This version of the form is not currently in use and is provided for reference only. Download this version of

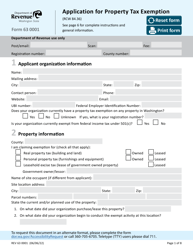

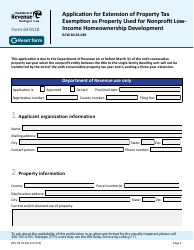

Form REV63 0029

for the current year.

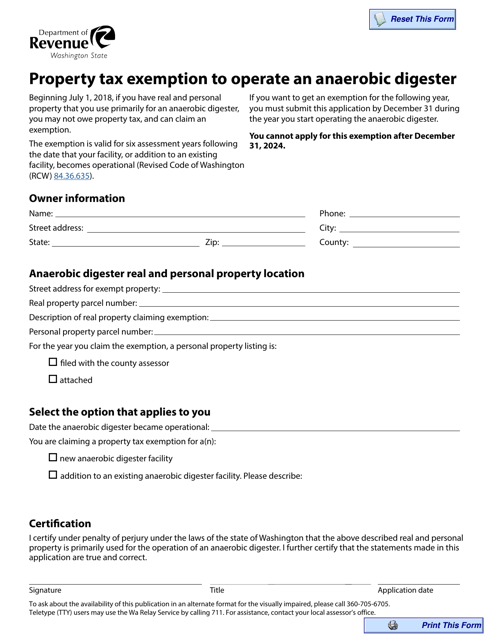

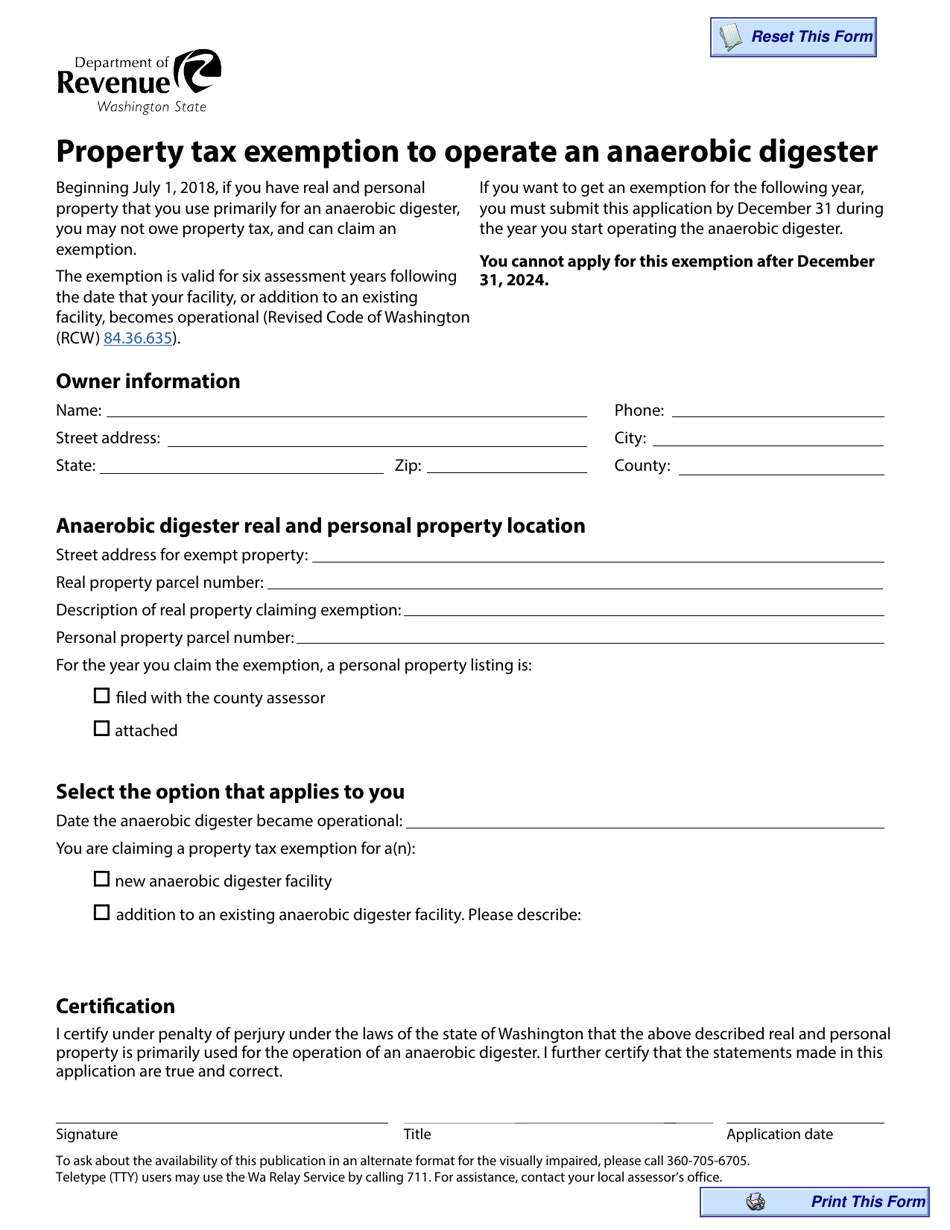

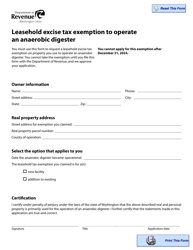

Form REV63 0029 Property Tax Exemption to Operate an Anaerobic Digester - Washington

What Is Form REV63 0029?

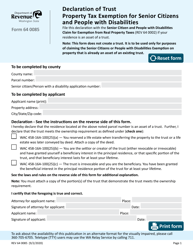

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV63 0029?

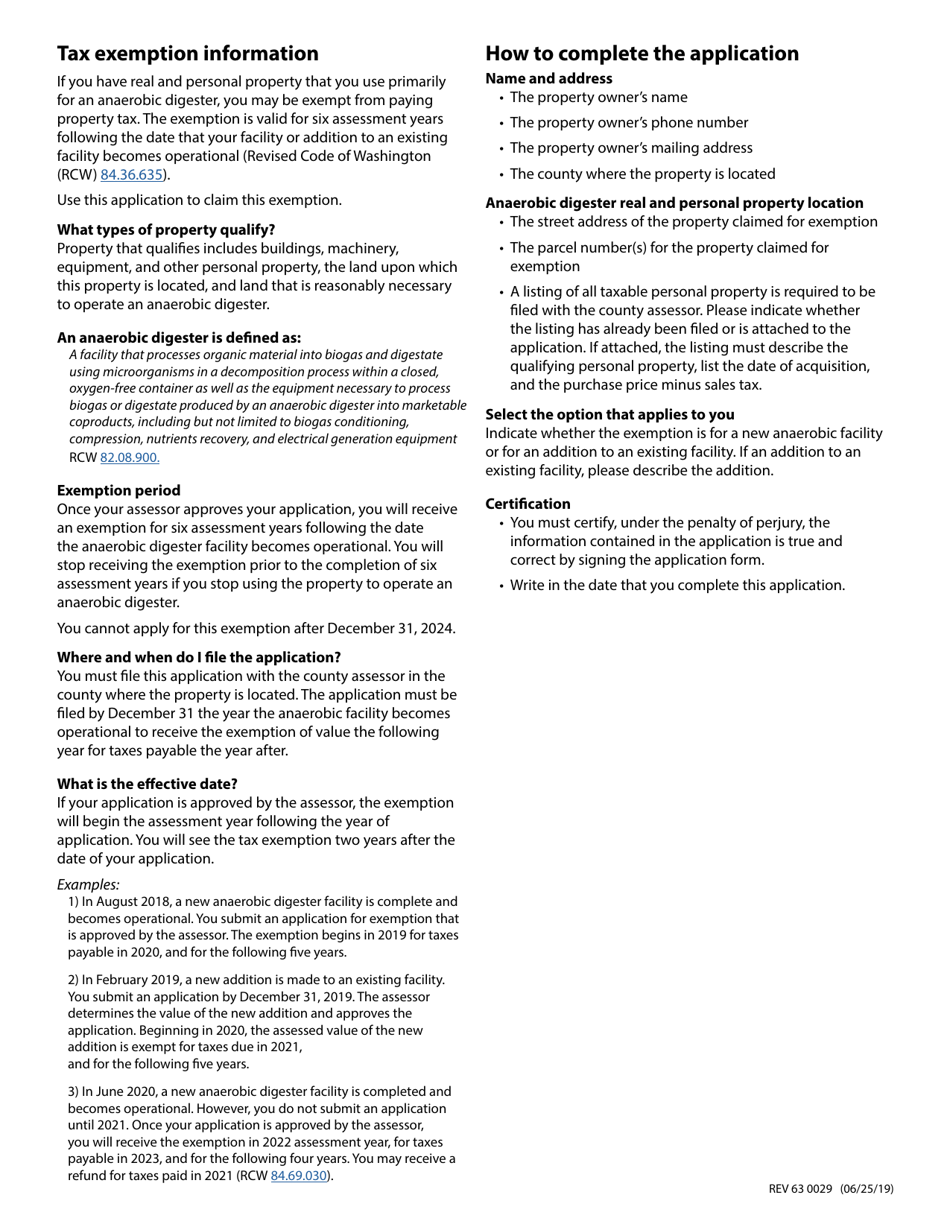

A: Form REV63 0029 is a document used to apply for a property tax exemption to operate an anaerobic digester in Washington.

Q: What is a property tax exemption?

A: A property tax exemption is a benefit that allows certain properties, like anaerobic digesters, to be exempt from paying property taxes.

Q: What is an anaerobic digester?

A: An anaerobic digester is a system that breaks down organic waste materials using bacteria in an oxygen-free environment to produce renewable energy, like biogas or electricity.

Q: Who is eligible for this property tax exemption?

A: Entities that operate anaerobic digesters in Washington may be eligible for this property tax exemption.

Q: What is the purpose of this property tax exemption?

A: The purpose of this property tax exemption is to incentivize and support the use of anaerobic digesters as a renewable energy source.

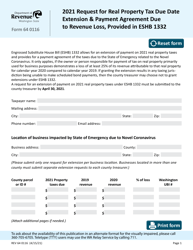

Q: Are there any deadlines for submitting Form REV63 0029?

A: The deadlines for submitting Form REV63 0029 may vary, so it is important to check with the relevant government agency to determine the specific deadline.

Q: What information is required in Form REV63 0029?

A: Form REV63 0029 may require information such as the property owner's name and address, details about the anaerobic digester, and other relevant information.

Q: Is there a fee to submit Form REV63 0029?

A: The fee for submitting Form REV63 0029, if any, may vary. You should check the instructions or guidelines provided with the form or contact the relevant government agency for more information.

Q: What happens after submitting Form REV63 0029?

A: After submitting Form REV63 0029, the government agency will review the application and determine if the property qualifies for the tax exemption. They will communicate their decision to the applicant.

Q: Is the property tax exemption for anaerobic digesters permanent?

A: The permanence of the property tax exemption for anaerobic digesters may vary. It is recommended to consult with the relevant government agency to understand the duration and conditions of the exemption.

Form Details:

- Released on June 25, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV63 0029 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.