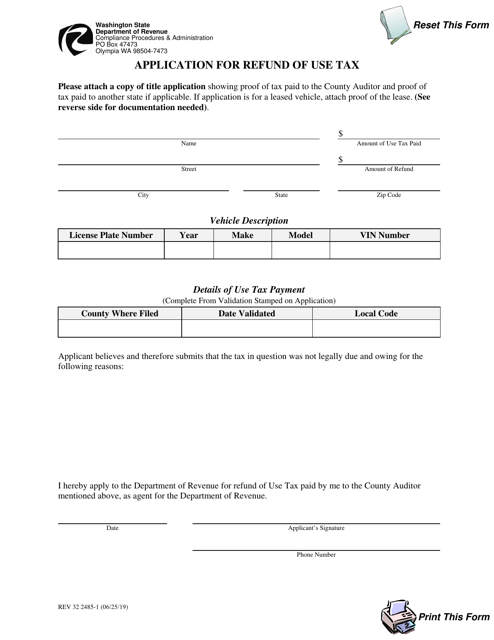

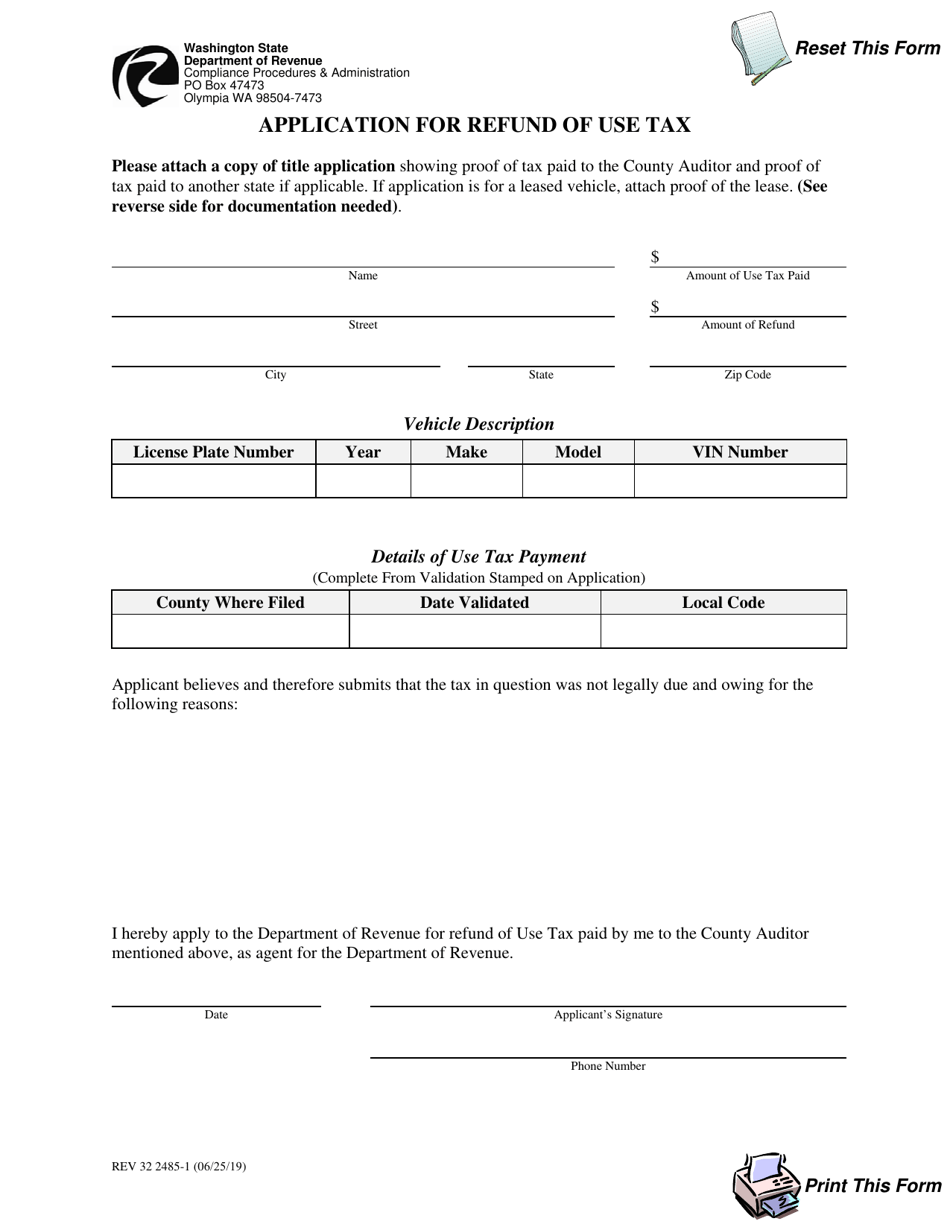

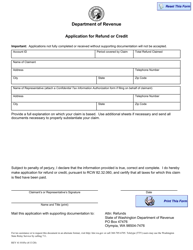

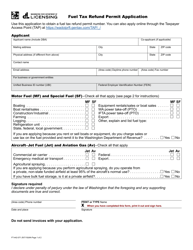

Form REV32 2485-1 Application for Refund of Use Tax - Washington

What Is Form REV32 2485-1?

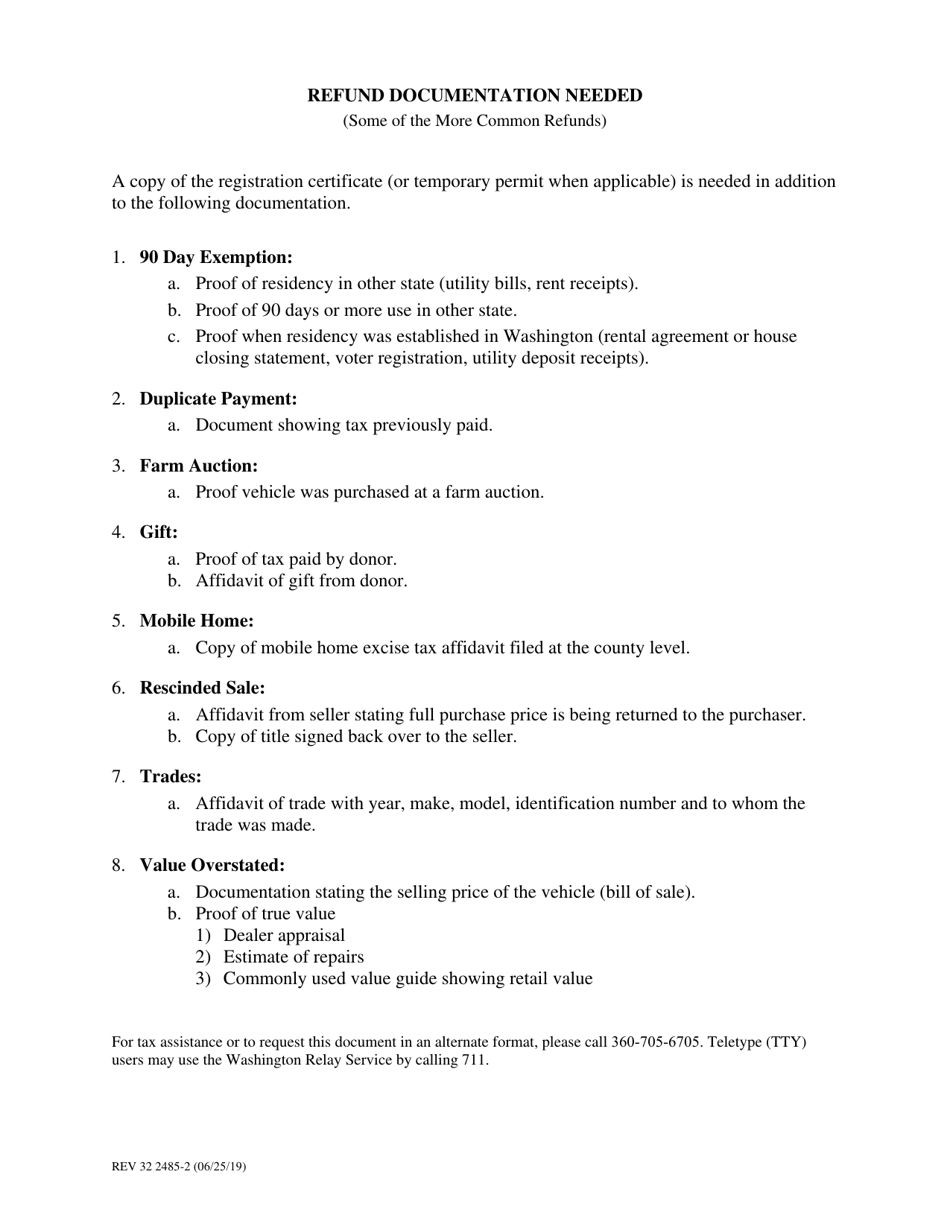

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV32 2485-1?

A: Form REV32 2485-1 is an Application for Refund of Use Tax in Washington.

Q: What is use tax?

A: Use tax is a tax on the use, storage, or consumption of tangible personal property in Washington when sales tax has not been paid.

Q: Who can use Form REV32 2485-1?

A: Anyone who paid use tax in Washington may use Form REV32 2485-1 to apply for a refund.

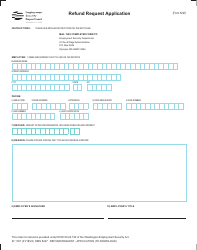

Q: What information do I need to provide on Form REV32 2485-1?

A: You will need to provide your name, address, Social Security number or UBI number, detailed description of the property, and the amount of use tax paid.

Q: Is there a deadline for filing Form REV32 2485-1?

A: Yes, Form REV32 2485-1 must be filed within three years from the date the tax was due or paid, whichever is later.

Form Details:

- Released on June 25, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV32 2485-1 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.