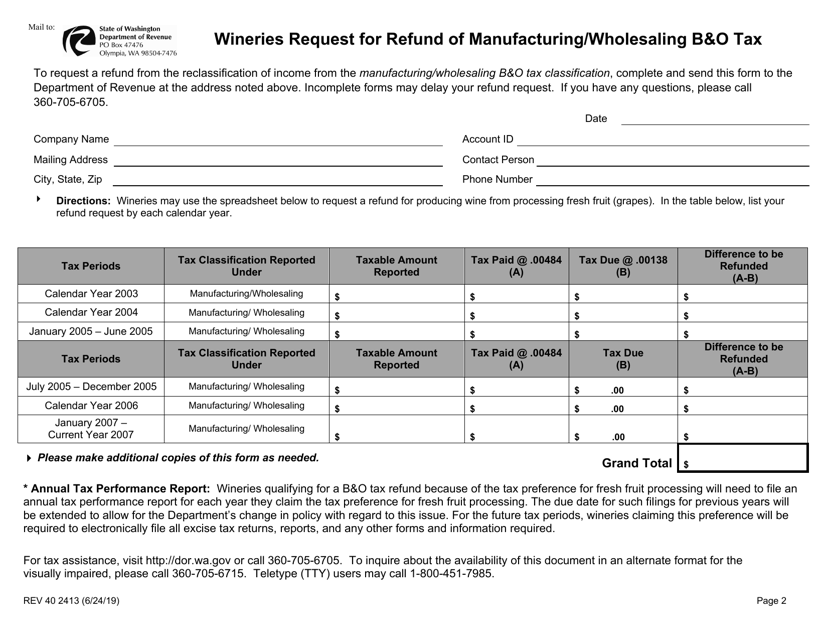

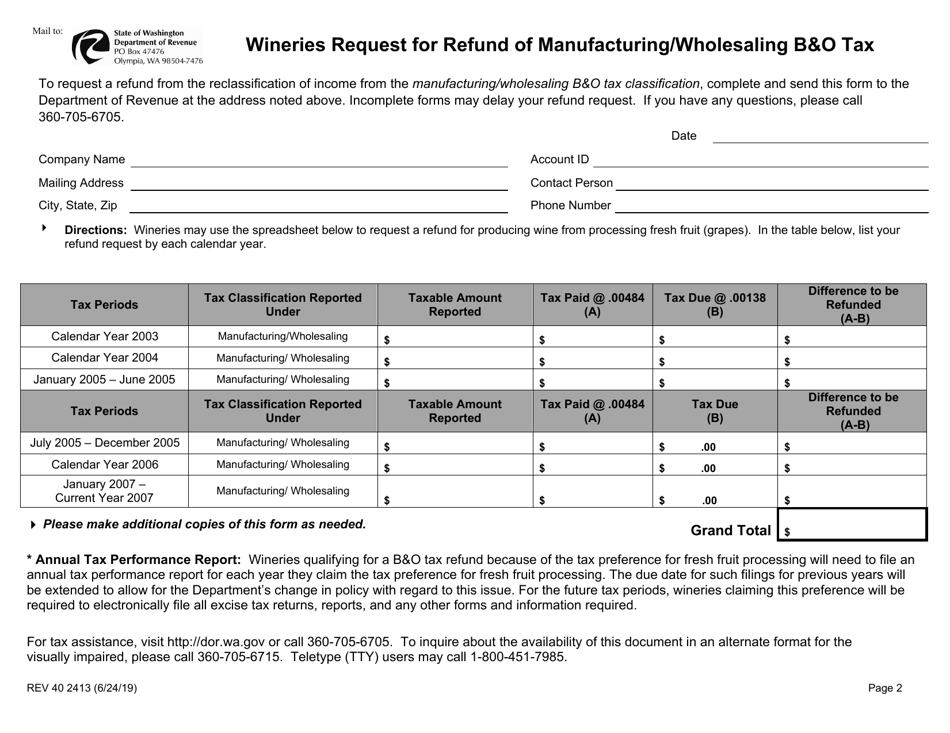

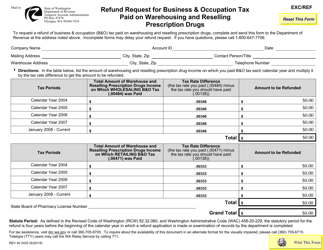

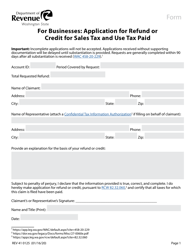

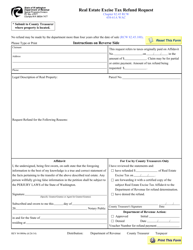

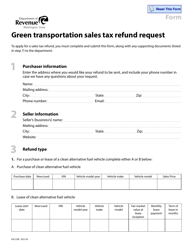

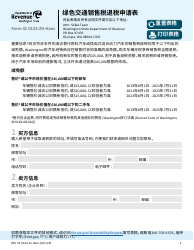

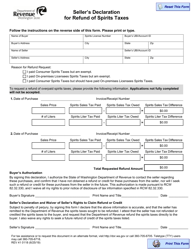

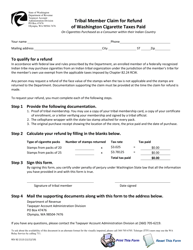

Form REV40 2413 Wineries Request for Refund of Manufacturing / Wholesaling B&o Tax - Washington

What Is Form REV40 2413?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV40 2413?

A: Form REV40 2413 is a request for refund of manufacturing/wholesaling B&o tax in Washington.

Q: Who can use Form REV40 2413?

A: Wineries in Washington can use Form REV40 2413 to request a refund of manufacturing/wholesaling B&o tax.

Q: What is a manufacturing/wholesaling B&o tax?

A: Manufacturing/wholesaling B&o tax is a type of tax that is applicable to wineries engaged in manufacturing or wholesaling activities in Washington.

Q: Why would a winery request a refund of manufacturing/wholesaling B&o tax?

A: A winery may request a refund of manufacturing/wholesaling B&o tax if they believe they have overpaid the tax or if they are eligible for any exemptions or deductions.

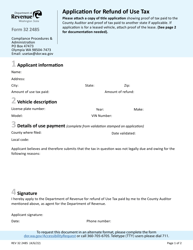

Q: How can a winery request a refund using Form REV40 2413?

A: To request a refund, a winery must fill out Form REV40 2413 and submit it to the Washington State Department of Revenue.

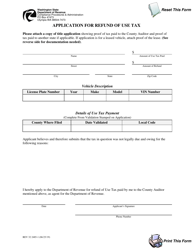

Q: Are there any specific requirements or documentation needed to request a refund?

A: Yes, the winery must provide supporting documentation along with Form REV40 2413 to substantiate their refund claim.

Q: Are there any deadlines for submitting Form REV40 2413?

A: Yes, the winery must submit Form REV40 2413 within the prescribed time period specified by the Washington State Department of Revenue.

Form Details:

- Released on June 24, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV40 2413 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.