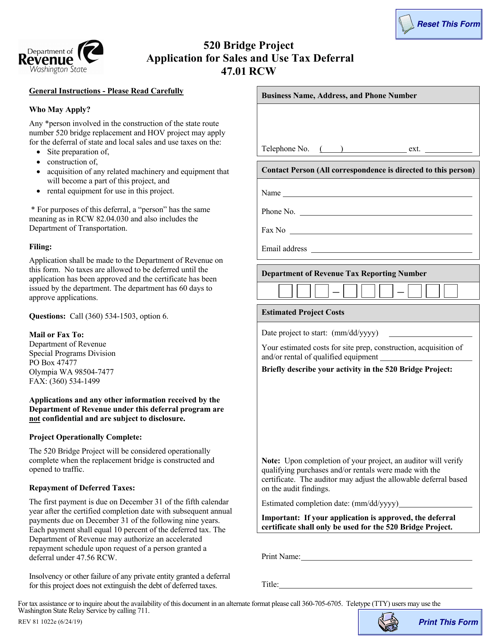

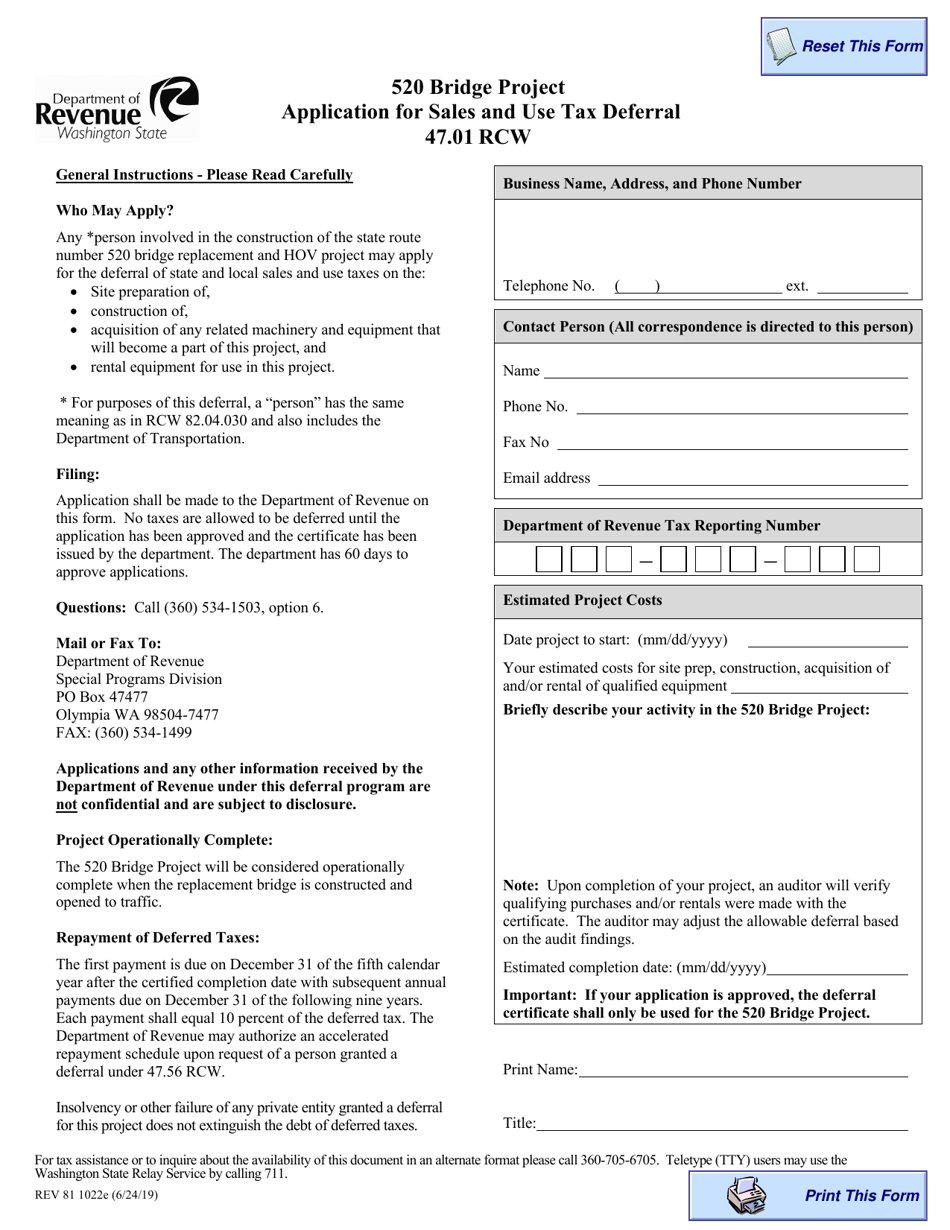

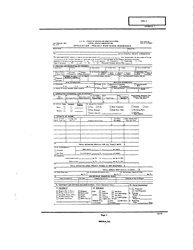

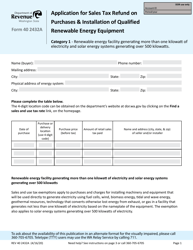

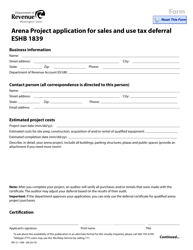

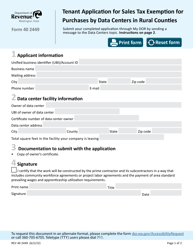

Form REV81 1022E 520 Bridge Project Application for Sales and Use Tax Deferral 47.01 Rcw - Washington

What Is Form REV81 1022E?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV81 1022E?

A: Form REV81 1022E is an application for Sales and Use Tax Deferral.

Q: What is the 520 Bridge Project?

A: The 520 Bridge Project refers to the construction project on State Route 520 in Washington.

Q: What is Sales and Use Tax Deferral?

A: Sales and Use Tax Deferral is a program that allows qualified businesses to defer paying sales and use taxes on construction projects.

Q: What is RCW 47.01?

A: RCW 47.01 refers to the Revised Code of Washington section that pertains to highway laws and regulations.

Q: How do I apply for Sales and Use Tax Deferral?

A: You can apply for Sales and Use Tax Deferral by completing and submitting Form REV81 1022E to the appropriate tax agency in Washington.

Q: Who is eligible for Sales and Use Tax Deferral?

A: Qualified businesses engaged in construction projects, such as the 520 Bridge Project, may be eligible for Sales and Use Tax Deferral.

Q: What are the benefits of Sales and Use Tax Deferral?

A: The benefits of Sales and Use Tax Deferral include cash flow improvement and interest-free financing for eligible construction projects.

Q: What other laws and regulations are relevant to the 520 Bridge Project?

A: Various laws and regulations, including environmental protection and transportation laws, are relevant to the 520 Bridge Project.

Q: Is Sales and Use Tax Deferral available in other states?

A: Sales and Use Tax Deferral programs may vary by state, so it is best to check the regulations of the specific state you are interested in.

Q: Can individuals apply for Sales and Use Tax Deferral?

A: Sales and Use Tax Deferral is typically available for qualified businesses and not for individual taxpayers.

Q: Are there any fees or penalties associated with Sales and Use Tax Deferral?

A: Fees and penalties may apply if the requirements and conditions of the Sales and Use Tax Deferral program are not met.

Q: What should I do if I have additional questions about Sales and Use Tax Deferral?

A: If you have additional questions, you can contact the tax agency in Washington or consult with a tax professional.

Q: Can Sales and Use Tax Deferral be used for any construction project?

A: Sales and Use Tax Deferral is typically specific to qualifying construction projects, such as infrastructure improvements or public works projects.

Q: Is Sales and Use Tax Deferral available for residential construction?

A: Sales and Use Tax Deferral may have different eligibility requirements for residential construction projects, so it is important to review the specific regulations.

Q: How long does the Sales and Use Tax Deferral last?

A: The duration of the Sales and Use Tax Deferral will depend on the specific terms and conditions outlined in the program.

Q: What are the reporting requirements for Sales and Use Tax Deferral?

A: Businesses receiving Sales and Use Tax Deferral may be required to report on the progress and status of their construction projects.

Q: Can Sales and Use Tax Deferral be retroactively applied?

A: Sales and Use Tax Deferral is typically not available for retroactive application, so it is important to apply before starting the construction project.

Q: Can Sales and Use Tax Deferral be combined with other tax incentives?

A: In some cases, Sales and Use Tax Deferral can be combined with other tax incentives, but it is best to review the specific rules and regulations.

Q: How long does it take to process the Sales and Use Tax Deferral application?

A: The processing time for Sales and Use Tax Deferral applications may vary, so it is advisable to submit the application well in advance of the project start date.

Q: What happens if the Sales and Use Tax Deferral application is denied?

A: If the Sales and Use Tax Deferral application is denied, the business may need to pay the sales and use taxes on the construction project as required by law.

Q: Are there any limitations to Sales and Use Tax Deferral?

A: There may be certain limitations and restrictions on the use of Sales and Use Tax Deferral, so it is important to review the program guidelines.

Q: Can the Sales and Use Tax Deferral be transferred to another business?

A: The transferability of Sales and Use Tax Deferral may depend on the specific program and circumstances, so it is advisable to consult with the tax agency.

Q: What documents and supporting evidence are required for the Sales and Use Tax Deferral application?

A: The specific documents and supporting evidence required for the Sales and Use Tax Deferral application will be outlined in the application instructions.

Form Details:

- Released on June 24, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV81 1022E by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.