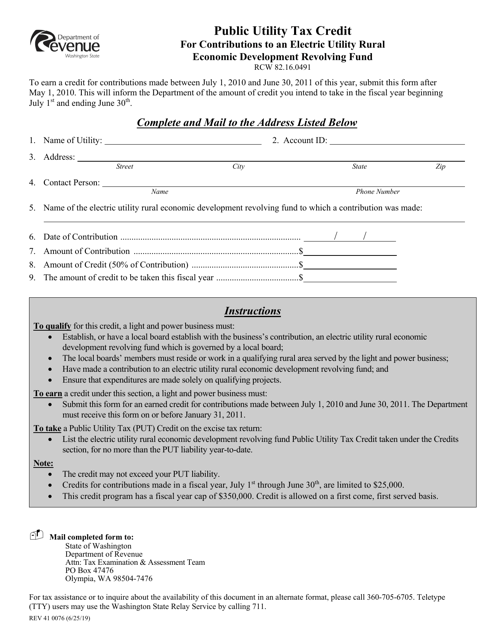

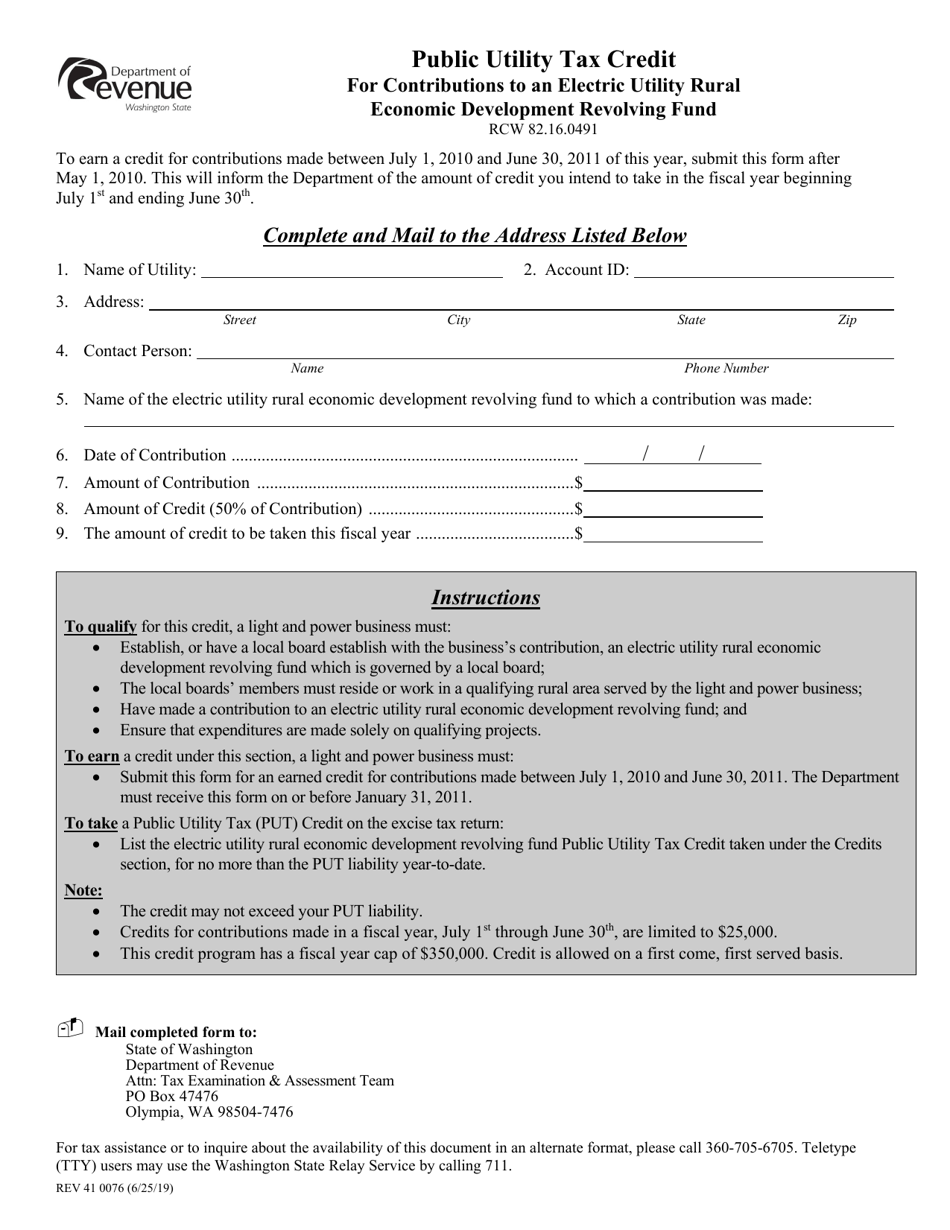

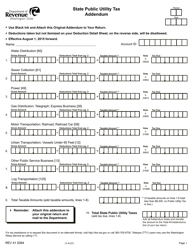

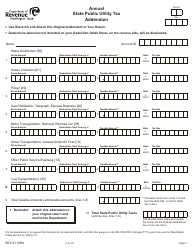

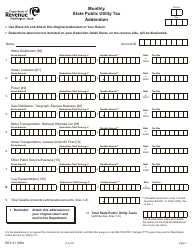

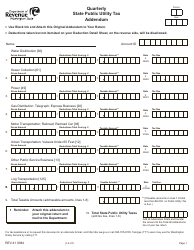

Form REV41 0076 Public Utility Tax Credit for Contributions to an Electric Utility Rural Economic Development Revolving Fund - Washington

What Is Form REV41 0076?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is REV41 0076?

A: REV41 0076 is a form for claiming a Public Utility Tax Credit for Contributions to an Electric Utility Rural Economic Development Revolving Fund.

Q: What is the purpose of the form?

A: The purpose of this form is to claim a tax credit for contributions made towards the Electric Utility Rural Economic Development Revolving Fund.

Q: What is the Electric Utility Rural Economic Development Revolving Fund?

A: The Electric Utility Rural Economic Development Revolving Fund is a fund that supports economic development in rural areas by providing funding for electric utility projects.

Q: Who can claim the tax credit?

A: Any individual or business that makes eligible contributions to the Electric Utility Rural Economic Development Revolving Fund can claim the tax credit.

Q: What is the benefit of claiming the tax credit?

A: By claiming the tax credit, individuals and businesses can reduce their public utilitytax liability and support economic development in rural areas.

Form Details:

- Released on June 25, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV41 0076 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.