This version of the form is not currently in use and is provided for reference only. Download this version of

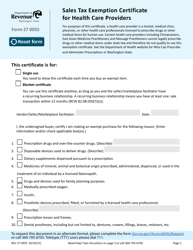

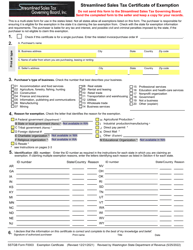

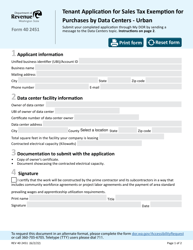

Form REV27 0021

for the current year.

Form REV27 0021 Sales and Use Tax Exemption Certificate for Manufacturing Machinery and Equipment - Washington

What Is Form REV27 0021?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

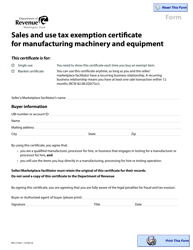

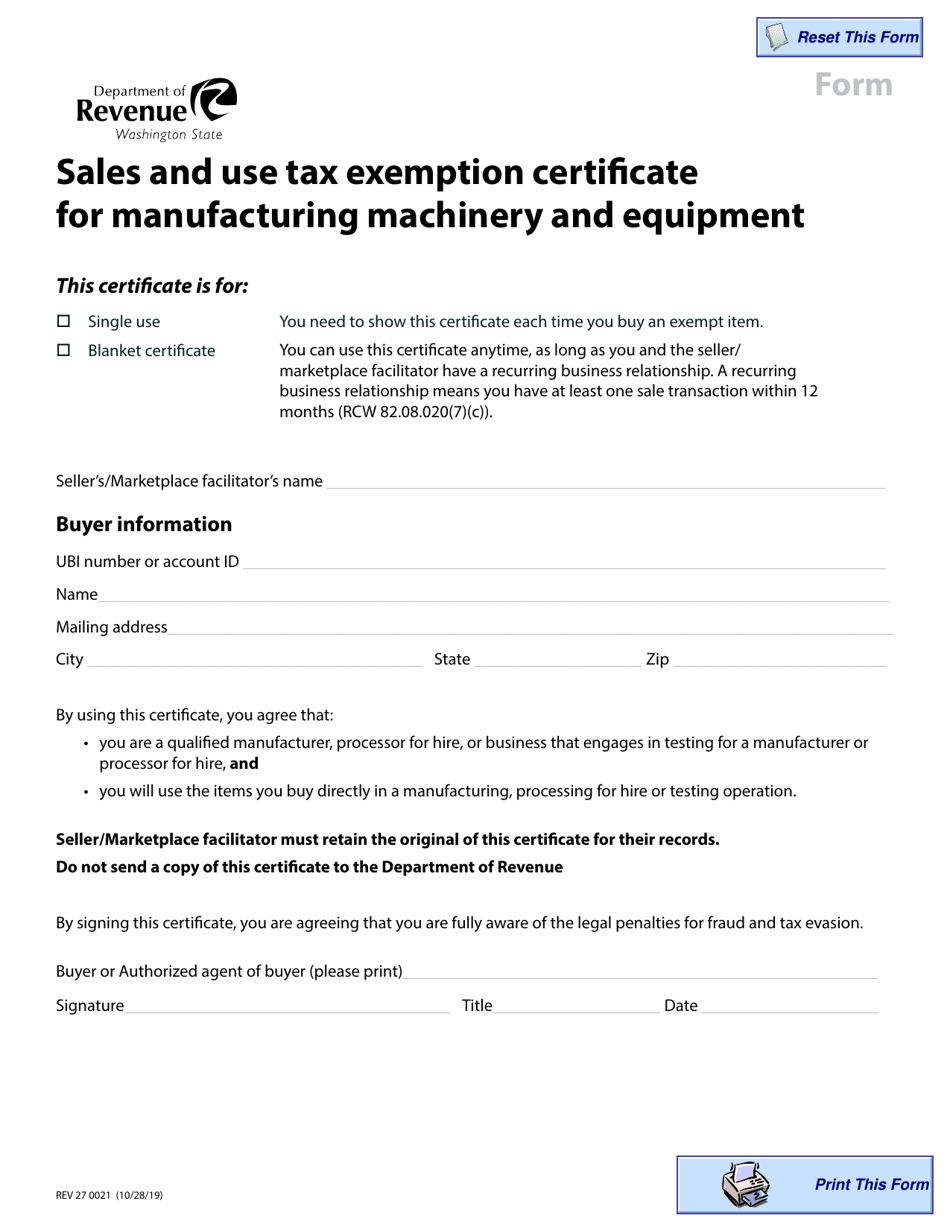

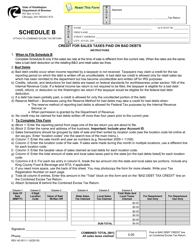

Q: What is Form REV27 0021?

A: Form REV27 0021 is a Sales and Use Tax Exemption Certificate for Manufacturing Machinery and Equipment in Washington.

Q: What is the purpose of Form REV27 0021?

A: The purpose of Form REV27 0021 is to claim exemption from sales and use tax on manufacturing machinery and equipment in Washington.

Q: Who needs to complete Form REV27 0021?

A: Manufacturers who want to claim exemption from sales and use tax on machinery and equipment in Washington need to complete Form REV27 0021.

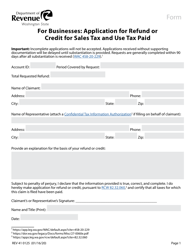

Q: What is the benefit of completing Form REV27 0021?

A: Completing Form REV27 0021 allows manufacturers to claim exemption from sales and use tax on manufacturing machinery and equipment, which can result in cost savings.

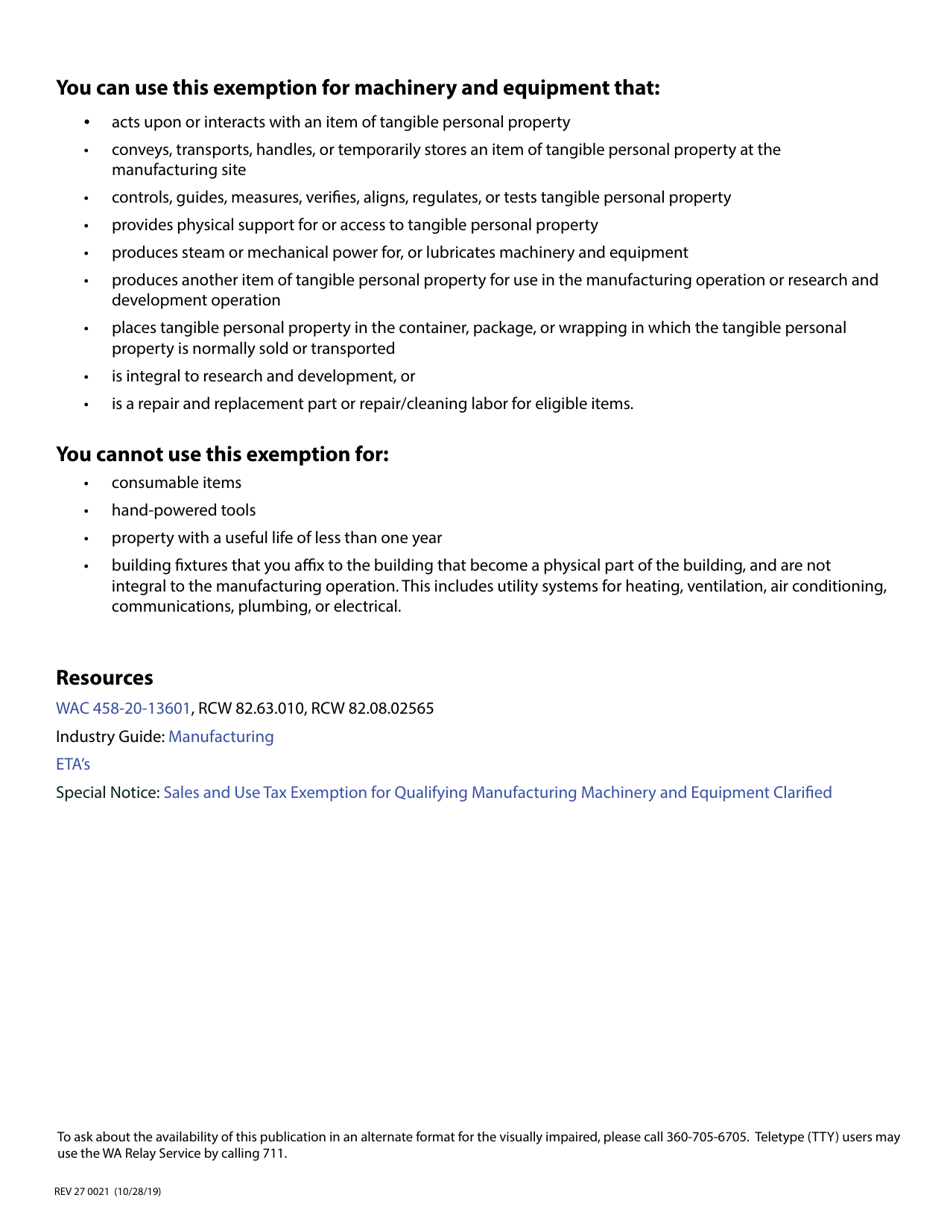

Q: Are there any other requirements to qualify for the exemption?

A: Yes, in addition to completing Form REV27 0021, manufacturers must meet certain criteria outlined by the Washington State Department of Revenue. These criteria may include factors such as the type of equipment being purchased and its use in manufacturing processes.

Form Details:

- Released on October 28, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV27 0021 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.