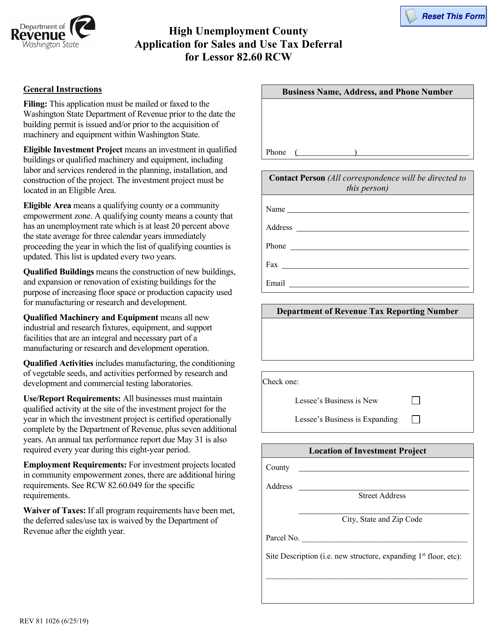

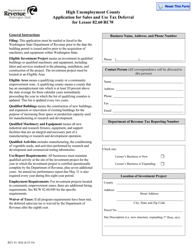

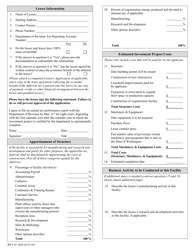

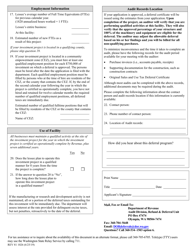

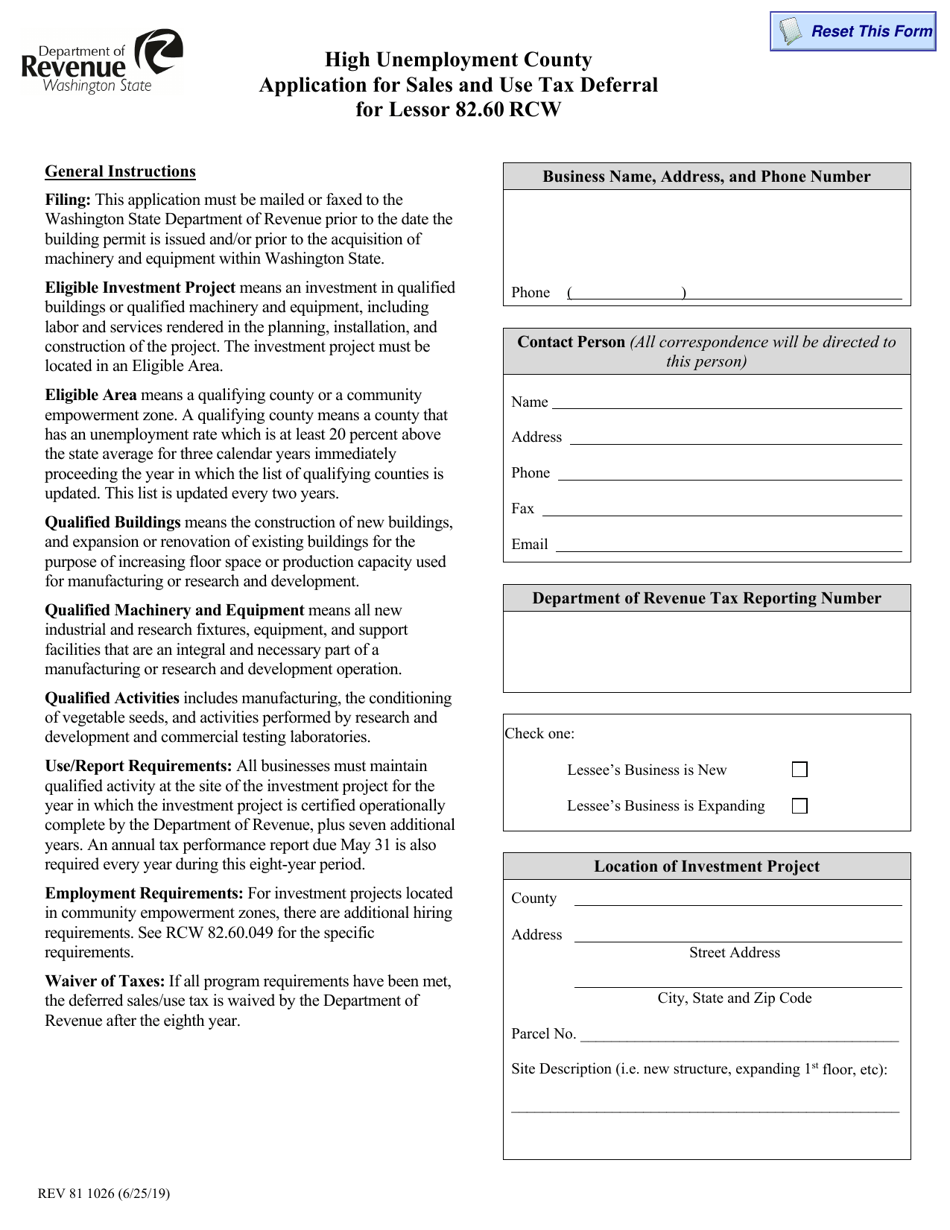

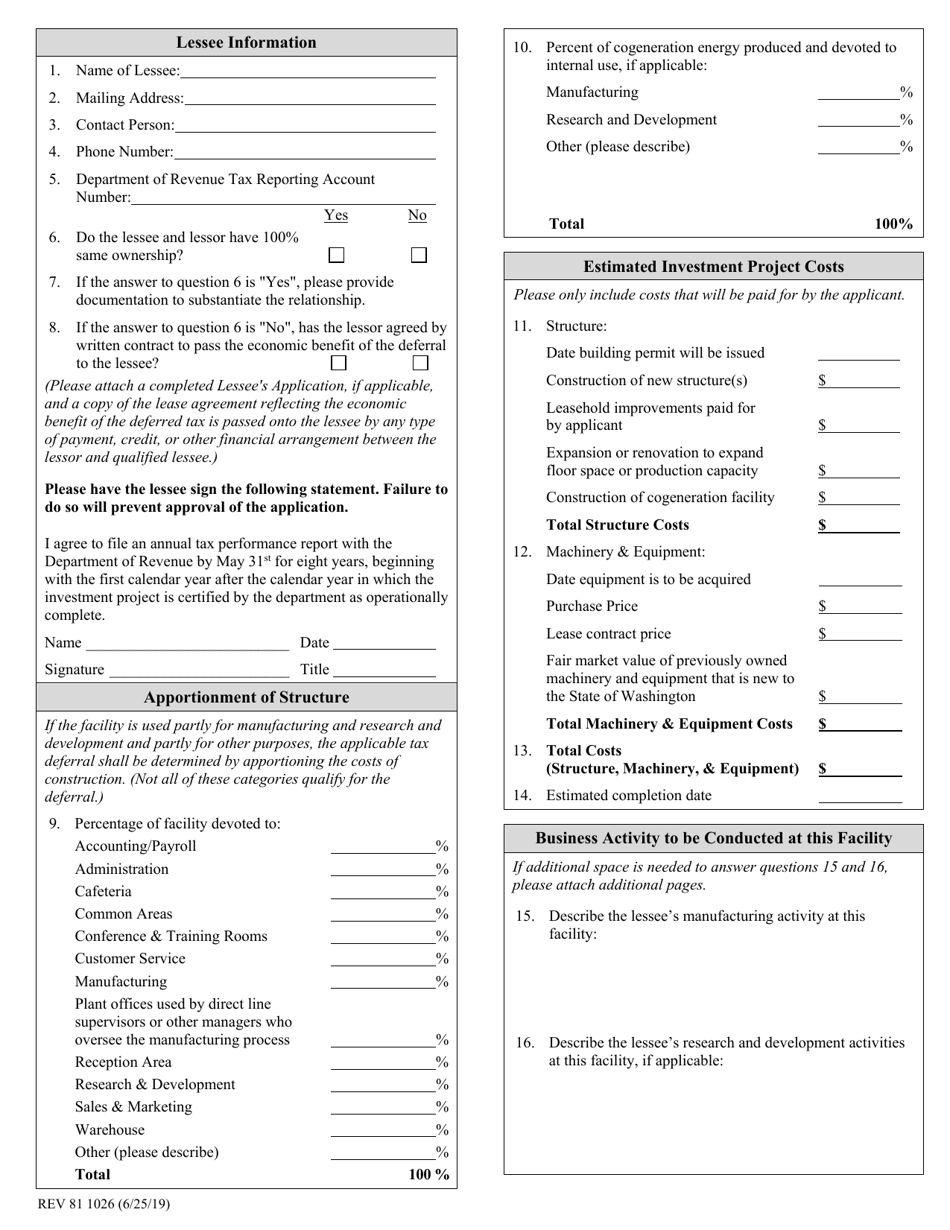

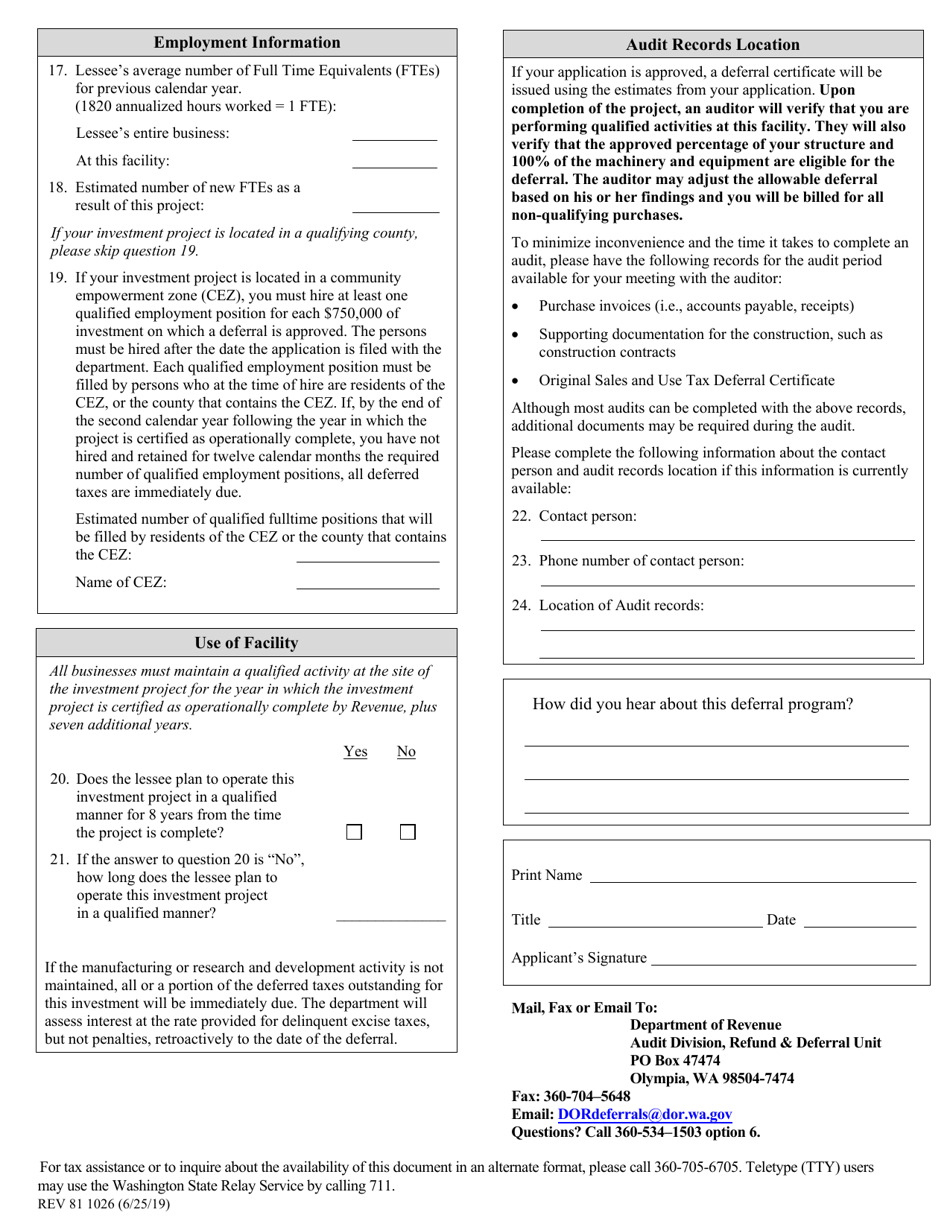

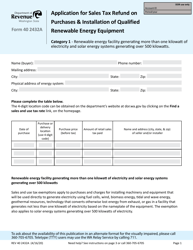

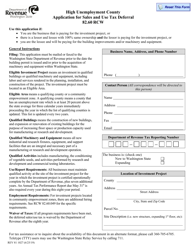

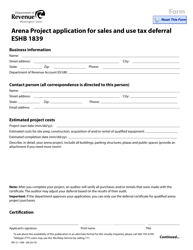

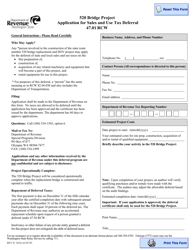

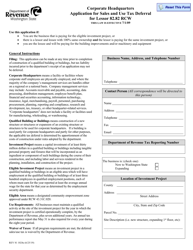

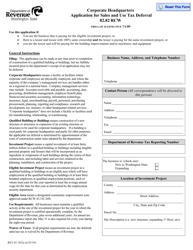

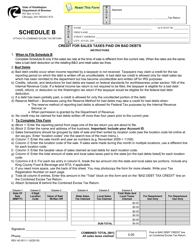

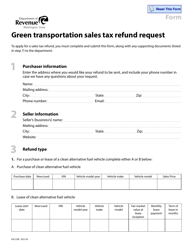

Form REV81 1026 High Unemployment County Application for Sales and Use Tax Deferral for Lessor - Washington

What Is Form REV81 1026?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV81 1026?

A: Form REV81 1026 is an application for Sales and Use Tax Deferral for Lessor in Washington.

Q: What is the purpose of Form REV81 1026?

A: The purpose of Form REV81 1026 is to apply for sales and use tax deferral for lessor in Washington.

Q: Who can use Form REV81 1026?

A: Form REV81 1026 can be used by lessors in Washington who are experiencing high unemployment in the county.

Q: What is sales and use tax deferral for lessor?

A: Sales and use tax deferral for lessor is a program in Washington that allows eligible lessors to defer paying sales and use tax on certain equipment.

Q: Are there any eligibility requirements to use Form REV81 1026?

A: Yes, to use Form REV81 1026, you must meet certain eligibility requirements, including experiencing high unemployment in the county where the equipment is used.

Q: Are there any deadlines for submitting Form REV81 1026?

A: Yes, there are specific deadlines for submitting Form REV81 1026. It is recommended to check the official instructions or contact the Washington Department of Revenue for the current deadlines.

Q: Is there a fee for filing Form REV81 1026?

A: There is no fee for filing Form REV81 1026.

Q: What should I do if I have more questions about Form REV81 1026?

A: If you have more questions about Form REV81 1026, you can contact the Washington Department of Revenue for assistance.

Form Details:

- Released on June 25, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV81 1026 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.