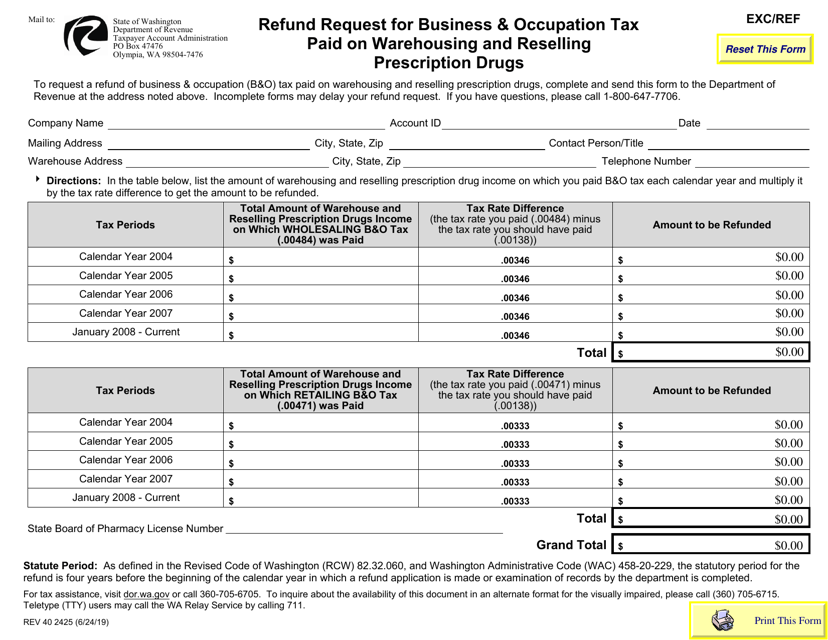

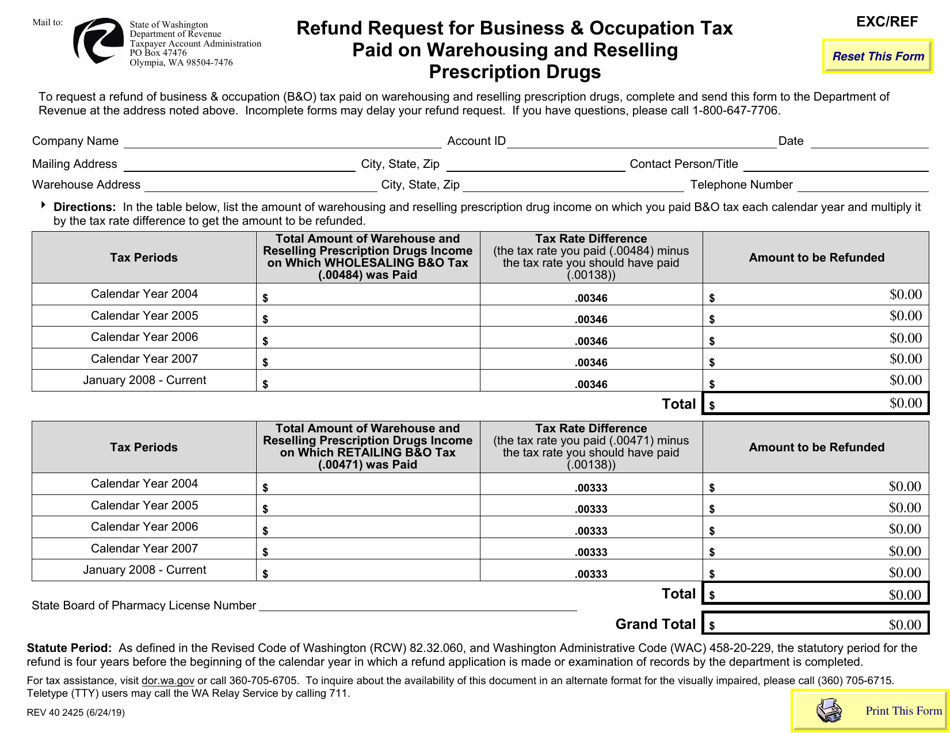

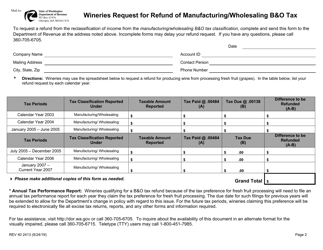

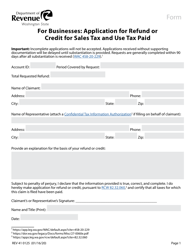

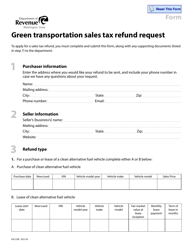

Form REV40 2425 Refund Request for Business & Occupation Tax Paid on Warehousing and Reselling Prescription Drugs - Washington

What Is Form REV40 2425?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV40 2425?

A: Form REV40 2425 is a Refund Request form for Business & Occupation Tax paid on warehousing and reselling prescription drugs in the state of Washington.

Q: What is the purpose of Form REV40 2425?

A: The purpose of Form REV40 2425 is to request a refund for Business & Occupation Tax paid on warehousing and reselling prescription drugs in Washington.

Q: Who needs to fill out Form REV40 2425?

A: Anyone who has paid Business & Occupation Tax on warehousing and reselling prescription drugs in Washington and wants to request a refund needs to fill out Form REV40 2425.

Q: Is there a deadline for filing Form REV40 2425?

A: Yes, Form REV40 2425 must be filed within four years from the date the tax was paid.

Q: What supporting documents are required to be submitted with Form REV40 2425?

A: The following supporting documents are required to be submitted with Form REV40 2425: copies of invoices, receipts, or other proof of purchase, and evidence of payment of the tax.

Q: How long does it take to process a refund request filed using Form REV40 2425?

A: The processing time for refund requests filed using Form REV40 2425 can vary, but it generally takes several weeks to process.

Q: Can I file Form REV40 2425 electronically?

A: No, Form REV40 2425 cannot be filed electronically and must be submitted by mail.

Q: Is there a fee to file Form REV40 2425?

A: No, there is no fee to file Form REV40 2425.

Form Details:

- Released on June 24, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV40 2425 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.