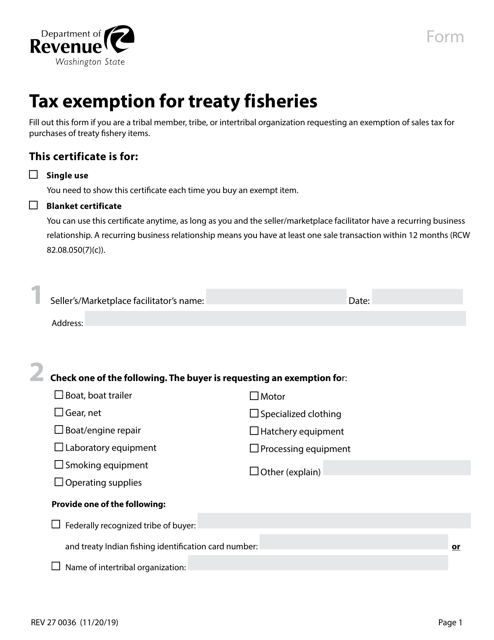

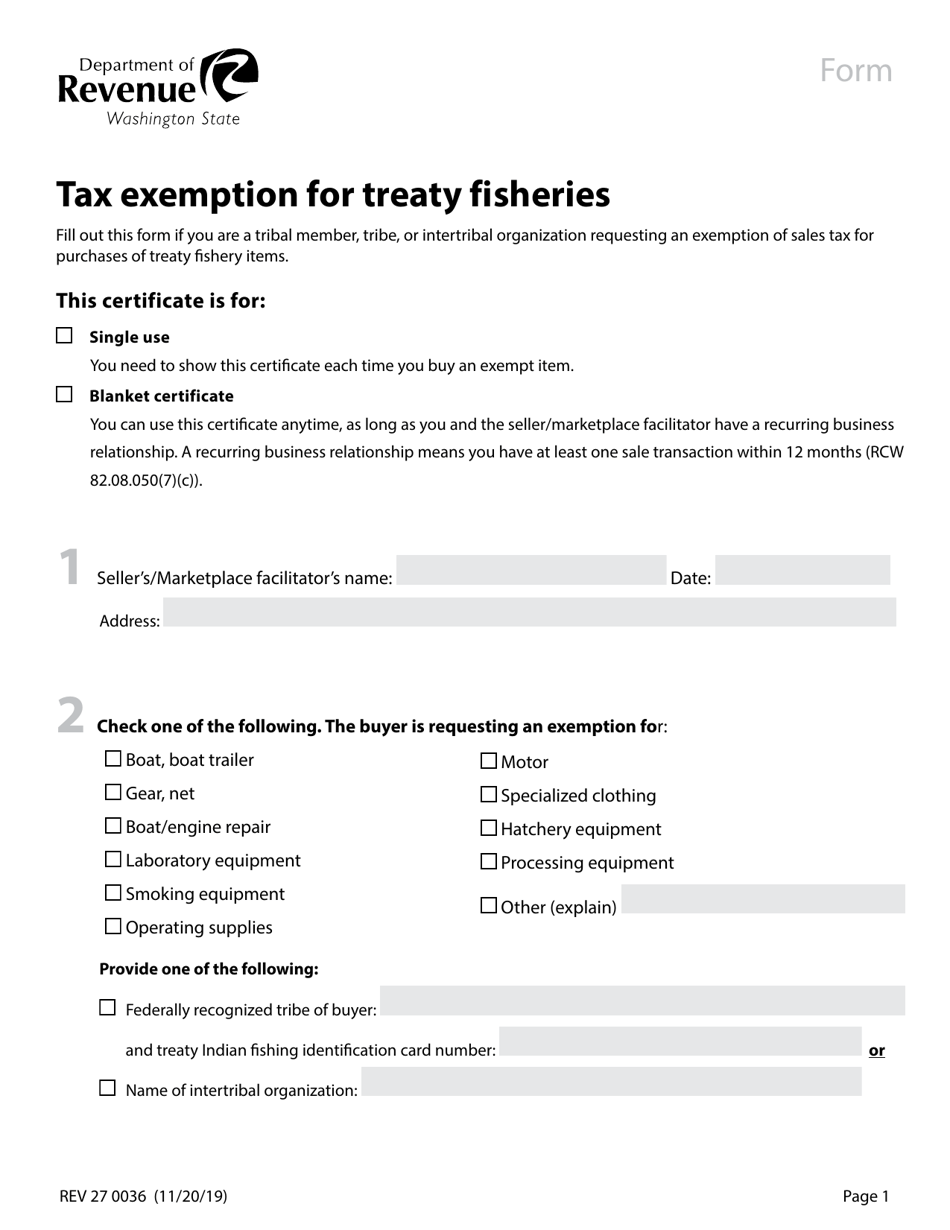

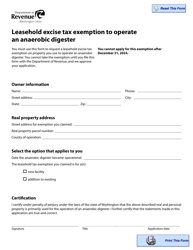

Form REV27 0036 Tax Exemption for Treaty Fisheries - Washington

What Is Form REV27 0036?

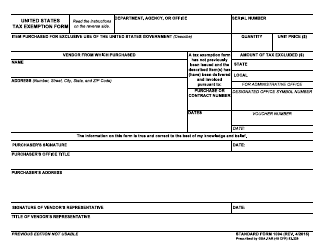

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV27 0036?

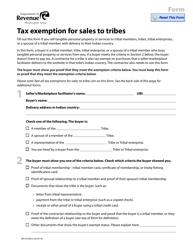

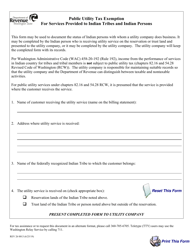

A: Form REV27 0036 is a tax exemption form specifically for treaty fisheries in Washington.

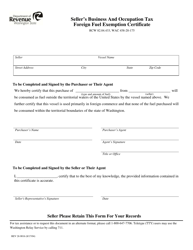

Q: Who is eligible to use Form REV27 0036?

A: Only treaty fisheries in Washington are eligible to use Form REV27 0036.

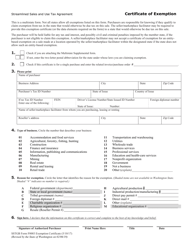

Q: What is the purpose of Form REV27 0036?

A: The purpose of Form REV27 0036 is to claim tax exemption for treaty fisheries in Washington.

Q: Why do treaty fisheries in Washington need tax exemption?

A: Treaty fisheries are granted certain fishing rights by treaties, and tax exemption is one of the benefits provided to support these rights.

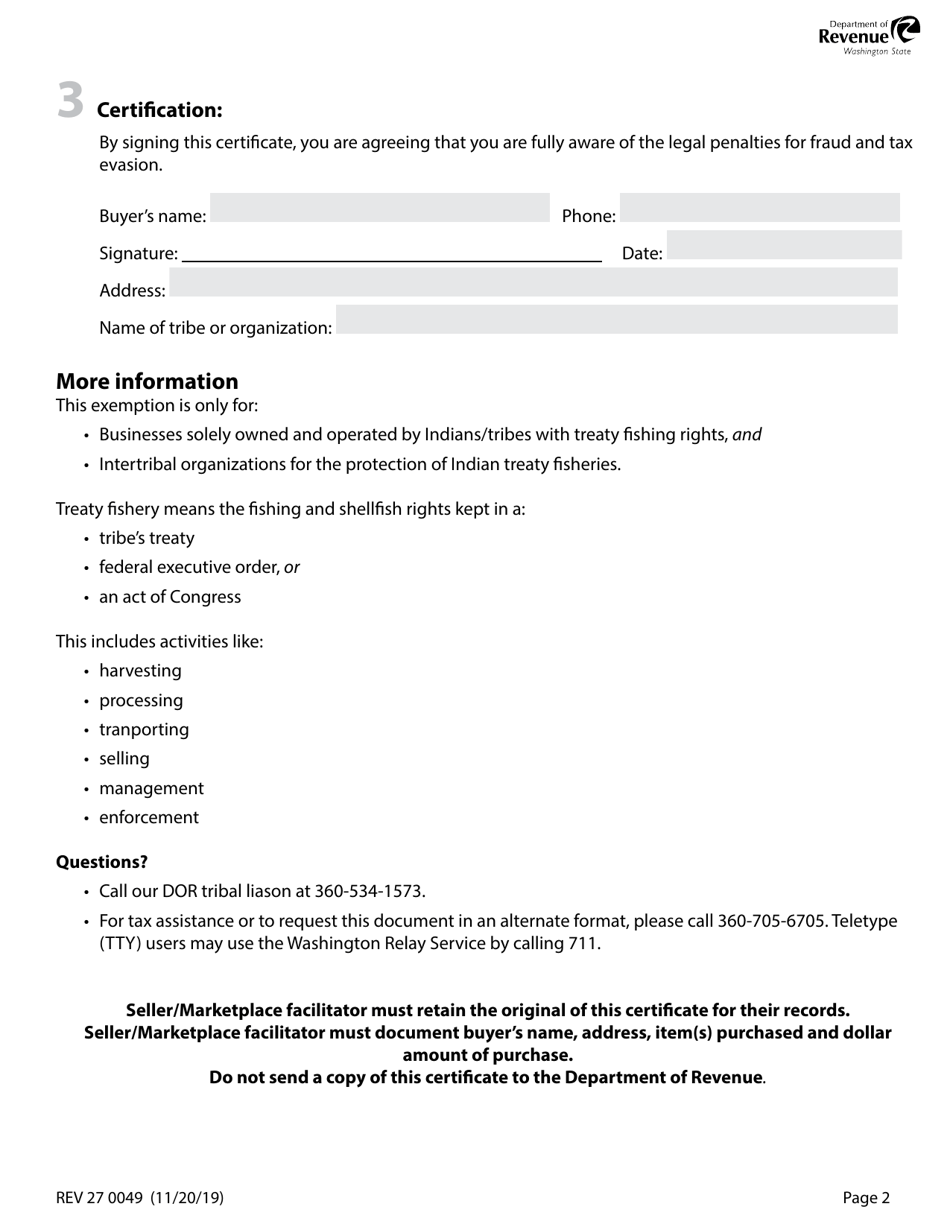

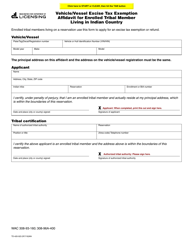

Q: What information do I need to provide on Form REV27 0036?

A: You will need to provide specific details about the treaty fishery, including the name, location, and identification number.

Q: Are there any deadlines for submitting Form REV27 0036?

A: Specific deadlines for submitting Form REV27 0036 may vary, so it is important to check with the Washington Department of Revenue for the most up-to-date information.

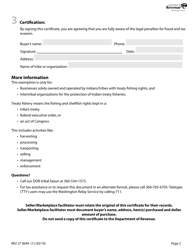

Q: What happens after I submit Form REV27 0036?

A: Once your form is reviewed and approved, you will receive the tax exemption for treaty fisheries in Washington.

Q: Are there any fees associated with filing Form REV27 0036?

A: There are no fees associated with filing Form REV27 0036.

Form Details:

- Released on November 20, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV27 0036 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.