This version of the form is not currently in use and is provided for reference only. Download this version of

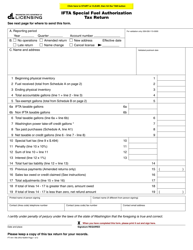

Form FT-441-750

for the current year.

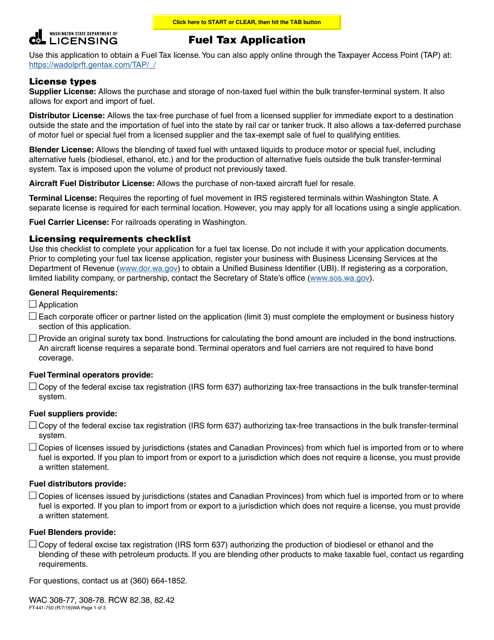

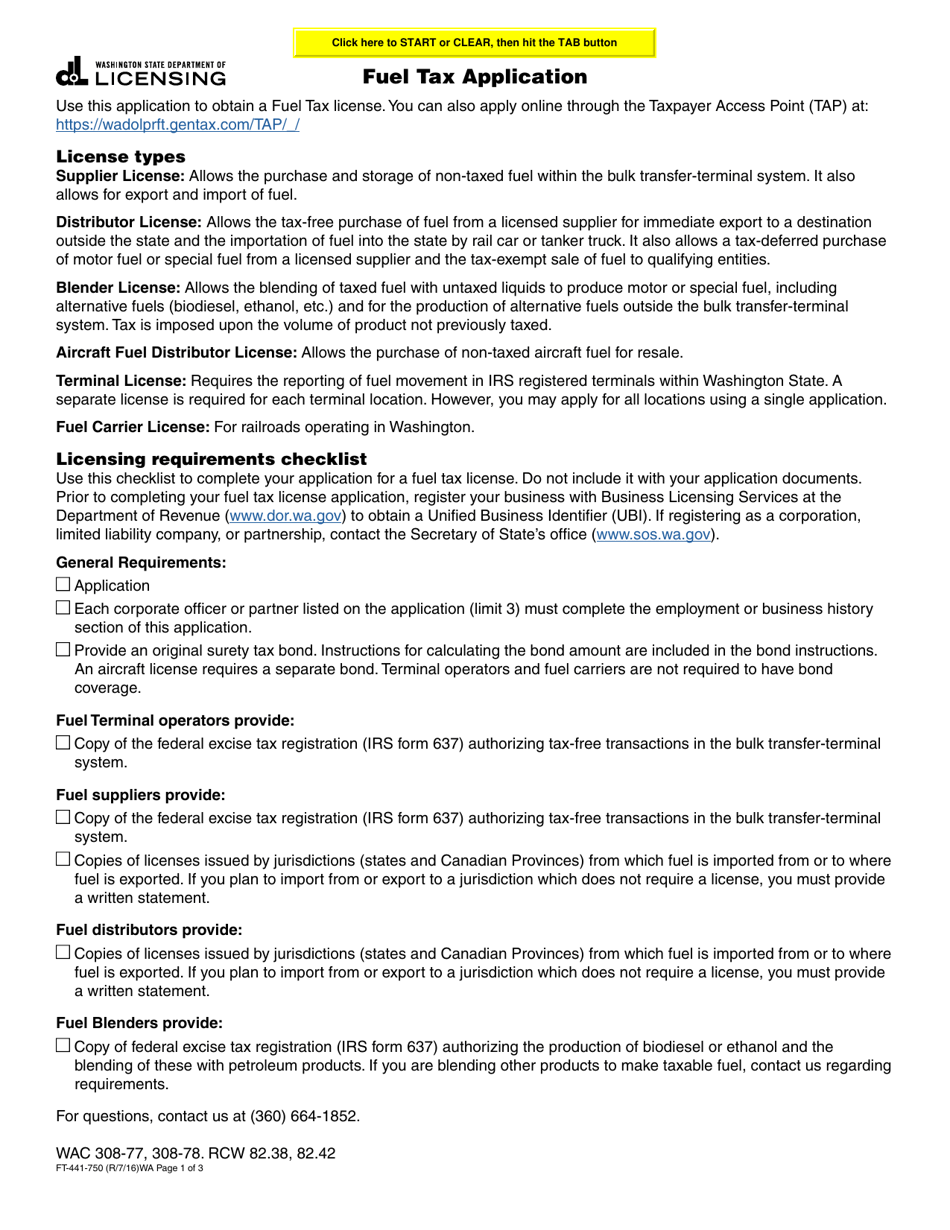

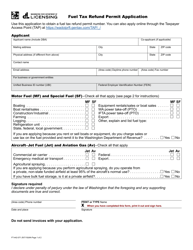

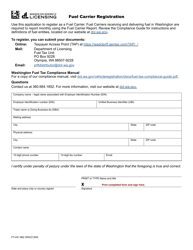

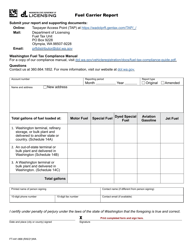

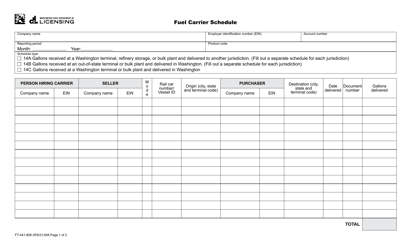

Form FT-441-750 Fuel Tax Application - Washington

What Is Form FT-441-750?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT-441-750?

A: Form FT-441-750 is the Fuel Tax Application form for the state of Washington.

Q: What is the purpose of Form FT-441-750?

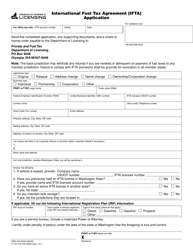

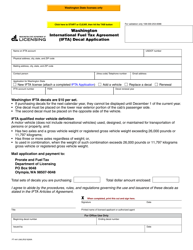

A: The purpose of Form FT-441-750 is to apply for a fuel tax license in the state of Washington.

Q: Who needs to fill out Form FT-441-750?

A: Any business or individual that sells or distributes fuel in Washington and meets the licensing requirements must fill out Form FT-441-750.

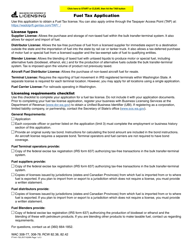

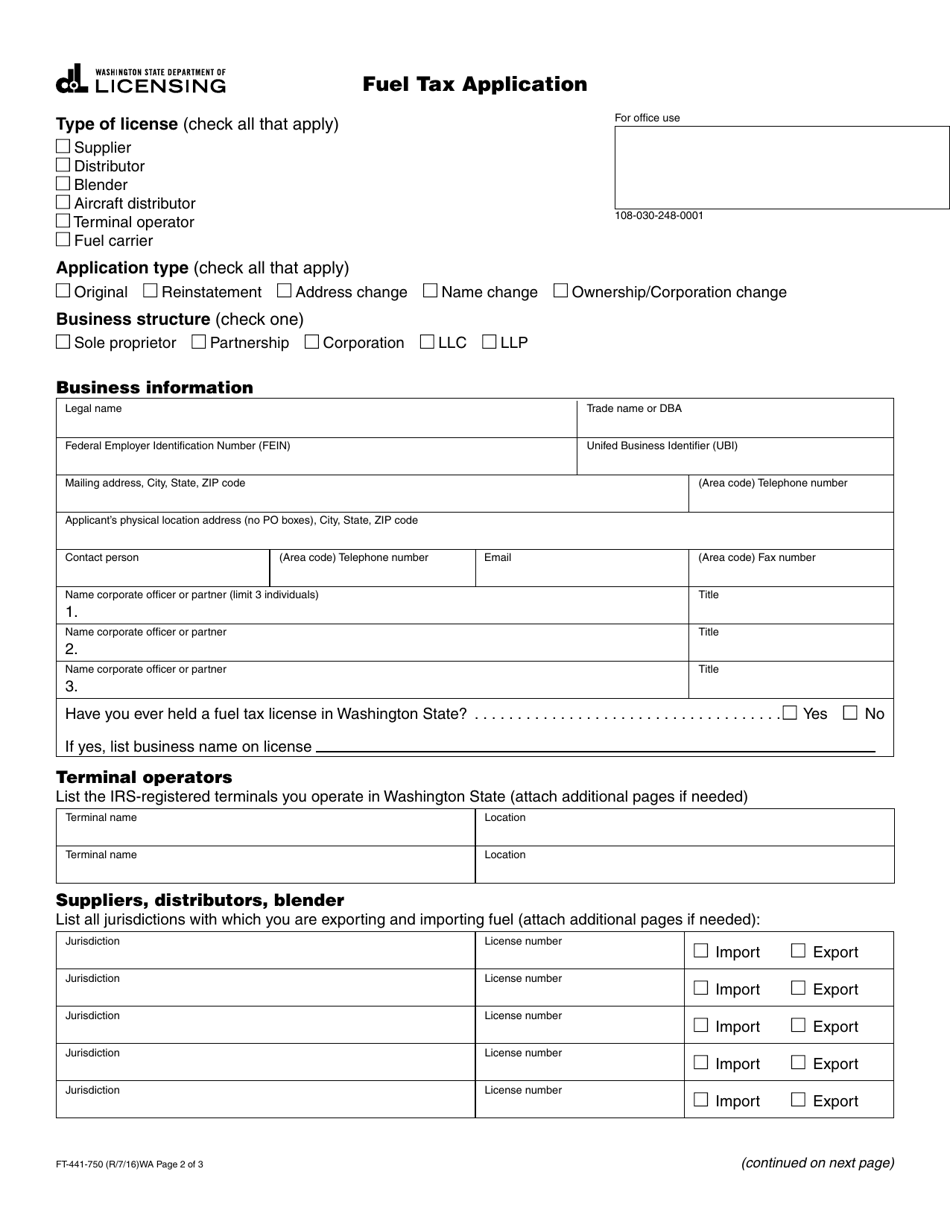

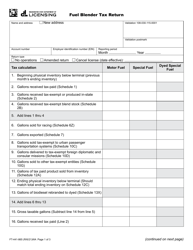

Q: What information do I need to provide on Form FT-441-750?

A: You will need to provide information such as your business details, types of fuel being sold or distributed, and estimated gallons sold.

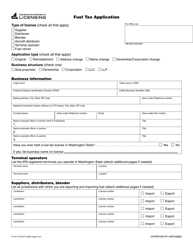

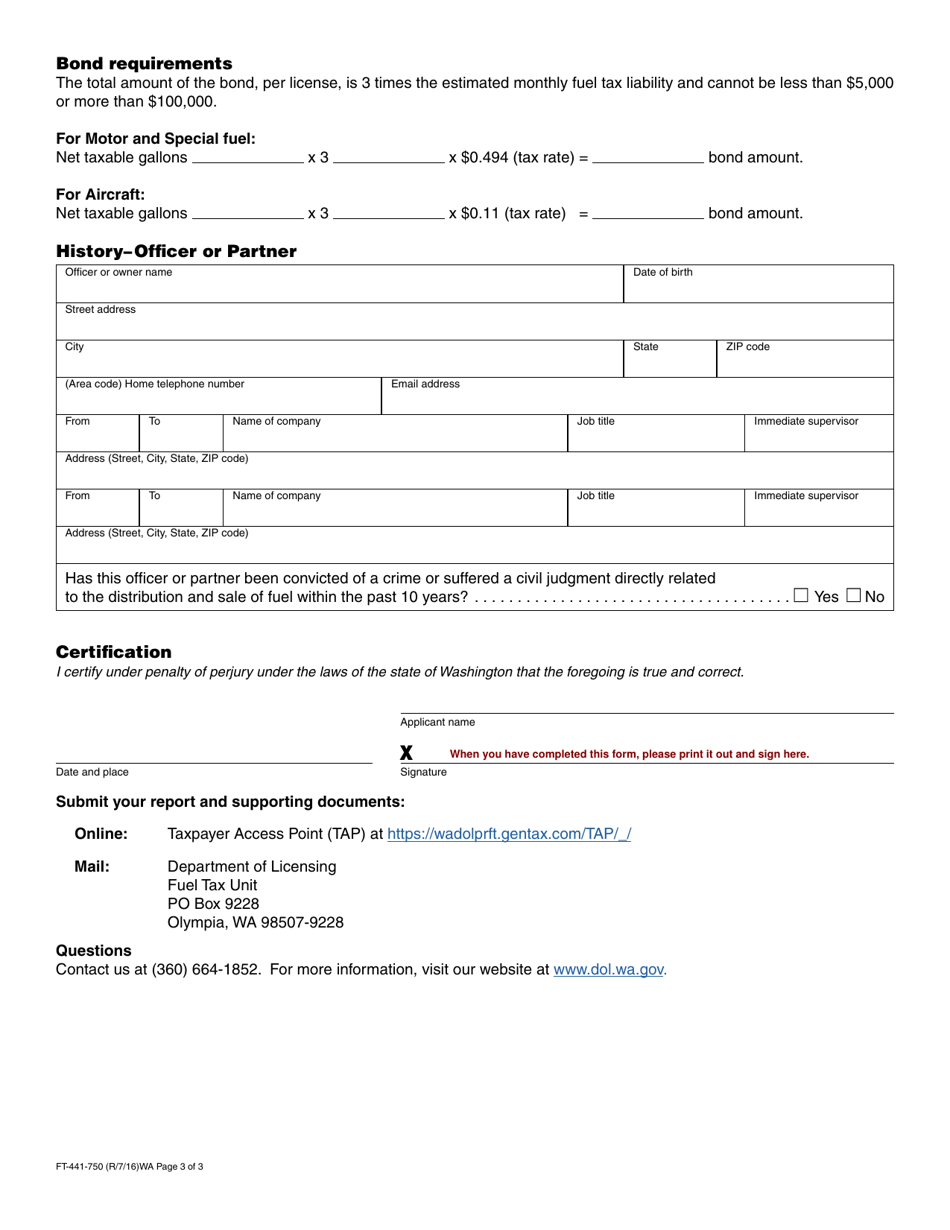

Q: Are there any fees associated with submitting Form FT-441-750?

A: Yes, there are fees associated with submitting Form FT-441-750. The amount of the fee depends on the fuel type and the estimated gallons being sold or distributed.

Q: When is Form FT-441-750 due?

A: Form FT-441-750 is due on the last day of the month following the end of the reporting period.

Q: What happens if I fail to file Form FT-441-750?

A: Failure to file Form FT-441-750 or pay the required taxes and fees on time may result in penalties and interest charges.

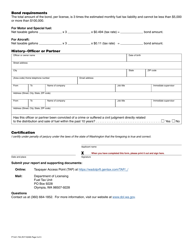

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-441-750 by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.