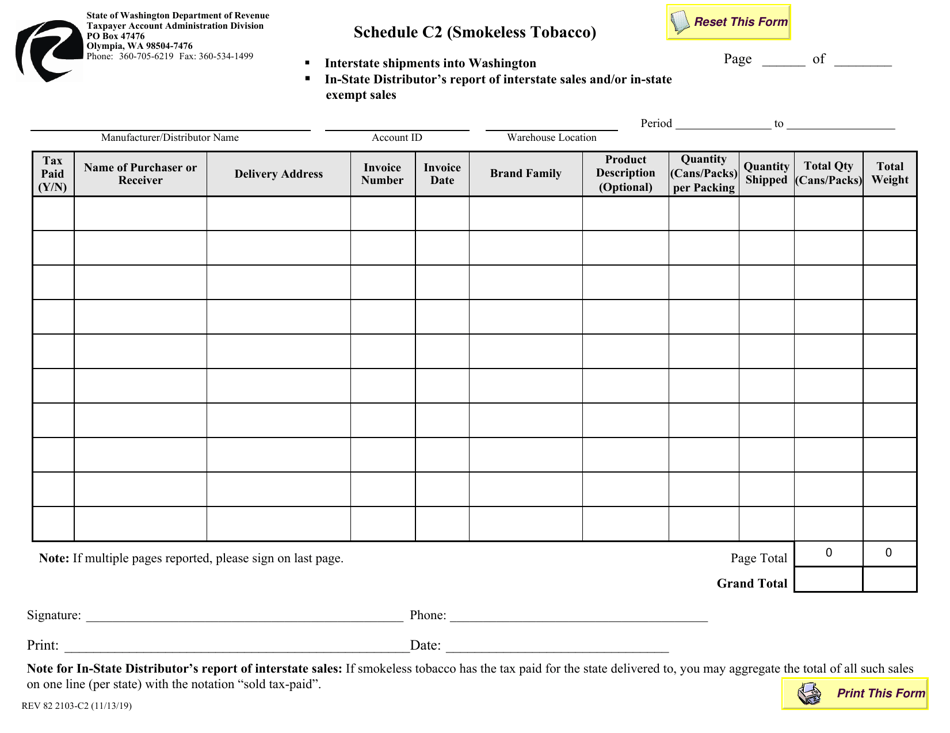

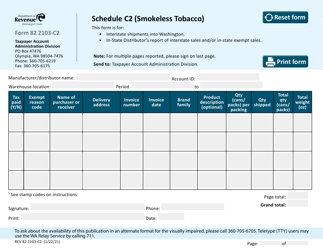

Form REV82 2103 Schedule C2 Smokeless Tobacco - Washington

What Is Form REV82 2103 Schedule C2?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV82 2103 Schedule C2?

A: Form REV82 2103 Schedule C2 is a tax form used in Washington State to report and pay the tax on smokeless tobacco.

Q: Who needs to file Form REV82 2103 Schedule C2?

A: Any business or individual engaged in the sale of smokeless tobacco in Washington State needs to file Form REV82 2103 Schedule C2.

Q: What is the purpose of Form REV82 2103 Schedule C2?

A: The purpose of Form REV82 2103 Schedule C2 is to accurately report the amount of smokeless tobacco sold in Washington State and calculate the associated tax liability.

Q: When is the deadline to file Form REV82 2103 Schedule C2?

A: Form REV82 2103 Schedule C2 must be filed and the associated tax paid by the 25th day of the month following the end of the reporting period.

Form Details:

- Released on November 13, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV82 2103 Schedule C2 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.