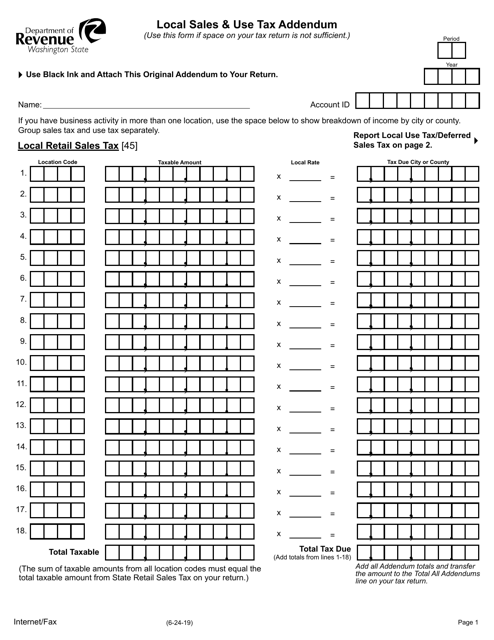

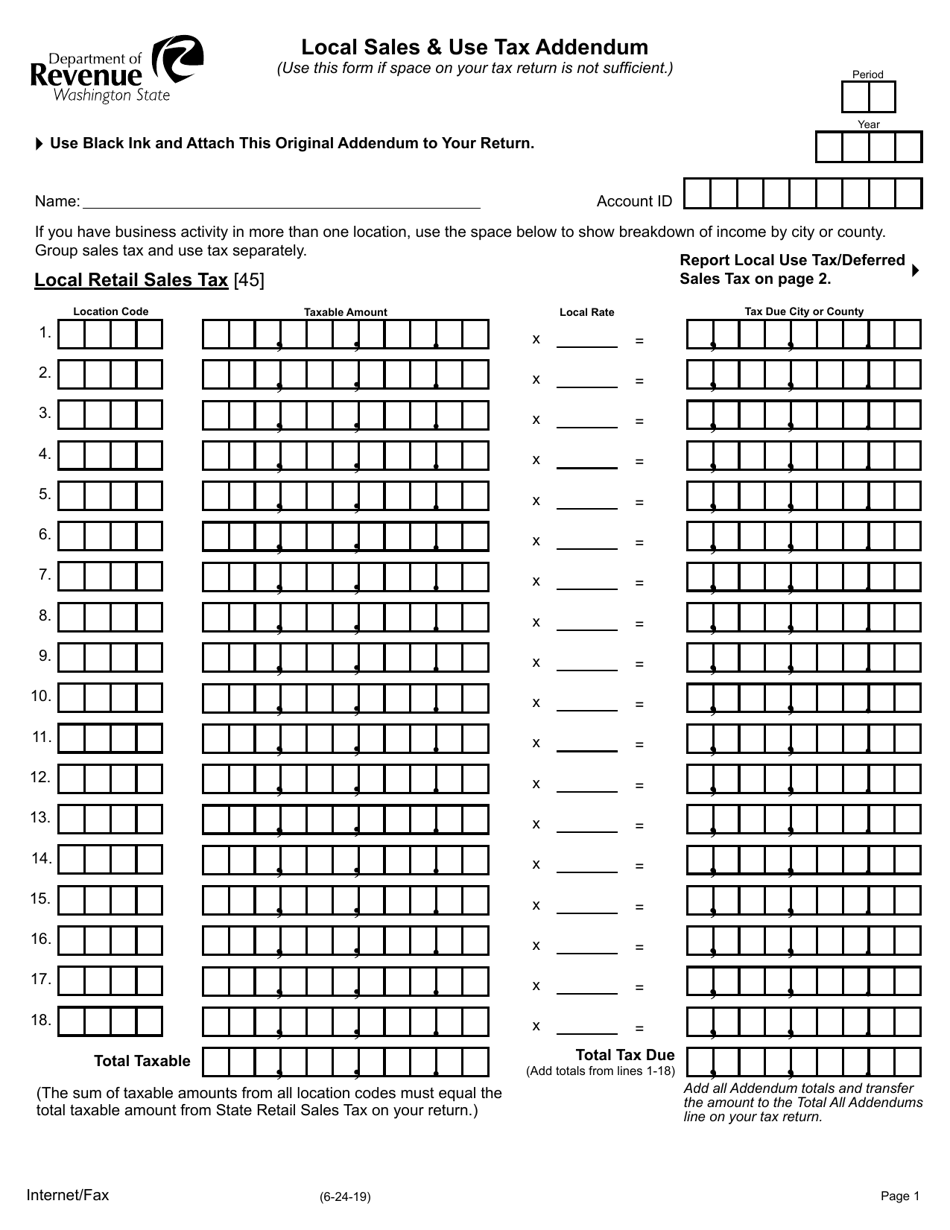

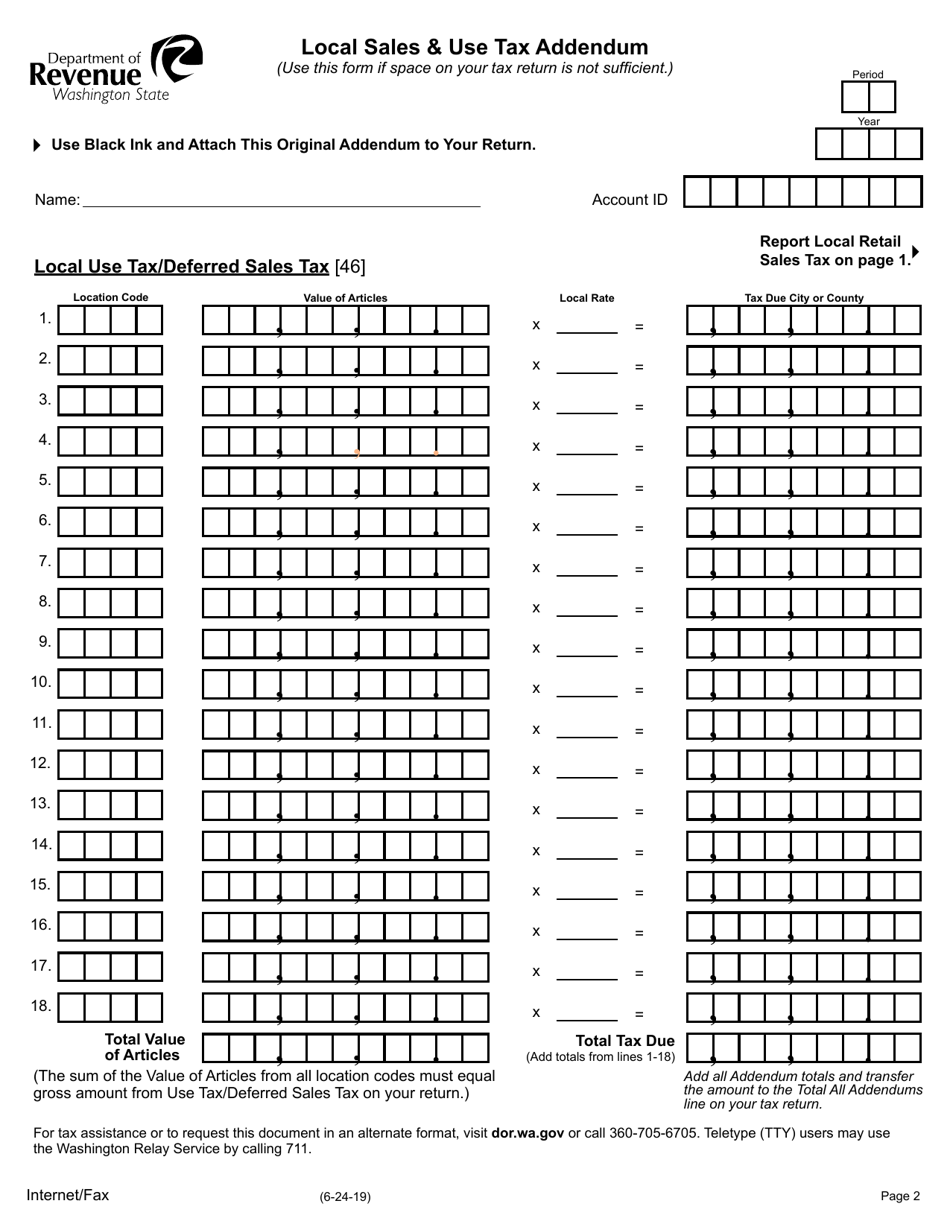

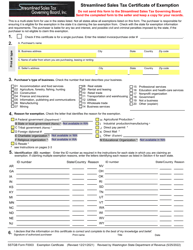

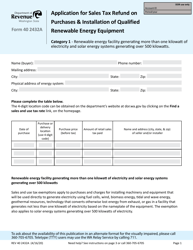

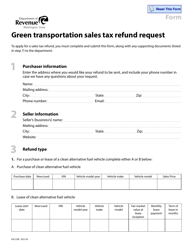

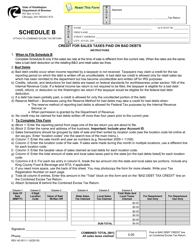

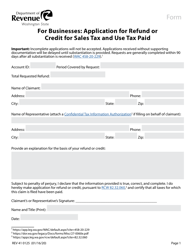

Local Sales & Use Tax Addendum - Washington

Local Sales & Use Tax Addendum is a legal document that was released by the Washington State Department of Revenue - a government authority operating within Washington.

FAQ

Q: What is the Local Sales & Use Tax Addendum in Washington?

A: The Local Sales & Use Tax Addendum is an additional tax that is imposed by local jurisdictions in Washington state.

Q: Who imposes the Local Sales & Use Tax Addendum?

A: Local jurisdictions, such as cities and counties, impose the Local Sales & Use Tax Addendum.

Q: What is the purpose of the Local Sales & Use Tax Addendum?

A: The purpose of the Local Sales & Use Tax Addendum is to generate revenue for local jurisdictions to fund various projects and services.

Q: How is the Local Sales & Use Tax Addendum collected?

A: The Local Sales & Use Tax Addendum is collected by businesses when they sell taxable goods or services.

Q: How much is the Local Sales & Use Tax Addendum?

A: The rate of the Local Sales & Use Tax Addendum varies depending on the specific local jurisdiction.

Q: Are there any exemptions or deductions for the Local Sales & Use Tax Addendum?

A: Exemptions and deductions may be available for certain categories of goods or services, but it depends on the local jurisdiction.

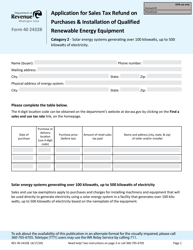

Form Details:

- Released on June 24, 2019;

- The latest edition currently provided by the Washington State Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.