This version of the form is not currently in use and is provided for reference only. Download this version of

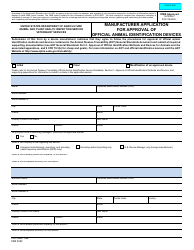

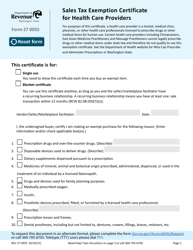

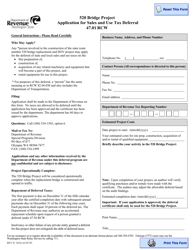

Form REV81 1029

for the current year.

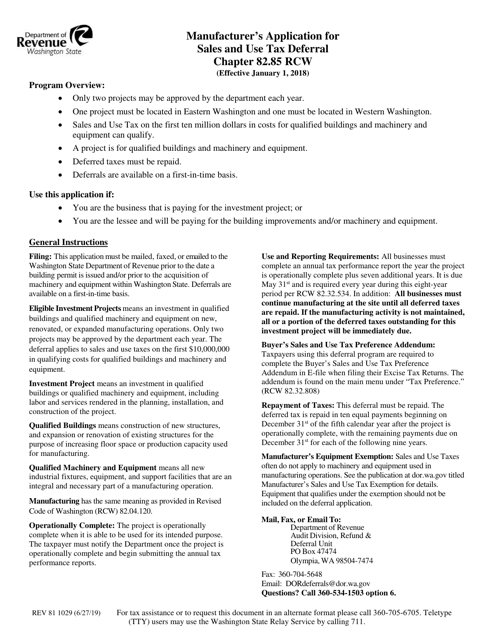

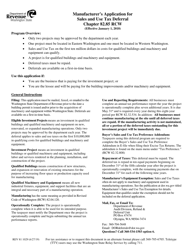

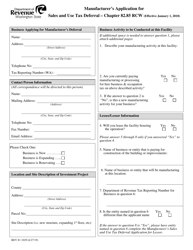

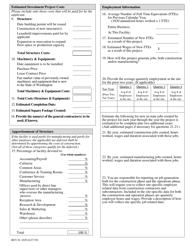

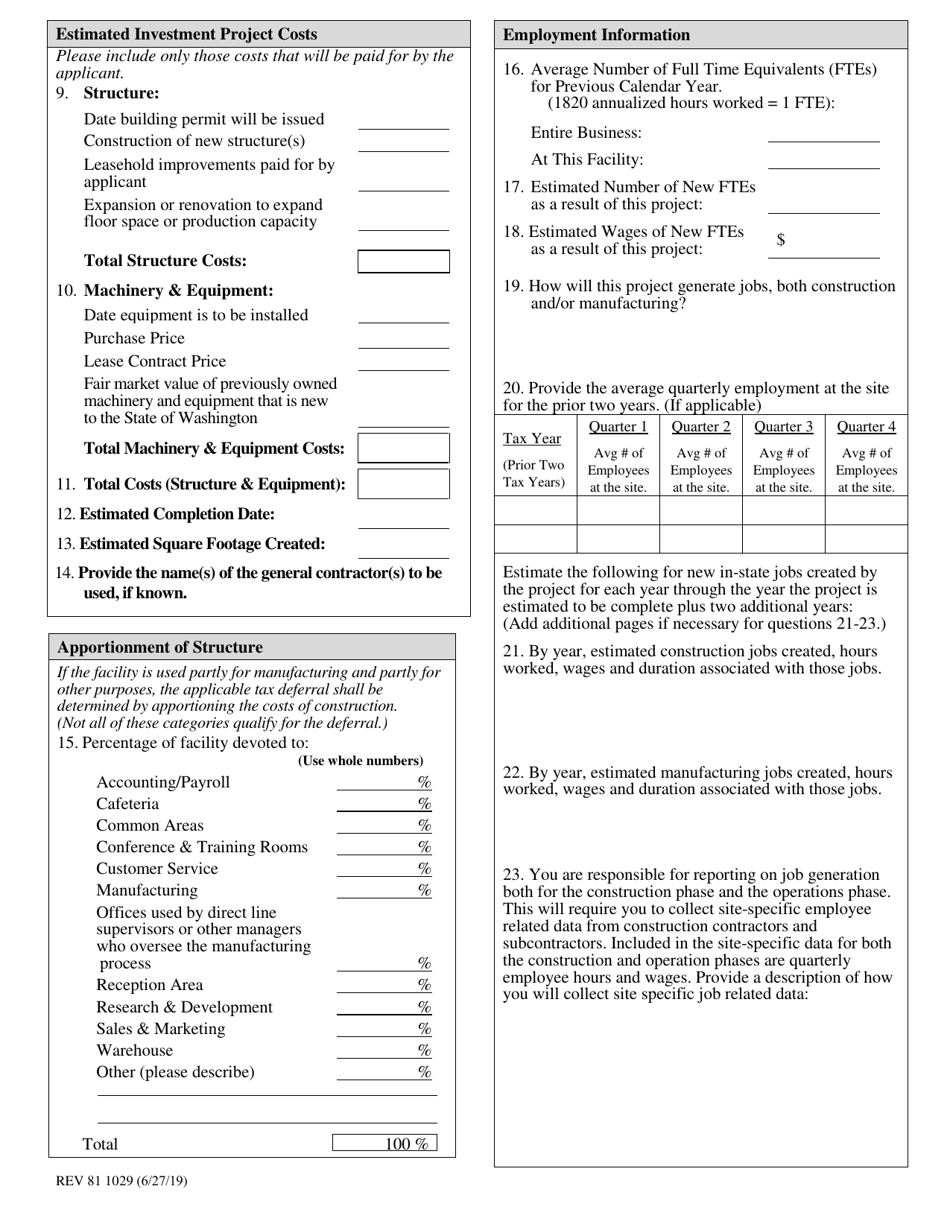

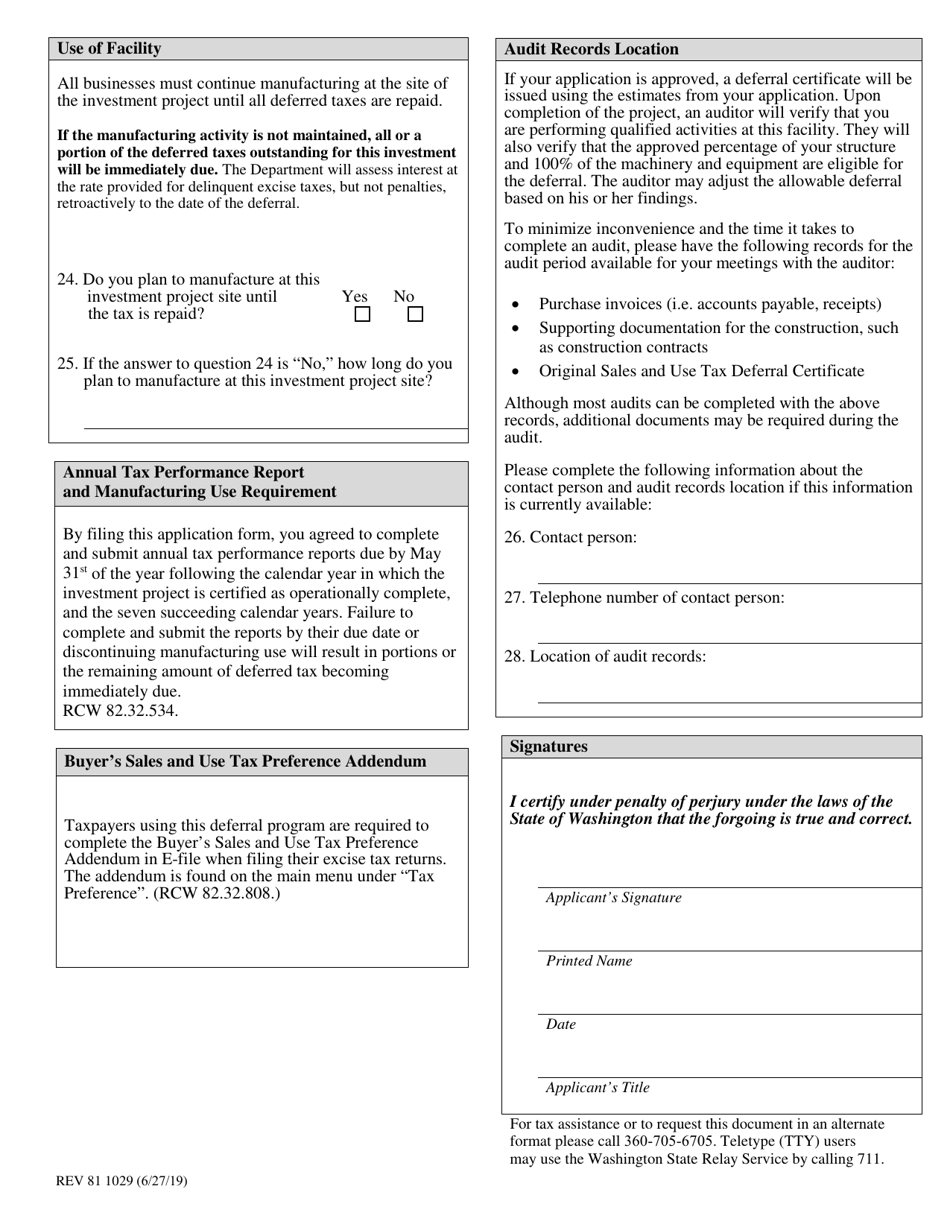

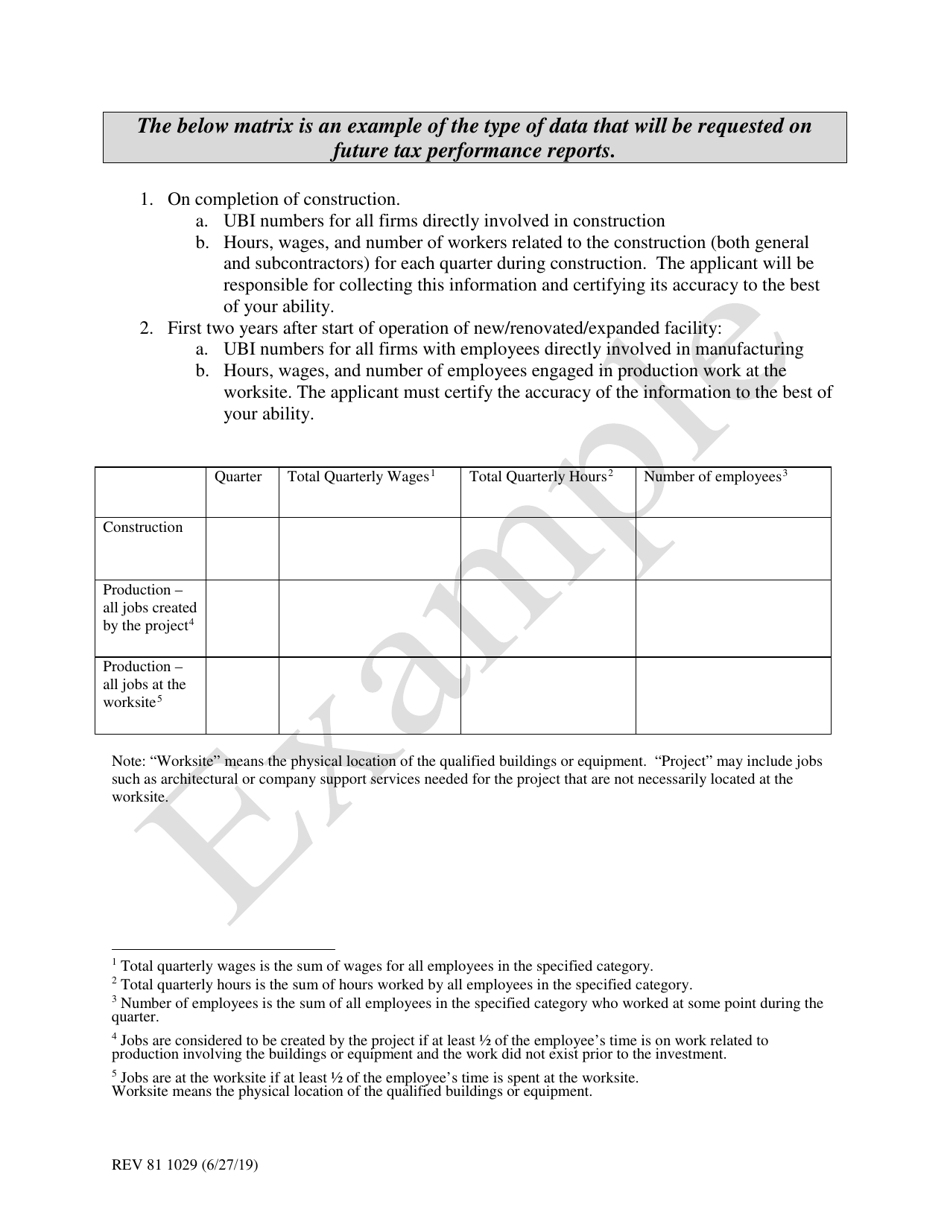

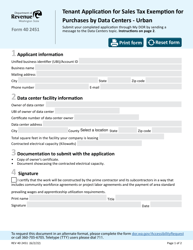

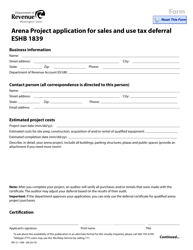

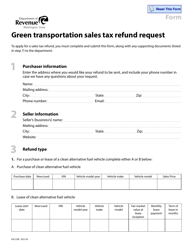

Form REV81 1029 Manufacturer's Application for Sales and Use Tax Deferral - Washington

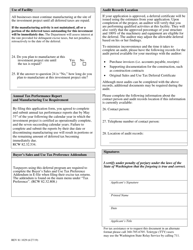

What Is Form REV81 1029?

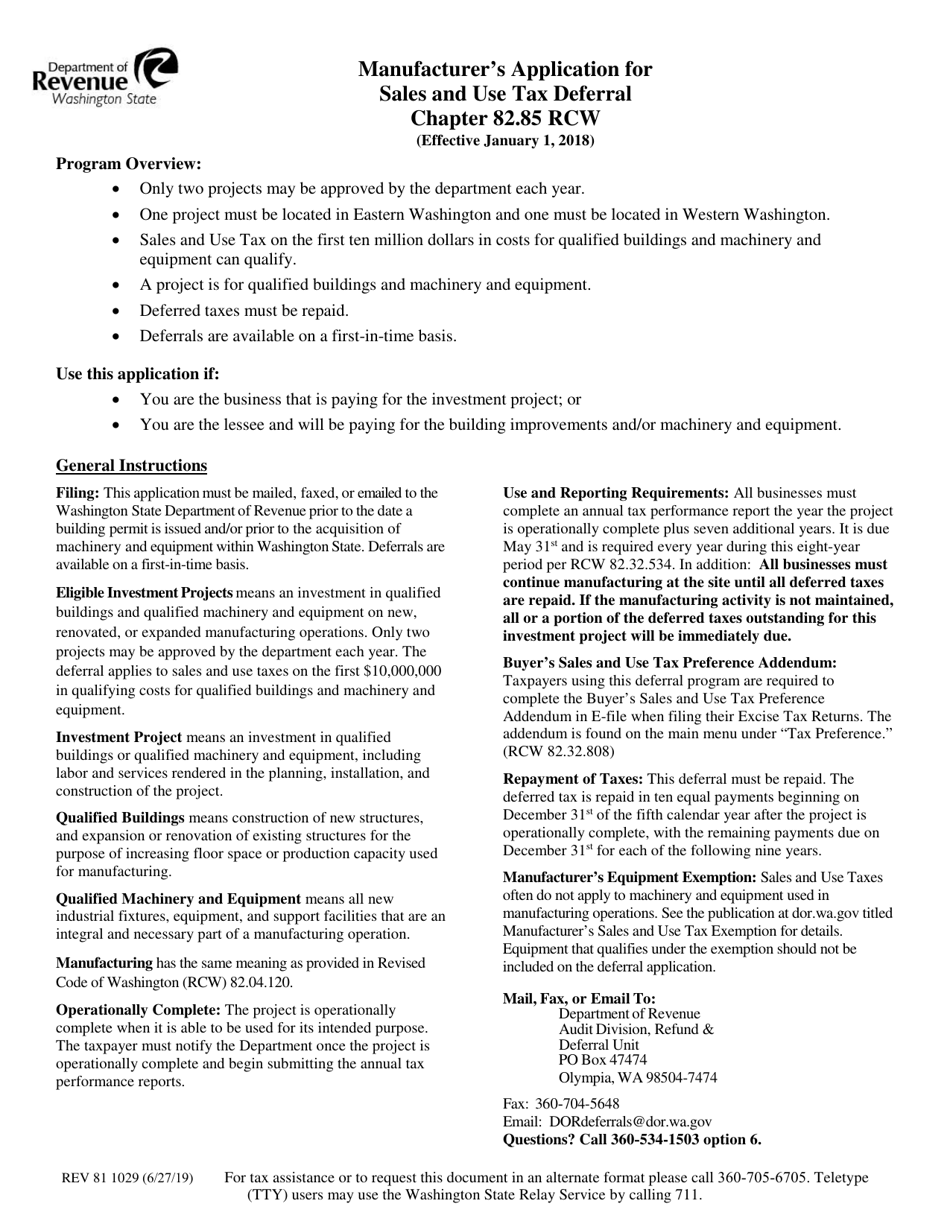

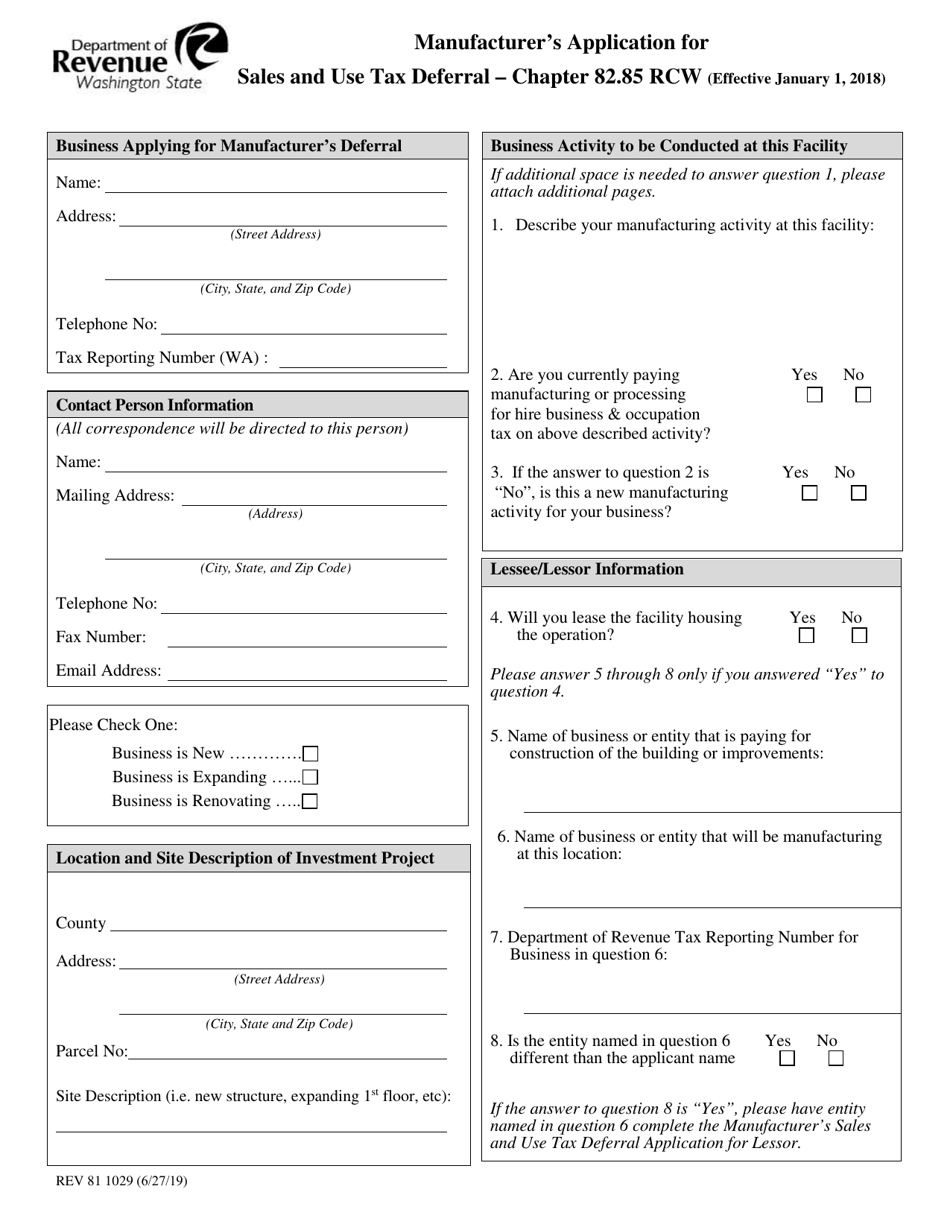

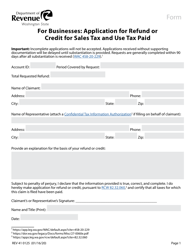

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV81 1029?

A: Form REV81 1029 is the Manufacturer's Application for Sales and Use Tax Deferral in the state of Washington.

Q: Who should use Form REV81 1029?

A: Manufacturers who want to apply for a sales and use tax deferral in Washington should use Form REV81 1029.

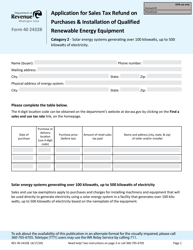

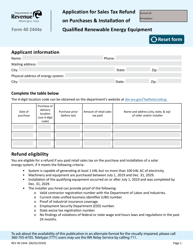

Q: What is a sales and use tax deferral?

A: A sales and use tax deferral is a program that allows manufacturers to delay paying sales and use taxes on certain equipment and machinery until a later date.

Q: Why would a manufacturer want to apply for a sales and use tax deferral?

A: Manufacturers may want to apply for a sales and use tax deferral to help manage their cash flow and reduce the upfront costs of purchasing equipment and machinery.

Q: How does Form REV81 1029 help with the application process?

A: Form REV81 1029 provides manufacturers with a standardized application form to apply for the sales and use tax deferral program in Washington.

Q: Are there any deadlines for submitting Form REV81 1029?

A: Yes, manufacturers must submit Form REV81 1029 to the Washington State Department of Revenue within 30 days of purchasing the eligible equipment or machinery.

Q: Can I apply for a sales and use tax deferral if I am not a manufacturer?

A: No, the sales and use tax deferral program is specifically for manufacturers in Washington.

Q: What are the eligibility requirements for the sales and use tax deferral program?

A: To be eligible, manufacturers must meet certain criteria, such as having a valid business license in Washington and using the equipment or machinery for manufacturing purposes.

Q: What happens after I submit Form REV81 1029?

A: After submitting Form REV81 1029, the Washington State Department of Revenue will review your application and notify you if it is approved or denied.

Form Details:

- Released on June 27, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV81 1029 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.